When it’s litigation, with the exception of Small Claims, Wisconsin law requires that corporations or LLCs be represented by an attorney. Wisconsin Statute §757.30 prohibits anyone without a law license from practicing law, the violation of which carries a fine of $50 – $500, or a year in jail, plus the risk of a contempt of court finding.

Full Answer

What is an LLC while a nonresident of Wisconsin?

While a nonresident: All LLC income or loss that is attributable to a business located in Wisconsin, services the individual personally performed in Wisconsin, or real or tangible personal property located in Wisconsin, while a nonresident of Wisconsin.

What is the Wisconsin limited liability company law (wllcl)?

The history of the Wisconsin Limited Liability Company Law (WLLCL) suggests that the drafters intended for members to have fiduciary duties to one another akin to the duties owed between partners.

Do Wisconsin limited liability companies have fiduciary duties to one another?

A straightforward question, but even after hours of research, a clear and definitive answer is elusive. The history of the Wisconsin Limited Liability Company Law (WLLCL) suggests that the drafters intended for members to have fiduciary duties to one another akin to the duties owed between partners.

Can a corporation file an appeal without an attorney in Wisconsin?

About ten years ago, the Wisconsin Supreme Court was asked whether a notice of appeal by a corporation signed by an officer of the corporation who was not an attorney was valid. The court concluded that it was not a valid notice of appeal, and therefore, the appeal was dismissed.

Who is legally responsible for their own negligence?

Although attorneys and firms want to limit their exposure for liability not only for themselves but also for their colleagues, individual attorneys always are legally responsible for their own professional negligence and for the negligence of individuals under the attorney’s supervision and control.

Do law firms have to have a limited liability?

Law firms organized as limited liability organizations must include a designation of that limited liability structure as part of their names. This requirement has led to wide varieties of usage. Some firms specifically say they are limited liability entities in addition to using LLC, LLP, or S.C. in their names.

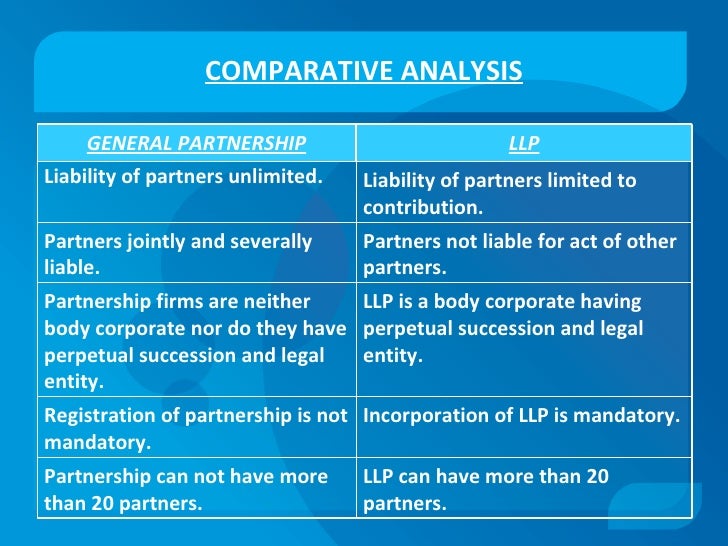

Is LLC better than LLP?

If multiple lawyers desire partnership tax treatment and are forming a new entity, LLCs are generally much better than LLPs. The LLP statute is somewhat out of date as compared to the LLC statute. Both provide the same limited liability protection, but the LLC statutes are simply more current.

Does a limited liability entity protect the attorney-owner?

A limited liability entity will not protect the attorney-owner in every instance of liability. Although organizing as a limited liability entity will protect an attorney-owner or employee from the entity’s general debts or contractual obligations and from the negligence and misconduct of any other person who is not under the owner or employee’s supervision and control, such organization will not shield the lawyer from his or her own acts, errors, and omissions associated with performing his or her professional services. SCR 20:5.7 (b).

What is the legal monopoly in the UK?

This all began 22 years ago in the United Kingdom when the Courts and Legal Services Act 1990 (CLSA) broke the monopoly that solicitors, barristers, and licensed conveyancers had over the provision of certain legal services known as “reserved activities.” This act also permitted nonlawyers to enter the legal market by creating alternate business structures that allowed lawyers and nonlawyers to work together to deliver legal and other services and also solicit outside investments.

Do lawyers oppose outside investment?

It is not surprising that many lawyers oppose outside investment in law firms. However, a large number of legal services providers that are not law firms have already evolved in the United States. In a recently published article, Tony Williams may have summed up the entire issue best. “If external funding permits lawyers to do more for their clients and build services the market wants, then as long as safeguards are in place, external investment could have a positive impact.”

When was the Wisconsin LLC law enacted?

The draft was completed, reviewed by the State Bar of Wisconsin, and enacted by the legislature in December 1993, effective Jan. 1, 1994.

When did Wyoming start LLC?

Wyoming passed the first U.S. version of the LLC law in 1977. 3 It did so to provide an entity with single flow-through-level income taxes and limited liability. To confirm that it had achieved this objective, Wyoming requested an IRS ruling, which was published 10 years later.

What was the purpose of Smith v. Kleynerman?

Kleynerman was decided on corporate fiduciary duty grounds in the court of appeals, Smith urged the supreme court to explicitly adopt common-law fiduciary duties between 50-percent members of an LLC, similar to the fiduciary duties of partners or joint venturers under common law.

When was Smith v. Kleynerman argued?

Kleynerman, argued in January 2017.

Is the WLLCL updated?

An update to the WLLCL may provide the opportunity for greater legislative clarity. A committee of the State Bar’s Business Law Section has been working on this update now for several years. It is anticipated that the Wisconsin Legislature will pass the legislation either this year or early next year. Some states have dealt with this issue by incorporating fiduciary duties by statute and allowing LLC members to alter or eliminate the duties via operating agreement.

Can an LLC be organized in Wisconsin?

An LLC may be organized for any lawful purpose. However, a business subject to other provisions of the Wisconsin Statutes may organize as an LLC only if not prohibited by, and subject to the limitations of, the other statutes . [§183.0106, Wis. Stats.]

Does an LLC have to withhold taxes in Wisconsin?

For withholding tax purposes, LLCs with two or more members are treated in the same manner as other business entities. The LLC, if an employer, is required to withhold, deposit, and furnish reports of Wisconsin income taxes withheld as are other employers. [§§71.63(3), 71.65(1)(a), and 71.71, Wis. Stats.]

Is LLC a partnership?

In general, an LLC that is classified as a partnership or tax-option (S) corporation is required to withhold income or franchise tax on the income allocable to nonresident members.

Is LLC a separate entity?

If an LLC is disregarded as a separate entity, its activities are treated in the same manner as a sole proprietorship, branch, or division of the owner. The owner is subject to Wisconsin tax on or measured by the LLC’s income.

Popular Posts:

- 1. what happens to a lawyer when their client is guilty

- 2. how to find entertainment lawyer/manager for entertainment group?

- 3. why did the dc madam fire her lawyer

- 4. how long before a court date can a lawyer present evidence

- 5. probate law attorney

- 6. when should criminal lawyer advise permanent resident that he can be deported by a guilty plea

- 7. how hard is getting a job as a lawyer

- 8. who plays henry sullivan (lawyer) on general hospital?

- 9. what are some advantages and disadvantages of becoming a lawyer?

- 10. what do you expect from yourself as a lawyer