Full Answer

What is JG Wentworth?

The rest reply: "Call J.G. Wentworth!" The company offers cash payments to people in return for all or a portion of their future payments from annuities, legal settlements, or lottery payouts. "They've helped thousands, they'll help you, too," sings a fellow in a gold helmet flanked by two horns.

Does it make sense to do business with Wentworth?

There are times when it might make sense to do business with a company like J.G. Wentworth. You may need cash for a medical emergency and have no where else to turn. Or perhaps you want to pay off high-interest credit-card debt. You might be eager to cash out an annuity.

What happens if JG Wentworth declares bankruptcy?

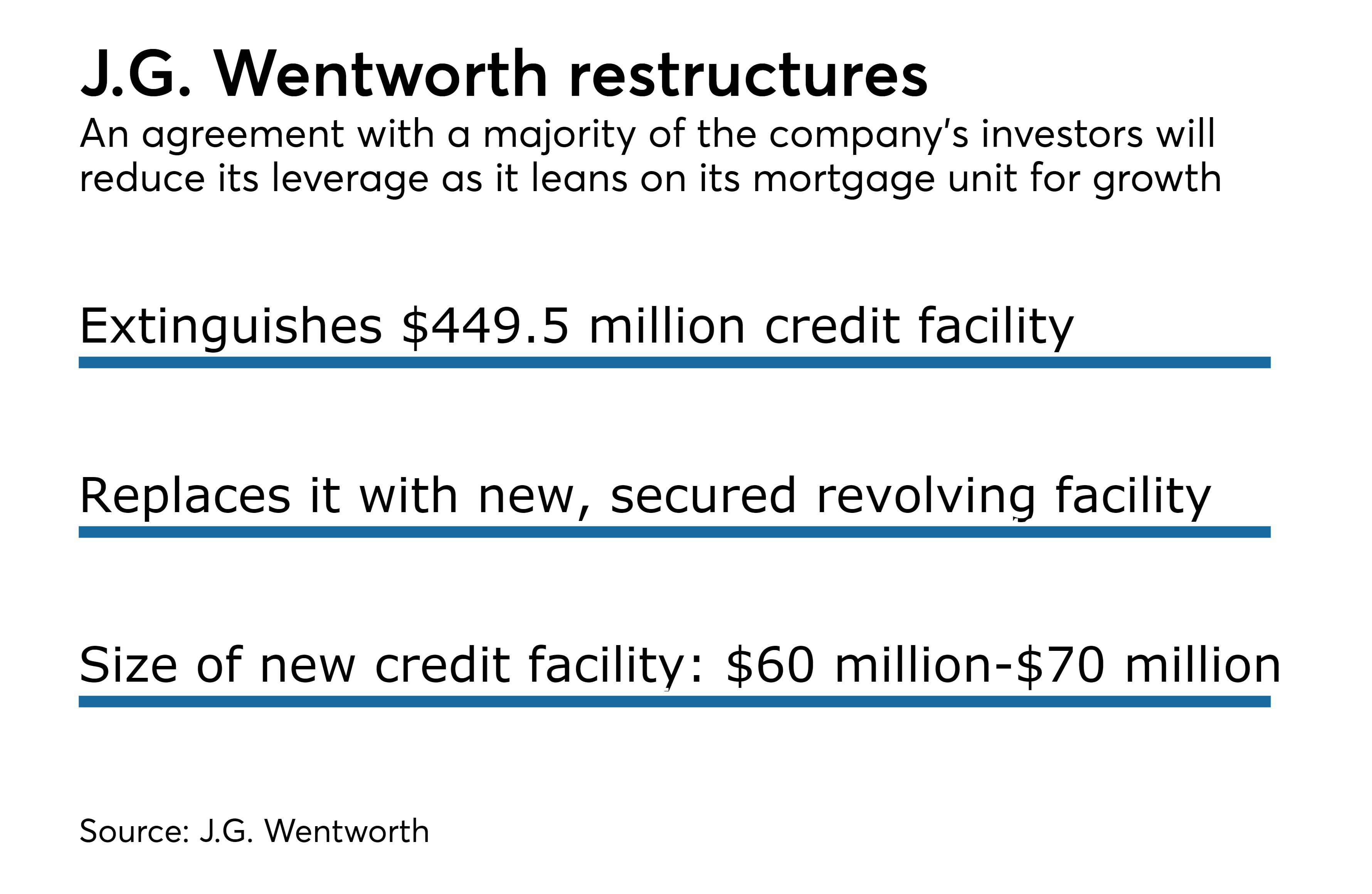

One thing you need to know about J.G. Wentworth, however, is that the company recently reorganized to lessen its debt load, which allowed its holding companies to emerge from bankruptcy last June. If it declares bankruptcy again while your payment is being processed, you may have difficulty getting your cash.

How can JG Wentworth help me reduce my debt?

If JG Wentworth is able to broker a reduction in debt with your creditors – this is not always possible – you will receive further instructions on setting up a non-interest savings account. You make one monthly payment into this account for JG Wentworth to draw on. You stop making payments to your creditors.

Is JG Wentworth an attorney?

JG Wentworth is a financial services company that focuses on helping consumers who are experiencing financial hardship or need access to cash.

Is JG Wentworth a ripoff?

Is JG Wentworth Legit? Yes, this is a legitimate financial services company founded in 1991. JG Wentworth offers structured settlement payment purchasing, debt relief services, and annuity purchasing. The company has an accredited BBB profile with an A+ rating.

How much money does JG Wentworth take from settlement?

J.G. Wentworth may be willing to help you out, but it will retain a portion of your payout in return. The total amount it pockets is called the "effective discount rate," which includes all its fees, and can total 9 percent to 15 percent or more.

How much does JG Wentworth cost?

This time, Wentworth proposed buying annuity payments that begin in 2039. The monthly payments start at $1,891 and increase by 3 percent a year, until October 2055 or her death.

What percentage do structured settlement companies take?

9% to 18%How Do Structured Settlement Purchasing Companies Make Money? Factoring companies generally take anywhere from 9% to 18% to cover their operating costs and turn a profit.

Is it a good idea to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

Who owns JG Wentworth?

JG WentworthJ.G. Wentworth / Parent organization

How do you get money from JG Wentworth?

Here are the steps you'll take:Call JG Wentworth for a free evaluation and quote. ... Accept your quote and return your contract. ... Attend your court date. ... Receive your lump sum!

How do I sell my structured settlement?

You can sell your structured settlement to a factoring company for immediate cash. Although you must first obtain court approval, you have the legal right to cash out your payments, either in part or in full, to a structured settlement buyer.

What credit score do you need for JG Wentworth personal loan?

While J.G. Wentworth doesn't display credit requirements outright on its website, usually the rule of thumb is around 700 FICO score to qualify for a conventional loan and 620 as a minimum for some government-backed loans.

Popular Posts:

- 1. what does it mean to make an appearance on the plantiffs lawyer

- 2. fox news russian lawyer who met with trump je. is linked to kremlin

- 3. how do i answer in a civil matter without a lawyer

- 4. what are some responsibilities of a lawyer

- 5. what does a lawyer have to do to drop your case

- 6. how much to have lawyer on retainer

- 7. what to do when your lawyer doesn't do his job

- 8. why contact lawyer for workmanscomp

- 9. what does a personal injury lawyer do

- 10. lawyer i know you are but what am i