If you use a CPA, they’re not going to be able to represent you in court most of the time. At that point, you’ll need to get a tax audit attorney. Your attorney will usually work with your CPA to learn about your case, but it’s not the same as if they were there from the beginning.

Should I hire a tax attorney or a CPA?

Apr 16, 2022 · If criminal charges are a possibility, you should always talk to a tax attorney first. CPAs and Enrolled Agents can represent you before the IRS, but they can’t help with your criminal case. In addition, a prosecutor can force your accountant to tell the prosecutor what you told your accountant. Anything you say to your lawyer is protected by ...

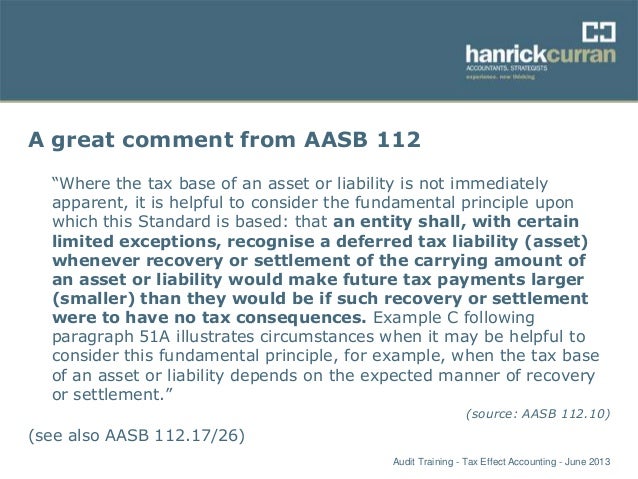

Can a CPA firm provide tax opinions to audit clients?

Apr 04, 2019 · Keep in mind that a tax attorney can do basically everything a CPA can do. But they also have the legal background and license to address court-based matters. When Hiring a CPA is the Right Choice The best time to hire a CPA is when you’re not dealing with any formal legal issues or extra-complicated tax matters.

What does a CPA do for small businesses?

The SEC includes tax among the non-audit services CPA firms provide. AS PROPOSED, THE SEC RULES PUT IN DOUBT whether an auditor can do anything other than review the tax provision in the financial statements or prepare the client’s tax returns without further disclosure or …

How will the SEC’s new audit rules affect CPA firms?

Apr 02, 2020 · CPAs are trained to examine financial statements. A CPA can handle a tax audit. But tax litigation counsel, with input from the CPA, should represent the taxpayer before the IRS Appeals Office or in U.S. Tax Court. Tax collection matters—levies and lien foreclosure proceedings—require a tax litigation attorney.

Can a CPA go to tax court?

A CPA can handle a tax audit. But tax litigation counsel, with input from the CPA, should represent the taxpayer before the IRS Appeals Office or in U.S. Tax Court. Tax collection matters—levies and lien foreclosure proceedings—require a tax litigation attorney.Jan 25, 2014

Can I sue my tax preparer if I get audited?

Since it is your tax returns, it's your responsibility. When you suspect the tax preparer of misconduct that results in an IRS audit and penalties, you can report them to the IRS for misconduct or sue for damages.Mar 28, 2019

Are Cpas liable for tax mistakes?

The IRS doesn't care if your accountant made a mistake. It's your tax return, so it's your responsibility. Even though you hired an accountant, you are liable to the IRS for any mistake.Mar 24, 2015

What is the difference between a CPA and a tax preparer?

A Certified Public Accountant (CPA) is a licensed professional with advanced education and training in many areas of accounting and business. A licensed tax preparer does not need advanced degrees for basic tax prep, but must show competence through a formal exam or IRS employment.

How much does a CPA charge for an IRS audit?

The average hourly fee for an in-person IRS audit is $150 and the average fee for an IRS audit response letter is $128. Only 8.8% of preparers never charge for an audit response letter.Jan 31, 2017

Can a CPA report you to the IRS?

Accountants can receive an award as a whistleblower under the IRS program. They do not have any special internal reporting requirements. However, there are two restrictions on their ability to submit information and earn a reward.

Is tax preparer responsible for audit?

Tax Accountants Are Not Liable for Audits Income tax preparation simply involves reporting the information that you provide. It's your responsibility to review your return for any problems before signing it.Feb 23, 2021

Can I get in trouble if my tax preparer made a mistake?

A tax preparer who made mistakes in your return could be subject to an IRS monetary penalty. The IRS does take into account the preparer's testimony regarding the cause of the mistake, and errors deemed reckless carry the biggest penalties.Jun 18, 2019

Can you sue a tax preparer?

Even if you're correct, your client may still sue. And their lawsuit still requires you to fork over thousands in legal fees. They might even win the case, which would result in damage awards.Jan 4, 2022

Is it better to use TurboTax or a CPA?

Even though Turbotax and other programs are easy to use, they have their own limitations. Spending the extra cash to hire a professional can actually save you money in the long run if your financial situation becomes complex....Tax Preparation Costs.TurboTaxAccountant$60 - $120$323Nov 8, 2021

Are tax preparers worth it?

For busy non-tax professionals, their time can generally be better spent earning money in their area of expertise. Even if your tax situation is straightforward, hiring a professional will save you the time and stress of doing your taxes.

What is the difference between an accountant and a CPA?

An accountant is a person whose job is to keep financial accounts. A Certified Public Accountant (CPA) is an accountant who has met state licensing requirements. The accountant cannot provide attestation services. You are required to have a CPA license to provide attestation services.

What is a Tax Lawyer?

A tax lawyer is a legal professional who graduated with a law degree and specialized in the very complicated world of tax law. A tax attorney must...

What is a CPA?

A CPA, or certified public accountant, does not have a law degree, but a five-year business degree. CPA programs require at least 150 hours of lear...

Tax Attorney vs CPA: When is a Tax Lawyer the Better Choice?

Trying to decide between hiring a tax attorney or a CPA? It depends on your business’s tax situation. Keep in mind that a tax attorney can do basic...

What is the role of a tax attorney?

The role of a tax attorney. Tax attorneys are lawyers who have gone through law school, passed their state’s bar exam and emphasize tax issues in their practice.

Who can help with tax issues?

However, two of the most reliable and well-known professionals that can aid you with various tax problems are the tax attorney and the CPA, both of which offer different — though often overlapping — services.

What is the difference between a tax attorney and a CPA?

While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes , the advantages of having a two-in-one professional are hard to overstate.

What is the role of a CPA?

The role of a CPA. CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available.

What can a CPA do?

However, one of the most beneficial services a CPA can offer is the ability to review or audit a business’ financial records to identify problem areas that need improvement, as well as where you are in good standing.

What is the AICPA tax executive committee?

The AICPA tax executive committee formed a working group to study and comment on the tax aspects of the SEC proposal. Given the nature of client representation engagements before the IRS and other government agencies, the “advocacy” language was especially problematic for the working group.

What are the new rules for auditor independence?

The new rules focus on three areas that might impair independence, provide some limited exceptions and require most public companies to disclose in the annual proxy statement information about auditor independence. The major factors that might impair independence are.

What is tax attorney experience?

Tax Attorneys have experience when it comes to audits. They have witnessed and handled so many that they can do it in their sleep. You on the other hand, may be very new to this. It may even be your first time. Chances are, you may contradict yourself during the questioning and end up looking guilty even when you are not. An experienced Attorney will make the whole process easy and less strenuous on your side. The Attorney will also inform you of the places where the IRS targets the most and show you how to protect them.

Who is Venar Ayar?

Venar is an award-winning tax attorney ranked as a Top Lawyer in the field of Tax Law. Mr. Ayar has a Master of Laws in Taxation – the highest degree available in tax, held by only a small number of the country’s attorneys.

Can a CPA testify against you?

Did you know your CPA can testify against you? That is true. If you are suspected of tax fraud, your most trusted accounting assistant can be compelled to testify against you in court. If you are actually a fraudster, you will definitely end up behind bars despite the fact that there is CPA-client privilege. The good news is your tax attorney cannot testify against you. With him or her, your tax defense is rock solid. You can share with them all your secrets and private information so that he can understand your situation better. Never do that with your CPA.

Who cannot conduct a tax audit of a company?

A person or a firm who directly or indirectly has business relationship with the company, or its subsidiary, or its holding or associate company or subsidiary of such holding company or associate company cannot conduct tax audit of such company. The term “business relationship” is wide in nature and includes ample number of instances in its ambit.

Who cannot sign tax audit report?

A person who, or his relative or partner cannot sign tax audit report, if such person is holding any security or interest in the company or the subsidiary or the holding or its associate company (holding of such security or interest is exempted to the extent of Rs. 1 Lakh)

What is an officer in the company?

Section 2 (59) of the Companies Act defines officer as “officer” includes any director, manager or key managerial personnel or any person in accordance with whose directions or instructions the board of directors or any one or more of the directors is or are accustomed to act. The term ‘employee’ has not been defined under the act. Hence, in the layman sense, a person employed for wages or salary (temporary or permanent) can be considered as an ‘employee’. Therefore, all persons providing any form of services to the company are barred from being an auditor.

How long can a person be a tax auditor?

A person who has been convicted by the court of an offence involving fraud and a period of 10 years has not elapsed from the date of such conviction cannot be appointed as a tax auditor.

Can a Chartered Accountant practice in India?

Any member wanting to engage in public practice has to first apply for and obtain a Certificate of Practice from the Council of ICAI. Only members holding a Certificate of Practice may act as auditors or certify documents required by various tax and financial regulatory authorities in India. In India, an individual Chartered Accountant, a firm or a Limited Liability Partnership of Chartered Accountants can practice the profession of Chartered Accountancy.

One of the Best Tax Audit Defense Lawyers and CPAs in Oakland

In California, there are four major tax authorities that perform tax audits: The Internal Revenue Service (IRS), the California Department of Tax and Fee Administration (CDTFA), formerly known as the BOE, the California Franchise Tax Board (FTB), and the California Employment Development Department (EDD).

Why Am I Being Audited by the IRS or California State (FTB, CDTFA, EDD)?

Tax audits can have dozens of different causes, ranging from how much income an individual earns to what sort of service a business owner provides. In general, audits are conducted for one of three reasons:

Different Types of Audits

Audits generally fall into one of three categories. Differentiating between these categories is important, because each type of audit carries different implications, similar to the way a felony charge has different implications than a misdemeanor charge.

Eggshell Audits and Criminal Tax Investigations

The term “eggshell” audit is a term of art that describes any civil audit in which the taxpayer is being examined for major errors.

Oakland Tax Audit Attorneys for Businesses and Individuals

The Tax Law Office of David W. Klasing is based in California, but our diligent tax professionals have earned national recognition for our skillful, effective handling of even the most complex tax cases.

Oakland Tax Law Offices

For any of your tax planning compliance and controversy needs in Oakland, contact the Lawyers at The Tax Law Offices of David W. Klasing today. Our experienced Tax Lawyers offer a reduced-rate consultation on new cases or engagements.

What is an Independent Audit?

First things first.

Independent Audit Requirements for CA Charities

The Council on Nonprofits has a helpful guide for each state’s requirement, if any, for an independent audit. About one-third of all states require nonprofits of a certain annual revenue size to be audited if they solicit funds from their state’s residents.

Independent Audit Required by Certain Funders

Whether or not state law applying to a particular organization mandates an independent audit, certain government agencies or other grantors may require one.

Conclusion

It’s good that an independent audit is not required in all cases because it’s expensive. Even for a small nonprofit, the fee might be $5,000 to $10,000 – and audit fees for larger nonprofits in major urban areas can exceed $20,000.

The Role of A Tax Attorney

The Role of A CPA

- CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available. Considered the most trusted advisor in their industry, CPAs are a great choice for year-round financial recordkeeping and tax preparation; however, their diverse s…

The Benefits of A Dually-Certified Professional

- While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes, the advantages of having a two-in-one professional are hard to overstate. Not only do dually-licensed Attorney-CPAs have the financial backgro...

Experience

Attorney-Client Privilege

- Did you know your CPA can testify against you? That is true. If you are suspected of tax fraud, your most trusted accounting assistant can be compelled to testify against you in court. If you are actually a fraudster, you will definitely end up behind bars despite the fact that there is CPA-client privilege. The good news is your tax attorney cannot testify against you. With him or her, your ta…

Handle Disputes and Court Cases

- You may be able to file taxes like a pro on your own but how well do you handle disputes? It is usually very scary when you start receiving letters you can’t make heads or tails of. With a tax attorney by your side, all those worries are put to rest. They have seen it all and know the right course of action to take. Better yet, the tax attorney can communicate with the IRS officials on y…

Save Time

- Do you know how time consuming a tax audit is? The IRS has to comb through all your record books dating back several years ago and scrutinize every single detail. A series of questions are then asked for the sake of verification. Since you are no expert, you will waste even more time preparing and wondering what to do. A tax attorney already knows what needs to be done. You c…

Popular Posts:

- 1. what costs may a lawyer charge australia

- 2. what is p c lawyer

- 3. what to do if your lawyer committed malpractice

- 4. when to contact lawyer when someone dies

- 5. how much is a speeding ticket lawyer

- 6. what is a cause lawyer

- 7. what do you do if you cant afford a divorce lawyer florida

- 8. what to do if my lawyer is pressuring me into settling my case

- 9. what do you call a person your lawyer is defending

- 10. be a lawyer who helps people