What is a durable power of attorney (dpoa)?

Jan 27, 2022 · A power of attorney, also called a POA, is a document that appoints a person (an agent) to act on another's (the principal's) behalf.1 Agents have the power to make important legal, financial, and health decisions on behalf of the principal. An agent is often a caregiver, family member, or close friend, and sometimes it's an attorney.

Can a power of attorney be used in another state?

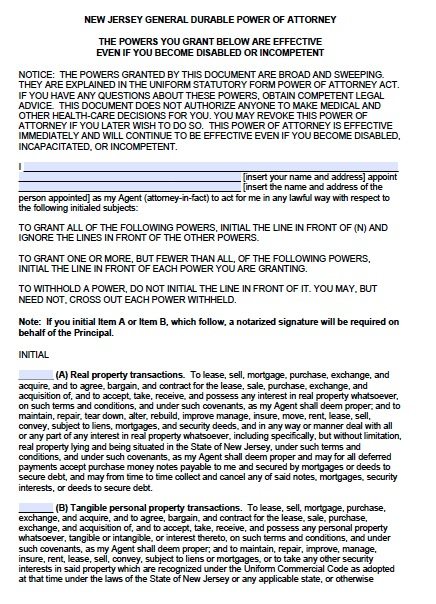

Jan 31, 2022 · When a person becomes incompetent, the power of attorney given by that individual ceases. To establish a “durable” power of attorney, the document needs to state explicitly that it is to continue to be effective in the event of the principle’s disability. The Durable Power of Attorney is different in each state.

Can a durable power of attorney be used for an incapacitated principal?

A durable power of attorney, or DPOA, is a legal document designed to protect aging parents’ independence and decision-making, while also simplifying the eventual transition to elderly care. A durable power of attorney also serves as a safety net in the event of possible physical or mental incapacitation, ensuring that a trusted appointee has the legal right to make important …

What is a power of attorney and do you need one?

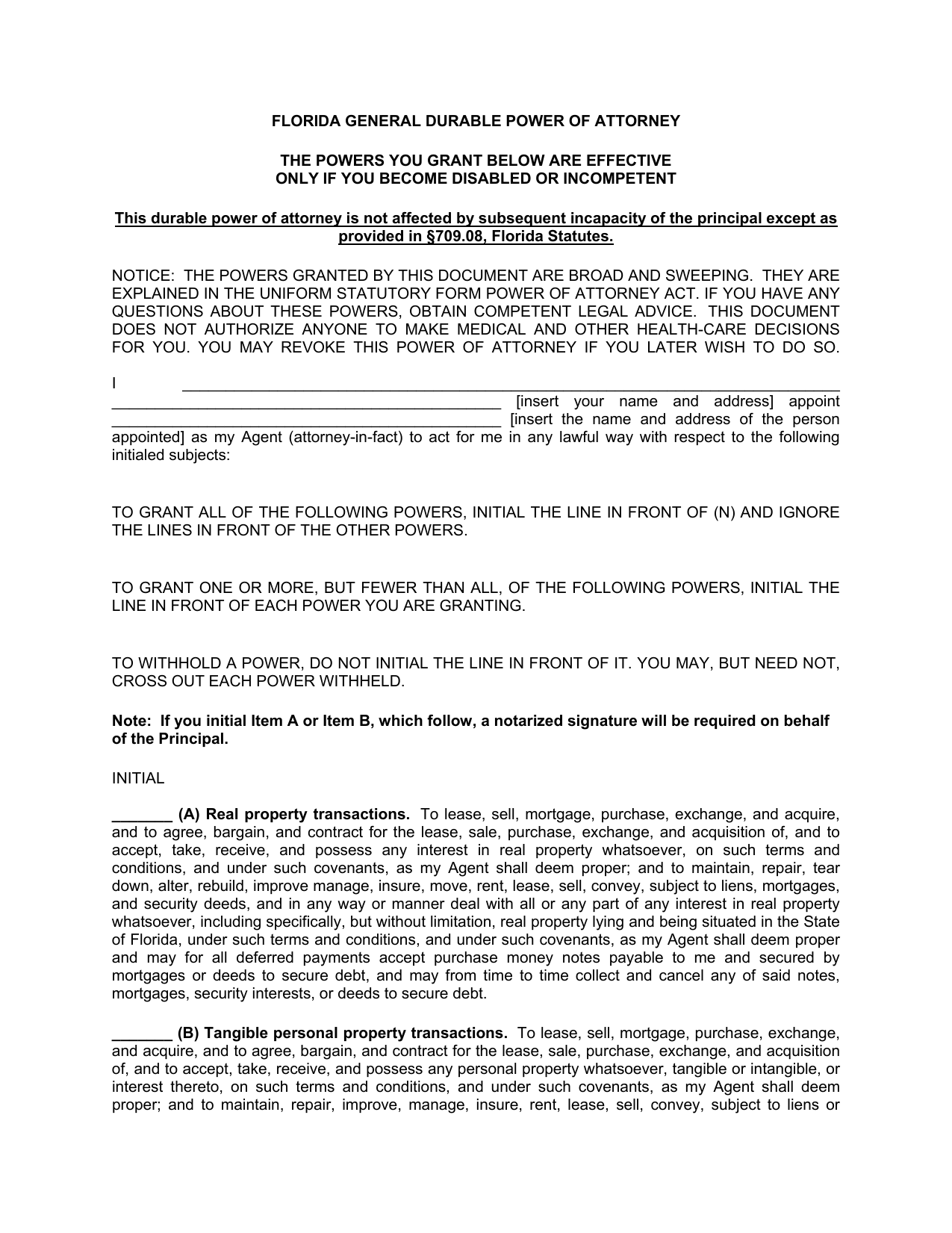

Durable Power of Attorney. Specifically authorized by Florida Statutes, a Durable Power of Attorney (“DPOA”) is one of the most important legal documents a person (known as the “Principal”) may create for their lifetime legal planning. Under a DPOA, one or more persons known as an “Agent” or “Attorney-in-Fact” are appointed by the Principal and granted broad and …

Is a California power of attorney valid in other states?

A power of attorney is accepted in all states, but the rules and requirements differ from state to state. A power of attorney gives one or more persons the power to act on your behalf as your agent.

Does a power of attorney need to be recorded in Washington state?

The power of attorney should be recorded because recording provides notice of the agent's authority, allows the agent to obtain certified recorded copies, and is usually required by title companies and other entitles involved in land transactions.Jul 26, 2013

Does a power of attorney have to be notarized in Washington state?

The requirements for a valid Power of Attorney are: The document must be titled “Power of Attorney.” The document must be signed and dated by you and either notarized or witnessed by two disinterested people.

Can you add another person to power of attorney?

Can you make other changes to named attorneys? It's not possible to add an Attorney to a Lasting Power of Attorney once it's been registered with the Office of the Public Guardian. You are also unable to completely change the list of named Attorneys, for example by removing some and adding others.

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What happens if you don't draft a DPOA?

If the DPOA is not drafted in accordance with the changes in the Florida POA Act, your DPOA may be an ineffective, if not defective, legal planning tool.

What is a DPOA?

Under a DPOA, one or more persons known as an “Agent” or “Attorney-in-Fact” are appointed by the Principal and granted broad and general powers within the document to act on behalf of the Principal. By statute, a DPOA expressly survives the incapacity of the Principal, and serves as a cost effective, convenient legal, financial management, ...

What is a Durable Power of Attorney?

Specifically authorized by Florida Statutes, a Durable Power of Attorney (“DPOA”) is one of the most important legal documents a person (known as the “Principal”) may create for their lifetime legal planning. Under a DPOA, one or more persons known as an “Agent” or “Attorney-in-Fact” are appointed by ...

Is a DPOA grandfathered in?

Old DPOA’s are “grandfathered in” but a DPOA signed after October 1, 2011, can no longer have “springing” language in it. Additionally, it is presumed that all DPOA’s are “executory” in nature, meaning, the powers and authorities granted to the Agent are effective immediately upon the Principal’s signing of the DPOA.

Can a DPOA be granted?

If the individual proposed to grant the DPOA to the Agent in fact does not have the requisite mental capacity to enter into a contract, then a DPOA may not be granted, and a formal filing for a legal incapacity determination and guardianship of the property in Circuit Court, Probate Division, may be required.

What is a power of attorney?

A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the “principal”) grants the right to act on the maker’s behalf as that person’s agent. What authority is granted depends on the specific language of the power of attorney.

How to determine if a power of attorney is valid?

The authority of any agent under a power of attorney automatically ends when one of the following things happens: 1 The principal dies. 2 The principal revokes the power of attorney. 3 A court determines that the principal is totally or partially incapacitated and does not specifically provide that the power of attorney is to remain in force. 4 The purpose of the power of attorney is completed. 5 The term of the power of attorney expires.

What happens if a guardianship court is initiated after a power of attorney is signed by the principal?

If a guardianship court proceeding is begun after the power of attorney was signed by the principal, the authority of the agent of certain individuals is automatically suspended until the petit ion is dismissed, withdrawn or otherwise acted upon.

What happens if an agent dies?

The agent dies. The agent resigns or is removed by a court. The agent becomes incapacitated. There is a filing of a petition for dissolution of marriage if the agent is the principal’s spouse, unless the power of attorney provides otherwise.

What is the purpose of an affidavit for a power of attorney?

The purpose of the affidavit is to relieve the third party of liability for accepting an invalid power of attorney.

Can a power of attorney be used for incapacitated principal in Florida?

However, there are certain exceptions specified in Florida law when a durable power of attorney may not be used for an incapacitated principal. A durable power of attorney must contain special wording that provides the power survives the incapacity of the principal. Most powers of attorney granted today are durable.

Can a third party sign a power of attorney?

(The agent may wish to consult with a lawyer before signing such a document.) The third party should accept the power of attorney and allow the agent to act for the principal.

A durable power of attorney

A DPOA (durable power of attorney) becomes effective right after you made your power of attorney and your agent signs it. It allows your agent to take control of your decisions and act on your behalf immediately when you become debilitated.

A non-durable power of attorney

A non-durable power of attorney becomes ineffective or expires when you die or become debilitating. For example, if you die while you are paralyzed then the agent will no longer be able to make decisions on your behalf. The state court will then appoint a guardian that would look after your affairs.

Medical Power of Attorney

Also called advance directives, medical power of attorney allows you to get yourself a healthcare agent. That means to appoint someone that makes healthcare decisions for you when you can’t make them for yourself.

A general power of attorney

A general power of attorney grants your agent a broader range of authorities such as making real estate decisions, resolving financial matters, and taking legal steps on your behalf – this includes:

Limited power of attorney

Conversely, with the general POA, this type basically grants the agent an authority to act on behalf of the principal but only in particular conditions. For instance, your agent will be able to cash your checks for you, but won’t cast a check on your behalf.

Springing power of attorney

Also called conditional power of attorney in many states, it becomes effective when the event mentioned in the form comes into action – generally injury, physical incapability, or incapacitation.

What is the difference between a power of attorney and a durable power of attorney?

A general power of attorney ends the moment you become incapacitated. A durable power of attorney stays effective until the principle dies or until they act to revoke the power they’ve granted to their agent. But there are a handful of circumstances where courts will end durable power of attorney.

What does having a durable power of attorney mean?

A Durable Power of Attorney acts as a permission slip, giving authority to a third party to do things on behalf of someone else who cannot do it for themselves.

What does a durable power of attorney allow you to do?

A Durable Power of Attorney may be the most important of all legal documents. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

What are the limitations of durable power of attorney?

The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.

What type of power of attorney covers everything?

General power of attorney With a general power of attorney, you authorize your agent to act for you in all situations allowed by local law. This includes legal, financial, health, and business matters.

What is the difference between limited and durable power of attorney?

Both documents give the agent very broad financial powers, but can be more limited if you decide to limit the agent’s powers. In the case of a non-durable power of attorney, the agent is generally authorized to act once you sign the document, but the agent’s authority ceases when and if you become incapacitated.

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

How many separate documents do you need for a power of attorney?

To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances. Fortunately, powers of attorney usually aren't difficult to prepare.

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

Why do you need separate documents for your health insurance?

Making separate documents will keep life simpler for your agent and others. For example, your health care documents are likely to be full of personal details, and perhaps feelings, that your financial broker doesn't need to know. Likewise, your health care professionals don't need to be burdened with the details of your finances.

Can a power of attorney be used to pay bills?

With a valid power of attorney, the trusted person you name will be legally permitted to take care of important matters for you -- for example, paying your bills, managing your investments, or directing your medical care -- if you are unable to do so yourself. Taking the time to make these documents is well worth the small effort it will take.

Can a power of attorney prevent accidents?

While medical and financial powers of attorney can't prevent accidents or keep you young, they can certainly make life easier for you and your family if times get tough.

What happens to a POA when it is incompetent?

However, a durable power of attorney (DPOA) is a special kind of POA that does not end if the principal becomes incompetent. For example, if the principal has a DPOA and falls into a coma, the agent can still take care of the principal’s day-to-day responsibilities (e.g., paying rent, collecting welfare benefits, etc.). To be valid, a DPOA must be signed before the principal becomes incompetent. Some DPOAs take effect right away and then stay in effect when the principal becomes incompetent. Some DPOAs take effect only if and when the principal becomes incompetent. A guardianship of an incapacitated person can be an option if someone is already considered incompetent.

What is an advance health care directive?

An Advance Health Care Directive (AHCD) is a way to give someone else the power to make health care decisions on your behalf. It is similar to a living will, as it lets you put certain health care decisions in writing so that doctors and family know what you want if you become incompetent (e.g., brain damaged or comatose).

What is the fourth requirement of a divorce?

Fourth, the transaction must be for one of four allowed purposes, such as for the, “advantage, benefit or best interests of the spouses or their estates,” or for, “the care and support of either spouse or of such persons as either spouse may be legally obligated to support”.

What is a 3100 petition?

Once the conservatorship is established the conservator may then also still need to prepare and file a Petition for Substituted Judgement or a 3100 Petition to obtain a court order authorizing the conservator to complete the transaction on behalf of the incapacitated spouse.

What is required to file a 3100 petition?

The 3100 petition has numerous requirements, including the following: First, the incapacitated spouse must be examined by a physician and a capacity evaluation form filed with the court, the same as in a conservatorship proceeding.

Who is the guardian ad litem?

Persons whom I have seen appointed as the guardian ad litem include an adult child of the incapacitated spouse or an attorney.

Can a spouse transfer property in the absence of community property?

In the absence of community property, the well spouse may “transmute” (change) some of the well spouse’s own separate property interests into community property in order to meet the requirement that community property be involved. Fourth, the transaction must be for one of four allowed purposes, such as for the, “advantage, ...

Popular Posts:

- 1. how much should a landlord-tenant lawyer cost

- 2. what personality does a lawyer need to hav3e

- 3. what are the requirements of being a lawyer

- 4. what happens if a lawyer lies in court act

- 5. when your working for a lawyer your a

- 6. how a lawyer should address in court

- 7. lawyer professional responsibility can i discuss which work confidentiality

- 8. how to become a corporate lawyer in ny

- 9. how much will a lawyer cost for a speeding ticket in wi

- 10. what amendment says you have the right to a lawyer