If you use Quickbooks Online, you can easily track lines of credit. Create an Account for the Principle To get started, you need to create an account for the principle of the line of credit. While logged in to Quickbooks Online, click the “Settings” button on the home screen and choose “Chart of Accounts.”

Full Answer

How do I use QuickBooks for my law firm?

There are effectively three ways you can use QuickBooks: QuickBooks Professional installed locally on your firm’s desktops/server (On-Premise). QuickBooks Professional run within a Private Cloud / Virtual Desktop (Cloud). QuickBooks Online (Cloud). Your first option is to simply install QuickBooks on your law firm’s local desktops and server (s).

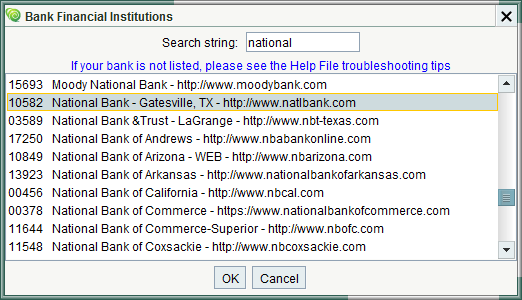

How do I set up a line of credit in QuickBooks Online?

After setting up the principle account, you need to create an expense account for the line of credit. This is done by going back to the Quickbooks Online home screen and clicking “Settings,” followed by “Chart of Accounts” and “New.” From here, select “Current liabilities” in the “Account type” menu.

How do I track a line of credit in QBO?

To start tracking a line of credit in QBO, you'll need two accounts. One is for the principal, and the other is an expense account for the interest. Follow these steps to create an account for the principal: Click the Accounting tab.

What is line LoC in QuickBooks?

The typical line LOC entry in QuickBooks is a transfer of funds from the Other Current Liability LOC account to the bank the money was transferred to. have put their business into a surmountable amount of credit card and loan debt of different types.

How do I enter a line of credit in QuickBooks Online?

Line of Credit in QuickBooks desktopGo to Lists menu then Chart of Accounts.Right-click anywhere then press New.Choose Loan then Continue. If you don't see this option, pick Other Account Types then Other Current Liability.Press Continue to proceed.Enter the details of your LOC then press Save and Close.

How do I record a payment to a line of credit in QuickBooks?

When you pay for things with your line of credit, you'll record the transaction as a bill or expense in this account.Go to Settings ⚙, then select Chart of accounts.Select New.From the Account Type ▼ dropdown menu, select Current liabilities.From the Detail Type ▼ dropdown menu, select Line of Credit.More items...•

How do I record a retainer in QuickBooks?

Option 2. Invoice customers for deposits or retainersSelect + New.Select Invoice.Select the Customer name from the dropdown list.In the Product/Service column, select the Retainer or Deposit item you set up.Enter the amount received for the retainer or deposit in the Rate or Amount column.Select Save and close.

How do you record a line of credit in accounting?

There are a few ways you can record the LOC in your books but the easiest may be with a journal entry. Go to Company, Make General Journal Entries. Enter the date the LOC was deposited into your bank account. Debit your bank account and Credit the LOC account for the total amount.

Is a line of credit considered an asset?

No, a credit line is not an asset. If you owe money on your line then it would show up as a liability on your balance sheet. When you list the line of credit, you only have to record the portion you have actually withdrawn, not the whole amount.

How do I record creditors in QuickBooks?

0:272:59QuickBooks - How to enter your opening creditor balances - YouTubeYouTubeStart of suggested clipEnd of suggested clipSelect expenses from the menu on the left of the screen click on new transaction at the top right ofMoreSelect expenses from the menu on the left of the screen click on new transaction at the top right of the screen. Choose bill from the drop-down menu choose the supplier from the drop-down.

Is a retainer an asset or expense?

The retainer is really like a deposit. When you make that type of deposit, you will secure it as a prepaid expense on the balance sheet. You don't expense it because you haven't benefited from those services since the lawyer hasn't done the work.

How do you record legal retainer fees in accounting?

For example, write “Cash” in the accounts column and “$6,000” in the debit column to reflect the receipt of the retainer fee in cash. Write “Unearned Revenue” with a left indent in the accounts column on the next line of the journal entry and the amount of the retainer fee in the credit column on the same line.

How do you invoice a retainer?

How to draw from a retainerGo to Invoices > Overview and click New invoice.Select the client and choose to create an invoice for tracked time, expenses, or fixed fees, then click Choose projects.At the bottom of the New invoice page, you'll be asked if you want this invoice to draw from the relevant retainer.More items...

What type of account should a line of credit be in Quickbooks?

To track a line of credit, you need to set up two accounts if you don't already have them. One account is for tracking the principle, and the other is an expense account to track incurred interest.

How is a line of credit reported on the balance sheet?

When using a line of credit, a line of credit account should exist in your chart. This account should be reflected as a liability. In the example, $5,000 is receipted into the bank account and is also setup as a liability. Now that you have drawn money from the line, the liability must be present on your Balance Sheet.

Is a line of credit recorded as a liability?

The line of credit is considered a liability because it is a loan. You will also need to record the amount of interest payable on the line of credit when there is a balance outstanding.

How to find line of credit in Quickbooks?

While logged in to Quickbooks Online, click the “Settings” button on the home screen and choose “Chart of Accounts.”. From here, select “New,” at which point you can choose “Current liabilities” form the “Account Type” menu, followed by “Line of Credit” in the “Detail Type” field.

Why is it important to track lines of credit?

Whether it’s $1,000 or $1 million, tracking lines of credit is important because it allows you to see exactly how much of the available credit you’ve used. As a result, you can take precautions to ensure that you don’t overspend and up paying an excessive amount of interest. If you use Quickbooks Online, you can easily track lines of credit.

Can you track line of credit in QuickBooks Online?

Once you’ve created an account for the principle and an expense account, you can begin tracking the line of credit in Quickbooks Online. When you use your line of credit to make a purchase, for example, you’ll probably incur interest charges. As a result, you should record these interest payments in your newly created expense account.

How to reconcile a loan in QuickBooks?

To reconcile your loan right click the loan in the chart of accounts and click reconcile. Enter the closing date and the current outstanding amount in the reconcile window and reconcile away. Properly recording loans in QuickBooks is another very important part to your monthly bookkeeping processes.

What is a personal financier in QuickBooks?

personal financier to help purchase equipment, consolidate debt, or use a line of credit to help meet the cash flow needs of the business. Booking the subsequent loan into QuickBooks isn’t a blanket entry for every situation. Depending on the kind of loan and what it was used for different account types in QuickBooks will be used.

Is outsourcing your bookkeeping more affordable?

Outsourcing your bookkeeping is more affordable than you would think. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO.

What is QuickBooks for law firms?

QuickBooks is industry-neutral accounting software, which means it can be (and is) used by many different industries, including law firms.

What is included in QuickBooks?

QuickBooks includes the fundamentals of accounting, including a complete Chart of Accounts, P&L accounts and Balance Sheet accounts. Bank Accounts and Credit Cards. QuickBooks includes registers for managing bank accounts (operating accounts) as well as for credit cards and lines of credit. Financial Reporting.

What do law firms need?

However, law firms have unique needs when it comes to accounting. Most law firms need: General / Business Accounting. Trust / IOLTA Accounting. Cash Basis (vs. Accrual)

Is QuickBooks Desktop or QuickBooks Professional?

QuickBooks Professional. QuickBooks Professional (sometimes also referred to as QuickBooks Desktop) is the traditional, desktop-installed version of QuickBooks. The advantages of QuickBooks are a more robust, more developed set of features. Broadly speaking, QuickBooks Professional is a good fit for law firms that:

Is QuickBooks Online good for law firms?

Broadly speaking, QuickBooks Online is a good fit for law firms that:

Is QuickBooks Online web based?

QuickBooks Online (Web-based) Your third option is to simply use of the editions of QuickBooks Online, which is web-based and lightweight. This involves simply signing up for a QuickBooks Online account (pricing information is below), and creating logins for each person in your firm that needs it.

Does QuickBooks have time tracking?

Track billable hours and related expenses for a particular client or matter. However, time tracking is very limited, and best managed in dedicated Law Practice Management software.

What is LeanLaw Law?

LeanLaw is a technology company that helps solo lawyers and small law firms leverage technology to achieve Lean Practice, which we define as overhead of 20% of revenue or less.

Can you see what is being billed in QuickBooks?

In QuickBooks, you can see what has been billed, but you don’t see what is yet to be billed (work-in-progress) nor do you easily see by attorney revenue reports, by timekeeper reports, or by origination reports.

Is there a timer in QuickBooks Online?

QuickBooks Online timekeeping is not geared toward attorneys’ needs – especially if you want to track time on the go. If you want timers in QuickBooks Online, you have to buy a more expensive version. It’s not mobile and not built for your desktop.

Is QuickBooks Online a platform?

QuickBooks Online is not a platform I can rely on. This is a very 2015 type of myth. Truth be told, Intuit is strongly encouraging users to move away from the desktop version of QuickBooks to QuickBooks Online.

Can I do trust accounting in QuickBooks?

QuickBooks can’t do trust accounting for law firms. Actually, it can, but it’s a daunting 12-step process. Solution: LeanLaw created a behind-the-scenes, industry-approved legal workflow where you can resolve IOLTA trust accounting with one click. The legal trust accounting happens in QuickBooks Online, but your law firm can use simple, ...

Can you track expenses in QuickBooks?

Tracking expense in QuickBooks doesn’t connect to client matters. Expenses are tricky especially with trust accounting as it relates to contingency. QuickBooks has the ability to record expenses, but lacks the context relative to client matters.

Can QuickBooks handle fixed fee billing?

QuickBooks can’t handle fixed fee or hybrid billing. QuickBooks Online can do products & services fixed fees, but they don’t have all the instruments today’s law firms need such as milestone / recurring fixed fees. Solution: LeanLaw has a more matter-centric approach: hourly/flat fee milestone / flat fee recurring / flat fee with hourly, and more.

Popular Posts:

- 1. what is a lawyer that doesn't pass the test

- 2. where find lawyer

- 3. who is the best lawyer in the united states

- 4. what class do you have to be good in to be a lawyer

- 5. learn how to be a lawyer online

- 6. how much does a lawyer cost for eviction

- 7. how to find a lawyer like saul goodman

- 8. best famous lawyer who do green card process in usa

- 9. how gemara helps with becoming a lawyer

- 10. how i become a lawyer in new jersey