These services can include:

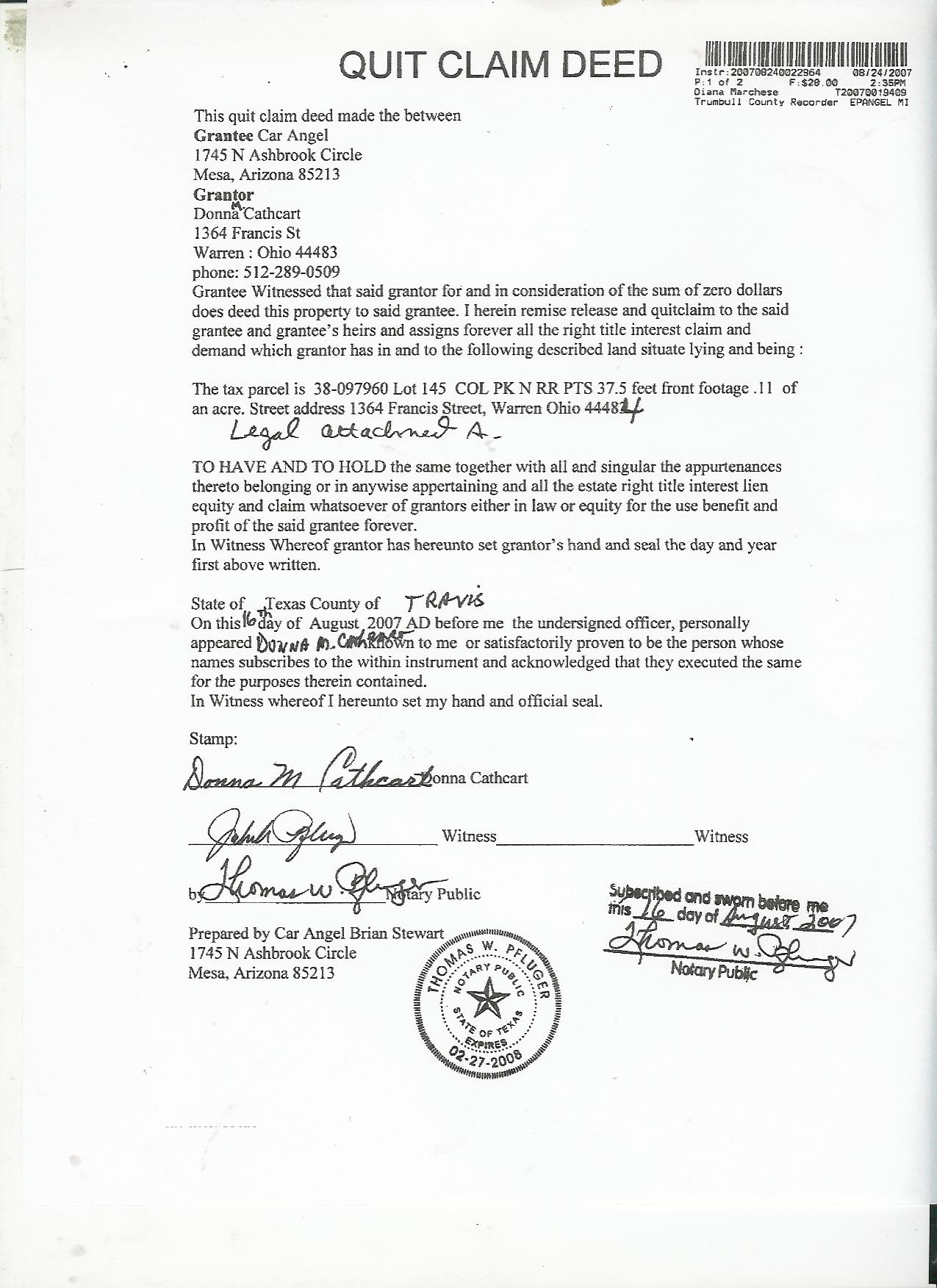

- Confirming that ownership is appropriately vested in the seller of the home

- Identifying any unpaid loans, liens, litigation or other claims against the property and working to clear them, as well as uncovering deed restrictions and covenants and any breaks in the ...

- Arranging for title insurance

Why do I need a lawyer to get a mortgage?

Your lawyer is invaluable as he/she understands the way lenders draft mortgage documents and what to look for from a legal standpoint to ensure your best interests always remain top of mind.

What does a mortgage lender do?

A mortgage lender, or mortgagee, provides a loan to a borrower, or mortgagor, to purchase a home or property. In most cases, a mortgage lender is a bank or mortgage company.

What does a real estate attorney do?

What Is A Real Estate Attorney? A real estate attorney, also known as a real estate lawyer, is someone who is licensed to practice real estate law, meaning they have the knowledge and experience to advise parties involved in a real estate transaction, such as a home sale or short sale. What Does A Real Estate Attorney Do?

Why do I need a lawyer to sell my home?

Selling a home is a complex process that requires knowledge of and familiarity with local, state and federal laws. An attorney helps you protect your investment and assets while ensuring you’re conducting your side of the transaction legally — which can prevent costly missteps.

A mortgage broker helps connect buyers with lenders

Content provided by Credible, which is majority owned by Fox Corporation. Credible is solely responsible for this content and the services it provides.

What is a mortgage broker?

A mortgage broker is a licensed third party who essentially acts as a liaison. A broker’s job is to find the best mortgage lenders and home loan rates for your unique situation. This means shopping around and comparing lenders on your behalf, as well as analyzing the best loan options for you.

When to see a mortgage broker

As a buyer, you aren’t required to work with a mortgage broker, and in some cases, you may not want to. But working with a mortgage broker may be a good idea if:

How does a mortgage broker get paid?

A mortgage broker can be paid by commission, by salary or both, depending on whether the broker works for a lender or works independently. In some cases, the lender will pay the mortgage broker’s fees, while in other cases, the borrower pays.

Pros and cons of working with a mortgage broker

When shopping for a mortgage loan, consider these benefits and drawbacks of working with a mortgage broker.

How do you choose a mortgage broker?

When it comes to finding a good mortgage broker, word of mouth is one of the most valuable and trusted sources. If you have friends, family members or neighbors who recently purchased a home, consider asking for a mortgage broker referral.

Why do you need an attorney for a home purchase?

Here are a few reasons you might need or want an attorney to be part of your home buying team: State or lender requirement: Every state has slightly different laws regarding real estate transactions, and some states consider certain actions that are part of the process to be “practicing law.”. These regulations are often meant to prevent real ...

What is a real estate attorney?

A real estate attorney is someone who is licensed to practice real estate law, meaning they have the knowledge and experience to advise parties involved in a real estate transaction, such as a home sale.

Who is in charge of closing a home?

In some cases, a real estate attorney is also the person who’ll be in charge of your closing. In a home purchase transaction, both the buyer and seller can hire an attorney to represent their interests during the process. Or, in the case where an attorney is overseeing a closing where the home is being purchased with a mortgage loan, ...

Is it legal to buy a home?

Buying a home isn’t just a simple purchase; it’s also a legal transfer of a property from one entity to another. Because the legal side of this transaction can be so complex, sometimes it makes sense (or is even required) for home buyers or sellers to enlist an attorney who can look out for their best interests.

Do you have to have an attorney at closing?

If your mortgage lender requires an attorney to be present at closing, whether the buyer or seller covers the cost of the closing attorney will depend on how your contract was negotiated. If you want your own attorney in addition to the one required by your lender, you’ll also pay for any services they provide you.

What does a real estate attorney do?

Real estate attorneys sometimes handle additional parts of the home purchase like title searches and title insurance, to ensure there are no outstanding claims or liens against the property. They may also provide documentation of the transfer of funds to the seller and to your lender, or facilitate the transaction as a third party.

What states require an attorney to take care of a notary?

If you are buying a home in certain states, including Connecticut, Delaware, Georgia, Massachusetts, New York, North Carolina, South Carolina and West Virginia, ...

Do I need a lawyer for real estate?

In states where it's customary or required to have a lawyer, your real estate agent likely has recommendations too. Check your attorney's credentials with your state's bar association to ensure they are in good standing. (State bar association websites can also help you find real estate lawyers near you.)

Can I go to court for a home purchase?

For the purposes of most home buyers, purchasing real property doesn't involve going to court. Instead, a real estate lawyer may prepare or review all of the documents related to your home purchase, including the contract, any additional agreements made with the seller, documents from your lender, and title and transfer documents. ...

Do you pay real estate attorney fees?

Real estate attorney fees are generally paid as part of your closing costs. You'll see it on your loan estimate document under "services you can shop for," since it's not a set cost. The estimate given in the loan estimate can change depending on the attorney you hire and your legal needs.

Why do you need an attorney for real estate?

An attorney helps you protect your investment and assets while ensuring you’re conducting your side of the transaction legally — which can prevent costly missteps. Real estate attorneys are required in many states, but even if you aren’t legally required to use an attorney while selling, it can be a good idea.

What is a real estate attorney?

Real estate attorneys help oversee home sales, from the moment the contract is signed through the negotiating period (aptly called the “attorney review”) to closing. A seller’s attorney reviews sales contracts, communicates terms in a professional manner and attends closings to prevent mishaps. Selling a home is a complex process ...

How much does a real estate attorney charge?

How much does a real estate attorney cost? How much you’ll pay for real estate attorney fees depends on your market and how involved they are in the transaction, but they typically charge a flat rate of $800 to $1,200 per transaction. Some attorneys charge hourly, ranging from $150 to $350 per hour.

What to do if you inherited a home?

An attorney can help you navigate the complexities. Estate sale: If you inherited the home you’re selling, hiring an attorney to sort through ownership documents can ease the burden, which is especially helpful when you’re grieving the loss of a family member.

Who is responsible for underwriting title insurance?

Title company: A representative of the title company is responsible for underwriting the title insurance and transferring the clean title of the home to the buyer.

Who hires an inspector to inspect a house?

Inspector: The inspector is hired by the buyer. Their job is to make sure the buyer knows about everything that may need to be repaired on the home. Sellers also sometimes hire an inspector to do a pre-inspection so they can make any necessary repairs before putting the house on the market.

Do you need an attorney for a closing?

In 21 states and the District of Columbia, attorneys are legally required as part of the closing process. Attorney-required states include: As a best practice, if the other party in your transaction has a lawyer representing them and supporting their best interests, you should too.

Popular Posts:

- 1. how do i report a lawyer to the bar association

- 2. i live in md how do i get a lawyer for a speeding ticket in virginia

- 3. what kind of lawyer is woodruff carroll attorney

- 4. when a lawyer does a cease and desist order

- 5. what does pllc mean for a lawyer

- 6. who plays the lawyer in closer

- 7. name of the lawyer who won oj"s case

- 8. how much is a lawyer to file bankruptcy

- 9. how to become a congressional lawyer

- 10. how much is a gun trust from a lawyer