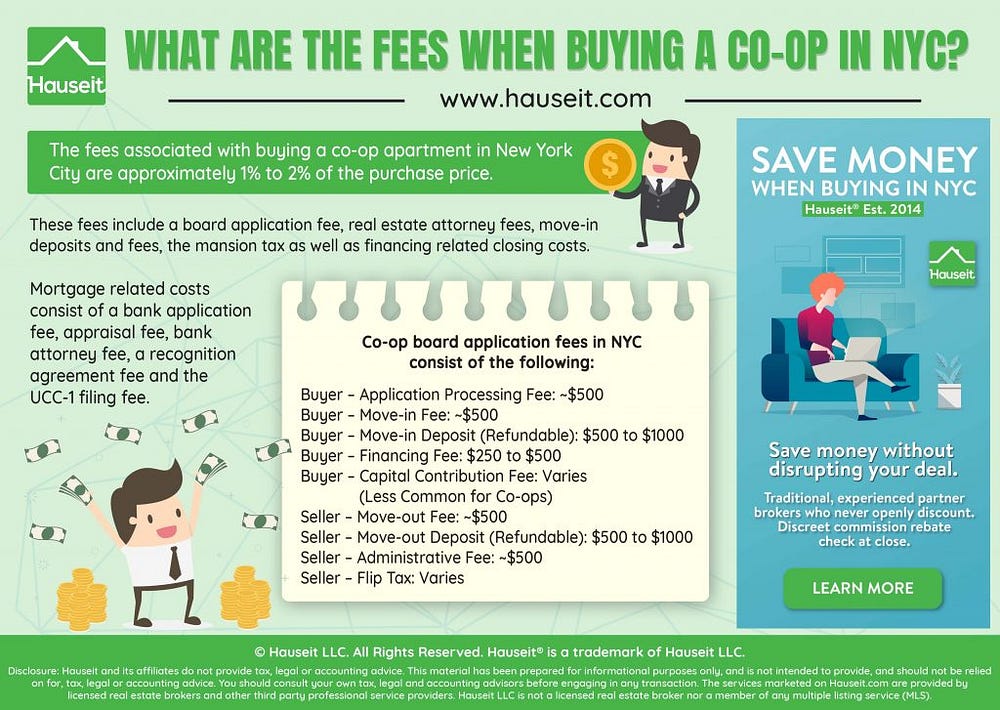

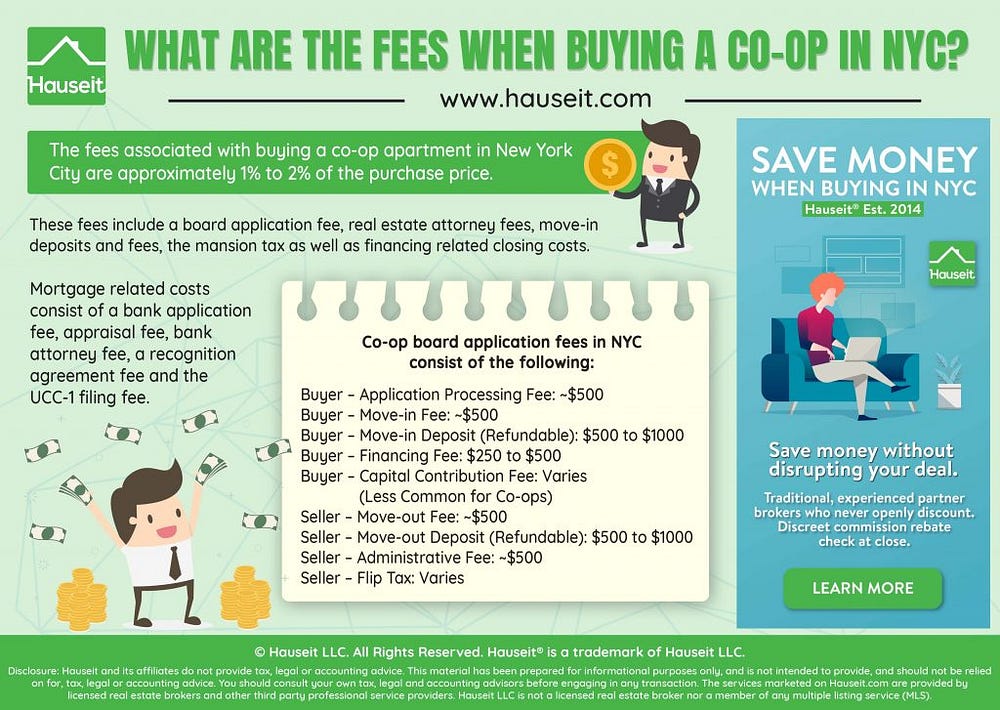

What are the fees when buying a co-op in NYC?

What Are the Fees When Buying a Co-op in NYC? The fees associated with buying a co-op in NYC are approximately 1% to 2% of the purchase price. These fees include a board application fee, real estate attorney fees, move-in deposits and/or fees, the Mansion Tax as well as financing related closing costs.

How much does a real estate attorney cost in NYC?

Generally speaking, real estate agents will estimate that attorney fees in NYC will range anywhere from $1,500-$4,000 per transaction.

How much are co-op board application fees?

How Much Are Co-op Board Application Fees? The average co-op board application fee is $500, paid by the buyer. In addition to the application fee, most buildings will charge both buyers and sellers fees and deposits relating to move-in and move-out.

How much do attorneys charge for attorneys?

Attorneys usually charge by the hour, from $150 to $350. However, some real estate attorneys may have a fee schedule for certain services, such as preparing real estate closing documents.

How much do real estate lawyers charge in NYC?

$2,000 to $3,000The typical real estate attorney based in NYC will charge anywhere from $2,000 to $3,000 for a normal purchase or sale transaction. Rates are higher for real estate lawyers based in New York City vs attorneys based in lower cost locations such as Long Island or the Hudson Valley.

Do you need a lawyer to buy a coop in NYC?

The right mortgage broker can help you determine the right amount you are able to spend and find financing options that are best for your needs. A Lawyer: If you are buying a co-op in NYC, an NY co-op attorney is an essential part of your co-op buying team.

How much is closing cost for co-op in NYC?

1% to 2%Co-op buyer closing costs are 1% to 2% of the purchase price in NYC.

What do real estate attorneys do in NYC?

Just what does a real estate attorney do for a seller? The short answer is that they oversee home sales from contract signing and negotiating to close, preventing any problems. What's more, in NYC, it's actually required that an attorney represent both buyers and sellers in the sale of real property.

Is it worth buying a coop in NYC?

As a general rule, buying a co-op is cheaper than buying a condo. This affordability is the primary perk of purchasing a NYC co-op. You'll also enjoy lower closing costs if you buy a co-op as you won't have to worry about title insurance or the mortgage recording tax.

Are NYC coops a good investment?

Is buying a coop a good investment? Buying a coop can be a good investment under certain circumstances as New York City's real estate has been on an upward trend in recent years. That means that if you plan to buy a coop and live in it for an extended period, it will likely appreciate and prove to be a good investment.

Who pays the flip tax on a coop in NYC?

the sellerThe average co-op apartment flip tax in NYC is 1% to 3% of the sale price, and it's customarily paid by the seller. Exact flip tax amounts vary by building. A flip tax can be structured as a percentage of the sale price, a percentage of profits, a flat-fee or a per-share amount.

How long does it take to close on a coop in NYC?

around two to three monthsGenerally, the co-op closing time in NYC takes around two to three months from the time you sign the contract because it requires the buyer to be approved by the board. A typical financed deal usually takes at least three months to close. Many factors affect the closing of a coop apartment purchase.

Do you pay taxes on co-op in NYC?

You own shares in a building and the entire building receives the property tax bill, not the individual owners. A maintenance payment is usually about 50% property taxes and 50% common charges.

What does a real estate attorney do?

They advise their clients on various property related matters. They draft MOUs, lease agreements, leave and license agreements, etc. They also handle land or property related disputes. Their clients range from individuals investing in a flat to developers or promoters.

Who pays for title search in NY?

the buyerTitle Search and Insurance Title companies can charge from around $150 to $500 for a title search. Nearly all lenders will require title insurance as an added protection against any potential disputes after the closing — this is usually paid by the buyer in a one-time premium.

Is New York an attorney closing state?

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New ...

State requirements

It’s important to know whether your state is an attorney state or a title state. An attorney state, such as Massachusetts, requires the the involve...

Services

Real estate attorneys are qualified to handle all legal matters related to real estate, including disputes and transactions. They write and review...

Pricing

Attorneys usually charge by the hour, from $150 to $350. However, some real estate attorneys may have a fee schedule for certain services, such as...

Finding the right attorney

Ask your real estate agent to recommend an experienced, state-licensed real estate attorney, then do some online research. For example, if you’re b...

How much does a real estate attorney cost in NYC?

Generally speaking, real estate agents will estimate that attorney fees in NYC will range anywhere from $1,500-$4,000 per transaction. Each real estate lawyer may charge a different amount for their legal representation based on how complicated the transaction is, so it is advisable to confirm in advance what the fees will be before you hire ...

What factors will affect the attorney fee?

When buying a pre-existing condo, co-op, or home, your purchase should be very straightforward and so should your attorney’s fee. All-cash purchases can be even more straightforward as there are less documents you and your attorney will need to review during the contract and closing processes.

Do real estate attorneys charge hourly?

Per transaction fees vs. hourly fees. Real estate lawyers typically don’t charge you an hourly rate – it’s one fee per transaction and is usually only paid upon the closing of the transaction in NYC. Many buyers are hesitant to bring a real estate attorney in early on to ask questions about a potential purchase, ...

How much is a co-op board fee?

How Much Are Co-op Board Application Fees? The average co-op board application fee is $500, paid by the buyer. In addition to the application fee, most buildings will charge both buyers and sellers fees and deposits relating to move-in and move-out.

When are move in fees payable?

In most cases, the processing fee and the move-in/move-out deposits and fees are payable at the time you submit the purchase application to the managing agent.

When was the New York Mansion Tax imposed?

The New York Mansion Tax was imposed in 1989, and it was never adjusted for inflation until 2019. We explain the Mansion Tax in detail and the latest updates to the tax rates as of 2019 and show how you can reduce or eliminate the tax here. The Mansion Tax is technically an additional real estate transfer tax.

Is a co-op considered real property?

Co-ops are not considered to be real property since there is no deed and unit owners simply own shares in a corporation along with a proprietary lease entitling them to occupy a specific apartment.

Is a real estate offer binding in NYC?

Real estate offers in NYC are not binding until a contract is signed, and you won’t be able to sign a contract until your lawyer completes due diligence and negotiates the contract.

How much does a real estate attorney charge?

Attorneys usually charge by the hour, from $150 to $350. However, some real estate attorneys may have a fee schedule for certain services, such as preparing real estate closing documents. For example, real estate attorney John I. O’Brien in Wakefield, Mass., charges the same closing fee regardless of the cost of the house. Also, he offers a package service for buyers who hire him for the purchase and sale as well as the closing.

What is a real estate attorney?

Real estate attorneys are qualified to handle all legal matters related to real estate, including disputes and transactions. They write and review purchase agreements, title and transfer documents, and other important documents. They also make sure the property transfer is legal, binding and in the best interest of the client. A real estate attorney can help clients who need to back out of a contract.

What states require a real estate attorney?

An attorney state, such as Massachusetts, requires the the involvement of a real estate attorney in the purchase, sale and closing of a house. In a title state, such as California, a real estate attorney is necessary only when there are legal disputes to settle.

Can you limit the number of hours an attorney can spend on a transaction?

As the client, you can set limits on the number of hours your attorney spends on your transaction. Write into your retainer agreement the number of hours you expect to work with the attorney, so you can avoid an open-ended number of billable hours. Many attorneys offer a free or discounted consultation before agreeing to a contract.

How much is a real estate attorney?

Real estate lawyer fees vary significantly, said Michael Romer, managing partner at Romer Debbas, LLP based in New York City. For example, fees vary depending on the level of experience an attorney has.

How much does an attorney charge per hour?

While most attorneys charge a flat rate, some will charge by the hour, with hourly rates ranging from $150 to $350, according to Thumbtack.

What is the difference between a realtor and a real estate agent?

A real estate agent, or realtor, is tasked with marketing a property for sale or finding a property for a buyer, Romer said, while an attorney is enlisted to ensure someone’s legal rights are protected during a home sale. Real estate agents are paid based on commission , while attorneys are paid a separate legal fee that is typically a flat rate, he said.

Do you need a real estate attorney to close a house?

Some states require a real estate attorney for closing, while others don’t. In states that don’t require an attorney, it’s still a good idea to consider hiring one to help make sure everything is in good order. How much does a real estate attorney cost may factor into your decision-making given how many costs are associated with closing on a house .

Do real estate attorneys help you buy a house?

Real estate attorneys may give you the peace of mind that your home purchase will go smoothly, drastically lowering the possibility that you’ll be hit with any unexpected legal problems.

Who to negotiate with to get a contract?

Negotiate your contract with the seller’s attorney if necessary.

Do you need a real estate lawyer at closing?

Some states require a real estate attorney to not only be involved during the entire home sale process but also to be present at closing. In addition, Realtor.com notes that laws in this area can differ depending on the region within the state.

How much does a real estate attorney cost?

Hiring an attorney for real estate area costs from your pocket indeed. The typical and average rate of a real estate attorney ranges from $2,500 to $3,000 for a simple buy and sell transaction. The average cost of the real estate attorney may also go high according to different states.

How much does a real estate lawyer charge?

The hourly rate of a real estate lawyer may be $150 to $300, but it is rare to find. Most of the real estate attorney’s fees are typically structured on the basis of a flat fee, and this fee is paid after the completed transaction. So when a real estate lawyer is saying that he works on an hourly basis, it is important to make sure if there is any other extra charge with an hourly fee. In some cases, the buyer and seller may request to the lawyer to work on an hourly basis if they can be capable to accomplish some portion of property buy and sell tasks.

Why is it important to have a real estate attorney?

The role of a real estate attorney is very crucial because it is totally about huge money.

Can a real estate lawyer double fees?

It may double fees of a real estate lawyer in case the buyer will buy a new development. The developers generally expect to share their closing costs with new buyers and sponsors’ attorney fees. So it may be found that a new buyer is paying for his personal attorney fees and sellers attorney’s fees.

Do lawyers get paid at the closing table?

The real fact is the good and renowned lawyer don’t go for an engagement letter and they don’t want their clients to go after getting service for the first time. So the standard system to pay the attorney is when the transaction is completed, the lawyer will be paid at the closing table.

Do real estate lawyers get paid after closing?

It is common to see that the real estate lawyers are paid their fees after the closing and cost is also determined according to closing. However, any extra charge after closing cannot be accepted. A written agreement may cease the lawyer to pursue more dollars from your pocket in the name of additional charge.

Is it normal to charge higher fees for a complex transaction?

It is normal to believe that fees for the complex transaction can be higher. There is complexity with the heir of the property, which is really difficult to handle this issue. A real estate lawyer has to work much more with their law and future complexity of the property issue. More importantly, if there is any foreign buyer, ...

How Much Should You Pay for a Real Estate Lawyer?

The average real estate lawyer based in NYC will charge anywhere from $2,500 to $3,000 as a flat fee for a normal purchase or sale transaction.

Why are real estate attorney fees higher?

Real estate lawyer fees could be higher for a complicated estate sale with heirs that are hard to track down and a power of attorney involved. Or the real estate attorney fees could be higher for a purchase involving a foreign buyer and a convoluted corporate structure.

What Do Real Estate Attorneys Do?

Ideally a property lawyer will do much more than just show up for the contract signing.

How to Find a Good Real Estate Attorney?

As with most things real estate: starting early is the name of the game.

What happens if you don't hire a lawyer?

If you are not an attorney yourself and don’t hire one, as a buyer you run the risk of getting a contract devised by your seller’s lawyer, which will probably not have your best interests in mind.

What should an attorney review?

Your attorney should also review financial statements, and your offering plan, which will include details like bylaws and special risks of the project.

What does it mean when a lawyer determines one of the bedrooms doesn't meet legal requirements?

For instance, if the unit is listed as two bedroom, but your lawyer determines one of the bedrooms doesn’t meet legal requirements, that could mean a price cut —and a reason to be thankful for your attorney.

How much do sellers pay?

I hope you are sitting down… closing costs for sellers can total more than 8% of their sale price! If you have a mortgage this can mean a significantly larger percentage of your equity. In some instances, 8% in fees from closing costs could be 40% or more of the equity in your home if you only put 20% down when you got a mortgage.

How much is transfer tax in New York?

New York State charges you an additional 0.40% transfer tax on the purchase price. The New York State transfer tax increases to 0.65% for residential transactions greater than $3,000,000 (as of the 2020 New York State budget passed on March 31, 2019).

Our Services

From owners to board members to tenants to developers, our attorneys handle co-op and condo matters in Manhattan, Brooklyn, Queens, the Bronx, Staten Island, Westchester, Nassau and Suffolk Counties. Our services include:

Learn More About Us

If you are seeking a qualified, trusted legal team to help with an issue involving a cooperative or condominium, reach out to our team to learn more about us and how we can help.

Popular Posts:

- 1. who is the best civil lawyer in northwest florida

- 2. how to i finad a lawyer that will help me with health insruance issues

- 3. who is a family lawyer

- 4. how to be a witness with an agressive lawyer

- 5. when is the bar become a lawyer 2019 bloomington indiana

- 6. advantages of hiring a lawyer when suing for medical negligence

- 7. why would a state sttoney call me if i have a lawyer

- 8. lawyer referral service 800 pain how does it work ?

- 9. which career pathway is a lawyer

- 10. how to look like a lawyer