Who pays realtor fees when selling a house?

Well, buyers and sellers are responsible for paying for different fees, so it’s important to know best practices for a typical home sale. Here’s what you need to know about who pays the realtor fees and how much cash you can expect to contribute.

What does a lawyer do when buying a house?

Lawyers represent the buyer’s best interests, explain the process to them, and also make sure that the title is clean. In some states, you could have three attorneys involved — the buyer’s attorney, the seller’s attorney, and the mortgage lender’s attorney — in a purchase and sale.

Why do real estate lawyer fees vary so much?

David Reischer, a real estate attorney based in New York City and CEO of LegalAdvice.com, said real estate lawyer fees also vary depending on the market the home is in. “Geographic location plays a big part in the cost for a home closing,” he said. “Rural areas will typically charge much less than an urban major metropolis.”

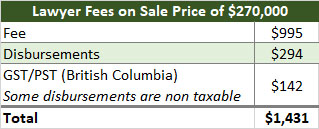

How much does it cost to hire a lawyer to sell a house?

You can also hire attorneys for flat fees for specific services. This can run anywhere from $800 to $1,500 when selling a home. Whether or not you decide to hire an attorney will depend on what state you live in and your particular circumstances.

State requirements

It’s important to know whether your state is an attorney state or a title state. An attorney state, such as Massachusetts, requires the the involve...

Services

Real estate attorneys are qualified to handle all legal matters related to real estate, including disputes and transactions. They write and review...

Pricing

Attorneys usually charge by the hour, from $150 to $350. However, some real estate attorneys may have a fee schedule for certain services, such as...

Finding the right attorney

Ask your real estate agent to recommend an experienced, state-licensed real estate attorney, then do some online research. For example, if you’re b...

What is escrow fee?

Escrow Fees. During the closing process, an escrow account will usually hold the money while the buyer and seller finalize the agreement. In addition, you’ll probably have a portion of your monthly mortgage payment go into escrow to pay for property taxes and insurance. Essentially, you prepay some of the homeowner's insurance ...

How much does a home warranty cost at closing?

These cost anywhere from $278 to $391.

What is origination fee?

An origination fee is paid to the bank or lender for their services in creating the loan. You also may owe an underwriting fee, an application fee, and a fee for your credit report. 3

What do you focus on when buying a house?

When buying a home, most people focus on the price of the house and what interest rate they can get on their mortgage loan. While knowing these costs is very important, they aren’t the only expenses you’ll encounter on your journey toward homeownership.

How many days before closing do you have to pay closing costs?

These will all be outlined in your closing disclosure, which you should receive at least three days before your closing date. For an idea of these costs earlier in the process, ...

How much down payment do I need for a $300000 home?

Though some loans (like USDA and VA loans, for example), require no money down, the majority of homebuyers will need a down payment of at least 3% (on conventional loans) or 3.5% (on FHA loans). 2 On a $300,000 home purchase, this would equate to a down payment of $9,000 to $10,500.

How much does it cost to inspect a house for mold?

This requirement can vary by location, and the cost usually runs between $50 and $280. 15 .

Who pays for title insurance?

Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender. In general, title insurance ensures the home is “free and clear” and that no third party has an unknown claim to the property.

How much is escrow fee?

Cost: Usually 1% of the purchase price. On a $200,000 house, that’s $1,000 for the seller and $1,000 for the buyer. Note that this does not include the actual ...

How much does a Zillow warranty cost?

They typically cover the home’s major systems, including plumbing, electrical and appliances. Cost: A one-time cost of between $300 and $500 for one year of warranty coverage. To avoid negotiating with a buyer and paying for additional incentives like a home warranty, sell directly to Zillow instead.

How much does title insurance cost?

Cost: Lender’s title insurance coverage costs between $500 and $1,000.

How much does a home inspection cost?

Cost: The average home inspection costs between $250 and $700. Sellers sometimes decide to do a pre-inspection for a better sense of what the buyer’s inspector will find ...

Why do sellers do pre inspections?

Sellers sometimes decide to do a pre-inspection for a better sense of what the buyer’s inspector will find and the chance to make any important repairs before listing. A pre-inspection costs the same amount as a buyer’s inspection.

Who is responsible for paying transfer taxes?

The seller is responsible for paying any real estate transfer taxes, which are charged when the title for the home is transferred from the old owner to the new owner. Transfer taxes can be levied by a city, county, state or a combination.

What is a real estate attorney?

Real estate attorneys are qualified to handle all legal matters related to real estate, including disputes and transactions. They write and review purchase agreements, title and transfer documents, and other important documents. They also make sure the property transfer is legal, binding and in the best interest of the client. A real estate attorney can help clients who need to back out of a contract.

What states require a real estate attorney?

An attorney state, such as Massachusetts, requires the the involvement of a real estate attorney in the purchase, sale and closing of a house. In a title state, such as California, a real estate attorney is necessary only when there are legal disputes to settle.

How much does an attorney charge per hour?

While most attorneys charge a flat rate, some will charge by the hour, with hourly rates ranging from $150 to $350, according to Thumbtack.

What is the difference between a realtor and a real estate agent?

A real estate agent, or realtor, is tasked with marketing a property for sale or finding a property for a buyer, Romer said, while an attorney is enlisted to ensure someone’s legal rights are protected during a home sale. Real estate agents are paid based on commission , while attorneys are paid a separate legal fee that is typically a flat rate, he said.

Do you need a real estate attorney to close a house?

Some states require a real estate attorney for closing, while others don’t. In states that don’t require an attorney, it’s still a good idea to consider hiring one to help make sure everything is in good order. How much does a real estate attorney cost may factor into your decision-making given how many costs are associated with closing on a house .

Who pays the agent fee?

The agent fee is typically paid by the seller to the listing broker who, in turn, shares part of it with the agent who brings a buyer to the table, explains Adam Reliantra, a real estate agent in West Toluca Lake, CA. When the sellers set a listing price for the home, they usually take the agent’s commission into account;

Who pays the commission of a real estate agent?

The home seller usually picks up this payment. Typically, the fee is paid by the seller at the settlement table, where the fee is subtracted from the proceeds of the home sale.

What fees can be negotiated down?

Attorney fees, commission rates, recording costs, and messenger fees can all be negotiated down. Sometimes the buyer will have written into the contract that the seller will pay the buyer’s closing costs up to a certain percentage or amount. “That’s why you need a good real estate agent to negotiate a contract for you,” Layman says.

What are closing costs?

Closing costs are the miscellaneous fees separate from the real estate agent fees that must be paid at closing. They cover things such as the following: Loan processing. Title company fees. Surveyor costs (if needed) Recording of the real estate deed.

How much does closing cost for a home?

The amount of the real estate closing costs will vary with each home sale/purchase and can range widely from 2% to 7% of the home’s purchase price. Typically, though, closing costs amount to about 3.5% of the sale price of a home, according to Leah Layman, a real estate agent in Augusta, GA.

What is real estate agent fee?

Real estate agent fees are how most agents are paid for the homes they sell. This commission can vary from state to state and among brokerages. But in real estate, who is responsible for paying commission—the buyer or the seller?

Can closing costs be rolled into a mortgage?

If the closing costs are too steep and the sellers won’t chip in as much as buyers would like, the buyers can request that real estate closing costs be rolled into the mortgage. So whether you’re the buyer or the seller, the listing price isn’t the only number you should focus on.

How much does a notary charge for closing?

A notary makes your signature official. Notaries charge by the signature, about $100 for closing paperwork but they can add fees for their travel.

How much does a closing cost for a home?

Typical closing costs for a buyer of a $250,000 home might range between $5,000 and $12,500.

What is the average mortgage origination fee?

The average loan origination fee is 1% of the total loan amount . For example, on a loan of $300,000, the loan origination fee would be $3,000.

How to lower closing costs?

How to reduce closing costs 1 Shop various lenders for the lowest origination fees. 2 Utilize military benefits for VA financing, if eligible. 3 Ask the seller to pay your closing costs as part of the negotiations.

What happens to escrow funds during a purchase and sale?

During the purchase and sale transaction, your funds will enter into a holding account managed by a third party — an escrow company. When the transaction is complete, the escrow representative will disperse your down payment, fees and loan to the appropriate individuals.

How much does a HOA transfer cost?

During the negotiation, you can detail which party will pay the transfer fee. HOA transfer fees generally cost about $200. In addition to the transfer fee, your monthly HOA fee will likely be mortgaged. The first payment is often prorated, depending on your closing date.

What percentage of sellers make trade offs with buyers?

According to the Zillow Group Consumer Housing Trends Report 2019, 81% of sellers make some kind of trade-off with the buyer to facilitate the sale of a home. This can be a beneficial strategy if you don’t have enough cash available after paying your down payment to pay for your closing costs, too.

Who is responsible for paying for the fees for a home sale?

Buyers and sellers are responsible for paying for different fees, so it’s important to know best practices for a typical home sale. Here’s what you need to know about real estate agent commission and how much cash you can expect to contribute.

Who pays the broker fee?

It’s up to the landlord and the tenant to decide who pays the rental agent’s fee. Broker fees for finding you a rental generally fall between one month’s rent and 15% of the annual rent of the property. In some situations, the landlord pays the broker to help him find a desirable tenant.

What should be included in a real estate agent fee?

Generally, things like photography, the cost of listing the property, and the cost of any printed materials or signs are included in the fee, ...

Do landlords pay broker fees?

In some situations, the landlord pays the broker to help him find a desirable tenant. But in other areas, like big cities with large rental populations, the renter will be required to pay the broker fee, even if the landlord hired the broker. Customs vary widely by location, so always make sure you clarify who is going to pay for what, ...

Do buyers pay closing costs?

In fact, even though the buyer usually pays most of the closing costs, they are up for negotiation, too. That’s one of the many things a good agent will do for a buyer—make sure you get the sweetest deal possible.

Can a seller negotiate with a buyer?

A seller can negotiate the terms of the listing agreement—which contains the real estate agent fees—with the brokerage or agent. If a buyer is in a tough seller’s market or bidding war, offering to pay some or all of the real estate agent’s fees can be a way to stand out from other offers. In fact, even though the buyer usually pays most ...

What can a real estate attorney do?

A real estate attorney can help you through all of the paperwork required to make the sale. He or she usually comes in after you have determined the selling price and terms of the sale. Even in states where you are not required to hire a lawyer, you may want an attorney to look over the contract.

Why do you need an attorney for a trust?

You will also want to use an attorney to make sure that you are complying with the terms of any trust that may have been established. There may be fiduciary responsibilities for the property that you may not be aware of. An attorney will help you determine what your obligations are for the trust.

What to do if you get a foreclosure notice?

It's always best to contact a real estate attorney if you get a foreclosure notice. They may be able to find a way to stop foreclosure through an injunction. You may also want to hire an attorney if you are going through a divorce or separation. The attorney can help you negotiate the sale with an uncooperative partner.

What to do if you sell a rental unit on behalf of a deceased owner?

The last thing that you want is a legal entanglement due to your rental unit. You may also want to hire an attorney if you are selling on behalf of a deceased owner. It's best to talk to a lawyer to ensure that, if the property is inherited, the rightful heir is legally determined.

What to do when selling a house with an uncooperative partner?

The attorney can help you negotiate the sale with an uncooperative partner. An attorney will also be able to you determine what your legal rights are (and those of your spouse) during the selling process. You will also want to contact an attorney if you are selling a property that has tenants.

What does a partner agent do?

In most cases, a Partner Agent will be able to help you through all of the legal requirements of selling your home, in addition to finding you a large pool of potential home buyers. But spending a few hundred dollars for an attorney to check over all of the fine print in the final deal can be worth it.

Do you have to contact an attorney if you are selling a property?

You will also want to contact an attorney if you are selling a property that has tenants. There are a myriad of local and state laws when it comes to tenants rights. Most have legal requirements that you must meet (and notices that you must provide to tenants) before tenants have to vacate.

Who does the title work for a home buyer?

Top-selling real estate agent Teresa Cowart of Richmond Hill, Georgia shares that in her market, the homebuyer hires the attorney, who technically works for the lender and handles the title work. However, the buyer can negotiate for the seller to pay the cost, Cowart says. She’ll encourage sellers to hire an attorney if they’re selling their home on their own or if there’s not a lender involved, such as in a cash deal.

How can an attorney help you?

An attorney can help you by: Representing you at a foreclosure auction or when filing bankruptcy. Sifting through the contents of short sale documents. Explaining your personal liability after completing a short sale. Understanding whether your remaining debt will be forgiven, taxed, or require augmented payments.

What to do if you are behind on your mortgage payments?

If you’ve fallen behind on your mortgage payments, a real estate attorney is a good resource to help you navigate the details of these transactions. Your lender or bank has to approve your short sale, so you’ ll have to provide detailed records supporting your financial hardship.

What questions should I ask a real estate attorney?

Before you hire a real estate attorney, our experts say to ask: 1 How many transactions do you handle a year? 2 How do you charge (by the hour or a flat fee)? Do you have a retainer? 3 What does your fee include? 4 What if my property has title issues, or a buyer whose financing falls through? (Ask your real estate agent about other potential problems so you can gauge the attorney’s response.) 5 Can you supply references (such as other real estate agents who have worked with the attorney, or clients who wouldn’t mind speaking with you)?

How do I find a good real estate attorney?

The best way to find a good real estate attorney is through a referral from someone who has worked with this person before and recommends them highly. Like Cowart, your real estate agent can suggest attorneys they trust.

Do I need an attorney to sell my house?

You won’t always need to hire an attorney when you sell a house. But let’s say you’re going through a divorce, just inherited property, or must resolve a complex title issue before closing. In these scenarios, you might want to lawyer up.

Did Nogee's son have probate work?

The owner had died a decade ago, but no one had done probate work on her estate. The son’s assurances that he was the only living heir legally weren’t enough to allow the deal to continue..

Who Pays Real Estate Commission?

Who Pays Escrow Fees?

- Escrow fees are typically split 50-50 between buyer and seller. Escrow fees cover the services of an independent third party to conduct the closing and manage funds during the transaction. Cost:Usually 1% of the purchase price. On a $200,000 house, that’s $1,000 for the seller and $1,000 for the buyer. Note that this does not include the actual money being held in your escrow …

Who Pays For The Home Inspection?

- The buyer pays for a home inspection if they choose to conduct one. Inspections are meant to protect the buyer from any hidden defects in the home that could impact the home’s value, cost a lot of money to repair or make the home unsafe to live in. Cost:The average home inspection costs between $250 and $700. Sellers sometimes decide to do a pre-inspectionfor a better sens…

Who Pays For The Appraisal?

- Buyers cover the cost of the home appraisal, which is usually required by their lender if they will be taking out a mortgage to buy the home. Even if it isn’t required, buyers sometimes complete appraisals for peace of mind that they’re making a smart investment and not overpaying. Cost:The average cost of a home appraisal nationally is $350.

Who Pays For A Land Survey — Buyer Or Seller?

- The home buyer pays for a land survey, if they request one. Considered due diligence (much like a home inspection), a land survey lets the buyer know the details of the exact property they’re purchasing, including property boundaries, fencing, easements and encroachments. Cost:The average price is around $550, but it can vary depending on property size, shape and location.

Who Pays For Title Insurance?

- Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender. In general, title insurance ensures the home is “free and clear” and that no third party has an unknown claim to the property.

Who Pays For A Home Warranty — Buyer Or Seller?

- The seller pays for a home warranty. It’s often offered as an incentive to attract buyers, but it’s not required. Offering a home warranty gives the buyer assurance that they won’t have to pay any huge repair bills soon after moving in — most policies are good for a year. They typically cover the home’s major systems, including plumbing, electrical and appliances. Cost:A one-time cost of be…

Who Pays Real Estate Transfer Taxes?

- The seller is responsible for paying any real estate transfer taxes, which are charged when the title for the home is transferred from the old owner to the new owner. Transfer taxes can be levied by a city, county, state or a combination. Cost:Transfer tax costs vary dramatically in different parts of the country and can even vary from one city to its nearby suburbs. And rates can fluctuate over t…

Popular Posts:

- 1. how t get a name change lawyer bossier city

- 2. whos who top lawyer

- 3. what can a lawyer get with browser history in incognoto mode

- 4. who was the lawyer in omaha that filed for prednisone class action

- 5. how does a lawyer submit a motion for a detainer lift

- 6. how to make money as a solo lawyer

- 7. represents criminal defendants who are too poor to hire a lawyer

- 8. how to become a lawyer in us

- 9. how long does it usually take for a lawyer to settle a case for a car accident

- 10. how to be a lawyer for nintendo