What do you need to know about Form 1120?

Mar 01, 2022 · Instructions for Form 1120 (2021) | Internal Revenue Service. By thuyphuong Posted Tháng Ba 1, 2022 0 Comment(s) The corporation must show its 2022 tax class on the 2021 class 1120 and take into history any tax police changes that are effective for tax years beginning after December 31, 2021. The 2022 shape 1120 is not available at the time ...

Where do I enter compensation of officers on 1120?

If the corporation's total receipts (line 1a, plus lines 4 through 10) are $500,000 or more, complete Form 1125-E, Compensation of Officers. Enter on Form …

How do I fill out a 1120-S for a 2021 Corporation?

Enter on Form 1120-S, line 7, the amount from Form 1125-E, line 4. Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the corporation's stock. Also report these fringe benefits as wages in box 1 of Form W-2.

How do I enter an installment payment on Form 1120-S?

Jul 13, 2020 · Other Deductions – Line 19: If these fees do not fit any of these categories, you could record your payments to contractors on line 19 on Form 1120 S – Other Deductions. You add an attachment and narrate contactors’ 1099 total …

Are legal fees tax deductible for a business?

The IRS allows businesses to deduct legal fees that are ordinary and necessary expenses for running the business. These include: Attorney fees, court costs, and similar expenses related to the production or collection of taxable income.Apr 16, 2021

Can legal fees be deducted?

Legal fees that are deductible In general, legal fees that are related to your business, including rental properties, can be deductions. This is true even if you didn't win the legal case in which the legal fees were incurred.Oct 16, 2021

Can I deduct consulting fees?

Professional services are tax-deductible for consulting businesses, according to NOLA.com, which notes that “you can deduct fees that you pay to attorneys, accountants, consultants, and other professionals if the fees are paid for work related to your consulting business.”

Where does Fdii go on Form 1120?

For the federal corporate taxpayer, GILTI is reported on line 4 of IRS Form 1120 while the corresponding FDII deduction is claimed on line 29b.Jun 1, 2019

Are legal fees capitalized?

Personal legal fees are nondeductible. Legal fees related to the active conduct of a trade or business may be deducted as ordinary and necessary business expenses. Investment legal expenses are deductible as investment expenses. Legal fees related to acquiring or preserving capital assets must be capitalized.

What legal fees are not deductible?

Legal costs incurred in establishing the right to spousal support amounts, such as the costs of obtaining a divorce, a support order for spousal support, or a separation agreement, are not deductible.Sep 8, 2020

Where do professional fees go on tax return?

To claim this expense, report this amount on line 212 of your income tax return.Jan 6, 2020

Are consulting fees an expense?

The fees you paid the consultant to determine the amount of the credit are operating expenses and should be recorded as expense, just like any other accounting services fee or temporary service. You cannot capitalize that type of fee under GAAP or for US tax purposes.Apr 19, 2016

What legal and professional fees are tax deductible?

Legal and professional fees that are necessary and directly related to running your business are deductible. These include fees charged by lawyers, accountants, bookkeepers, tax preparers, and online bookkeeping services such as Bench.Mar 8, 2022

Does CA allow Fdii deduction?

Call our California CPA for exclusion of Foreign Derived Intangible Income to understand and claim the deduction when filing taxes today. The Foreign-Derived Intangible Income deduction (also known as the FDII deduction) is a crucial part of the Tax Cuts and Jobs Act of 2017.

Do states allow Fdii deduction?

Currently, 22 states conform to the FDII deduction. Of the nine states and the District of Columbia that tax GILTI but conform to the GILTI deduction, all but New Hampshire and the District of Columbia also conform to the FDII deduction.May 25, 2021

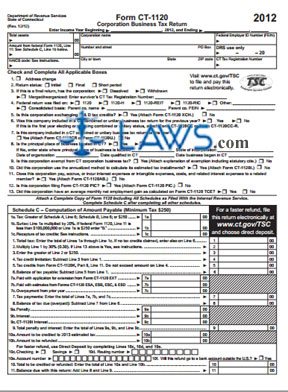

How do I fill out form 1120?

0:242:20Learn How to Fill the Form 1120 US Corporation Income Tax ReturnYouTubeStart of suggested clipEnd of suggested clipProvide the name of the corporation. Along with contact information in the top box of the form.MoreProvide the name of the corporation. Along with contact information in the top box of the form. Provide the employer identification number date of incorporation.

When is the 1120-S due?

Generally, an S corporation must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. For calendar year corporations, the due date is March 15, 2021. A corporation that has dissolved must generally file by the 15th day of the 3rd month after the date it dissolved.

When does the FFCRA credit end?

Under the Families First Coronavirus Response Act (FFCRA), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick leave or family leave if incurred during the allowed period, which starts in 2020 and ends March 31, 2021.

What is a significant transferor?

Every significant transferor (as defined in Regulations section 1.351-3 (d)) that receives stock of a corporation in exchange for property in a nonrecognition event must include the statement required by Regulations section 1.351-3 (a) on or with the transferor's tax return for the tax year of the exchange.

What is lye soap made of?

Our lye soaps are hand-made with quality grade natural oils and butters, food grade sodium hydroxide, and herbs grown in our garden without pesticide or chemical fertilizer—- no additives, no fragrance, no dye.

Is paper towel eco friendly?

Our towels, washcloths, and napkins are natural and eco-friendly alternatives of paper towels, paper napkins, and tissue papers for you to enjoy in the comfort of your home while saving money and the environment.

Popular Posts:

- 1. how to get a count appointed lawyer gor childsupport in housyon

- 2. how to work for the fbi as a lawyer

- 3. state of mayflower how to be a lawyer

- 4. what do you call the lawyer on the other side of the case?

- 5. why is mueller going after trump's lawyer

- 6. tng episode where picard worf lawyer

- 7. what not to do when hiring a lawyer

- 8. how to find lawyer for juvenile court?

- 9. how much will it be to get a lawyer for guardianship in ohio

- 10. lawyer has what degree