Because the process to dissolve a partnership can vary from state to state, you should consult with an experienced and local business attorney. Someone local to you will have the best understanding of your state’s laws, as well as how those laws will affect your legal options moving forward.

How do I dissolve a partnership?

An experienced and local business attorney can assist you in determining what steps of the business dissolution you will need to take, as well as help you obtain and file all necessary forms. Additionally, an attorney can also represent you in court as needed, should any legal issues arise.

Why do I need a business dissolution attorney?

If you are ready to dissolve your partnership, either because you are winding down your business or want to take it in a new direction, you need the counsel of an experienced partnership dissolution lawyer. Contact JGPC Law today to discuss the …

How to leave a business partnership without an agreement?

May 23, 2018 · Dissolving a partnership can be a complex process. You may need to enlist the services of a qualified business lawyer in your area. An experienced lawyer can explain what you need to do in order to protect your assets and business interests. Also, your lawyer can provide representation in court if you need to file suit regarding a dissolution dispute.

What should you do if your business partnership goes bankrupt?

Apr 09, 2015 · A partnership continues for tax purposes until it terminates. A partnership's tax year ends on the date of termination. If a partnership terminates before the end of what would otherwise be its tax year, IRS Form 1065 must be filed for the short period. There are two types of tax terminations of partnerships: real and technical.

How much does it cost to dissolve a partnership?

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

What do you need to dissolve a partnership?

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement. ... Vote on Dissolution and Document Your Decision. ... Send Notifications and Cancel Business Registrations. ... Pay Outstanding Debts, Liquidate, and Distribute Assets. ... File Final Tax Return and Cancel Tax Accounts. ... Limiting Your Future Liability.

How do I get rid of my 50/50 business partner?

When faced with a business partner who refuses to waive ownership, as a last-ditch effort, you can dissolve the partnership by leaving the company yourself. Follow your removal agreement and use your buyout funds to start a new company on your own.

Can one partner dissolve a partnership?

Separation Agreement to Prevent Partnership Dissolution When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.Jun 10, 2020

How long does it take to dissolve a partnership?

90 daysIt can take up to 90 days from the date you file the statement of dissolution for your partnership to be dissolved.

What happens when a partnership is dissolved?

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.Mar 11, 2020

How do you dissolve a partnership without an agreement?

The partner must provide the notice in writing and the partnership will dissolve from the date specified on the notice. If no date is mentioned, the dissolution will take place from the date of communication of the notice. Additionally, in some cases, the court may give an order to dissolve a partnership as well.Feb 14, 2019

How do you deal with a toxic business partner?

Here are four tactics that will help you handle conflicts with your business partner:Plan Ahead When Possible, and Stop Fights Before They Start. ... Plan Ahead When Possible, and Stop Fights Before They Start. ... Don't Rush to Judgment. ... Don't Rush to Judgment. ... Have an “Active Listening” Session. ... Have an “Active Listening” Session.More items...

How do I remove my name from a partnership business?

If you want to remove your name from a partnership, there are three options you may pursue:Dissolve your business. If there is no language in your operating agreement stating otherwise, this will be your only name-removal option. ... Change your business's name. ... Use a doing business as (DBA) name.

How do you break up a 50/50 partnership?

One popular type of partnership arrangement is the 50/50 split where profits and decision making is split equally. Partners entered into a 50/50 partnership agreement can dissolve the partnership at any time, and when a partner involved in a 50/50 agreement dies, the partnership automatically gets terminated.

Before You Dissolve Your Partnership

If you think that a partnership dissolution might be the right course of action for your business, there are a few things you should consider before taking the next step.

How to Dissolve a Partnership

Partnership dissolution in California is governed by Sections 16801 through 16807 of the Corporations Code. The process of dissolving a partnership varies slightly, depending on the type of partnership that you have.

Get Help from a Partner Dissolution Attorney

If you are ready to dissolve your partnership, either because you are winding down your business or want to take it in a new direction, you need the counsel of an experienced partnership dissolution lawyer. Contact JGPC Law today to discuss the best course of action for you and you partnership.

What happens when a partnership is dissolved?

These can include: Disputes over partner shares and profits. Disputes involving the risks and losses incurred by the organization. Conflicts regarding changes in management and other internal matters.

What is partnership law?

Partnership laws govern the formation, operation, and termination of business partnerships. Partnerships form when two or more persons (or businesses) combine their resources under a single name to accomplish their business goals. Unlike other business formations such as corporations, partners usually share equally in the company’s profits, ...

What happens when a partner withdraws from a partnership?

For general partnerships, a withdrawal of a partner will usually dissolve the partnership. By action: Certain actions may dissolve a partnership, such as a partner terminating their own membership by providing information to a competing organization. By law: The courts can sometimes impose a dissolution, especially if the organization has been ...

Why do we need a lawsuit?

Issues with copyrights, trademarks, and other protected information. In most cases, a lawsuit is required in order to settle such disputes. Remedies may include a damages award in order to help compensate a non-violating party for losses caused by a dispute.

Who is Jose from LegalMatch?

Jose (Jay) is a Senior Staff writer and team Editor for LegalMatch. He has been with LegalMatch since March of 2010. He contributes to the law library section of the company website by writing on a wide range of legal topics.

Can a partnership be disbanded?

For general partnerships, a withdrawal of a partner will usually dissolve the partnership.

What does it mean when a partnership dissolves?

Winding Up the Business of a Dissolved Partnership. When a partnership dissolves it means the individuals involved are no longer partners in a technical legal sense. However, the partnership continues for the limited purpose of winding up the business.

When does a partnership end?

A partnership's tax year ends on the date of termination. If a partnership terminates before the end of what would otherwise be its tax year, IRS Form 1065 must be filed for the short period. There are two types of tax terminations of partnerships: real and technical.

What is a real termination?

Real Terminations. A real termination for tax purposes occurs when a partnership ceases doing business. This occurs if all its operations are discontinued and no part of any business, financial operation, or venture is continued by any of its partners.

What happens when a partner retires?

a partner becomes mentally or physically incapacitated. a partner retires. one or more partners expel another partner. the partnership business files for bankruptcy. the partners agree to dissolve the partnership. the partnership business is illegal.

Is a partnership a pass through entity?

A partnership is a legal entity that may own property and operate a business, but it is not a taxpaying entity. Instead, a partnership is a pass-through entity for tax purposes—that is, it pays no taxes itself. Instead, the profits, losses, deductions, and tax credits of the business are passed through ...

Does a partnership end for tax purposes?

The partnership technically ends for tax purposes, but a new partnership for tax purposes immediately begins. This new partnership automatically takes over all the old partnership’s assets and liabilities which are immediately distributed to the partners in the old partnership.

Can a partner take money from a partnership?

The partners may, however, agree that one or more of them will have exclusive authority to dispose of the assets upon dissolution. When a partnership is dissolved, the partners can’t simply take the partnership’s money and property.

What are the issues that should be dealt with when a partnership is dissolving?

Other matters which should be dealt with on dissolution include: Permits, licenses, and registrations. Terminate or cancel your partnership’s business permits, licenses, and any business-related registrations, such as a fictitious name registration. Creditors and taxes.

What should be discussed in a partnership dissolution agreement?

Even if your partnership agreement contains provisions for dissolution, you and your partners should discuss the issues related to your partnership dissolution, including how outstanding obligations and debts should be handled. Once you’ve come to an agreement, a partnership dissolution agreement should be drafted.

Why do you want to dissolve a partnership?

There are many reasons you may want to dissolve a partnership. A partner may retire, or perhaps become bankrupt. Or perhaps you and your partners created your partnership in order to meet specific objectives, and with those objectives now met, the partnership is no longer necessary. Dissolving a partnership may not even mean you ...

What is a dissolution agreement?

A dissolution agreement sets out the termination terms to which you’ve agreed and can provide clarity on issues which may help prevent any future misunderstanding.

What happens if a partnership dies?

If one of the partners retires, dies, or enters bankruptcy, the partnership may be dissolved automatically under the terms of its governing agreement. Alternatively, the objectives of the partnership may have been met and the parties’ official relationship may no longer be necessary. May 17, 2019 · 10 min read.

What does a clean break mean?

A change in the business climate or in the parties’ goals may signal that it’s time to terminate the contract and release the parties from their duties . A clean break will give both parties peace of mind, discharging their obligations and leading to an amicable conclusion of the arrangement. May 17, 2019 · 7 min read.

How long does it take to file a statement of dissolution?

You’ll be required to file a statement of dissolution (in some states this is called a certificate of cancellation) with your state. It can take up to 90 days from the date you file the statement of dissolution for your partnership to be dissolved.

Why do you need to dissolve a partnership?

There are a number of reasons you may need to dissolve a partnership, such as: Retirement of a partner, Death of a partner, One partner no longer wishing to participate in the business, Bankruptcy of a partner, Serious disputes within the partnership, or. One partner’s illegal or wrongful actions harming the business.

What happens if you dissolve a partnership in Michigan?

If you are dissolving a partnership without an agreement and you can’t agree, then the terms of dissolution will be based on the Michigan Uniform Partnership Act. 5. Address Unresolved Matters in Court. If you cannot reach an agreement regarding important terms of dissolution, you may need to take the matter to court.

What happens if a party breaches a separation agreement?

Remedies that may be available if a party breaches the separation agreement. If the other partners intend to carry on the business after your departure, it is especially important that the separation agreement protects you from liability for actions the other partners may take in your absence.

What to do if you leave a business?

Once you’ve decided to leave, you should notify your business partners of your intentions. This may be achieved through a partnership meeting, especially if your relationship with the partners is good. If you are leaving due to serious conflicts within the partnership, you may consider having your attorney communicate your plans.

What to do if you are considering leaving a business partnership?

If you are considering leaving a business partnership, it is important to consult with an experienced partnership attorney. There are many things you will need to address in winding down a partnership.

What happens if you can't reach an agreement in Michigan?

If you cannot reach an agreement regarding important terms of dissolution, you may need to take the matter to court. A Michigan court will consider any allegations against a partner that might affect the propriety of dissolution or their interest in the partnership, such as: Breach of fiduciary duty, Fraud,

What to do when you leave a business partnership?

When you are leaving a business partnership, you should notify your clients, creditors, suppliers, and anyone else you do business with that you are leaving. Giving others notice that you are no longer involved in the business will help protect you from future liability.

What happens if you don't sign a partnership agreement?

If you didn't sign an agreement and you live in the U.S., Yonatan says, "then the Uniform Partnership Act will apply," if the partners live in one of the 37 states that abide by the act. Check with an attorney either way— whether you have a written agreement in place or not—to see what your rights may be. 2.

What happens when a partnership ends?

Once the partnership has ended, it's important to pay all debts and to close all bank and credit accounts. If the business no longer exists, there should be no open leases, credit cards, loans, or other financial arrangements.

Who is Heinrich Long?

Before speaking with his business partner, Heinrich Long, a privacy expert with Restore Privacy, met with his attorney about their partnership agreement "to ensure termination could end amicably without any disputes."

Is it risky to start a partnership with someone?

Starting a partnership with someone is risky without a comprehensive partnership agreement spelling out what's expected of the partners and how you'll run the business. See what's included in a partnership agreement and how to create one.

What is dissolution of a partnership?

In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

What to do if you don't have a partnership agreement?

If you don't have a partnership agreement, you'll have to rely on the Uniform Partnership Act. California's version of this Act is different than in other states.

What is partnership work in progress?

completing any partnership work in progress. selling some or all assets (if the partners want and have agreed to do so) paying debts, and. distributing any remaining assets to the partners. It's particularly important that all debts are paid before you make any distributions to the partners.

What form do you use to close out a business in California?

You can use Form BOE-65, Notice of Close-Out, to satisfy this requirement.

What is the Uniform Partnership Act?

California's Uniform Partnership Act has rules for the order in which people get paid when winding up a partnership. In general, creditors must be paid first, then partners are entitled to receive back their capital contributions, and, finally, if anything remains, the partners are entitled to distributions. 4.

When is a 1065 due?

Under IRS rules, if your partnership terminates before the end of its normal tax year, the final federal return is due by 15th day of the fourth month following the termination date. In addition, if you partnership had a seller's permit (for collecting sales tax), ...

Can you file a statement of dissolution online?

Filing a Statement of Dissolution will help make clear that your partnership has ended and limit your liability. You cannot file a Statement of Dissolution unless you have first filed a Statement of Partnership Authority. You can file the Statement of Dissolution online or on paper.

How to dissolve an LLC?

Ending the LLC's status as a legal entity and taxpayer is just part of the dissolution process. State LLC laws also require a dissolving LLC to wind up its business affairs by: 1 Appointing a manager or trustee to wind up the LLC's business 2 Conducting an inventory of all LLC assets and liabilities 3 Converting the LLC's assets to cash by liquidating them 4 Paying the LLC's creditors 5 Establishing reserves for contingent liabilities 6 Distributing any remaining assets to the LLC's members

What happens if an LLC does not have an operating agreement?

If the LLC does not have an operating agreement or if the document does not include a process for dissolving the company, the company must follow its state LLC laws. For example, in the absence of guidance from an operating agreement, Delaware law requires a vote in favor of dissolution by those members owning at least two-thirds of the membership interests.

What is an operating agreement for LLC?

A well-drafted LLC operating agreement spells out requirements for member or manager votes or approvals to begin the dissolution process. Typically, those members who collectively own at least 51 percent of the membership interests, or a majority of the equity, must approve the decision to dissolve, but it's not unusual for operating agreements to set a higher supermajority approval threshold as a way to give minority owners some input.

6 Steps During & After Dissolution of Partnership

Use the tips to serve as an informal checklist of the necessary steps to follow before, during and after the dissolution of the partnership.

Accounting Procedure of Dissolution of Partnership

Now let us proceed with the accounting procedure of dissolution of partnership in order to close the books of the firm, the following accounts are prepared:

Settlement of Accounts on Dissolution of Partnership

Settlement of accounts on dissolution of partnership is necessary because maybe there is a dispute, maybe there is fighting among the partners, there could be lost making business potential death of a potential partner.

How to Dissolve A Partnership

Your Partnership Agreement

- Hopefully, your partnership agreement will include a dissolution clause or terms of dissolution; some partnership agreements may even include specific dissolution procedures to be followed for specified circumstances. If your particular situation, or dissolution in general, is covered under your partnership agreement. You will need to follow the provisions outlined in the agreement for …

What If There Is No Provision For Dissolution in Your Partnership Agreement

- What if your partnership agreement doesn’t include any provisions for dissolution? Or perhaps you and your partners never had a formal partnership agreement, to begin with. In such cases, you will need to sit down with your partners and decide on the terms of dissolution together. There are a number of things that must be considered when dissolving a business. If you have problems co…

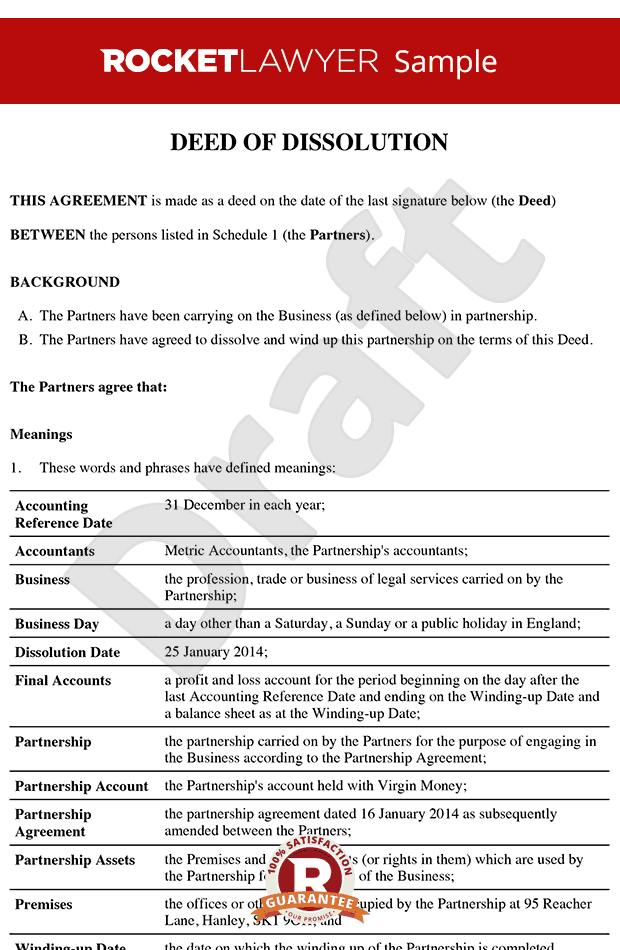

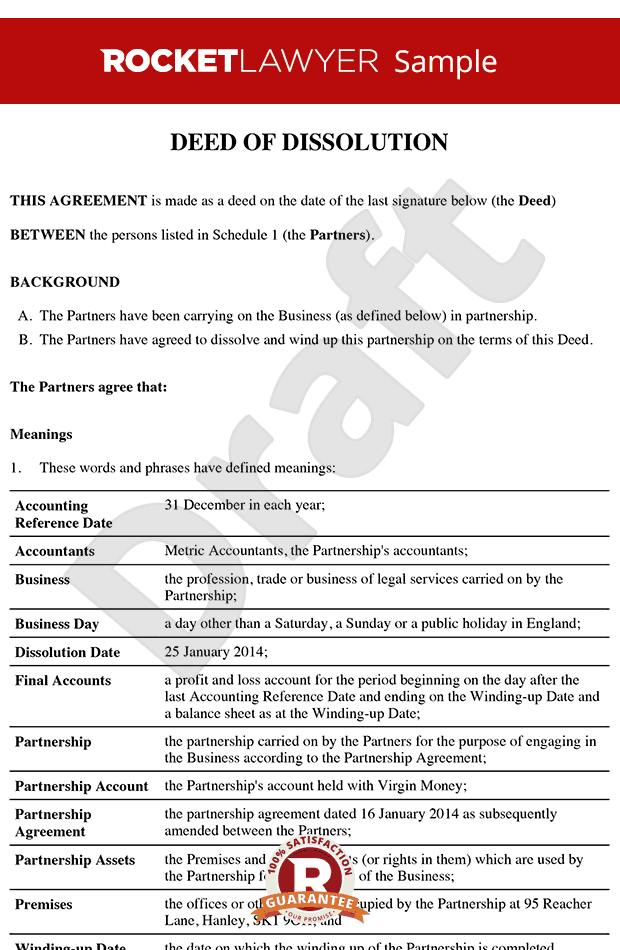

Partnership Dissolution Agreement

- Even if your partnership agreement contains provisions for dissolution, you and your partners should discuss the issues related to your partnership dissolution, including how outstanding obligations and debts should be handled. Once you’ve come to an agreement, a partnership dissolution agreement should be drafted. A dissolution agreement sets out the termination term…

State Laws

- In addition to your partnership agreement, you’ll need to check your state business laws, as the dissolution of partnerships is governed by state law. Your state’s Secretary of State office or website should provide information regarding the process that applies to a partnership dissolution, any applicable termination fees, and the forms which need to be filed. You’ll be requi…

Notify Your Clients, Customers, and Suppliers

- While your state laws might require you to publish a notice of your partnership dissolution in a local paper, it’s important that you also directly notify all the people and businesses with whom you’ve dealt with as a partnership. By giving this notification to your clients, customers, and suppliers, you’re informing them that the partnership no longer exists, and you along with your p…

Other Matters

- Other matters which should be dealt with on dissolution include: 1. Permits, licenses, and registrations. Terminate or cancel your partnership’s business permits, licenses, and any business-related registrations, such as a fictitious name registration. 2. Creditors and taxes. Creditors should be notified and their accounts settled. If your partnership had any employees, p…

Popular Posts:

- 1. what do you call a person your lawyer is defending yahoo

- 2. when you request a lawyer do all questions have to stop

- 3. what is the salary of the us justice sepreme court lawyer

- 4. who is the black actor that was the lawyer in the tv show the practice

- 5. how much is the cost to change name with lawyer

- 6. how do i know if m lawyer has sorted my court date

- 7. the lawyer how stay office

- 8. how do i check if someone is a lawyer mass

- 9. what is the first job a lawyer can get

- 10. which country lawyer from ashtabula