The cost of probate in Connecticut largely depends on the following factors: How large the estate is - previous law maxed capped fees at $12,500, but in 2015 that cap was removed; now estates exceeding a $2M value will pay a flat rate (currently $5615) plus an additional ½ percent of the gross estate value over $2M

...

How much do lawyers charge in Connecticut?

| Practice Type | Average Hourly Rate |

|---|---|

| Trusts | $345 |

| Wills & Estates | $260 |

Do I need a lawyer to make a will in Connecticut?

No. You can make your own will in Connecticut, using Nolo's Quicken WillMaker & Trust. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

How much does a lawyer charge to write a will?

It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300. A price of closer to $1,000 is more common, and it's not unusual to find a $1,200 price tag.

What does an executor of a will do in Connecticut?

In Connecticut, you can use your will to name an executor who will ensure that the provisions in your will are carried out after your death. Nolo's Quicken WillMaker & Trust. produces a letter to your executor that generally explains what the job requires.

How do I finalize a will in Connecticut?

To finalize your will in Connecticut: you must sign your will in front of two witnesses, and your witnesses must sign your will in front of you.

How much does a lawyer charge for a will?

How much does it cost to write a will?

Why do lawyers have flat fees?

Why do estate lawyers charge flat fees?

How much does a lawyer charge for a living trust?

How much does an estate planning lawyer charge?

Can a lawyer recommend a living trust?

See more

About this website

How much does it cost to make a will in Connecticut?

It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300. A price of closer to $1,000 is more common, and it's not unusual to find a $1,200 price tag.

What makes a will legal in CT?

Signature: The will must be signed by the testator. Witnesses: At least two witnesses must sign a Connecticut last will and testament in the presence of the testator in order for it to be valid. The witnesses must sign after witnessing the testator sign the will. Writing: A will must be in writing to be valid.

Does CT require a will to be notarized?

No, in Connecticut, you do not need to notarize your will to make it legal. However, Connecticut allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that.

What are executor fees in CT?

Most people in Connecticut will classify reasonable as between 3% and 5% of the total estate value and fiduciary fees of under 4% are generally considered reasonable by Connecticut probate judges. How to Charge as an Executor?

Is a handwritten will valid in Connecticut?

A handwritten or holographic will isn't valid in Connecticut. Technically, a handwritten will can still meet the requirements of having two witnesses and the testator's signatures (properly executed) and be a valid will.

Do wills expire CT?

No. Once written a will is good forever, a will does not expire. However, there are events in one's life that can make the will invalid unless appropriate steps are taken.

Are wills public record in Connecticut?

You may be curious about the terms of the will and the amount of your inheritance. In Connecticut, wills are filed with the probate court for administration. You can obtain a copy of the probate records of a will by contacting a Connecticut Probate Court.

How do I file a will in CT?

File an application with the appropriate probate court, together with a certified death certificate and the original Will and codicils. The application will list basic information about the decedent, including the beneficiaries under any Will or codicil and all heirs at law.

Can a notary notarize a will in CT?

You should definitely have your will notarized. Under Connecticut law, a will that meets certain requirements — including proper notarization — is “self proved”. Connecticut General Statutes § 45a-285.

What is the average cost of probate in CT?

The cost of probate in Connecticut largely depends on the following factors: How large the estate is - previous law maxed capped fees at $12,500, but in 2015 that cap was removed; now estates exceeding a $2M value will pay a flat rate (currently $5615) plus an additional ½ percent of the gross estate value over $2M.

How much does an estate have to be worth to go to probate in CT?

$40,000"Probate" is ONLY required by law if the person who dies, with or without a will, owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

How do you avoid probate in CT?

In Connecticut, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Should I Hire a Lawyer to Write a Will or Do It Myself?

Editor’s note: This is one of the 20 tough financial questions posed in the “Do This or That?” cover story in the September 2011 issue of Kiplinger’s Personal Finance. Use the drop-down ...

How Much does a Will Cost with & without a Lawyer? | Trust & Will

Wondering how much does a Will cost? We'll break down the fees whether you opt to create your Will online or work with an Estate Planning attorney.

How Much Will a Criminal Defense Lawyer Cost? | LegalMatch

Travis earned his J.D. in 2017 from the University of Houston Law Center and his B.A. with honors from the University of Texas in 2014. Travis has written about numerous legal topics ranging from articles tracking every Supreme Court decision in Texas to the law of virtual reality.

How Long Does Probate Take in Connecticut?

Depending on which type of probate you go through in Connecticut, the process could last anywhere from 30 days (for a simplified or expedited proceeding) to up to six months or longer (for a regular probate process).

What is probate in Connecticut?

Probate is the legal court process that appoints a Personal Representative (also known as an Executor) to oversee the administration of an estate after the passing of the owner. Not long ago, Connecticut changed their probate fee schedule to remove the cap, so it’s important to know the estate value before you begin the probate process.

What is Considered a Small Estate in Connecticut?

Connecticut has a “small estate limit” of $40,000 – this means all assets totaling in value must equal less than that amount to qualify.

Is probate difficult?

Probate can be difficult. Both expensive and time-consuming, it can feel overwhelming for those going through it the first time. Let’s look at the costs associated with probate, along with some other key information.

Where Can I Find Connecticut's Laws About Making Wills?

You can find Connecticut's laws about making wills here: General Statutes of Connecticut Title 45a Probate Courts and Procedure Chapter 802a Wills: Execution and Construction.

What happens if you die without a will in Connecticut?

In Connecticut, if you die without a will, your property will be distributed according to state "intestacy" laws. Connecticut's intestacy law gives your property to your closest relatives, beginning with your spouse and children. If you have neither a spouse nor children, your grandchildren or your parents will get your property.

Why Should I Make a Connecticut Will?

A will, also called a " last will and testament ," can help you protect your family and your property. You can use a will to:

Should My Will Name an Executor?

Yes. In Connecticut, you can use your will to name an executor who will ensure that the provisions in your will are carried out after your death. Nolo's Quicken WillMaker & Trust. produces a letter to your executor that generally explains what the job requires. If you don't name an executor, the probate court will appoint someone to take on the job of winding up your estate.

Can I Revoke or Change My Will?

In Connecticut, you may revoke or change your will at any time. You can revoke your will by:

Can I Make a Digital or Electronic Will?

In a few states, you can make a legal will digitally – that is, you can make the will, sign it, and have it witnessed without ever printing it out. Although such electronic wills are currently available in only a minority of states, many other states are considering making electronic wills legal. It is generally assumed that most states will allow them in the near future.

How to make a will?

Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses. Store your will safely.

How much does it cost to make a will?

Nationwide, the average cost for an attorney or firm to create a will is $940 to $1,500 for an individual person. You can typically add on a second nearly identical will for a spouse. Most firms will reduce their price to a few hundred dollars for this. Ultimately, the fee you pay to create a will varies and depends on the size and complexity of your estate. Most attorneys charge a flat fee for writing a will, though there may be additional hourly charges if you have unique estate planning needs.

Why is it more expensive to write a will?

Writing a new will for large estates with complicated financial affairs are more expensive, since they take more time to write than a simple will.

What affects the cost of a will?

The more assets you have, and the more special requirements you have for distributing those assets, the more you will pay for a will.

What types of will and estate planning services should I consider?

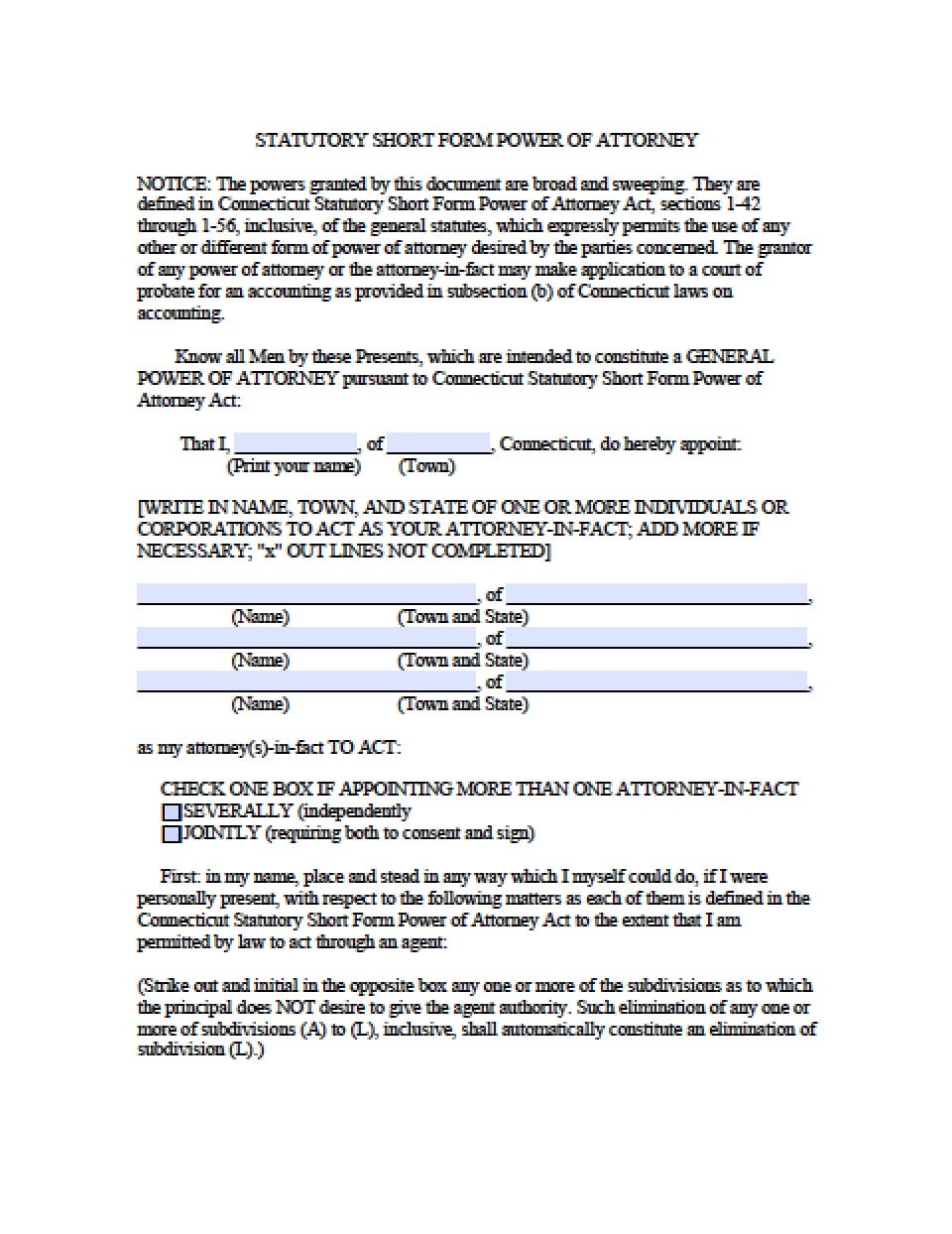

A will is just one part of your estate planning tools. You may need to augment it with a power of attorney. This legal document lets you appoint an attorney-in-fact, or someone to oversee your finances, if you become incapacitated.

What are the benefits of hiring an attorney to write my will?

There are plenty of services you can use to create a will online. These DIY wills cost less than the attorney fees you would spend for professional will-writing. However, many of these offer a one-size-fits-all solution where you fill-in-the-blank on common questions. Online wills often lack the personalization you need.

How long will it take to write a will?

Creating a will can take anywhere from two to four weeks or more. Clients typically begin the process by meeting with an attorney who reviews their individual estate planning needs, identifies areas of concern and designs a plan that fits the client's goals and budget. Then, the attorney begins the will-drafting process.

How can I save money on a will?

The more complex your estate, the more you will spend on estate planning services. Simplifying your estate as much as possible can save you money on a will .

How much does a lawyer charge for a will?

Depending on where you live and how complicated your family and financial circumstances are, a lawyer may charge anything from a few hundred to several thousand dollars for a will and other basic estate planning documents.

How much does it cost to write a will?

It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300. A price of closer to $1,000 is more common, and it's not unusual to find a $1,200 price tag.

Why do lawyers have flat fees?

Finally, some lawyers feel that a flat fee arrangement lets everyone relax and makes for a better attorney-client relationship. You won't feel reluctant to call or email with a question, and the lawyer can take the time necessary to listen to your concerns and explain things to you without feeling like the meter is running.

Why do estate lawyers charge flat fees?

Lawyers like flat fees for several reasons. First, they can use forms that they've already written – most estate planning lawyers have a set of standard clauses that they have written for different situations, which they assemble into a will that fits a new client's wishes. It won't take a lawyer much time to put your document together, ...

How much does a lawyer charge for a living trust?

It's rare to see a price of less than $1200 or $1500 for a trust. One caveat: After your will has been property signed and witnessed, you're done. But after a living trust is drawn up ...

How much does an estate planning lawyer charge?

The hourly rate will depend primarily on the lawyer's experience and training, and where you live. In a small town, you might find someone who bills at $150/hour, but in a city, a rate of less than $200/hour would be unusual. Lawyers in big firms generally charge higher rates than sole practitioners or small firms, unless a small firm is made up of lawyers who specialize in sophisticated estate planning and tax matters. A lawyer who does nothing but estate planning will probably charge more than a general practitioner, but should also be more knowledgeable and efficient. (See details of hourly fees reported by estate planning attorneys around the country.)

Can a lawyer recommend a living trust?

(See the results of this national survey on how much lawyers charge to prepare estate planning packages .) A lawyer may also recommend a living trust, which will let your family avoid the expense and delay of probate court proceedings after your death.

Popular Posts:

- 1. who is nickis lawyer on orange is the new black sseason 6

- 2. pharmacist or lawyer which is worse

- 3. i am a lawyer in illinois how do i get my realestate license

- 4. lawyer who have fought cps in tucson az

- 5. how hard is to become a lawyer

- 6. what colors to wear as a lawyer

- 7. how to have a family lawyer for everything nyc

- 8. how to get lawyer for people with disabilities pa

- 9. this is the term used for a lawyer who argues for the conviction of a defendant in a criminal case.

- 10. what is the lawyer websiet nolo?