What should I look for in a divorce attorney?

Nov 23, 2018 · Documents to Show Your Divorce Attorney: A Checklist Individual income tax returns for past three to five years (federal, state, and local) Business income tax returns for …

What does it take to become a divorce lawyer?

Jan 24, 2022 · These will include income tax returns and proof of income related to marital debt, assets, property valuations, etc. Attorneys want documents because dry ink doesn't lie. Your …

What documents are required to file for divorce?

Sep 13, 2020 · What Documents Do I Need To Bring To A Divorce Lawyer? Financial documents. Some of the most important documents your attorney will want to review relate to your …

Do I really need an attorney for my divorce?

Aug 21, 2017 · Agreements. If you and your spouse signed a prenuptial agreement or a postnuptial agreement (or if you’ve been working on a separation agreement), your attorney will …

What documents are needed for real estate?

Documents Related to Real Estate 1 Any documents showing the legal description of any real estate owned together or separately. These can be obtained from your mortgage company or bank. 2 Your current mortgage statements on any mortgages you have on real estate property. 3 All documents pertaining to the initial purchase of the real estate. 4 If the real estate has been refinanced, all documents pertaining to the refinance. 5 Tax assessor’s statement (s) pertaining to any and all real estate.

Why is it important to provide a complete and organized file with all documents to your attorney?

It’s important that you provide a complete and very organized file with all documents to your attorney, which will help the negotiation stage of the divorce. "Divorce is one of the greatest upheavals you will ever experience in your life," says former divorce lawyer Brette Sember. "Because the process is so overwhelming, ...

What information should be included in a monthly budget?

This should include the needs and expenses of any children you have .

Do you have to disclose debts during divorce?

"All debts entered into during the marriage must be disclosed as part of financial disclosure ," explains Sember. "The court will determine which are marital debts and divide them as part of the divorce ."

Do you have to disclose assets in a divorce?

Similar to income statements, the court needs documentation of all financial accounts, both separate and joint. "Both parties have to completely disclose their assets ," asserts Sember. "Any account opened or contributed to during the marriage is potentially marital property and must be assessed."

Can a divorce court prove truthfulness?

Your spouse might make claims to a mediator or in divorce court, but documents can prove whether they are being truthful. So, you need to provide any documents that tell the story of what has happened in your marriage financially and in any other way.

What is an intake form for family law?

Most family law lawyers have an intake form that gives them a snapshot of the issues and your goals, and gives them important details about you and your family. At McCabe Russell, we don’t require you to fill it out our intake form advance, but if you can, it helps us move forward. Agreements.

What information does a credit card statement contain?

Other debt information (car loans, credit card debt, etc). As with the other documents, credit card statements contain a ton of information that can be useful to your attorney – the debt information, of course, but your history of spending (and your spouse’s) can also assist your attorney as you move forward. Text Message History.

Do you need a mortgage statement and a copy of deed?

Mortgage Statement and/or Copy of Deed. It’s not uncommon for clients not to know what is owing on their own mortgage or even whether they are on the mortgage. Bringing a mortgage statement and a copy of the deed can help your lawyer determine the answers to these important questions.

What to learn during an attorney interview?

During the interview process, you can learn about the attorney’s experience, their fees, and get a feel for whether or not you think the two of you could have a good working relationship. Once you’ve made your decision, your attorney will need information from you in order to get the ball rolling and the divorce process started.

What are the marital problems that led to divorce?

A list of the marital problems that led to the divorce if they involve alcohol or drug abuse, religious differences, infidelity, sexual incompatibility, or domestic abuse.

What is the basic information required for a job?

Personal Information. 1. Your basic information: full name, date of birth, and social security number. 2. Contact information such as an address, landline/cell phone number, and email address. 3. Proof of state residency. 4. Information about your employer: name, address, and phone number .

Forms For When You Want to File for Divorce on Your Own

You can file for divorce on your own without your spouse. There are various reasons why you may want to do that. One common reason is if you live in a “fault” state.

Forms For When You Want to File for Divorce Together

You and your spouse can file jointly in states that allow for a no-fault divorce.

Other Forms You Might Need

Depending on the details of your marriage and the state where you’re filing for divorce, there are some other forms you may need. Two of the most common are the Parenting Plan and the Financial Affidavit.

What do you include in a divorce affidavit?

Include any memberships, reward points, and other perks that may be considered as assets . If you’re in the dark about your finances, that’s okay. You and your spouse will be required to complete financial affidavits (disclosures) as part of the divorce process.

Who makes statements in a divorce case?

These may include statements made by your spouse, his/her attorney, or one of the third-party experts in your case.

Why is being organized important in divorce?

The Benefits of Being Organized. Depending on the complexity of your divorce, you may need a lot of documentation to give to your lawyer or Certified Divorce Financial Analyst . The more organized you are upfront will not only save you time and stress, but it will also save you money as well.

Why is it important to make sure you are treated fairly after divorce?

Making sure you are treated fairly is vital to give you the best chance of moving forward in the best possible way after your divorce is finalized. Whether your divorce issues are narrow and simple or complex and multifaceted, you will still need to acquire a fair amount of information to prepare for divorce.

How many pages are in a final escrow statement?

Final Escrow Statement from Close of Escrow/Settlement Statement for purchase or sale (usually 2-3 pages) and for last refinance (if applicable). Shows price, down payment, closing fees, etc.

How many bills do you have to pay before divorce?

Before your divorce, you had one house payment, one set of utility bills, one health insurance policy and so forth. Now, you and your spouse will now have two of each of these (and many others) to deal with. This means you’ll need to have a thorough understanding of your current and future expenses.

What to do when you get a sense of divorce?

When you get a sense you are heading for divorce, set up an official system that will include documentation, official correspondence, court records, research, notes and more. Make copies for yourself, your attorney and any other members of your team who will benefit from having pertinent information.

What documents are needed for a business loan application?

For all mortgages, second mortgages, home equity lines of credit (HELOCs), credit cards, lines of credit, car loans, and promissory notes, loan applications may include personal and business financial statements showing assets, debts, and income declarations. Because often business owners are personally liable for business debts, you will want to copy any other documents showing why the debt was incurred.

How to save a copy of a family law document?

If you can easily obtain the hard copies and the electronic copies, get both. Save the electronic versions of the documents to a thumb drive, burn them to a CD, or e-mail them to your lawyer. Because making copies of voluminous documents can be costly, you may want to avoid copying. However, skip photocopying only if you are absolutely sure that the electronic versions are exactly the same. Talk with your lawyer about who should make the copies, handle the scanning, and/or organize the documents. To save money, some lawyers encourage clients to copy and organize documents themselves. Other family law attorneys will perform these tasks in order to handle them within their own document management system. Who copies, scans, and organizes documents often depends on the size of the estate and the complexity of the disputed issues.

What do lawyers need to know about insurance?

Your lawyer needs copies of all insurancepolicies, including, but not limited to, life, annuity, health, accident, homeowner’s, renter’s, casualty, motor vehicle of any kind, property, or premises liability insurance. Also, many policies have separate “declaration pages” listing the specific names of owners, beneficiaries, and key financial information. Finally, make sure to obtain recent statements showing balances and premiums due. These statements generally are issued monthly, quarterly, or annually. If appraisals have been obtained to insure valuables under a homeowner’s insurance policy, copy those as well.

How long do you need to copy a financial statement?

For major documents, such as financial statements, tax returns, and brokerage account statements, you may want every single page you can put your hands on. For other documents, such as those concerning a major acquisition of a business interest seven years ago, you may want documents going back around eight years. For less valuable assets and debts, only three to five years’ worth may be needed. It just depends. When in doubt, copy it. But before going to a great deal of expense or effort, talk with your lawyer. Getting the right answer to a quick question can save time and money.

What is the first step in dividing assets and debts?

Before assets and debts can be divided, they first must be identified, classified, and valued. Classification means determining what is separate property and what is marital or community property. In determining spousal and child support, courts look at what the obligor spouse (the one who must pay) earns, and that analysis depends in large part on what the spouse’s earnings history has been. Your spouse’s income history may be reflected in the many pieces of paper gathering dust in closets and manila file folders.

Why is it important to have a resume for your spouse?

8. Resumes. Resumes for you and your spouse can be very important if one or both spouses are not earning as much money as in the past or are voluntarily underemployed or unemployed.

What happens if you omit a statement in a divorce?

Likewise, if you omit a particularly damaging statement, the missing page may stick out like a sore thumb. If that page eventually gets discovered and turns out to list charges for an out-of-town trip with a previously undisclosed paramour, your own lawyer can be blindsided in negotiations or, worse, in court in front of the judge. Active concealment of documents—from your own attorney, as well as from the other side—can destroy your credibility. Many experienced family law attorneys will tell their clients to assume that the other spouse will find out everything and, thus, clients need to share with their lawyer everything damaging to the case. Only careful planning with your attorney can safeguard your credibility with the judge and minimize any potential embarrassment and/or financial costs of the divorce.

1. The FICA Documents

All accountable institutions (including law firms) are obliged to comply with the Financial Intelligence Centre Act 38 of 2002 (“FICA”). Law firms must keep proper records of all dealings with clients and take the appropriate steps to verify the identity of its clients.

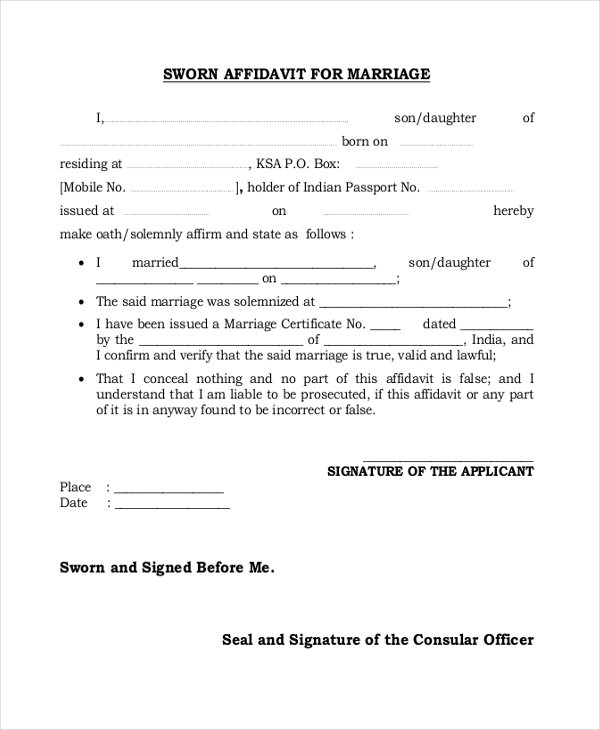

2. The Marriage Documents

The following documents which relate to your marriage will also be requested by your divorce attorney:

3. Financial & Other Documents

Depending on the contents of your divorce application, further documents may also be requested, for example: updated valuations of immovable property, list of assets and liabilities, etc.

Need more information?

Download the free e-book about divorce in which 56 frequently asked questions about divorce and the divorce process are answered in plain language.

Popular Posts:

- 1. who were the lawyer for george zimmerman for the trayvon martin case

- 2. how many years is family lawyer college

- 3. how does a paralegal become a lawyer

- 4. lawyer one million dollar offer to person who could prove trip could take 28 minutes

- 5. why did thurgood marshall become a lawyer and judge

- 6. what happened to cbs lawyer

- 7. describe what it means to be an integrated lawyer in an integrated law profession

- 8. how much does a community lawyer make

- 9. how long was cohn trumps lawyer

- 10. what to tell a lawyer working on a case lingo