Full Answer

How to find a lawyer to sue a debt collector?

Part 1 of 4: Gathering Evidence of the Abuse Download Article

- Identify abusive practices. Federal law strictly limits what a debt collector can do when collecting a debt.

- Keep a log of phone calls. You should always write down the day and time of any phone call. ...

- Tell the collector to stop. You should tell the debt collector to stop calling you. ...

- Gather proof of injury. ...

When to hire a debt collection attorney?

- allow the creditor to obtain a judgment against you (called a "default judgment")

- defend the lawsuit yourself, or

- hire an attorney to represent you in the lawsuit.

What to do first in a debt collection lawsuit?

- Did the seller use false advertising to entice you to buy their product or service?

- Were you pressured into buying? ...

- Was key information about the transaction or agreement hidden and only surfaced after you had already signed the agreement?

- Did the seller give you a "right to cancel" form? ...

How should you answer a debt collection lawsuit?

Win against credit card companies

- Bank of America

- Capital One

- Chase

- Credit One Bank

- PayPal Synchrony Card

- SYNCB/PPEXTR

- Synchrony Bank

- Target National Bank

- Wells Fargo

Can you dispute a debt if it was sold to a collection agency?

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

Can you sue for being wrongfully sent to collections?

Yes, the FDCPA allows for legal action against certain collectors that don't comply with the rules in the law. If you're sent to collections for a debt you don't owe or a collector otherwise ignores the FDCPA, you might be able to sue that collector.

How do you beat a debt collector in court?

How to Beat a Debt Collector in CourtRespond promptly to the lawsuit. ... Challenge the debt collector's right to sue. ... Bring up the burden of proof. ... Review the statute of limitations. ... File a countersuit. ... Decide if it's time to file bankruptcy. ... Use these 6 tips to draft an Answer and win. ... What is SoloSuit?More items...•

How do I fight a false debt collector?

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. ... Dispute the debt on your credit report. ... Lodge a complaint. ... Respond to a lawsuit. ... Hire an attorney.

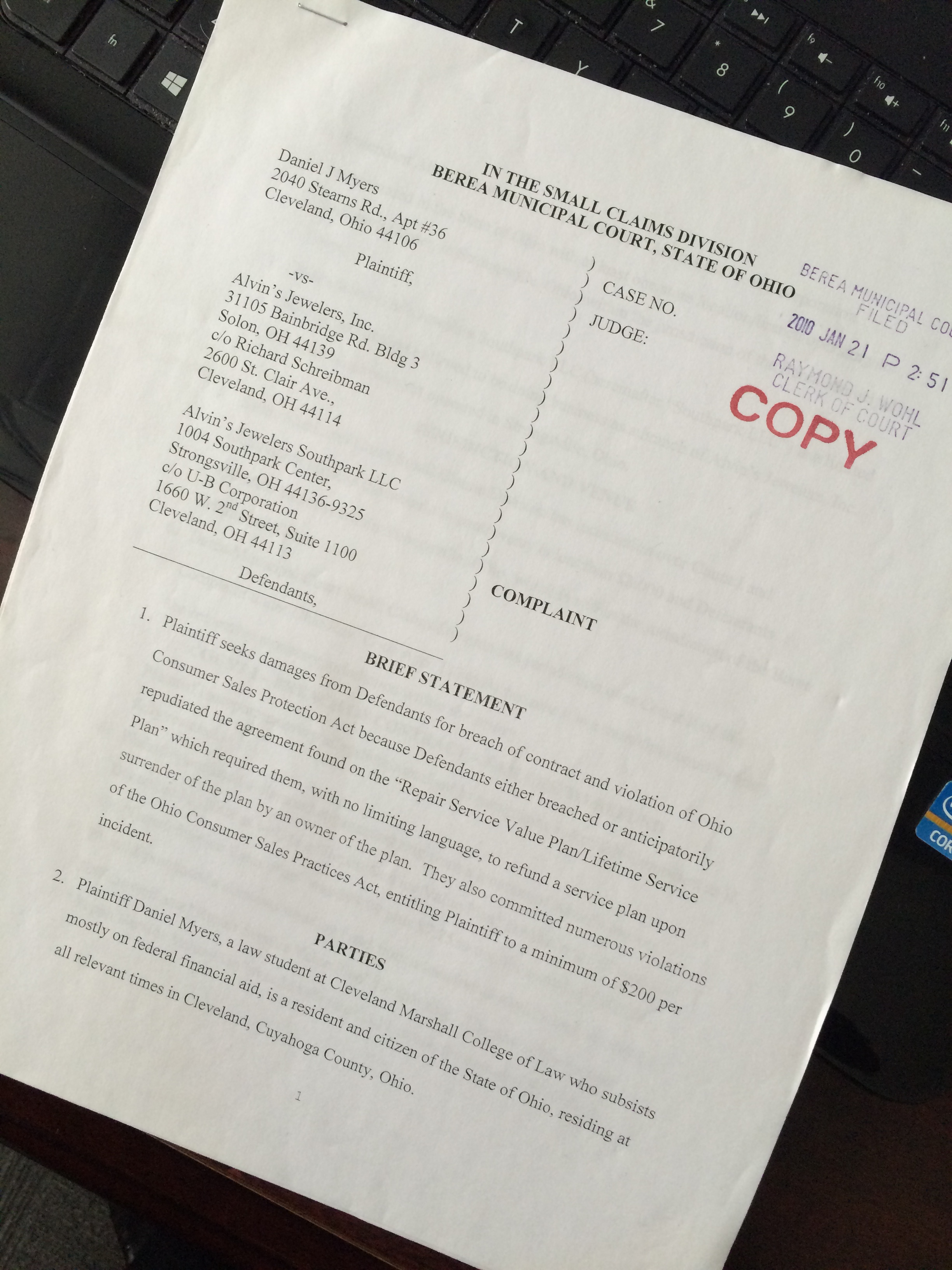

What is a debt collection lawsuit?

A debt collection lawsuit begins when the collection agency files a “complaint” (sometimes called a “petition”) in court. The complaint will explain why the collector is suing you and what it wants—usually, repayment of money you owe, plus interest, fees, and costs.

What happens if a collector gets a judgment against you?

Once the collector gets a money judgment against you, you might face wage garnishment, a bank account levy, or a lien on your property.

What is discovery in a lawsuit?

“ Discovery ” refers to the formal procedures that parties in a lawsuit use to get information and documents from each other to prepare for trial or settle the case. If you don’t raise any defenses or counterclaims, the collector probably won’t engage in discovery. But if you have a good defense or file a counterclaim, you and the collector might want to participate in discovery.

How long does it take to file a lawsuit?

Generally, you’ll get around 20 to 30 days to file a written answer to the lawsuit with the court. You’ll have to respond to the allegations in the complaint and raise any defenses you have, like that the statute of limitations (the law that sets a time limit on the right to file a lawsuit) has expired, or counterclaims against the collector, such as violations of the Fair Debt Collection Practices Act.

How to challenge summary judgment?

To challenge a summary judgment motion, you’ll have to file paperwork opposing the motion. If you don’t, you’ll probably lose. Because the outcome of the lawsuit is at stake, you should seriously consider consulting with a lawyer, if you haven't already, if the collector files this kind of motion.

What happens if a collector grants a motion?

If the judge grants the motion, the court will enter a judgment against you without a trial.

What happens if a collector files a summary judgment?

If the judge grants the motion, the court will enter a judgment against you without a trial.

What to do if your rights are violated by a debt collector?

If your rights have been violated by a debt collector, you should bring evidence of that to court. Check the Fair Debt Collection Practices Act(FDCPA), Fair Credit Reporting Actand Truth in Lending Actfor specific violations. Under the FDCPA, for example, debt collectors may not:

What to do if a debt collector calls you to pay?

Act impulsively. If a debt collector on the phone insists you must pay immediately, take a deep breath and count to 10. Don’t agree to anything or share too much information. Ask for a debt validation letter or proof of the lawsuit in writing before anything else.

How long does it take for a debt collector to send a letter?

This typically occurs when a debt is 180 days past due. Within five days of contacting you, the debt collector must send you a debt validation letterstating how much you owe, the name of the creditor and how to dispute the debt if you believe it’s not yours.

What happens if you are months past due on a debt?

When you are months past due on a debt, your creditor may assign or sell the debt to a third-party debt collection agency, which will attempt to collect it. In extreme cases of nonpayment, you may find yourself sued by the debt collector. If you’re confused about the lawsuit and aren’t sure how to respond, follow the guidelines outlined below.

What happens if you have debt in collections?

If you’ve had debt in collections for a long time, you could be sued by the debt collector. Ignoring or losing the lawsuit can have severe consequences. Here’s what to do. If you’ve had debt in collections for a long time, you could be sued by the debt collector. Ignoring or losing the lawsuit can have severe consequences.

How long can a debt collector collect?

The statute of limitationsis the amount of time that a debt collector can legally collect a debt from you. It can be anywhere from three to 20 years. The time frame depends on the state in which you’re being sued and the type of debt you owe.

What to do if you are being sued for debt?

If you’re being sued for debt and you disagree with any or all of the information in the debt collection lawsuit, you will want to file a response to the lawsuit in court. You will then have the opportunity to contest what’s in the lawsuit or ask the court to dismiss it altogether.

What To Expect When a Debt Collector Is Pursuing You

The process can be overwhelming. You get call after call, letter after letter demanding payment. You get a shiver up your spine whenever the phone rings; you dread checking the mail because of what you may find. This can cause a lot of anxiety, to say the least.

What Is The Fair Debt Collection Practices Act?

Congress believed that many debt collectors engaged in abusive, deceptive, and unfair debt collection practices. In its view, these practices contributed to personal bankruptcies, marital instability, the loss of jobs, and generally invaded consumers' privacy. So it passed a law to stop this behavior.

When You Can Sue: Prohibited Conduct by Debt Collectors

The FDCPA generally prohibits debt collectors from doing all sorts of harassing things, including:

Reasons to Sue: Common Claims Brought Against Debt Collectors

Consumers who choose to sue debt collectors and debt collection agencies typically assert the following claims:

Common Defenses a Debt Collector Might Raise in a Lawsuit

Debt collection agencies are sophisticated. And most are not stupid. They know they might get sued, so they generally have practices designed to minimize exposure. These include robust compliance management systems and high standards for preserving records of debts they have purchased.

If You Sue You May Be Able to Recover Damages

If a debt collector or a debt collection agency violates this law, you may be entitled to recover monetary damages. These include your actual damages, statutory damages up to $1,000, and, if you win, costs and reasonable attorney fees. You cannot get punitive damages (those are damages designed to punish a wrongdoer).

To Sue or Not To Sue: What Should You Do?

If you are being harassed by a debt collector, there are steps you should take. Maintain records of all contacts, whether they take place at home or at work. Record calls. Save any voice mails. Keep all texts and emails. You want to have proof in case you do decide to speak with a lawyer.

Your Rights Under the FDCPA

If you’re being contacted by a debt collector, you have rights under the FDCPA. The FDCPA is a federal law that limits what a debt collector can do while attempting to collect money from you. Most importantly, if a debt collector violates the FDCPA while trying to collect money from you, you can sue them.

How to File a Lawsuit Against Your Debt Collectors

You can file an FDCPA lawsuit in either state or federal court. Consumer protection laws also exist at the state level, so you may consider filing your complaint in state court since they’ll have more experience applying state law. Even if you do file in state court, you’ll still be able to bring your FDCPA claims.

Things That Will Help Set You Up for a Successful Lawsuit

If you’re preparing to sue a debt collection agency for FDCPA violations, there are some important steps you can take to set you up for a successful lawsuit:

Other Ways to Stop Harassment From Debt Collection Agencies

If you don’t want to take direct legal action against the collection agency that’s harassing you, there are other ways to stop them.

What to do if you are sued for debt collection?

If you are part of a legal case involving debt collection, you may want to hire a debt collection attorney. A lawyer with experience in debt collection can help fight for your rights as a consumer, defending you against a debt collector or creditor. Conversely, if you have successfully sued someone but still haven't been paid, ...

How many debt collection lawsuits were filed in 2010?

According to WebRecon, a record breaking 12,000 debt collection lawsuits are expected to be filed in 2010, up from 9,300 in 2009 and 4,400 in 2007.

What to do if you are sued and still awaiting payment?

If you have sued someone successfully and still are awaiting payment, you may require the services of a debt collection attorney. There are different debt collection regulations and procedures that a debt collection lawyer can use to most effectively get your money.

What to do if you hire a lawyer to defend a collection suit?

If you decide to hire the attorney to defend the collection suit, be sure that you sign a retainer agreement. The retainer agreement is a contract that governs your employment relationship with the attorney and should spell out at a minimum the details of the fee arrangement you negotiated.

What happens if you don't respond to a collection lawsuit?

The summons attached to the complaint will tell you the deadline for your response. If you don't respond, the court could enter a judgment against you. (Learn more about receiving and responding to a collection lawsuit .)

How do attorneys charge?

How an attorney charges for services can have a big effect on the cost. Most attorneys will charge for their services in one of three ways: 1 A flat fee, no matter how much time it takes or how the suit is resolved. 2 By the hour, often with a cap to ensure that you do not pay the attorney more than the lawsuit is worth 3 By the result. Usually this fee is based on how much the attorney saves you in the long run. For instance, an attorney may agree to a fee of one third of the difference between the amount of the debt and the settlement amount. If you are sued for $10,000, and settle for $4,000, the attorney will get one third of the difference, or $2,000.

How does an attorney charge for services?

Most attorneys will charge for their services in one of three ways: A flat fee, no matter how much time it takes or how the suit is resolved. By the hour, often with a cap to ensure that you do not pay the attorney more than the lawsuit is worth.

What to expect when hiring an attorney?

From the attorney, you should expect competence, ethical behavior, and adequate communication as your case progresses.

What should an attorney explain to a creditor?

The attorney should explain any additional costs, like court fees and expenses you'll be responsible for, like copy costs, postage, and other charges . If the attorney thinks settlement is possible, the attorney will ask you if you have a maximum amount you are willing to pay the creditor.

Can a lawyer recover a counterclaim against a creditor?

If you have a counterclaim that you can file against the creditor, such as one for illegal debt collection practices or unfair trade practices, the attorney might be able to recover his or her fees from the creditor if you win.

How to collect a judgment?

Judgments give debt collectors much stronger tools to collect the debt from you. Depending on your situation and your state’s laws, the creditor may be able to: 1 Garnish your wages 2 Place a lien against your property 3 Move to freeze or garnish all or part of the funds in your bank account

What happens if you ignore a lawsuit?

If you ignore a court action, it's likely that a judgment will be entered against you for the amount the creditor or debt collector claims you owe.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

What is a judgment in a court case?

A judgment is a court order.

Popular Posts:

- 1. how to become a first amendment lawyer

- 2. what physical ailment does the new lawyer on generalospital have?

- 3. how to start a business lawyer in my area

- 4. how to get a family law lawyer with no money

- 5. what happens if the judge wont appoint a lawyer and you cant afford one

- 6. how to contact lawyer in timberwood

- 7. how to check for a good divorce lawyer in orland park

- 8. what steps do i need to take to become a lawyer

- 9. what dramatic actor became known for his role as don corleone's lawyer in "the godfather" (1972)

- 10. what type of lawyer helps subcontractors get payments