Filing for bankruptcy requires you to complete a lengthy packet of forms. Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

What do I need to file bankruptcy?

In order to ensure a quick and efficient bankruptcy you should make sure all the necessary paperwork is filed. This includes information about your income, expenses, debts, assets, recent financial transactions, and the property you’re allowed to exempt. In total, most bankruptcies take around 4 to 6 months. Find the Right Bankruptcy Lawyer

What can I expect from a bankruptcy attorney?

You'll also need proof of other income sources such as Social Security funds, disability, or rental properties. If you're self-employed and filing for bankruptcy, you'll probably need to provide a year-to-date profit and loss statement, as well as for the two full years before filing. Also be prepared to present business bank statements to verify the profit and loss amounts.

How do bankruptcy attorneys file bankruptcies?

Feb 28, 2018 · The most important, mandatory documents to bring to your initial bankruptcy consultation are a list of your outstanding debts and a list of your assets, focusing on major assets, such as houses, cars, boats, trailers, timeshares and the like. We rarely ask for the actual bills from the creditors, as we routinely download a credit report, which captures most of the …

What information do I need to provide my attorney?

One way to find out if it's a good fit is to to ask whether the lawyer has represented clients in similar situations in the past. Expect Sound Legal Advice From Your Bankruptcy Lawyer In general, your retainer agreement (the contract you and your attorney sign) will outline the services your bankruptcy attorney will provide.

What does a bankruptcy trustee look for?

In addition to making sure that your paperwork is accurate and complete, the trustee will be on the lookout for omitted or undervalued assets, undisclosed income, fraudulently transferred property, and any other red flags that can benefit your creditors or indicate abuse of the bankruptcy process.

What should I gather for bankruptcy?

Documents You'll Need to Complete Chapter 7 Formssix months of paycheck stubs.six months of bank statements.tax returns (the last two years)current investment and retirement statements.current mortgage and car loan statements.home and car valuations (printouts from online sources work)More items...

How do I prepare for a bankruptcy meeting?

0:195:35Bankruptcy Meeting of Creditors Preparation - YouTubeYouTubeStart of suggested clipEnd of suggested clipFirst it's really important to bring a photo ID. So a driver's license or passport.MoreFirst it's really important to bring a photo ID. So a driver's license or passport.

What can prevent you from filing bankruptcy?

What Not To Do When Filing for BankruptcyLying about Your Assets. ... Not Consulting an Attorney. ... Giving Assets (Or Payments) To Family Members. ... Running Up Credit Card Debt. ... Taking on New Debt. ... Raiding The 401(k) ... Transferring Property to Family or Friends. ... Not Doing Your Research.

What is the means test for Chapter 7?

The bankruptcy means test determines who can file for debt erasure through Chapter 7 bankruptcy. It takes into account your income, expenses and family size to determine whether you have enough disposable income to repay your debts.

Is it better to file a Chapter 7 or 13?

Most consumers opt for Chapter 7 bankruptcy, which is faster and cheaper than Chapter 13. The vast majority of filers qualify for Chapter 7 after taking the means test, which analyzes income, expenses and family size to determine eligibility.

What kind of questions do they ask at bankruptcy court?

Common Bankruptcy Trustee QuestionsDid you review your bankruptcy petition and schedules before you filed them with the court?Is all of the information contained in your bankruptcy papers true and correct to the best of your knowledge?Did you disclose all of your assets?

What questions will the trustee ask?

Questions the Trustee Can (and Will) AskDid you read and review your bankruptcy petition, including all of the schedules, before signing it?Was the information contained in the petition accurate when you signed it?Has anything changed since you signed the petition?Have you filed for bankruptcy before?More items...•Dec 31, 2020

What is a no asset Chapter 7?

With a no-asset chapter 7 bankruptcy, the debtor will not lose any of their property. A “no-asset” Chapter 7 bankruptcy means you do not have assets that the bankruptcy trustee can sell to pay your creditors.

What happens to your bank account when you file Chapter 7?

In most Chapter 7 bankruptcy cases, nothing happens to the filer's bank account. As long as the money in your account is protected by an exemption, your bankruptcy filing won't affect it.Mar 21, 2022

What debts Cannot be included in bankruptcy?

Fraud Debts arising from an act of fraud will not be written off as part of a bankruptcy order. Debts in joint names If you owe debts jointly with someone else, these will still be included in your bankruptcy. The creditor will chase the other party until the entire balance owed is repaid (or otherwise resolved).

What assets are protected in Chapter 7?

Exempt property (items that a debtor may usually keep) can include:Motor vehicles, up to a certain value.Reasonably necessary clothing.Reasonably necessary household goods and furnishings.Household appliances.Jewelry, up to a certain value.Pensions.A portion of equity in the debtor's home.More items...•Apr 7, 2021

What Documents Do You Need to File For Bankruptcy?

The documents you’ll need are the same whether you are filing a Chapter 7 bankruptcy or Chapter 13 matter, with slight variations. However, for exa...

Retirement and Bank Accounts

Recent bank and retirement account statements must be provided to the bankruptcy trustee for all accounts.IdentificationWhen you go to your hearing...

What Information Do You Need to Complete The Bankruptcy Forms?

Most of the information you’ll need to fill out your bankruptcy paperwork will be in those documents, including asset value and income information....

Credit Counseling Requirement

In addition to the documents above, the law requires that you complete a credit counseling class and obtain a certificate before you can file for b...

Why is it important to have a bankruptcy attorney?

Because filing for bankruptcy is a complex legal claim, finding the right bank ruptcy attorney is important. A bankruptcy attorney will help you decide whether or not to file for bankruptcy, and what type of bankruptcy you should file. Additionally, if you decide to file, an attorney can help ensure that your property is protected, ...

What is the most important thing to do when filing for bankruptcy?

The last point is especially important. For the most effective bankruptcy filing, it is crucial that you are completely transparent with your attorney. Make sure you take note of any questions, legal inquiries, or laws that you may wish to address with your attorney.

Why do people declare bankruptcy?

Declaring bankruptcy gives individuals or businesses that are unable to pay their debts a better way to solve their financial problems. It can also help them start rebuilding their credit and lives in a more positive and financially stable way.

What is a credit report?

A list of your creditors that you owe money, and their contact information, account numbers, and how much money you owe each one; Documents relating to any outstanding loans that you may have, including mortgages,student loans, car loans, or any other loans you might have;

How long does it take to file for bankruptcy?

In total, most bankruptcies take around 4 to 6 months.

What happens when you file for bankruptcy?

That way, when you complete your bankruptcy, you will be on the right path to financial recovery.

Can you rebuild your credit after bankruptcy?

Although there may be an initial lowering of the credit score the debtor will have an opportunity to slowly rebuild it after the bankruptcy is filed. A bankruptcy is public information- A common issue with filing for bankruptcy is that everything filed with the court is public and can be accessed by anyone.

What information do you need to file for bankruptcy?

What Information Do You Need to Complete the Bankruptcy Forms? Most of the information you'll need to fill out your bankruptcy paperwork will be in those documents, including asset value and income information. For example, you'll use the income documentation to calculate your average monthly income.

How to get a credit report for bankruptcy?

Start by finding loan statements or bills so that you can list each of your creditors in the bankruptcy. Alternatively, you can obtain a credit report that shows all your debts; however, be aware that you're required to list the creditor's billing address, and that address rarely shows up on your credit report.

Do you have to pay child support if you file for bankruptcy?

If you have other circumstances affecting your bankruptcy, such as being required to pay alimony, child support, or another unusual expense, you'll need to show proof of these costs. For instance, it's common to provide a copy of a child support order. If you've divorced recently, you might need to produce an order or marital settlement agreement documenting a property distribution.

Bankruptcy Consultation Documents: What to Bring to Your First Meeting with Your Lawyer

The most important, mandatory documents to bring to your initial bankruptcy consultation are a list of your outstanding debts and a list of your assets, focusing on major assets, such as houses, cars, boats, trailers, timeshares and the like.

Contact a Bankruptcy Attorney Today for a Free Consultation

If you are thinking of filing for bankruptcy, you are not alone. Lawyers can help you decided whether or not you even need to file a bankruptcy, but if you do, they’ll let you know which chapter would be most appropriate.

What do bankruptcy attorneys do?

Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

How to file for bankruptcy?

First, you can expect your attorney to tell you whether filing for bankruptcy would be in your best interest. If it is, you should also learn: 1 whether Chapter 7, Chapter 13, or another type will help you achieve your financial goals 2 what you can expect during the bankruptcy process, and 3 whether your case involves any particular difficulties or risks.

What to expect during bankruptcy?

Most importantly, if you have any questions, you can expect your attorney to respond to your calls or emails promptly.

What is the mandatory hearing for bankruptcy?

After filing for bankruptcy, all debtors must attend a mandatory hearing called the 341 meeting of creditors. But, depending on your case, you (or your attorney) might need to go to additional hearings. Some common types of hearings you can expect your attorney to represent you at: Chapter 13 confirmation hearings.

What is a retainer agreement?

In general, your retainer agreement (the contract you and your attorney sign) will outline the services your bankruptcy attorney will provide . Your attorney's job is also to provide you with competent advice throughout the bankruptcy process.

Can an attorney text you?

Attorneys have the option, but are not required, to send text messages to you. You will receive up to 2 messages per week from Martindale-Nolo. Frequency from attorney may vary. Message and data rates may apply. Your number will be held in accordance with our Privacy Policy.

Is filing for bankruptcy a good idea?

Filing for bankruptcy is a great way to get out from under burdensome debt, and most people feel a tremendous sense of relief when their bankruptcy case is over. But understanding the process and filling out the bankruptcy forms can be daunting. That's where a bankruptcy lawyer comes in. Not only will you receive legal advice, ...

How long do you have to take credit counseling before filing for bankruptcy?

Take Credit Counseling. Every person who files for bankruptcy has to take a credit counseling course in the 6 months before their bankruptcy petition is filed with the court. This is a requirement in both Chapter 7 and Chapter 13 cases.

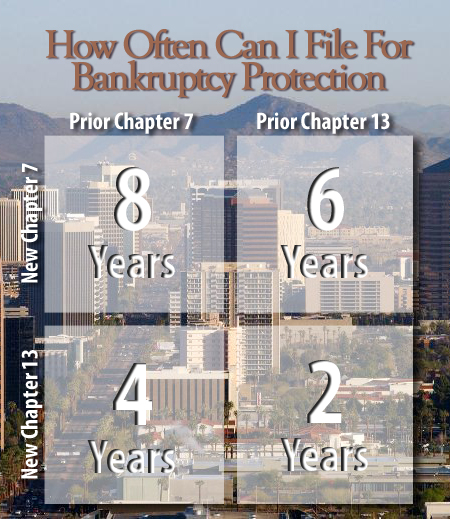

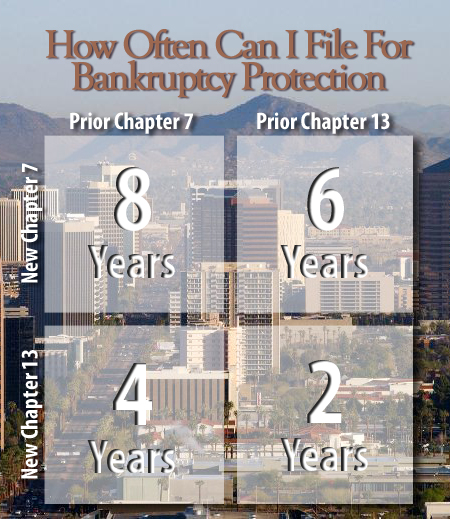

How often can you file for bankruptcy?

You can file bankruptcy under Chapter 7 once every 8 years . Chapter 13 bankruptcy is another type of bankruptcy available to consumers. The main difference to Chapter 7 is that you pay back some of your debts through the Chapter 13 trustee. Your monthly payment is based on how much you’re able to pay.

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy is a very effective tool for erasing credit card debt, medical debts, and most other unsecured debt. Although Chapter 7 is a liquidation bankruptcy, filers are able to keep all their property in more than 90% of all consumer bankruptcy cases in the United States.

When is a 341 meeting?

Your 341 meeting, or meeting of creditors, will take place about a month after your bankruptcy case is filed. You’ll find the date, time, and location of your 341 meeting on the notice you’ll get from the court a few days after filing bankruptcy. Due to the COVID-19 pandemic, all 341 meetings are held either by video conference or via telephone until at least October.

What happens if you own a car that you still owe?

If you own a car that you still owe on, you’ll have to let the bank and the court know what you want to do with it one one of your bankruptcy forms.

How long does it take to rebuild credit after bankruptcy?

Either way, once granted permanent debt relief in the form of the bankruptcy discharge, most people are able to rebuild their credit score in less than one year. Collect Your Documents.

Can you file for bankruptcy if you have cosigners?

If you have any cosigners, they will not be protected by your personal bankruptcy. If you have great credit when your Chapter 7 bankruptcy is first filed, your credit score will likely drop a bit once the bankruptcy filing is reported to the credit bureaus.

What is the bankruptcy code?

The Bankruptcy Code obligates your bankruptcy lawyer to conduct a meaningful evaluation of all information provided. In theory your attorney can be subject to financial penalties if he/she files a petition with significant inaccuracies.

How long does it take to get payroll information?

And payroll information and bank account information often can be obtained online. The issue in many cases is time – it can take days or even weeks to gather all the information you need so you will be best served by starting the process early.

Can a Chapter 13 case be dismissed?

While debt limits are not an issue for most people, your Chapter 13 case will be dismissed if it turns out that your debts exceed these limits. If you think that your debts may approach these numbers, you and your attorney need accurate and updated statements about all your debts.

Is financial information accurate?

Financial information provided to your attorney prior to filing should be current and accurate. Out of date information is likely to contain inaccuracies and inaccurate information can result in objections or possibly even dismissal of your case.

What is post confirmation work?

In general, post-confirmation work in chapter 13 cases involves additional fees regardless of whether it is with the same lawyer or a new one. You might ask the new lawyer whether he is willing to put most of the additional fees into the modified plan, but it is very common for lawyers to ask for additional funds up front before doing work on a motion to modify a chapter 13 plan.

Can I choose my attorney for Chapter 13 bankruptcy?

Any new attorney will likely be able to collect his fee as part of the monthly payment you send in to the trustee and so should not seek a large upfront retainer. It is not easy for a new attorney to jump into the middle of a chapter 13 like this but as long as you find a competent attorney that has a lot of chapter 13 experience everything will be fine.

Do you have to pay a retainer for Chapter 13?

Once the case is confirmed, the attorney has earned the balance of the legal fee according to most retainer agreements and the Trustee pays the balance of the legal fee to the attorney (or his estate, unless received in full prior to his death). Any additional work that would need to be performed after the confirmation would typically not be included in the flat fee & would be extra. So until the time comes when you need an attorney, you may not need to have cash in hand right now. But in the future, you will need an attorney to alter your plan, and you would have needed to pay even your original attorney for performing the additional work, so I see no change in the cost to you.

Do you pay attorney fees?

Most of the fees that you pay to your attorney are earned in the beginning of the case. You should look at the contract that you signed with the attorney but I' m not sure that you would be able to recover the fees from the attorney . Often times making changes to your plan also require additional fees. I would just suggest speaking to the attorney at his firm or looking for a new attorney to take over the case.

Popular Posts:

- 1. what does a criminal defense lawyer do

- 2. how smart do you have to be a lawyer

- 3. what kind of lawyer takes peoperty

- 4. lawyer who focuses on animals

- 5. why los angles lawyer expensive

- 6. who is trumps tax lawyer

- 7. what if my lawyer get an creditor address wrong on chapter 7

- 8. why lawyer copied on i 485 interview

- 9. how much does a lawyer make an hour in california

- 10. identity theft what can a lawyer do