The attorney will need the name and last address of the Decedent. This will give enough information to determine what county Probate Court the case will be filed. Next is a brief summary of the assets the decedent has.

- Is the Previous Power of Attorney Still Valid? ...

- What Can I Do to Protect the Assets? ...

- Do I Need to Open a Probate Estate? ...

- How Can I Find Out if There is a Will? ...

- What About Debts and Taxes? ...

- How Do I Handle Notification of the Death? ...

- How Do I Obtain a Death Certificate?

What questions should you ask an estate attorney after a death?

Here are some critical questions you should ask when you meet with an estate attorney in the wake of a loved one’s death. Is the Previous Power of Attorney Still Valid? You may have had a power of attorney for the loved one who has just died, and you may erroneously believe that the power of attorney is still in force.

What to do when someone dies in a hospital?

❑ Most deaths occur in hospitals and other places such as nursing homes. Talk to the staff about their process. ❑ Contact close family and/or friends of the deceased, the deceased’s doctor (if a hospice is not involved), and the deceased’s lawyer, if any.

What to do if you don’t receive a death certificate?

If you do not receive a death certificate from the funeral home, you should ask the funeral director for one as soon as possible. You will need a death certificate to claim certain benefits, and for the estate process as well. If you need additional copies of the death certificate, you should contact your local Department of Vital Records.

What should I do if someone dies without a will?

The IRS has an interest in the estate, and you should check the tax status of your deceased loved one as soon as possible. It is easy to forget about taxes when handling an estate, but the IRS will be there to remind you. If you are unsure about the tax situation, you should contact the person who handled returns for the deceased.

How do you deal with greedy family members after death?

9 Tips for Dealing with Greedy Family Members After a DeathBe Honest. ... Look for Creative Compromises. ... Take Breaks from Each Other. ... Understand That You Can't Change Anyone. ... Remain Calm in Every Situation. ... Use “I” Statements and Avoid Blame. ... Be Gentle and Empathetic. ... Lay Ground Rules for Working Things Out.More items...•

What happens to a settlement when a person dies?

If the person dies before the lawsuit is filed, then the personal representative files the lawsuit as the party. The lawsuit is filed in the name of the personal representative of the estate. It is not filed in the name of the dead person. The claim becomes an asset of the deceased's probate estate.

What do you do with your phone after death?

They recommend calling, and providing them with a death certificate, an obituary or a letter from an attorney or a court.

Who gets money if beneficiary is deceased?

A beneficiary is a person or persons who will receive the death benefit from your life insurance policy when you die. If you die without naming anyone, the money will go to your estate (the sum of all your property, possessions, financial assets and debts) by default.

How do I claim an estate of a deceased person?

The estate of a deceased person must be reported to the Master of the High Court within 14 days of the date of death. Any person that has control or possession of any property or a will of the deceased, can report the death by lodging a completed death notice with the Master.

Who notifies the bank when someone dies?

Family members or next of kin generally notify the bank when a client passes. It can also be someone who was appointed by a court to handle the deceased's financial affairs. There are also times when the bank leans of a client's passing through probate.

Do credit card companies know when someone dies?

Credit card companies will report the death to the credit bureaus, but it may not happen immediately. If you don't want to wait, you can report the death to the three major consumer credit bureaus (Experian, TransUnion and Equifax) yourself.

How long after a death is a will read?

The Probate Office or Registry will send you a Grant of Representation by post. This usually takes around 3 weeks.

1. What is the Probate Policy for British Columbia?

Unless your loved one went through the process of advanced estate planning before their death, the house and estate will have to go through the local probate process before any assets can be spilt up amongst the beneficiaries.

2. What are the Monthly Expenses?

It is important to ask the estate lawyer questions related to the ongoing expenses and upkeep of the property, such as:

3. What Should I Do with the House?

When it comes to inheriting a house, there are three options that you can choose from: 1) keep the house for personal use. 2) rent the house. 3) sell the property.

4. How Much is the House Worth?

No matter what you are planning on doing with the property you have inherited, knowing the value can give you insights into how to best split the property between multiple heirs or if selling is the best option. Consider asking a realtor for a comparative market analysis to find out the estimated market value of the house.

The loss of a loved one is a devastating event. While grappling with your loss, it is understandable if you don't have the right frame of mind to deal with the issues of the decedent's estate. Attorney Jimmy Wagner can help you with this legal advice. The legal advice can be about tax returns, estate planning, and to sell property or not

The loss of a loved one is a devastating event. While grappling with your loss, it is understandable if you don't have the right frame of mind to deal with the issues of the decedent's estate. Attorney Jimmy Wagner can help you with this legal advice. The legal advice can be about tax returns, estate planning, and to sell property or not.

The loss of a loved one is a devastating event. While grappling with your loss, it is understandable if you don't have the right frame of mind to deal with the issues of the decedent's estate. Attorney Jimmy Wagner can help you with this legal advice. The legal advice can be about tax returns, estate planning, and to sell property or not

There is usually a lot going on in the immediate aftermath of a loved one's passing and matters relating to the estate can easily be put on the back burner. The first legal advice everyone seeks is about tax returns, federal estate tax, and how soon does the personal representative have to complete the estate tax return.

What to do if someone dies unexpectedly?

The medical team will help you figure out the next steps. If the deceased was receiving hospice care, call the hospice.

What does "deceased" mean in a letter?

The words “deceased” and “decedent” mean “the person who died.” “ Estate” is the property belonging to the person who died.

What is the phone number for King County probate?

By phone: 206-682-9552, ext. 114. Seniors Rights Assistance (a program of Sound Generations): For King County seniors. Call or check online for a list of King County probate lawyers, and other consumer issues for seniors. Email: info@ soundgenerations.org.

How long does it take for a beneficiary to receive money?

It can take two or more months for benefits to arrive, so be sure to start soon.

How long does it take to file a will in Washington state?

In Washington, a valid and signed Will must be filed with the Superior Court, usually in the deceased’s county of residence, within 30 days of the death. This is an extremely important step to complete if there is a Will.

Do you need a copy of a death certificate for a car?

You may also need a certified copy for items such as life insurance policies, veterans’ survivor benefits, and annuities.

What to do if you run out of copies of your death certificate?

If you run out of copies, the Department of Vital Records can be contacted for additional copies. Determine if taxes are current. Following the death, there are so many things to take care of, it can be easy to forget about the decedent’s taxes.

What to know after death of loved one?

10 Things to Know After the Death of a Loved One. A power of attorney is no longer valid. Many people believe that, as the power of attorney , they continue to have the power to administer an estate following the death of a loved one. This simply is not the case. A power of attorney is no longer valid after death.

Why do creditors have to hold the assets of the decedent?

Holding the assets of the decedent in an effort to prevent creditors from reclaiming their debt is a risky proposition. Creditors have the right, after enough time passes, to petition the court to open the probate estate themselves.

Why is it important to protect assets after death?

Assets need to be protected. Following the death of a loved one, there is often a period of chaos. This, coupled with grieving, presents a unique opportunity for those bent on personal benefit. It is important for the family, even before the opening of an estate, to protect all assets that belonged to the decedent.

What is the phone number to call for probate?

If you have questions about the management of your loved one’s estate or the probate process, call us anytime at (888) 694-1761 to get answers.

What to do after losing a loved one?

After losing a loved one, your focus is on your family and on grieving the loss —not administering the estate. But there are many concerns that must be resolved to ensure your loved one’s final wishes are respected while protecting the bonds of your family. Knowing what to do before grief strikes can help you navigate the difficult time ...

Who should check if a decedent has a copy of his or her name?

The family should check with the decedent’s attorney or accountant to see if they have the original or a copy. The family should also check with the bank where the decedent maintained an account to see if one may be located in a safe deposit box.

What does it mean when a deceased leaves a pour over will?

If the deceased left a pour-over Will, it means that the assets mentioned be put in a trust. A probate attorney with estate planning or trust administration skills can be of great assistance. 12.

Can a decedent's assets be frozen?

In the blink of an eye, a decedent’s assets can be heisted, pillaged, squandered, or frozen. Probate attorneys help to execute the deceased’s estate plan or intestacy laws so that this doesn’t happen.

How can estate attorneys help with dementia?

Estate attorneys should help clients fiscally prepare for the possibility of disability or dementia by drawing up powers of attorney , healthcare directives, and living wills .

What are the things to consider when planning an estate?

When building an estate plan, you may have a variety of concerns, including the following: Maintaining an orderly administration of assets while you are living. Ensuring that your heirs and loved ones receive your assets. Helping to reduce or avoid conflicts and confusion.

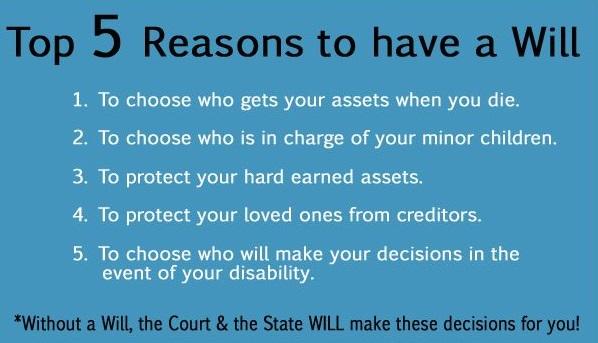

Why is it important to have an estate plan?

It's important to have a solid estate plan in place to ensure that your loved ones receive your assets without a hassle or undue delay after your death. There are many questions you should ask prospective estate-planning attorneys before hiring one to craft your estate plan. Above all, make sure you hire an attorney who demonstrates ...

How to build an estate plan?

When building an estate plan, you may have a variety of concerns, including the following: 1 Maintaining an orderly administration of assets while you are living 2 Managing estate assets flexibly while you are living 3 Reviewing estates involving tenants in common or community property 4 Considering assets in multiple states 5 Examining small business assets 6 Naming your children’s legal guardian 7 Ensuring that your heirs and loved ones receive your assets 8 Helping to reduce or avoid conflicts and confusion 9 Minimizing legal expenses and taxes 10 Assessing wealth preservation

Is an estate attorney a tax advisor?

While an estate attorney's expertise may overlap with these fields, they may not be a general tax expert or investment advisor. Give yourself enough time to gain a broader, big-picture perspective on your estate plan and the logistical practicalities of implementing it.

Can a lawyer draw up a will?

Although any lawyer can draw up a simple will for straightforward situations, such as naming the beneficiary of one's 401 (k), seasoned trust-and-estate lawyers can help navigate more complicated situations involving several trusts and multiple heirs. 1:21.

Do lawyers draw up trusts?

Some lawyers merely draw up estate-planning documents, while others also execute the associated trusts. It's generally more efficient to retain a lawyer in the latter category, who can ensure that the correct assets are transferred into the trust.

What is the role of a probate attorney?

The role of a probate attorney includes, but is not limited to, settling disputes, the sale of the estate property, and distributing the assets of the deceased among the beneficiaries. So, you’ve made the decision to hire a probate attorney, but have you considered the necessary questions to ask?

What documents are needed to be filed in probate court?

If a will exists, then the original will and death certificate also need to be filed in court.

What is probate process?

The term probate refers to various steps such as the verification process, the court where the issue is handled, and the distribution of the deceased’s assets.

How long does it take to get a probate?

The probate process can vary in length of time, but generally, completion can take a few months to a year (or more). The main determining factors on this duration includes the number and type of assets and the state’s legal requirements.

Is probate a straight forward process?

In most cases, the probate process is fairly straight forward. Especially if you have the help of a professional. But sometimes there can be a few issues that occur. One example is if family members challenge the validity of the will. These unforeseen instances are where a probate attorney can be especially helpful.

Popular Posts:

- 1. how to diagnose and overcome lawyer burnout

- 2. what is a lawyer called who does retirement planing

- 3. what if harry potter was a lawyer fanfiction

- 4. name of tax lawyer who works at accounting firm

- 5. what college can i go to to be a lawyer

- 6. how much does the bankruptcy lawyer cost in brooklyn

- 7. what is a relevant experience for a lawyer

- 8. lawyer who sues schools

- 9. how to sue a lawyer

- 10. why is a corporate lawyer needed to assess an uncertain tax position?