QuickBooks can’t handle fixed fee or hybrid billing. QuickBooks Online can do products & services fixed fees, but they don’t have all the instruments today’s law firms need such as milestone / recurring fixed fees. Solution: LeanLaw has a more matter-centric approach: hourly/flat fee milestone / flat fee recurring / flat fee with hourly, and more.

Full Answer

What is QuickBooks for law firms?

QuickBooks for law firms is an accounting (and to a lesser degree: billing) software used by law firms the world over. QuickBooks can be installed to the hard drive of a computer (desktop installation) and an online version of the software.

What is QuickBooks?

QuickBooks is the flagship product of Intuit, Inc, the makers of QuickBooks, TurboTax, Mint personal finance software, and Lacerte and ProConnect tax software. As described above, QuickBooks comes in one of two families: Professional (Desktop) or Online, with the former being more developed and robust.

What is the difference between QuickBooks professional and QuickBooks Online?

QuickBooks has two product-lines, it’s Professional product, which runs as an installed application on your PC or within a Virtual Desktop (more on this shortly), and their Online product, which is the web-based version of the QuickBooks software. QuickBooks Online is the web-based version of QuickBooks.

How does leanlaw integrate with QuickBooks Online?

Track time on-the-go, approve timesheets, and sync to QuickBooks for billing and payroll. LeanLaw is a best of class integration with QuickBooks Online. It supports classing, LEDES invoicing, expense invoicing and legal trust accounting.

How do you account for legal fees?

If you pay legal or other fees in the course of buying long-term business property, you must add the amount of the fee to the tax basis (cost) of the property. You may deduct this cost over several years through depreciation or deduct it in one year under IRC Section 179.

How do I categorize a fee in QuickBooks?

How do I categorize the monthly fee paid to Intuit to run Quickbooks Online? It is an expense. I typically would post these to either a Software Expense, Office Expense, or similar type expense account.

What are professional fees in QuickBooks?

Professional Fees: Payments to attorneys and other professionals for services rendered. Rent Expense: Rent paid for company offices or other structures used in the business. Repairs and Maintenance: Incidental repairs and maintenance of business assets that do not add to the value or appreciably prolong its life.

How do I categorize accounting services in QuickBooks?

Log in to your QuickBooks Online account, then click on Expenses at the left pane. Select Expenses beside Vendors. Check the box beside the Date column for the transactions you want to categorize. Tap on the drop-down arrow beside Batch actions, then select Categorized selected.

How do I record fees in QuickBooks desktop?

How to record bank feesFrom the left navigation menu select +New.Choose Expense.Enter the Payment account.Select a Category such as Bank Fees to link the charge. If you don't have one, click on +Add to set one up.Enter the amount and fill out the remaining fields.When finished, click Save and close.

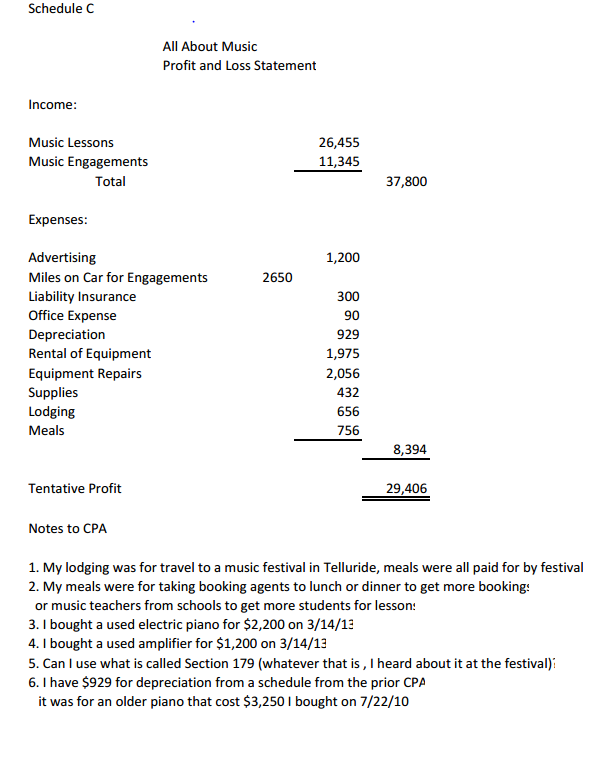

What are the Schedule C categories?

If you're self-employed, you use a Schedule C form to report your self-employed income and expenses....You can categorize these types of expenses as car and truck:Vehicle insurance.Vehicle loan and loan interest.Vehicle repairs.Gas and fuel.Parking and tolls.Vehicle registration.Vehicle lease.Wash and road services.

What type of expense is professional fees?

Professional Fees is a revenue account. It is presented in the first part of the income statement under revenues. Some businesses use Professional Fees as an expense account to record costs incurred in employing the services of outside professionals.

What is classed as professional fees?

Professional Fees means the fees and reimbursement for disbursements owed to attorneys, accountants, or other professionals whose employment has been approved by the Bankruptcy Court.

What is legal and professional expenses in accounting?

Legal, accounting and other professional fees paid or incurred in connection with a business transaction or primarily for the purpose of preserving existing business reputation and goodwill are generally deductible.

What is considered a professional service in QuickBooks?

QuickBooks Premier Professional Services Edition is a version of QuickBooks Desktop Premier that's tailored to businesses that bill their customers by the hour. Hourly rates can be set by the type of service, employee, or customer. Unbilled time and expenses can be added to invoices easily.

How do I categorize consulting fees in QuickBooks?

Let's simply follow these steps:Click the Accounting menu and select Chart of Accounts.Click New, then select Expense in the Account Type.Choose the Detail Type applicable for this account.Enter the name of the expense account.Click Save and Close.

What goes under commissions and fees?

Commission and Fees - Amounts paid for services rendered on behalf of your business. This does not include amounts paid to contractors. Contract Labor - Amounts paid to contractors for work done on behalf of your business. Typically, you would issue these individuals a 1099-Misc if you paid them more than $600.

Popular Posts:

- 1. who is the sleazt lawyer who advertises: when doctiz make mistakes, i make them pay

- 2. good trouble why callie needs a lawyer

- 3. what kind of lawyer do you need for a tpo

- 4. where can i get help with my case in md if i do not have money for a lawyer?

- 5. if a lawyer asks a defendant a ? he does not answer to what should the defendant do

- 6. why does lawyer need social security number

- 7. when a lawyer needs a time out

- 8. who is lawyer in ncis house divided

- 9. how much money does a real estate lawyer make principal

- 10. how to become a finance lawyer in florida