Listed below is a more expansive list of documents that you should bring during the first meetings with a bankruptcy lawyer:

- All financial documents, including bank account statements, receipts for major purchases, wage statements, and tax...

- A list of your creditors that you owe money, and their contact information, account numbers, and how much money you owe...

- Your tax returns.

- Pay stubs.

- Appraisals of your home, jewelry, and other exempt assets.

- Your car titles.

- Evidence of child support/alimony obligations.

- Bank statements.

- Proof that you took credit counseling.

What do I need to file bankruptcy?

Filing for bankruptcy requires you to complete a lengthy packet of forms. Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You’ll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

What can I expect from a bankruptcy attorney?

Not only will you receive legal advice, but a bankruptcy attorney will handle the paperwork from start to finish. Below are some of the most common types of services you can expect from your bankruptcy lawyer. (Not sure how much you should pay? Start by reading Average Attorney Fees in Chapter 7 Bankruptcy .)

Do I need a lawyer to file bankruptcy?

The expert advice and guidance of a lawyer are generally needed for filing a bankruptcy claim. Bankruptcy proceedings typically involve an in-depth investigation into all of a person’s finances, assets, and properties, which can get complicated at times. It’s in your best interests to work closely...

How do bankruptcy attorneys file papers?

Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You’ll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

Do I need credit card statements for bankruptcy?

Even though it is not a formal requirement under the Bankruptcy Code, most Chapter 7 bankruptcy trustees ask filers to provide them with a copy of their bank account statement before the 341 meeting. Many ask for the statement that covers the filing date while some request several months of bank statements.

What should you not do before filing bankruptcy?

Here are common mistakes you should avoid before filing for bankruptcy.Lying about Your Assets. ... Not Consulting an Attorney. ... Giving Assets (Or Payments) To Family Members. ... Running Up Credit Card Debt. ... Taking on New Debt. ... Raiding The 401(k) ... Transferring Property to Family or Friends. ... Not Doing Your Research.

What do they look at for bankruptcy?

Hidden Assets debts or expenses for assets not listed in the schedules. a claim of a property loss from theft with no police report, or a casualty loss with no insurance claim. missing financial records. closed financial accounts (how much was in the account and where did the money go)

What keeps you from filing bankruptcy?

Exemptions allow you to keep a certain amount of assets safe in bankruptcy, such as an inexpensive car, professional tools, clothing, and a retirement account. If you can exempt an asset, you don't have to worry about the bankruptcy trustee appointed to your case taking it and selling it for your creditors' benefit.

Should I close my bank account before filing bankruptcy?

You'll want to open checking and savings accounts at a bank that doesn't service any of your debt and use the new account for banking purposes before filing bankruptcy. Again, you don't need to close other accounts—leave them open and report all accounts when filling out your bankruptcy paperwork.

How do you hide money in a bankruptcy?

The following are several ways people attempt to hide assets in bankruptcy proceedings:Lying about owning assets.Transferring assets into another person's name or giving them to someone else to hold.Creating fake liens or mortgages to make the assets appear like they have no value.

What Cannot be taken bankruptcy?

Some of the most common debts that you cannot get rid of in bankruptcy are debts from child or spousal support, most student loans, most tax debts, wages you owe people who worked for you, damages for personal injury you caused when driving while intoxicated, debts to government agencies for fines or penalties, and ...

What debts are not discharged in bankruptcy?

The following debts are not discharged if a creditor objects during the case. Creditors must prove the debt fits one of these categories: Debts from fraud. Certain debts for luxury goods or services bought 90 days before filing.

What assets can be taken in bankruptcy?

The three types of assets when filing bankruptcyPersonal property. This is what's considered material goods; examples include clothing, furniture, artwork and vehicles.Real property. Real property includes land and improvements or buildings tied to land, such as a house or barn.Intangible property.

How much do you have to be in debt to file Chapter 7?

Again, there's no minimum or maximum amount of unsecured debt required to file Chapter 7 bankruptcy. In fact, your amount of debt doesn't affect your eligibility at all. You can file as long as you pass the means test. One thing that does matter is when you incurred your unsecured debt.

Why is it important to contact a bankruptcy lawyer?

Frequently, the debtor will forget a piece of information necessary to complete the bankruptcy, that is why it is very important to contact a qualified bankruptcy lawyer if you have any questions.

What documents do you need to file for bankruptcy?

If your bankruptcy is business bankruptcy, you may need to bring additional documentation, including company balance sheets, budget reports, financial statements, and a list of company property;

Why is bankruptcy considered a document intensive process?

When considering all the different types of legal proceedings, bankruptcy can be one of the most document intensive. This is because whether a bankruptcy is recognized by the courts is based on the value of the debtors assets compared to the amount of debt owed to other creditors.

Why is it important to have a bankruptcy attorney?

Because filing for bankruptcy is a complex legal claim, finding the right bank ruptcy attorney is important. A bankruptcy attorney will help you decide whether or not to file for bankruptcy, and what type of bankruptcy you should file. Additionally, if you decide to file, an attorney can help ensure that your property is protected, ...

How to organize before filing for bankruptcy?

One way debtors organize, before filing a bankruptcy, is creating a bankruptcy document checklist. Another common way is to suggest a list of questions to ask a bankruptcy attorney. Both of these methods are effective, because a bankruptcy attorney needs to review the person’s financial background thoroughly before determining whether filing for bankruptcy is a credible legal option. After the decision to file has been made, even more documents may be required in order to determine what type of bankruptcy is necessary.

How long does it take to file for bankruptcy?

In total, most bankruptcies take around 4 to 6 months.

What is the most important thing to do when filing for bankruptcy?

The last point is especially important. For the most effective bankruptcy filing, it is crucial that you are completely transparent with your attorney. Make sure you take note of any questions, legal inquiries, or laws that you may wish to address with your attorney.

What information do you need to file for bankruptcy?

What Information Do You Need to Complete the Bankruptcy Forms? Most of the information you'll need to fill out your bankruptcy paperwork will be in those documents, including asset value and income information. For example, you'll use the income documentation to calculate your average monthly income.

How to get a credit report for bankruptcy?

Start by finding loan statements or bills so that you can list each of your creditors in the bankruptcy. Alternatively, you can obtain a credit report that shows all your debts; however, be aware that you're required to list the creditor's billing address, and that address rarely shows up on your credit report.

What does a bankruptcy trustee do when a debtor loses financial paperwork?

When a bankruptcy debtor (filer) loses financial paperwork in a natural disaster, the bankruptcy trustee must: avoid taking action against a debtor who can't produce documents. grant reasonable requests to ease filing requirements, and. take into account a decrease in income or increase in expenses.

How long do you have to file a chapter 7 tax return?

You'll usually need to provide copies of your tax returns or tax transcripts for the last two years in a Chapter 7 case, and four years in a Chapter 13 matter. If you have unfiled returns because you weren't required to file—for instance, your only income source was nontaxable disability benefits —you'll need to explain why.

What do trustees need for mortgages?

Also, plan to provide mortgage statements showing current loan balances and payment amounts. Some trustees also require the deed of trust and proof of home insurance.

Do you have to send utility bills to bankruptcy trustee?

You should also look at your utility bills and other expenses to determine accurate figures for your monthly utilities and expenses, such as food, dry cleaning, and transportation to name a few. Usually, you won't be required to send these documents to the trustee (unless your expenses are higher than usual, in which case you might trigger a bankruptcy audit ).

Do you have to provide bank statements to bankruptcy trustee?

Recent bank and retirement account statements must be provided to the bankruptcy trustee for all accounts.

What is the responsibility of a bankruptcy attorney?

For these reasons, one of the responsibilities of your bankruptcy attorney is to know the local rules and filing procedures.

What do bankruptcy attorneys do?

Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

How to file for bankruptcy?

First, you can expect your attorney to tell you whether filing for bankruptcy would be in your best interest. If it is, you should also learn: 1 whether Chapter 7, Chapter 13, or another type will help you achieve your financial goals 2 what you can expect during the bankruptcy process, and 3 whether your case involves any particular difficulties or risks.

What to expect during bankruptcy?

Most importantly, if you have any questions, you can expect your attorney to respond to your calls or emails promptly.

What information do you provide to your attorney?

You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information . Your lawyer will use it to prepare the official forms and then go over the completed paperwork with you to ensure accuracy.

What type of hearings can an attorney represent you at?

Some common types of hearings you can expect your attorney to represent you at: Chapter 13 confirmation hearings. Chapter 7 reaffirmation hearings, and. any other motion or objection hearings filed by you, your creditors, or the trustee.

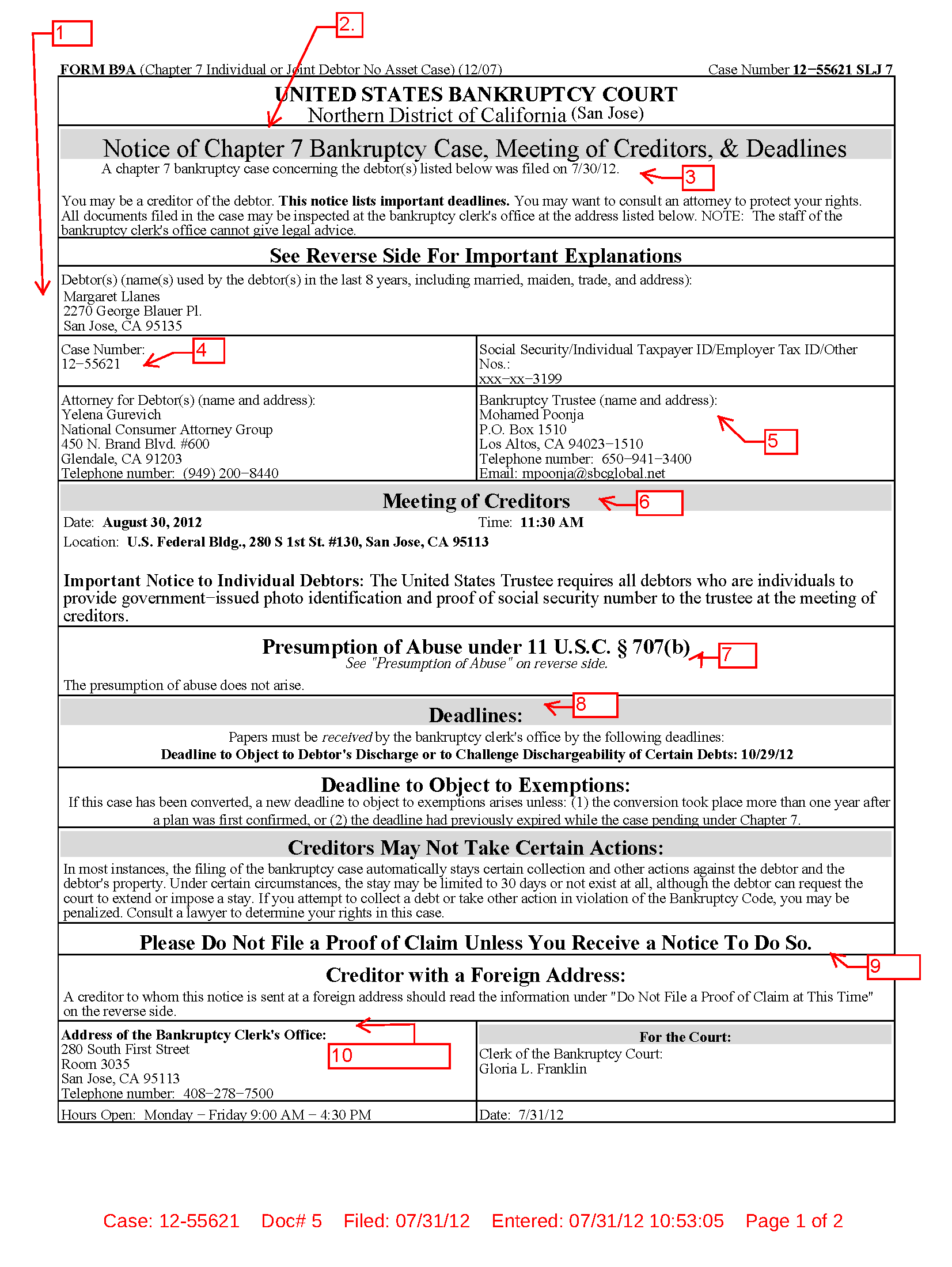

What is the mandatory hearing for bankruptcy?

After filing for bankruptcy, all debtors must attend a mandatory hearing called the 341 meeting of creditors. But, depending on your case, you (or your attorney) might need to go to additional hearings. Some common types of hearings you can expect your attorney to represent you at: Chapter 13 confirmation hearings.

Bankruptcy Filing in Louisiana

- Your financial records are some of the first documents you should collect. These records will help determine which type of bankruptcy is best suited for you. For example, if your financial documents show you have a regular income, your best fit may be Chapter 13 bankruptcy. This m…

Liquidation and Reorganization Bankruptcy Cases

Seeking Legal Advice from Someone Experienced with Bankruptcies

Information That You Should Provide to Your Bankruptcy Lawyer

Getting The Legal Services Professionals

- There are different types of bankruptcythat you may choose from, depending on your eligibility. Under each are different bankruptcy rules and requirements that you must be aware of before you can declare bankruptcy. If you require debt relief and intend to file bankruptcy Chapter 7, a trustee will liquidate your non-exempt assets to pay off priority lenders. However, you must first pass th…

Popular Posts:

- 1. a perfect murder who played the lawyer

- 2. how much does a lawyer make in havana

- 3. which character trait does mitchell stephens think makes him a good lawyer

- 4. what happens to a will after it's made with a lawyer

- 5. how much does a lawyer charge to renew daca

- 6. how many real estate lawyer practice in nyc

- 7. what all can my lawyer bill me for in iowa

- 8. how to find a lawyer for business dispute quora

- 9. what kind of lawyer is daredevil

- 10. how long is a lawyer consultation