- Look at biographical information, including the lawyers’ own websites. Do they appear to have expertise in the area of trusts and estates? ...

- Search the internet to learn more about prospective attorneys. Search using the name of the lawyer and his or her law firm. ...

- Ask other people if they have heard of the attorneys and what they think about them.

- Contact your state bar association or visit the bar association's Web site to find out if the lawyer is in good standing.

- Is the lawyer certified as a specialist in your state? Not every state certifies specialists in trusts and estates, or estate planning, but if your state does, selecting a lawyer ...

- Check the membership directory of local, state or national associations. Is the lawyer listed? One example would be the American College of Trust and Estate Counsel.

- Read any relevant Yelp reviews.

- Consider how lawyer's staff treats you when you call the office because they are a reflection of how the lawyer practices. ...

- Unless there are special circumstances, you'll want to hire a lawyer with a local office.

Full Answer

Do I need a lawyer to make a special needs trust?

The first place to look for a qualified special needs attorney is among friends, colleagues and other professionals. Word of mouth and positive referrals are usually among the best resources for locating an attorney, and especially one who must have particular skills.

How do I find a special needs attorney?

With a special needs trust, there are age limits. Specifically, the special needs trust must be created and funded before a beneficiary turns 65 years old. Once they turn 65, no additional funds may be added to the trust. Lastly, if there are leftover funds in a special needs trust when a beneficiary dies, the government will require the trust ...

How to choose a trustee for a special needs trust?

Special Needs Trusts. Special needs trusts are trusts that are created for the benefit of a person who is physically or mentally disabled. As in any trust, the trust establishes a legal relationship between the settlor or grantor, who created the trust; the trustee, who oversees trust assets, and the beneficiary, who receives distributions from ...

Should I hire a lawyer to write a trust?

Find an Attorney Hire an attorney who understands the intricacies of special needs law. Click on a State Where You’d Like to Find an Attorney You need to make sure you’re working toward a whole lifetime of good outcomes. You’re trying to meet a …

What are the disadvantages of a special needs trust?

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT – The yearly costs to manage the trust can be high. ... Lack of independence. ... Medicaid payback.

Who controls the money in a special needs trust?

trusteeLike all trusts, a special needs trust is organized around the people in three roles: a settlor (also called grantor) who creates the trust and provides the money. a beneficiary (the person with the disability), and. a trustee, who manages the money for the sole benefit of the beneficiary.

What is the difference between a special needs trust and a supplemental needs trust?

The term “special needs trust” refers to the purpose of the trust — to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name “supplemental needs trust” addresses the shortfalls of our public benefits programs.

What are alternatives to a special needs trust?

Special Needs Trusts are a useful tool and a long-term plan for savings; however, they are not always a good fit for everyone. Alternatives to opening a trust include spending down the funds, prepayment of living expenses, and ABLE Accounts.

What are the 3 types of trust?

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...•

Can a trust be a disabled beneficiary?

Leaving money to a disabled person in a will trust. Using a will trust can help you to look after a disabled relative in the future so that it does not affect their benefits. If your loved one is vulnerable or lacks capacity, a will trust can also help: protect them from the risk of financial abuse.

What are the advantages of a special needs trust?

Special needs trusts are designed to enhance the quality of life of a person with a disability by maximizing the resources available to them. It preserves eligibility for Supplementary Security Income (SSI) and Medicaid (which pay for food, shelter, and medical care but little else).

What can a supplemental needs trust be used for?

Supplemental Needs Trusts are often used to receive an inheritance or personal injury litigation proceeds on behalf of an individual with a disability, in order to allow the person to qualify for Medicaid benefits despite their receipt of the settlement.

Can you have more than one special needs trust?

A special or supplemental needs trust (SNT) is a specific type of trust that focuses on providing financial support to elderly or disabled persons. An SNT can supplement their standard of living without jeopardizing the government benefits they receive. There is more than one type of special needs trust.

What is a special needs trust?

As discussed above, a special needs trust is specifically used to care for an individual who has a mental or physical disability. Thus, the primary situation in which a special needs trust is used is when a parent or loved one wants to ensure that the beneficiary will be able to support themselves in the event of their death or incapacitation.

How old do you have to be to set up a special needs trust?

With a special needs trust, there are age limits. Specifically, the special needs trust must be created and funded before a beneficiary turns 65 years old. Once they turn 65, no additional funds may be added to the trust.

Why is a trustee important?

The reason why this is such an important advantage is because in many cases a disabled beneficiary will not be capable of handling their affairs on their own. By securing the property in the care of a trustee, however, the settlor and beneficiary can rest assured that the trust property will be handled in a sound and reasonable manner. In fact, a trustee is legally obligated to use “sound judgment” when managing the contents of a trust.

What age can you set aside money for a supplemental needs trust?

Second, there are no age limits on a supplemental needs trust. The only exception is if after the age of 64 the beneficiary enters a long-term care facility.

How is a special needs trust funded?

This may include funds inherited from a will, monetary gifts from relatives or friends that are deposited directly into the trust, or by survivorship life insurance policies.

Why do special needs trusts collect?

The reason why a special needs trust allows them to collect both is because its rules waive the standard requirement to reduce or eliminate the amount of government benefits when someone inherits or is given a monetary gift. This restriction does not apply to a special needs trust.

What is a trust?

A trust is a type of fiduciary arrangement that is formed between three parties: a settlor, a trustee, and one or more beneficiaries. In general, the purpose of a trust is to provide legal protection over the contents held within the trust (usually monetary funds or assets). However, there are many different kinds of trusts ...

How can a special needs trust attorney help you?

Some of the ways in which a special needs trust attorney can assist you include: Help you determine whether a special needs trust could benefit you. Assist in the creation of the trust. Make sure the trust has provisions to deal with potential unforeseen circumstances.

How to create a special needs trust?

Special needs trusts are created by complex federal and state laws that are often difficult to understand. Retaining an attorney who is familiar with the creation of special needs trusts can ensure that your assets are protected and you or your loved ones future needs will be met. Some of the ways in which a special needs trust attorney can assist you include: 1 Help you determine whether a special needs trust could benefit you 2 Assist in the creation of the trust 3 Make sure the trust has provisions to deal with potential unforeseen circumstances 4 Ensure that the trust complies with all state and federal laws

Who is the trustee of a trust?

As in any trust, the trust establishes a legal relationship between the settlor or grantor, who created the trust; the trustee, who oversees trust assets, and the beneficiary, who receives distributions from the trust assets.

What to look for in an estate and trust attorney?

So, if you need a trusts and estates attorney, look for one who specializes in the area of your concern. For example, if your mother just passed away and you want to hire an attorney to settle her estate, look for someone with lots of experience probating estates in the county where your mother lived. (Probate rules vary county to county.) Or, if you want to plan your estate but have a complicated financial situation, look for an attorney with lots of experience drafting trusts, ideally someone with a tax background as well.

What can a trust and estates attorney do?

A trusts and estates attorney can help you: make a plan for what will happen your property when you die ( wills and trusts) avoid probate (living trusts, transfer-on-death tools, beneficiary designations) reduce estate taxes. plan for incapacity (powers of attorney and living wills) set up trusts for loved ones. manage ongoing trusts.

How to choose a lawyer?

Use your common sense and instincts to evaluate the remaining lawyers on your list. Eliminate those that don’t feel like a good fit, as well as those that are not confident that they can help you. Trust your gut and choose the lawyer that feels right to you.

How to get a lawyer to know what you are doing?

Talk with several lawyers. Get a sense of their communication skills as well as their expertise. You want to be confident that they know what they’re doing professionally, but also trust your gut about how well you ‘click’ and about how well the attorney will meet your needs.

What to ask other people about attorneys?

Ask other people if they have heard of the attorneys and what they think about them.

Can an attorney draw up a will?

If one of these attorneys offers to draw up your will or trust, he or she will probably just plug your information into a software program without really knowing the details about the law or what effects it might have on your estate.

Does every state have a certified specialist in trusts?

Not every state certifies specialists in trusts and estates, or estate planning, but if your state does, selecting a lawyer with this certification provides an added assurance that he or she is qualified. (A certified specialist may charge more than someone without a certification.)

What is special needs trust?

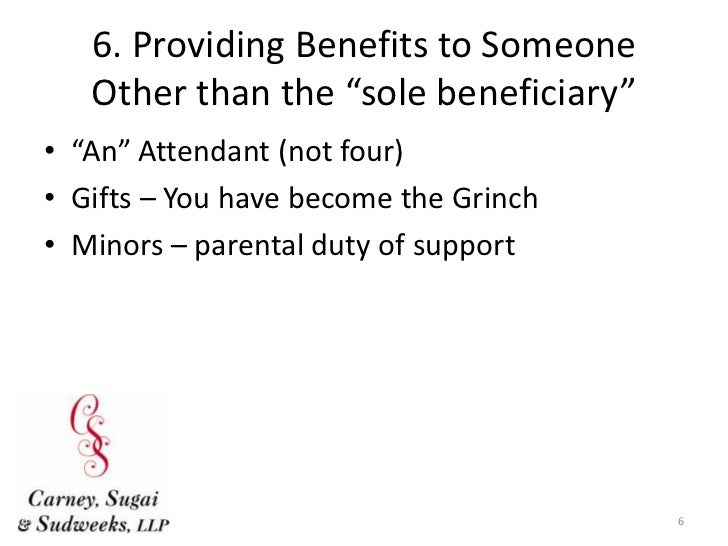

A special needs trust must be managed for the benefit of the beneficiary. This means that the person serving as trustee must not act in his or her own interests—or the interests of others—when making investment or spending decisions.

How to choose a trustee for a trust?

When you're choosing a trustee, you should do your best to find a trustee who will be around as long as the beneficiary needs the trust. This means you need to think about both the trustee's life expectancy, and the life expectancy of the person with special needs.

What is a trust protector?

Using a Trust Protector. In addition to naming trustees, some special needs trusts name people to serve as " trust protectors" or "advisors" to the trustee on various issues , such as investment strategies or compliance with SSI and Medicaid rules.

What does an honest trustee do?

However, an honest and honorable trustee will make decisions based solely on the beneficiary's needs. And if you don't expect the remainder beneficiary to inherit anything—for example, if the trust funds just won't last that long—this may not be a big issue for you.

What happens if a trustee is not the right age?

If you your ideal trustee is not the right age, in the trust document, you can give the trustee the ability to appoint a successor. Or, you could empower a trust protector to name a successor. (See below.)

How to facilitate understanding between trustee and beneficiary?

To facilitate understanding between the trustee and the beneficiary, you might consider giving the trustee a letter describing the beneficiary's needs, as we discuss in The Trustee's Job.

What are the qualities of a trustee?

The job of trustee requires a unique balance of care for the beneficiary, fiscal responsibility, ability to understand SSI and Medicaid laws, and more.

Popular Posts:

- 1. what did they call a lawyer in regency times

- 2. how does traffic lawyer work on my behalf

- 3. whats it called when a lawyer does not do what your paying them for

- 4. practicing lawyer who is also officer of a corporation

- 5. what what type of lawyer do you need to sue a therapist

- 6. what is the experience needed to be a lawyer

- 7. how much does a trial lawyer cost for big cases

- 8. lawyer and client when moving law firms

- 9. when does a lawyer have an unwaivable conflict of interest

- 10. who is the best lawyer in tattnall county