What Does A Bankruptcy Lawyer Do For You

- Assess. A bankruptcy lawyer can examine whether bankruptcy is the right remedy for your particular circumstances.

- Avoid. A bankruptcy lawyer helps avoid mistakes, some of them fatal, in completing the bankruptcy papers. ...

- Translate & explain. ...

- Complete. ...

What does a bankruptcy lawyer actually do?

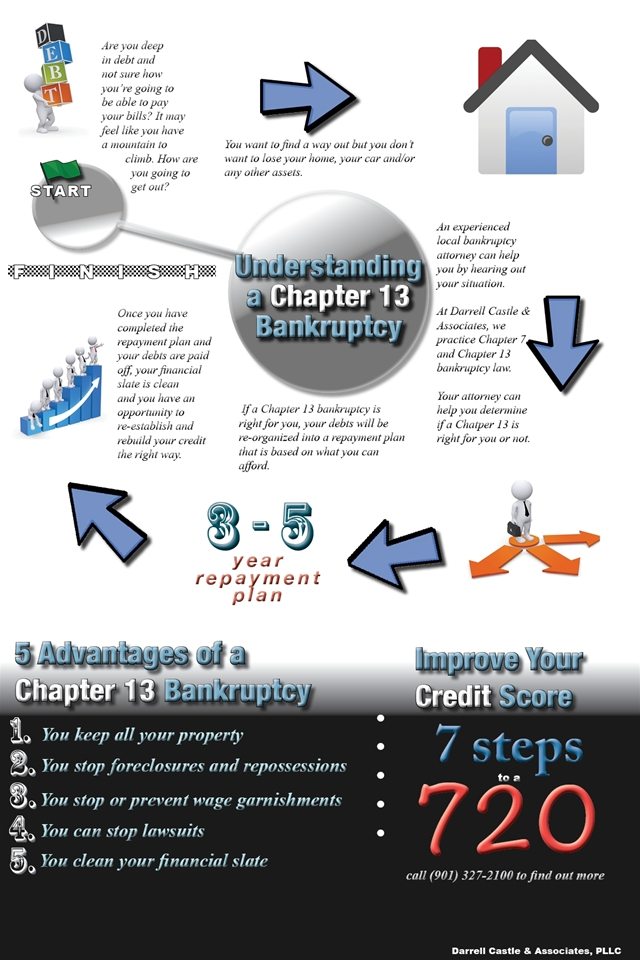

What Does a Bankruptcy Attorney Do. Bankruptcy attorneys help debtors file for bankruptcy, understand the legal proceedings surrounding bankruptcy, and manage their court petitions. Most bankruptcy attorneys focus on Chapter 7 and Chapter 13 bankruptcies, which are the most common types of bankruptcy filings. They involve liquidation and wage earner plans.

What questions do you ask a bankruptcy lawyer?

Ask a bankruptcy lawyer on JustAnswer. We use cookies to give you the best possible experience on our website. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

What does it mean to be a bankruptcy lawyer?

- The debtor neither complied with nor contested a statutory demand to pay their debt, for at least 21 days

- The debtor failed to comply with a court-issued execution to pay the debt

- The debtor fled the country to avoid repayment

What should I expect from my bankruptcy attorney?

- Last 6 Months of W-2 or 1099 Pay Stubs OR Social Security Statement OR Unemployment/Workman’s Compensation Statement (s) OR Business Profit/Loss Statement;

- Copies of All Unpaid Bills and/or Credit Report;

- Last 3 Months of Bank Statements

- Last Two Years of Tax Returns

- Most Recent Car Finance Statement (if applicable)

What happens to you during bankruptcy?

If you're struggling financially, bankruptcy gives you the opportunity to pay down a portion of your debts over time or have some of them eliminated entirely. Either way, declaring bankruptcy grants what's called an automatic stay, which is essentially a block on your debt to keep creditors from trying to collect.

Is it shameful to file bankruptcy?

Bankruptcy is a way of getting relief when you find yourself overwhelmed by debt. Unfortunately, in addition to being overwhelmed, many feel anxious and embarrassed about admitting that they need the type of debt relief bankruptcy provides. There is no reason to feel embarrassed about filing bankruptcy!

What's involved in a bankruptcy?

Bankruptcy is a legal proceeding involving a person or business that is unable to repay their outstanding debts. The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common.

What are three alternatives to bankruptcy?

Bankruptcy AlternativesDebt Settlement. ... Debt Consolidation. ... Sell Assets. ... Credit Counseling. ... Borrow Money from Friends or Family. ... Find a Way to Earn Extra Income. ... Restructure or Refinance Your Mortgage. ... Lower Expenses Making Changes to Your Budget and Lifestyle.More items...

What debts are not discharged in bankruptcy?

The following debts are not discharged if a creditor objects during the case. Creditors must prove the debt fits one of these categories: Debts from fraud. Certain debts for luxury goods or services bought 90 days before filing.

How much do you have to be in debt to file Chapter 7?

Again, there's no minimum or maximum amount of unsecured debt required to file Chapter 7 bankruptcy. In fact, your amount of debt doesn't affect your eligibility at all. You can file as long as you pass the means test. One thing that does matter is when you incurred your unsecured debt.

What are the four types of bankruptcies?

In fact, there are six different types of bankruptcies:Chapter 7: Liquidation.Chapter 13: Repayment Plan.Chapter 11: Large Reorganization.Chapter 12: Family Farmers.Chapter 15: Used in Foreign Cases.Chapter 9: Municipalities.

What happens to my credit score if I file bankruptcy?

Bankruptcy will have a devastating impact on your credit health. The exact effects will vary. But according to top scoring model FICO, filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. If your score is a bit lower—around 680—you can lose between 130 and 150 points.

What do you lose when you file Chapter 7?

A Chapter 7 bankruptcy will generally discharge your unsecured debts, such as credit card debt, medical bills and unsecured personal loans. The court will discharge these debts at the end of the process, generally about four to six months after you start.

How can I clear my debt without bankruptcy?

10 Simple Steps to Get Out of Debt Without Going into BankruptcyOrganize debts. ... Stop all credit card use. ... Trim the budget. ... Do not go shopping. ... Pay the minimum on all but the smallest. ... Reward yourself. ... Apply funds to next debt. ... Delay unnecessary purchases.More items...

How can I get out of debt without paying?

Ask for a raise at work or move to a higher-paying job, if you can. Get a side-hustle. Start to sell valuable things, like furniture or expensive jewelry, to cover the outstanding debt. Ask for assistance: Contact your lenders and creditors and ask about lowering your monthly payment, interest rate or both.

What is the best bankruptcy for an individual?

Chapter 7 bankruptcy is an efficient way to get out of debt quickly, and most people would prefer to file this chapter, if possible. Here's how it works: It's relatively quick. A typical Chapter 7 bankruptcy case takes three to six months to complete.

Can I get free help with my bankruptcy case?

Yes, nonprofit legal services offer help to low-income people who either need an attorney to represent them in a bankruptcy case or are handling a...

How long does a bankruptcy stay on your credit report?

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years, while a Chapter 13 bankruptcy may remain on your credit report for up to...

What types of debt can’t be included in a bankruptcy case?

Among the types of debt that can’t be discharged—meaning you’re no longer legally required to pay them—are most student loans, most taxes, child su...

What can a lawyer do to help you through bankruptcy?

A lawyer can help you pick the right exemptions and maximize the property that you keep through the bankruptcy. If you’ve moved recently, exemptions become more complicated due to length of residency rules.

Why do you need a bankruptcy lawyer?

A bankruptcy lawyer helps avoid mistakes, some of them fatal, in completing the bankruptcy papers.

How to get rid of a lien in bankruptcy?

Certain kinds of liens can be wiped out in bankruptcy, but to get rid of the lien, you have to file a motion and prove up your right to avoid the lien. There are no official forms for that.

What do debtors need after filing taxes?

After the papers are filed, debtors have additional requirements to provide paystubs, tax returns and back up documents to the trustee. How these duties are done requires you know both local written rules and, often, a healthy does of unwritten rules.

Is bankruptcy stressful?

Bankruptcy is stressful enough without having to worry about what happens when you go to court and what the authorities think about your case.

What is the job of a bankruptcy lawyer?

Part of the bankruptcy’s lawyer’s job is to find and organize all the necessary financial records. Many people worry about missing paperwork, but a good attorney can hunt it all down and present it properly.

What is the responsibility of a bankruptcy attorney?

The attorney’s responsibility is to make sure all follow-up and discharge is complete. Discharge means that you are legally released from the liability of your debt at the conclusion of the bankruptcy proceedings. The recovery process means helping identify the causes of your bankruptcy and how to avoid problems in the future. A good bankruptcy attorney can help arrange education about establishing smart financial habits and reestablishing your credit score.

What are the meetings that creditors must attend in bankruptcy?

All bankruptcy proceedings require meetings that you must attend, for example, the creditors meeting. These meetings are conducted by a trustee who is assigned by the court to your case. At the creditors meeting, your creditors (or their attorneys) will ask you (or your attorney) about your financial situation. You might be asked if you have read and signed your bankruptcy petition, or if you have disclosed all your creditors, debts and assets. At the end of the meeting, the trustee decides if the meeting has been completed or if it needs to be continued at a later date. A good attorney ensures that nothing is overlooked in these meeting and that your rights are protected. Good legal representation also makes it less likely that you will have to appear later in bankruptcy court.

What is sound legal advice?

Sound legal advice is meant to get you through this difficult time as quickly as possible. A good attorney does the work for you and makes sure it is completed correctly and on time.

Is bankruptcy a complex law?

Bankruptcy law is complex. A good lawyer can help you understand the language associated with the proceedings. Each bankruptcy situation requires careful consideration, for example, is it better to file for Chapter 7 or Chapter 13? Each district court also has its own set of rules and regulations that must be understood and honored. A reliable lawyer will advise you on how to avoid fraud or the hiding or destruction of property. None of these tactics are necessary since there are proper legal methods for you to get back on your feet.

What does a lawyer do?

Maybe most importantly, your lawyer acts as your communication between you and the courts. They’ll be on the phone and in email interactions with trustees, creditors, as well as keeping you up to date on what’s happening with your case.

Do you have to go to the first hearing in bankruptcy?

There are several meetings and hearings that take place during the bankruptcy process. You’re required to go the first hearing with your creditors, but only your lawyer will need to attend most (if not all) of the meetings after that.

Do bankruptcy lawyers know the rules?

Bankruptcy lawyers know all of the rules and expectations that go along with the bankruptcy process, so you know you’re in good hands.

What can a bankruptcy attorney do?

A bankruptcy attorney can streamline the process from beginning to end. They can help you gather paperwork, help you file on time, help you take the necessary courses, and help you prepare you for creditor meetings.

How successful is it to clear debts with an attorney?

According to the American Bankruptcy Institute, filers can clear their debts at a 96% success rate with an attorney’s help.

What is the area of law that Attorney Froehle practices?

Attorney Froehle practices in several areas, focusing primarily on the areas of Estate Planning, Probate and Trust Administration, Real Estate, and Municipal law. She is licensed to practice law before all courts in Wisconsin, including the Eastern and Western District Federal Courts, along with the Seventh Circuit Court of Appeals. She is a member of the Wisconsin Bar Association, Jefferson County Bar Association, and the Dodge County Bar Association.

How many pages are there in a bankruptcy?

A legal professional can also keep track of bankruptcy forms. Bankruptcy documents usually consist of 23 different documents. In total, you’ll complete 70 pages.

How much success rate can you get with a Chapter 13 bankruptcy?

If you file for Chapter 13 bankruptcy, for example, you can increase your success rate by around 44% with an attorney. Success in bankruptcy cases means getting your debts discharged and/or setting up a payment plan.

Does bankruptcy increase the likelihood of a positive outcome?

Moreover, a bankruptcy attorney can increase the likelihood of a positive outcome. People who file for bankruptcy on their own are less likely to win their cases.

Do you have to pay attorney fees upfront?

Before an attorney accepts your case, you must pay attorney fees. You must pay the attorney fees upfront.

What do bankruptcy attorneys do?

Almost all bankruptcy attorneys have specialized software that prepares and files your required bankruptcy paperwork with the court. You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information.

What is the responsibility of a bankruptcy attorney?

For these reasons, one of the responsibilities of your bankruptcy attorney is to know the local rules and filing procedures.

How to file for bankruptcy?

First, you can expect your attorney to tell you whether filing for bankruptcy would be in your best interest. If it is, you should also learn: 1 whether Chapter 7, Chapter 13, or another type will help you achieve your financial goals 2 what you can expect during the bankruptcy process, and 3 whether your case involves any particular difficulties or risks.

What to expect during bankruptcy?

Most importantly, if you have any questions, you can expect your attorney to respond to your calls or emails promptly.

What information do you provide to your attorney?

You'll provide your attorney with all of your financial information, such as income, expense, asset, and debt information . Your lawyer will use it to prepare the official forms and then go over the completed paperwork with you to ensure accuracy.

What type of hearings can an attorney represent you at?

Some common types of hearings you can expect your attorney to represent you at: Chapter 13 confirmation hearings. Chapter 7 reaffirmation hearings, and. any other motion or objection hearings filed by you, your creditors, or the trustee.

What is the mandatory hearing for bankruptcy?

After filing for bankruptcy, all debtors must attend a mandatory hearing called the 341 meeting of creditors. But, depending on your case, you (or your attorney) might need to go to additional hearings. Some common types of hearings you can expect your attorney to represent you at: Chapter 13 confirmation hearings.

What does a bankruptcy attorney do?

The attorney will review your case with an eye toward any issues that the bankruptcy trustee or creditors might raise. They also will attend the Section 341 meeting of creditors and handle interactions with the trustee. If a dispute arises in the course of your bankruptcy, they can advocate for you in court or during settlement negotiations.

What can an attorney do to help you with bankruptcy?

An attorney can advise you on alternatives to bankruptcy so that you can make sure to choose the right path for you. They also can explain the process so that you are not surprised by anything that happens, such as the loss of some of your property.

What to do if you need to file for bankruptcy?

If you need to file bankruptcy immediately, an attorney can help you file the paperwork efficiently and thoroughly. You may need to get relief right away if you are facing a foreclosure, an eviction, or the loss of your car, or if you are having money garnished from your bank account or wages, among other situations.

What is the purpose of an attorney in bankruptcy?

One of the most critical areas in which an attorney may be useful is determining which chapter of the bankruptcy code should serve as the basis for your filing. An attorney can help you go through the means test to determine whether you are eligible for Chapter 7. If you are not eligible, or if Chapter 7 is not right for you, ...

What to do if you are not eligible for Chapter 7?

If you are not eligible, or if Chapter 7 is not right for you, they can advise you on what you would need to do under a Chapter 13 repayment plan. This may involve asking you questions about your household, your income and expenses, your job, any previous bankruptcy filings, and tax payments. Also, an attorney can advise you on ...

Popular Posts:

- 1. why get malpractice insurance lawyer

- 2. how was the lawyer of joseph kahahawai

- 3. how to file a complaint on a bankruptcy lawyer

- 4. who plays the lawyer in cruella

- 5. what does a lawyer mean about going after wages or salary

- 6. what if you dont have the money to pay lawyer fees

- 7. who was lawyer in singhvi sex tape

- 8. when opposition lawyer does not answer phone calls after settlement

- 9. who is the state lawyer

- 10. what are other options to divorcing same sex in ga if can't afford a lawyer