How to Transfer a Deed Without an Attorney

- General Warranty Deeds. The deed most commonly used to transfer residential real property in the U.S. ...

- Special Warranty Deed. The special warranty deed is also known as a grant deed, resembling the general warranty deed in most ways.

- The Quitclaim Deed. Quitclaim deeds fall at the far end of the spectrum. ...

- Prepare and File the Deed. ...

- Retrieve your original deed. ...

- Get the appropriate deed form. ...

- Draft the deed. ...

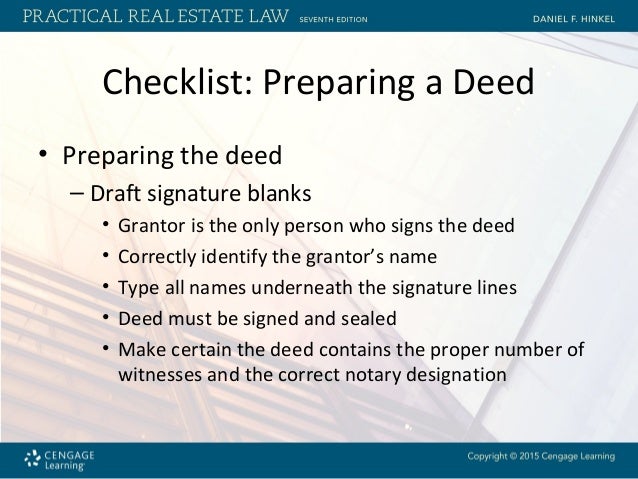

- Sign the deed before a notary. ...

- Record the deed with the county recorder. ...

- Obtain the new original deed.

How to transfer real estate with a power of attorney?

Jun 16, 2020 · What Are the Steps to Transfer a Deed Yourself? Step 1. Retrieve your original deed. If you’ve misplaced your original deed, get a certified copy from the recorder of deeds in the county where the ... Step 2. Get the appropriate deed form. Step 3. Draft the deed. Step 4. Sign …

How to transfer a deed of house after death?

How do you transfer property from one person to another? Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Do you need a lawyer to change a deed?

Nov 30, 2019 · Prepare and File the Deed. Generally, real estate professionals assist a seller in determining which deed to offer, preparing and filing it with the appropriate office. If the seller wishes to do these steps herself, she can obtain the appropriate deed form at an office supply …

How much does a deed transfer cost?

Jun 06, 2018 · Changing Or Transferring A Deed . To change or transfer a deed without a lawyer, obtain a certified copy and review the information. After checking for accuracy, use a deed …

How much does it cost to transfer a deed in NY?

How much does it cost to file a quit claim deed in New York?

How long does it take to transfer property ownership?

How do you transfer a property title?

- File and secure the documentary requirements. ...

- Secure assessment of transfer taxes. ...

- File documents at the BIR for the issuance of Certificate Authorizing Registration (CAR) or BIR Clearance.

What is the most common deed used to transfer residential property?

The deed most commonly used to transfer residential real property in the U.S. is the general warranty deed . If the owner is selling to a third party stranger, as is often the case, the buyer will likely insist on a warranty deed.

Do Quitclaim deeds contain title?

Quitclaim deeds fall at the far end of the spectrum. They do not contain any promises about title, encumbrances or ownership. That is, the seller does not even promise that he owns the property he is conveying, much less agree to protect the grantee from any title defects.

What is a quitclaim deed?

The Quitclaim Deed. Quitclaim deeds fall at the far end of the spectrum. They do not contain any promises about title, encumbrances or ownership. That is, the seller does not even promise that he owns the property he is conveying, much less agree to protect the grantee from any title defects.

What is a warranty deed?

The deed most commonly used to transfer residential real property in the U.S. is the general warranty deed. If the owner is selling to a third party stranger, as is often the case, the buyer will likely insist on a warranty deed. Any grantor signing this type of deed makes a series of binding promises called covenants to the buyer, including: 1 the covenant of seisin , under which the grantor promises that she owns the property and has the right to convey it; 2 the covenant against encumbrances , under which the grantor guarantees that the real property doesn't have any liens or encumbrances other than those mentioned in the deed; and 3 the covenant of quiet enjoyment , under which the grantor agrees to defend the grantee's title against anyone claiming under it from any point in the past.

What is a quit claim deed?

A quitclaim deed is utilized when you need to transfer an interest in the physical property from one person to another. On this type of deed, it will list the name of the person who is handing over their claim and the name of the person who is accepting ownership.

What is warranty deed?

It indicates that they are transferring title to another individual and that the seller owns the piece of property free and clear without any liens. Typically, a warranty deed will be used when a piece of property is sold.

Where to file quit claim deed?

Be sure to photocopy the document, distribute it to all parties and file the quitclaim deed with the local land records office where the property is located.

What does a real estate attorney do?

The real estate attorney will do an inquiry to establish the legal description of your property. He will also confirm the current owners whose names appear on the deed. Usually this process will fall into one of three categories: For a transfer to a trust, a certificate of trust or abstract of trust needs to be supplied.

Can an aging parent give responsibility for their home?

Sometimes an aging parent wants to give legal responsibility for their home to their child. If the property has a mortgage on it, the child who receives the property will need to get a loan before completion of the property transfer.

How to transfer real estate?

You can transfer real estate by completing a deed. A deed is a legal document which describes the property being sold and must be signed by the sellers. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property. Although you usually don’t need a lawyer to transfer real estate property, ...

What is a deed in real estate?

A deed is a legal document which describes the property being sold and must be signed by the sellers. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property. Although you usually don’t need a lawyer to transfer real estate property, you should contact an experienced real estate ...

What is a quit claim deed?

With a quitclaim deed, the seller transfers whatever interest in the property that they own. However, the seller does not promise that it actually owns the title to the property. Because quitclaim deeds provide less protection, they are usually used to transfer property between family members or between close friends.

What is warranty deed?

A warranty deed provides the buyer with the most protection. You should use it if you don’t know the seller. Quitclaim Deed. With a quitclaim deed, the seller transfers whatever interest in the property that they own. However, the seller does not promise that it actually owns the title to the property.

Can you transfer a deed to a beneficiary?

Most assets can easily transfer to beneficiaries outside of probate, but transferring real estate can be tricky. The process of transferring the deed of a house will hinge on how the house is titled. The first step is usually to procure a copy of the deed from the county recorder’s office to determine how the property is titled.

Can a decedent transfer the title of a house?

If the decedent owned the house individually, or if they owned the house as a tenant in common with other owners, the house can only transfer title of ownership through probate. If that’s the case, here’s how to transfer ownership of the house through probate court:

What happens when you die without a will?

When someone dies without a will, they die “intestate,” and their assets will be distributed to their legal heirs according to the state’s intestacy laws. Intestacy laws are designed to fairly award assets to legal heirs, but they don’t allow the decedent’s family to have any say in who receives which assets. In the state of Arizona, intestate succession is determined in the following order: 1 If the decedent was married and did not have children with another partner, their entire estate will transfer to their spouse ( ARS 14-2102) 2 If the decedent was married and had children with another partner, the spouse would receive 50% of the estate, and the children from the separate relationship (s) would split the remaining 50% of the estate 3 If the decedent was not married, their estate would go to their children by representation ( ARS 14-2103) 4 If the decedent was not married and didn’t have children, their estate would go to their surviving parent (s) 5 If the decedent was not married, didn’t have children, and doesn’t have surviving parents, the estate would pass to their siblings by representation 6 If the decedent was not married, didn’t have children, and doesn’t have surviving parents, siblings, nieces, or nephews, the decedent’s extended family can claim the estate (grandparents, aunts, uncles, cousins, etc.) 7 In rare cases where the decedent doesn’t have any family members, or if nobody comes forward to claim the estate, the state has the right to seize the decedent’s assets ( ARS 14-2105)

How long does it take for a personal representative to settle a claim?

Once probate has been opened, creditors usually have four months to file a claim against the estate.

How long does it take for creditors to file a claim against an estate?

Once probate has been opened, creditors usually have four months to file a claim against the estate. Liabilities take precedence over willed-beneficiaries and legal heirs, so the personal representative may be required to liquidate assets (including the house) if necessary to settle the liabilities.

What happens when a personal representative files a final accounting and report of their activities?

When the personal representative files a final accounting and report of their activities, the court will order a transfer of “clear title” and close the estate. With the court order in hand, the county recorder’s office will issue a new deed in the beneficiary/heir’s name.

Can a power of attorney be used to transfer a property?

Instead, the agent can use the power of attorney to manage the disabled principal’s affairs without court involvement. Powers of attorney are often used to transfer real estate. In the typical situation, the principal is physically or mentally disabled and cannot sign document on his or her own behalf.

Can a power of attorney sign a deed?

The person named as agent (usually a spouse or other family member) can use the power of attorney to sign the real estate documents—including the deed —without opening a guardianship or conserva torship or otherwise obtaining court permission.

What is a power of attorney?

A power of attorney is a legal document that authorizes one person, called an agent, to act on behalf of another person, called a principal . The agent owes a fiduciary duty to the principal. This means that the agent can only take actions for benefit the principal and should generally refrain from actions that benefit the agent personally.

Can a power of attorney be used to convey real estate?

Even though a power of attorney can be used to convey real estate, title insurance companies are not required to accept the power of attorney. If the title insurance company refuses to insure title to property previously conveyed by power of attorney, there could be a cloud on title that affects the property value.

What is a vesting paragraph in a deed?

The vesting paragraph is the portion of the deed that contains the language that transfers the real estate from the current owner ( grantor) to the new owner ( grantee ). Given that the agent under the power of attorney will sign the deed, who should be listed in the vesting paragraph? Should the vesting paragraph list the grantor even though the grantor will not be signing the deed? Or should the vesting paragraph list the agent even though the agent is not the current owner?

Where does the grantor's name appear in a notary?

The last place that the grantor’s name appears is in the notary acknowledgment. The acknowledgment is the place where a notary public certifies that the person signing the document is who he or she claims to be. There are specific rules that a notary must follow to comply with state law. These rules include verification of the identity of the person signing the document, stamping the document with a notary seal, and (in some states) keeping a record of the transaction in the notary log.

What are the rules for notary?

These rules include verification of the identity of the person signing the document, stamping the document with a notary seal, and (in some states) keeping a record of the transaction in the notary log.

Popular Posts:

- 1. lawyer who sues lawyers

- 2. when can you obtain a lawyer when talking to the police

- 3. who pays the mediator lawyer or client

- 4. how to resign desi consult lawyer

- 5. things to remember when meeting with lawyer defense

- 6. what charges to file if you are questioned without your lawyer

- 7. how to get a bankruptcy lawyer

- 8. what does it mean when a lawyer sanctions you

- 9. how much for lawyer to work on will

- 10. who was the lawyer that was on lawrence o donnell