How to respond to an attorney demand letter?

A demand letter is pretty much what it sounds like: a letter in which you (usually through your lawyer) demand an outcome. That outcome usually includes payment of some amount of money in exchange for an agreement not to sue. At some point after you send your demand letter, the employer, through its attorney, will respond. That letter will probably not be very nice. This post …

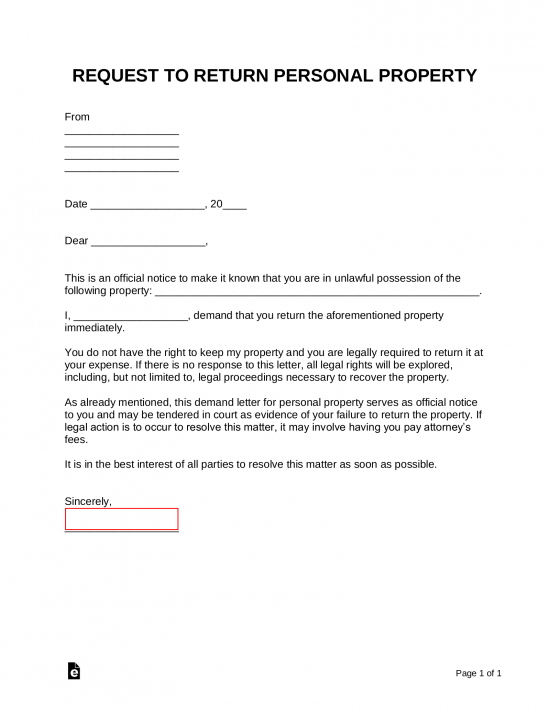

How to write a demand letter?

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange. It is rare for this to happen without at least some negotiation on the part of the insurance company.

When to send demand letter?

1-2 days = average time it typically takes a given opponent to respond to a demand letter after they receive it. 8-9 days = average time it typically takes a given opponent to propose a resolution, or to refuse yours. 30-45 days = average time it takes a given complainant to "proceed to next steps" when a resolution is not reached.

How do you write a letter of demand?

If you already have an attorney, then you will likely want to have them respond to opposing counsel on your behalf. If you don't have an attorney, you still might consider hiring one for the sole purpose of responding to the demand letter, if you can negotiate a nominal, one time legal fee. Using an attorney adds legitimacy to your response letter and ensures that it is written …

What is the next step after a demand letter?

In rare cases, it can be because the defendant party does not respond to the demand letter in the first place. Regardless, the next step for most attorneys is to initiate a lawsuit. It is crucial that lawyers initiate this process quickly once it becomes clear that reaching a settlement will be impossible.Aug 22, 2018

How long does it take to hear back from a demand letter?

Once you've written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

How effective is a demand letter?

Conclusion. As you can see, demand letters can be an efficient option for settling disputes. They can expedite a successful outcome and avoid costly litigation. Even if you do end up filing a lawsuit, a demand letter shows the court that you reasonably tried to work with the other party to settle the problem.

How do you respond to a demand letter from a lawyer?

That being said, here are several steps you should take if you have received a demand letter:Don't Ignore the Demand Letter.Assess the Validity of the Demand Letter's Arguments.Understand the Obligee's Motives for Sending the Demand Letter.Hire a Lawyer to Help You Respond to the Demand Letter.More items...•Nov 20, 2019

How long does it take for Progressive to respond to a demand letter?

thirty daysIn general, Progressive responds to demand packages in an average of thirty days. Considering this, it can take a few months to begin the negotiation process after initially filing your claim with an experienced attorney.

What happens if you don't respond to demand letter?

The fact that you ignored the demand letter will be used against you in court. The demand letter will likely end up as an exhibit to the court and jury in any subsequent litigation, and your response to the demand will be judged accordingly.Mar 24, 2019

Do you have to respond to a demand letter?

Demand letters are not legally binding – rather, they often demand that compensation be issued and threaten going to court if it is not issued. You are not legally required to respond to a demand letter, but that does not mean you should just brush it off.Jan 20, 2021

Is a demand letter a legal document?

Although demand letters are not legally required they are frequently used, especially in contract law, tort law, and commercial law cases. For example, if one anticipates a breach, it is advantageous to send a demand letter asserting that the other side appears to be in breach and requesting assurances of performances.

What is a demand letter for wrongful termination?

A demand letter, as the name suggests, is a letter that an employee (often through an attorney) sends to a former employer “demanding” that the employer do something to avoid the filing of a lawsuit.

Should you ignore a demand letter?

Ignoring a demand letter — particularly if you don't read it at all — usually gives the obligee no other choice but to initiate a formal legal action against you or your business, perhaps even sooner than they otherwise would have.

What happens when you receive a demand letter?

If you've received a demand letter, it means someone is expecting you to do something and they are giving you one last chance to do it, before taking you to court. Should you accept to do what they are asking, refuse to do it, or simply ignore the letter?

Can you ignore letter of demand?

What To Do If I Receive A Letter Of Demand? Generally speaking, you should not ignore a lawyer's letter as doing so may result in the party instructing the lawyer, to commence legal proceedings against you.

What is a denial of an injury claim?

An insurance company denial of an injury claim is a rare occurrence, since most insurance companies want to settle a claim (a sure thing) before courts get involved (an unpredictable process). Denials usually only occur when the claim is clearly unsupported by evidence (the "injured" person has no medical bills or records of treatment) or there is a procedural problem with the claim itself.

Can you get compensation without a release of liability?

You'll receive the compensation you asked for and sign a release of liability in exchange. It is rare for this to happen without at least some negotiation on the part of the insurance company. (Learn more about the timeline of a typical personal injury claim .)

How to write a letter of demand?

Your letter was clear on all of the important points: 1 The facts that led you to make the demand. 2 The specific resolution you are demanding. 3 The deadline by which you are demanding that resolution. 4 How you wish the letter's recipient to communicate with you moving forward.

Do not let your opponent's representatives waste your time by talking about anything other than a resolution?

One thing that follows from this is that you should therefore also not waste time talking to people who lack the authority to offer your desired resolution . Insofar as your demand letter was clear and complete, there is no additional exchange of information that is necessary for your opponent to decide whether to resolve your dispute as you've requested.

What happens if you don't respond to a demand letter?

You or your business can suffer consequences from failing to answer a demand letter in a timely fashion. Most demand letters will instruct you to provide a written reply (your response letter) within a certain amount of time (the response deadline), or else the sending party (the obligee) will consider taking legal action against you.

What is demand letter?

A demand letter is a preliminary tactic that individuals and entities use in an attempt to induce another party to take some particular action, usually in the form of a payment. Nolo has various resources advising on how you can send a demand letter to another party in an effort to resolve a dispute before taking formal legal action ...

What to do if you don't have an attorney?

If you don't have an attorney, you still might consider hiring one for the sole purpose of responding to the demand letter, if you can negotiate a nominal, one time legal fee. Using an attorney adds legitimacy to your response letter and ensures that it is written with relevant legal arguments and vernacular.

Can an attorney text you?

Attorneys have the option, but are not required, to send text messages to you. You will receive up to 2 messages per week from Martindale-Nolo. Frequency from attorney may vary. Message and data rates may apply. Your number will be held in accordance with our Privacy Policy.

After You Send Your Letter

Once you’ve written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

Factors That Could Delay Your Answer

When determining what’s holding up your demand letter response, keep in mind that there may not be a problem with your letter at all. Instead, the problem may lie with the insurance adjuster. They may be dealing with many cases at once, and that sometimes means that you won’t get as speedy a response for your questions and your letter.

Learn How a Lawyer Can Speed Up Your Settlement

Even if you know how much your claim is really worth, there’s a chance that your insurance company may be causing you problems. You may not know how long after a demand letter a settlement can take, so you’ll need guidance from an attorney who can help you seek answers.

Popular Posts:

- 1. how much does a lawyer saleing a house cost

- 2. how to comment lawyer

- 3. when i hire a lawyer should the lawyer call me to give me update about my case

- 4. what is a retainer for lawyer

- 5. what happened to rowlinga lawyer

- 6. which greenville lawyer was founds

- 7. is it okay to round up when billing as a lawyer

- 8. how to becone a lawyer

- 9. what is the average income for a lawyer

- 10. why im passionate about being a lawyer