What to know before hiring a student loan lawyer?

- They can provide you with legal advice and guidance regarding your rights and options.

- They can represent your interests in communications or negotiations with a student loan holder, student loan servicer, debt collection agency or administrative body.

- A lawyer can help you resolve delinquencies or defaults or apply for loan discharge.

When to hire a student loan lawyer?

Interest rates for new federal student loans reset every July and rely on a formula set in law based on the 10-Year Treasury note. While interest rates on federal student loans remain close to ...

When is it time to hire a student loan lawyer?

You must hire a student loan lawyer if one of two things is correct: you are being sued for a student loan, or you are not sure about the mortgage loan problem you are facing, and you need help. Having said that, if you are sued, you may not need to hire a student loan attorney to protect you, but you should at least hire him for a consultation.

What happens to my student loans if I file for bankruptcy?

Even if your student loans will not be discharged by a bankruptcy, you may still benefit from filing a bankruptcy or making a proposal to your creditors. Eliminating other debts may free up enough cash flow to allow you to repay your student debts on your own.

Can you get student loans removed with bankruptcy?

You may have your federal student loan discharged in bankruptcy only if you file a separate action, known as an "adversary proceeding," requesting the bankruptcy court find that repayment would impose undue hardship on you and your dependents.

What bankruptcy clears student debt?

Chapter 13 Bankruptcy The bankruptcy court will determine your new monthly debt payments, including your new student loan payment, based on your circumstances. 8 Chapter 13 might help you if you're struggling to pay student loan debts, and you can't lower your monthly payment any other way.

How can I get student loan forgiveness from Covid?

No, there is no coronavirus-related loan forgiveness for federal student loans. The Department of Education and your loan servicer should be your trusted sources of information about official loan forgiveness options. You never have to pay for help with your federal student aid.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

With Chapter 7, those types of debts are wiped out with your filing's court approval, which can take a few months. Under Chapter 13, you need to continue making payments on those balances throughout your court-instructed repayment plan; afterwards, the unsecured debts may be discharged.

The Undue Hardship Exception

To have your student loan discharged in bankruptcy, you must demonstrate that it would be an undue hardship for you to pay them. The test for deter...

Procedure to Discharge Your Student Loan in Bankruptcy

If you want to try to discharge your student loan in bankruptcy, you must file an adversary proceeding to determine dischargeability with the bankr...

Raising Defenses to Student Loan Debt in Bankruptcy

You might have defenses to payment of your student loan debt, particularly if you attended a vocational or trade school. Examples include breach of...

Consider Consulting With An Attorney

You’ll find the Brunner test or other standards applied to Chapter 7 and Chapter 13 debtors in lots of court cases. Knowing how the court in your j...

What Happens If Your Student Loans Aren’T discharged?

If, as in most cases, your loans are not discharged in bankruptcy, here’s what happens. 1. Chapter 7 bankruptcy. In Chapter 7 bankruptcy, if paymen...

Government Versus Private Loans

The federal government is the lender for a significant percentage of student loans. (The federal government started making loans directly in 2010.)...

Why Finding a Student Loan Attorney is Difficult

If you are having difficulty finding an attorney to take on your student loan case, it doesn’t necessarily mean you have a bad case. It is difficult to find a student loan attorney because there are so few. Even though student loans affect millions in the U.S., few attorneys are knowledgeable on the laws surrounding student loan issues.

Step Number One: Familiarize Yourself with the Relevant Student Loan Law

Don’t worry. You don’t need to be a legal scholar to get through this step. You just need to familiarize yourself with the basics of the relevant laws. The Internet provides a good resource for doing this. There are often websites, such as this one, that provide a broad overview of the concepts you’ll need to be aware of.

Step Number Two: Explain the Relevant Facts of Your Case

One of the most frequent mistakes we see people make when they’re explaining a legal situation is that they skip over important facts and focus on irrelevant details.

Step Number Three: Show That the Law is on Your Side

Legal research can be both expensive and time-consuming. If you can find cases, ideally in your court’s jurisdiction, you can save your attorney some time and convince them that you have a winnable case. This is another place where the research you did before can come in handy.

Step Number Four: Have Realistic Expectations

For many attorneys time is money. You will likely be asking them to step outside of their typical area of practice. Many attorneys prefer to stick to their niche and not stray into other types of cases. When you discuss what you are looking for, be sure to get to the point.

How to discharge student loans in bankruptcy?

If you want to try to discharge your student loan in bankruptcy, you must file an adversary proceeding to determine dischargeability with the bankruptcy court. But that's not all. You'll need to present evidence and prove to the court that payment of your loans will cause an undue hardship.

What to do if you have student loan debt?

If you have a substantial amount of student loan debt, it might be worthwhile to consult with a local bankruptcy attorney. The chances are that if you decide to litigate either the dischargeability issue or assert a defense to the loan in bankruptcy court, you'll need an attorney to represent you.

What are the factors that determine if you can discharge a student loan?

Some courts use the Brunner test. Under this standard, you can discharge your student loan if you meet all three of these factors: Poverty. Based upon your current income and expenses, you cannot maintain a minimal standard of living for yourself and your dependents if you are forced to repay your loan. Persistence.

Does bankruptcy affect student loans?

The federal government is the lender for a significant percentage of student loans. (The federal government started making loans directly in 2010.) However, private financial institutions, such as banks, also offer loans to students, primarily because many students cannot fund their entire education without such supplementation. It doesn't matter whether you have a government or a private student loan. To discharge either in bankruptcy, you must show that repaying the loan would cause undue hardship.

Can you get a student loan discharged in bankruptcy?

To have your student loan discharged in bankruptcy, you must demonstrate that it would be an undue hardship for you to pay them. The test for determining undue hardship varies between courts. Also, many courts look at the undue hardship test as all or nothing—either you qualify to get the whole loan discharged, or you don't. Other courts have discharged a portion of a debtor's student loan.

Can you owe student loans if you are in vocational school?

You might have defenses to payment of your student loan debt, particularly if you attended a vocational or trade school. Examples include breach of contract, unfair or deceptive business practices, or fraud. If you succeed, you won't owe the debt at all, making the dischargeability issue moot.

Can you file for bankruptcy if you can't pay student loans?

Chapter 13 bankruptcy. If you can't discharge your student loans, Chapter 13 bankruptcy provides some other ways that can help. For example, you'll likely be able to pay a reduced amount during your Chapter 13 plan —although you'll be on the hook for whatever amount is left after your repayment period ends.

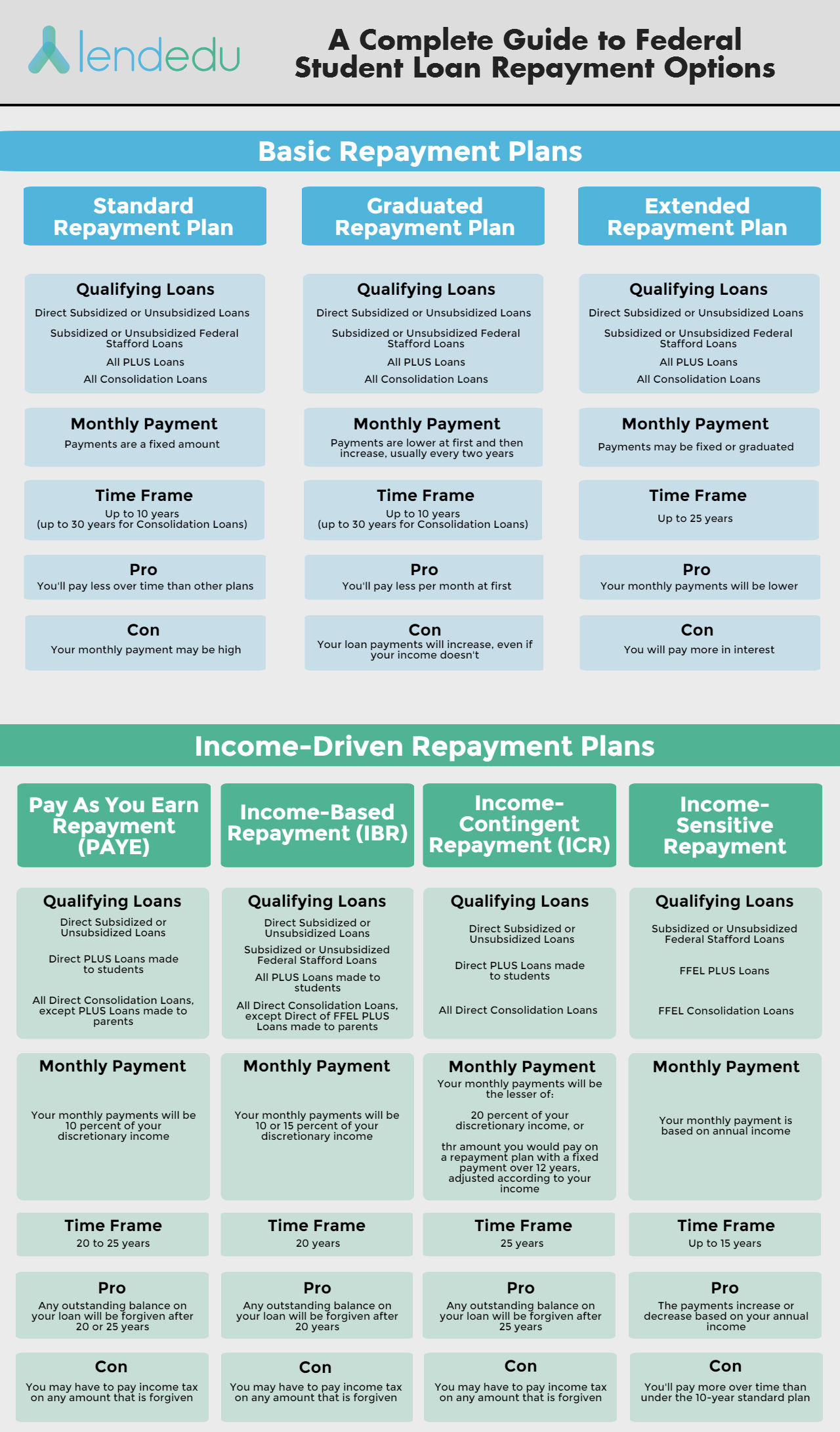

Why are student loans better than other loans?

Federal student loans have an advantage when it comes to lowering monthly payments because there are repayment plans available and other programs to help with monthly payments. The income-driven repayment plans offered by the federal government allow individuals to base their monthly payments on their income.

What is an eligible institution for student loans?

Eligible Institution: The college or university at which a private student loan borrower is enrolled must be an eligible institution. It is important to look for institutions that are unaccredited. Student debt is a problem for millions of people and many do not believe there are opportunities to get out of this problem.

What to discuss with a student loan lawyer?

When you meet with a student loan lawyer, you’ll start by reviewing your entire financial situation. This includes the types of student loans you have, the balances, the payments, and any other relevant facts such as when you went to school, your payment history, and your current employment.

What is considered an eligible student?

Eligible Student: An additional requirement for a qualified educational loan is that the private student loan borrower is an eligible student during the period of the loan. Some factors of an eligible student include being a US citizen or eligible non-citizen and enrollment in an eligible degree.

How long can you default on a student loan?

Defaulting on student loans, whether federal or private, can have huge repercussions on your loans. Once one payment on a federal loan is late for more than 270 days, your loan balance is subject to a 24.5% addition to the balance of the loan and you can default multiple times.

Is bankruptcy a civil or adversarial proceeding?

Opening a bankruptcy case is a relatively simple and straightforward process. The adversarial proceeding is similar to a civil action, in that it starts with a complaint and can require a trial if the case proceeds that far. Your type of student loan will be a big factor in how far you can expect the case to proceed.

Can student loans be discharged?

The truth is student debt can be discharged in several ways and there are many programs out there to help with student debt. The problem is there is not a lot of information available to student loan holders and there are very little professionals out there that understand the many options available.

How long do student loans default?

Your student loans are in default when you have not made payments for 270 days (about nine months). This is the point that signals to a lender that you do not intent to pay back a loan. Therefore, they will refer your case to a collection agency to take action against you. If you act quickly, you may be able to work things out with your loan servicer yourself. Even then, consulting with a student loan lawyer is not a bad idea even if you handle the bulk of the work yourself.

What to do if student loan default proceeds to a law suit?

But if your default proceeds to a law suit or collections, you should consult with a student loan lawyer. However, you could first try talking with your loan servicer and use some of the remedies such as an Income-driven payment plans described above in the Delinquency section.

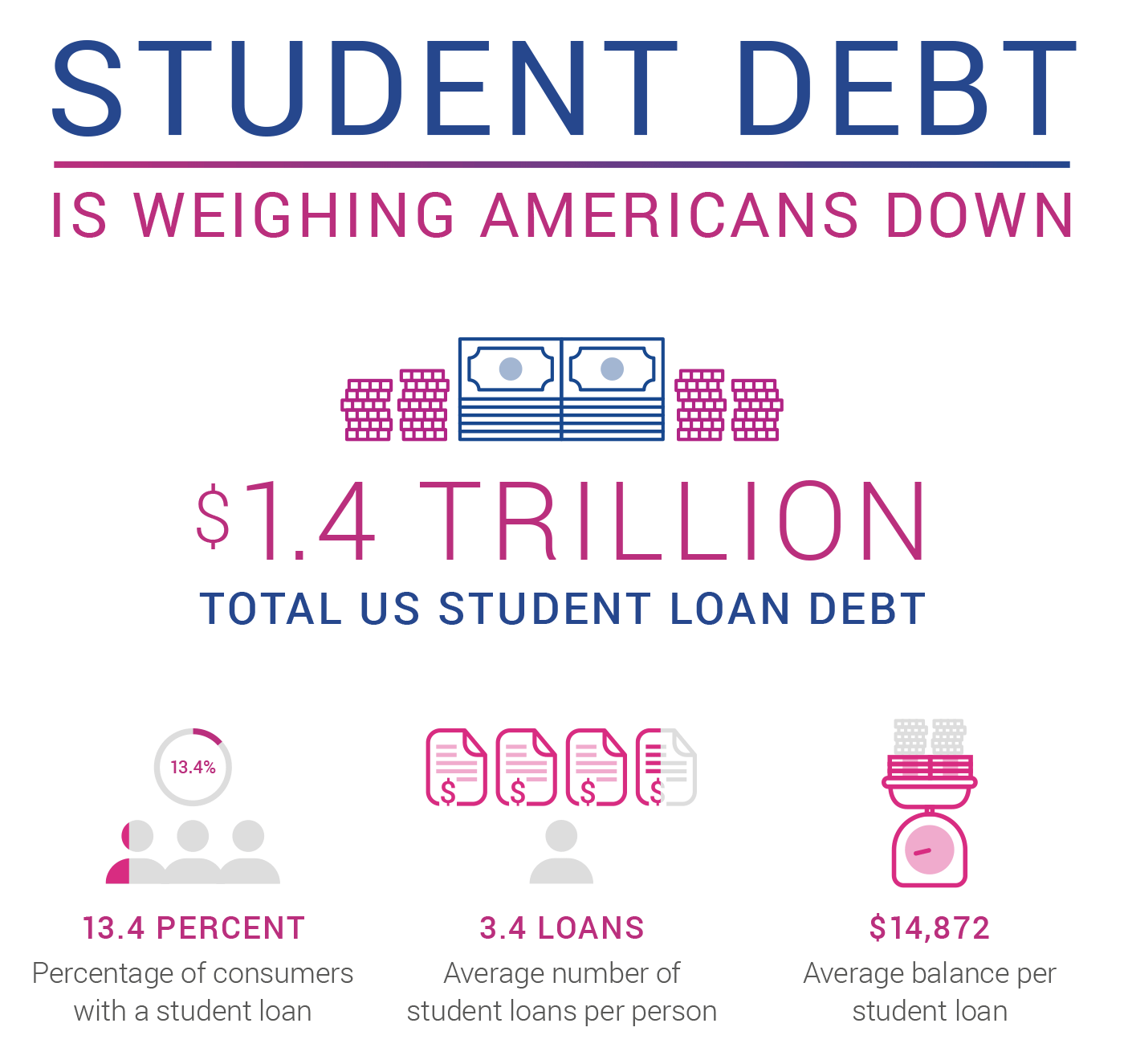

How many people default on student loans?

Over 3,000 people default on their federal student loans each day in the United States. Fortunately, you have many options to help you get your payments under control, and most of these you can do yourself. However, there are occasions when it pays to hire a student loan lawyer. A student loan lawyer is an attorney who is experienced in dealing ...

What is a TLFP?

The Teacher Loan Forgiveness Program (TLFP) is for those who teach in low-income schools or educational service agencies. To apply for student loan forgiveness for a teaching position, complete a Teacher Loan Forgiveness Application and submit it to your loan servicer.

What to do if you are being sued for student loans?

If you are being sued or are in collections, in most cases you will want to speak with a student loan lawyer. Often an attorney can help you see solutions you might miss before the window of opportunity for action narrows. Even if you decide to proceed on your own, it is a good idea to consult with an attorney.

What is it called when you can't pay your student loan?

Federal student loans and some private ones allow a postponement of payment under certain circumstances. This is called deferment. Various circumstances qualify such as being in school or the military.

Who is a student loan lawyer?

A student loan lawyer is an attorney who is experienced in dealing with student loan debt issues, can illuminate your options and can represent you with lenders, creditors and the courts. Every situation is different, so we are not here to tell you when you definitely should or should not hire a student loan lawyer.

How a student loan lawyer in Texas can help you

A student loan lawyer might be able to work out a settlement or file for bankruptcy on your behalf. In either case, it is important that the student loan attorney you choose understands student loans and how they work. They should also know what options are available to Texas borrowers.

A student loan attorney in Texas may help you with your federal student loans

They can advise you on student loan consolidation, student loan repayment plans, and student loan forgiveness programs.

Find a student loan lawyer in Texas

Consider this scenario: you’re one of the millions of Americans who have taken out student loans. You may find it tough to work with the IRS or another government agency since you must complete numerous paperwork and jump through hoops. You might not be familiar with all of your alternatives. We can help you in making this easy!

What happens at the end of a student loan settlement?

At the end of a successful student loan settlement, the borrower ends up paying only a fraction of the original balance claimed by the lender. The rest of the debt is forgiven by the lender and the settlement is a full and final settlement of the debt, leaving the borrower without the burden of student loan debt going forward.

Why are the Corinthian 15 protesting student debt?

Or there is the story of the “ Corinthian 15 ” who are protesting student debt because there for-profit school, Corinthian College, illegally pushed predatory loans on their students after lying to them about career assistance and job prospects.

Why do you need a student loan lawyer?

Here is the main reason you need a student loan lawyer to fight for you and protect you against student loan lenders , such as Navient, Discover, National Collegiate Trust, etc. — there is A LOT of money exchanging hands in the student lending market.

What are the two main types of student loans?

There are two main categories of student loans: federal and private. Federal student loans, such as Stafford Loans are backed by the federal government and are highly regulated. We do not work with federal student loans. On the contrary, private student loans may be issued by well known banks, like Citigroup or Chase Bank.

Do student loan collectors break the rules?

It is no secret that student lenders, servicers and collectors tend to break the rules. The CFPB, the government’s financial watchdog agency, recently reported that the federal government’s own student loan debt collectors are breaking the rules.

Is student loan debt higher than ever before?

Consequently, student loan debt has soared, higher than ever before. In particular, many were forced to take out higher interest rate private student loans, not backed by the federal government. Some less scrupulous schools lured people into education programs with promises of high paying jobs that never materialized.

Can you get a higher interest rate on a private student loan?

Interest rates for private loans are generally higher, cannot be forgiven, and are never subsidized. However, private student loans are not need-based so you can qualify for a higher loan amount if you have good credit.

How long does it take for a student loan to be forgiven?

Depending upon the type of federal student loan repayment plan you are in, your loans may be forgiven after 20 or 25 years of qualifying payments. If you are unsure of whether your loan qualifies for income-driven repayment forgiveness or are unsure of the type of income-driven repayment plan you’re in, our student loan forgiveness lawyer can ...

What is the best loan forgiveness program?

The main loan forgiveness program that gets the most notoriety is public service loan forgiveness. Public service loan forgiveness is not defined as a program you enroll in; rather, it is a redemption plan in which you redeem the forgiveness once you have reached the required 120 qualifying payment months. There is no limit on how much student loan debt can be forgiven. Public Service Loan Forgiveness has three requirements to make the payments “qualifying”: 1 The right kind of employer 2 The right kind of loan 3 Actively paying

How many years do you have to teach to get a teacher loan forgiveness?

The requirement for teacher loan forgiveness is teaching for 5 consecutive years in a qualifying school district. Generally, most rural and urban school districts and some suburban school districts will be qualifying school districts. However, a good rule of thumb is to ask the principal of any school if the school district will qualify.

How much can you forgive a teacher's student loan?

If you teach science or math in high school, you can get up to $17,500 forgiven.

How many months do you have to pay for a public service loan?

For public service loan forgiveness, when you get through your 120 qualifying payment months, you submit the necessary paperwork and you are granted forgiveness. If you paid months 121 and 122, you would receive those payments back upon acceptance of your forgiveness.

Is loan forgiveness good?

Loan forgiveness is a great option for those individuals who can meet the requirements. Unfortunately, many people make mistakes in meeting the requirements and there is no going back and changing who you worked for or the hours you worked. Therefore, it is essential that you start out in compliance.

Is student loan forgiveness taxable?

Unfortunately, unlike the public service forgiveness, income-driven repayment forgiveness is potentially taxable. We say potentially because there are exceptions to the rule. If this is a concern for you, our student loan forgiveness lawyer along with our tax lawyers can advise you on ways to address this.

Circumstances When a Student Loan Lawyer May Help

There are some common scenarios where hiring a student loan debt lawyer may be a good idea, such as when:

How to Find a Student Loan Lawyer

Because student loan issues can be complex and ever-changing, it’s important to find a lawyer who specializes in them. Here are some resources that can help.

How to Vet a Student Loan Lawyer

Most lawyers will offer a phone or video consultation for free. During this time, ask how many people they’ve helped with your specific issue. Get a feel for how experienced and comfortable they seem with your problem. Also consider how comfortable you are with the attorney. For example, can they answer all your questions in terms you understand?

Get to Work

Once you choose a student loan lawyer, assemble the related documents before your first official meeting. These may include monthly loan statements, proof of payments, letters from the lender, copies of online communication, previous tax returns and more.

Popular Posts:

- 1. what do you do when lawyer screws up qdro

- 2. how to qualify you for volunteer lawyer program, north dakota, income guidelines

- 3. what white house lawyer was fired by trump

- 4. how to send a legal notice without a lawyer

- 5. who is likely to need a criminal defense lawyer

- 6. when is it a good idea to have a lawyer review a mortgage at closing

- 7. how does a defendant's lawyer appeal the bail decision

- 8. how much should an immigration lawyer charge

- 9. how to ask a lawyer to take a pending case

- 10. what do you call a lawyer gone bad