4 tips for finding a reputable tax attorney #1 Verify the attorney is licensed If you want to verify that your attorney is licensed, you can search for their name on state bar website for the state where the person practices.

How do I find a tax lawyer?

And many of the organizations have a directory search on their website as well, so you can find a particular lawyer, if you’d like. They also offer a variety of tools to help both the public and the tax professional. Do you have a PTIN (preparer tax identification number)?

What should I ask my tax lawyer before I file taxes?

A few things to discuss with your tax lawyer would be gifts, donations, inherited money, and life insurance proceeds. There are always extenuating circumstances, you need to be 100% sure it doesn’t look like you’re trying to pull one over on the IRS.

Do I need a tax attorney for my taxes?

Taxpayers often find that they need the assistance of an affordable tax attorney to help them answer questions or concerns regarding the Internal Revenue Service (IRS). A good tax attorney should have his or her Jury Doctor (J.D.) and of course a license to practice law in your state.

How do I check if a lawyer is licensed in Texas?

In Texas, it’s simple to verify if a lawyer has a valid, current license with the Texas State Bar Association. Use this website to type in the name and the law firm of a lawyer. The search results verify if your lawyer has a valid license. Search results include: Where the lawyer went to law school and the year they graduated

How do I know if a tax preparer is legit?

All paid preparers are required to register with the IRS and get a PTIN, which should be included on your tax return. To check — and you should — that your preparer is legit, go to irs.gov and search for “Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.”

How do I verify an IRS agent?

Need to verify whether someone is an enrolled agent? You may email requests for enrolled agent status verification directly to epp@irs.gov....Please include the following information in your request:First and Last Name.Complete Address (if available)Enrolled Agent Number (if available)

How do I verify my tax information?

Verification of Tax Information or Nonfiling StatusUse the IRS Data Retrieval Tool, available in the FAFSA for eligible tax filers. ... Submit an IRS Tax Return Transcript. ... If you are the parent of a dependent student or are an independent student, submit an IRS Verification of Nonfiling Letter.

Can I look up someone's PTIN?

The IRS makes its directory of PTIN holders available for public search online. You can use the directory to find professional, credentialed tax preparers in your area. Visit the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications page of the IRS website.

Can a CPA represent you before the IRS?

Unlimited Representation Rights: Enrolled agents, certified public accountants, and attorneys have unlimited representation rights before the IRS. Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals.

Can the IRS show up at your door?

Yes, the IRS can visit you. But this is rare, unless you have a serious tax problem. If the IRS is going to visit you, it's usually one of these people: IRS revenue agent: This person conducts audits at your business or home.

Does the IRS ask you to verify your identity?

When you call the IRS, they will ask you to verify your identity. IRS phone assistors take great care to only discuss personal information with you or someone you authorize to speak on your behalf.

Can you verify your identity with the IRS online?

To verify their identity with ID.me, taxpayers need to provide a photo of an identity document such as a driver's license, state ID or passport. They'll also need to take a selfie with a smartphone or a computer with a webcam. Once their identity has been verified, they can securely access IRS online services.

How long does it take for the IRS to verify your identity?

If the verification proves you are the person named on the return and that you personally filed the return, the return will be processed. After successful verification, it takes about 6 weeks to complete processing.

Can I prepare tax returns without a PTIN?

Yes. The PTIN regulations require all tax return preparers who are compensated for preparing, or assisting in the preparation of, all or substantially all of a tax return or claim for refund of tax to register and obtain a PTIN.

What does PTIN stand for?

preparer tax identification numberA preparer tax identification number (PTIN) is an Internal Revenue Service (IRS) identifier implemented in 1999 that has required all paid federal tax return preparers to register with the federal government and obtain a unique number since 2010.

What does a PTIN number look like?

A PTIN is an eight-digit number preceded by the letter “P” and looks like this: P12345678.

What to consider when hiring a tax attorney?

When hiring a tax debt attorney, you want to consider several factors, including: Whether the tax attorney has experience handling tax debt situations similar to yours. What types of tax debt help the lawyer offers, and if you agree with the potential solutions to your tax debt. If you can afford the tax lawyer’s legal fees.

What is tax attorney?

Tax attorneys are lawyers who specialize in the complex and technical field of tax law. Tax attorneys are best for handling complex, technical, and legal issues. A good tax attorney has the vital experience. A trustworthy tax attorney who is familiar with the ins and outs of the tax industry will be perfect for handling your IRS issues.

How can a tax lawyer help you?

Here are some of the other ways that tax lawyers can help you: File an appeal of a tax court decision. Communicate with IRS officials. Help your business save money . Help you take advantage of tax credits.

Who represents the IRS in a tax case?

You plan to seek independent review of your case before the US Tax Court. You are under criminal investigation by the IRS. An IRS tax attorney represents the IRS, and not the taxpayer, that means you as the taxpayer need to hire your own tax attorney.

Do credentials lie?

2) Credentials rarely lie – Ask your possible attorney about their credentials. The attorney you want ought to be licensed to practice law by your state’s bar and have a Master of Laws degree at the very least (Less qualified attorneys will be cheaper but may cost you more in the long run).

Is the IRS a sensitive issue?

IRS problems are mostly quite sensitive. A wise man knows his personal limit, and knows when he must turn to other better suited men for help. Well, an IRS problem is your limit; it is at least if you’re not a Tax attorney. If you have an issue with the IRS get a Tax lawyer, Trust me, you need one.

What do tax preparers know?

They know about your marriage, your income, your children and your social security numbers – the details of your financial life. Most tax return preparers provide outstanding and professional tax service.

What are the different types of tax preparers?

There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and many others who don't have a professional credential. You expect your preparer to be skilled in tax preparation and to accurately file your income tax return.

Why do some taxpayers get hurt financially?

However, each year, some taxpayers are hurt financially because they choose the wrong tax return preparer. Be sure to check our tips for choosing a tax preparer and how to avoid unethical "ghost" return preparers.

What is the IRS's policy on avoiding unscrupulous tax preparers?

The IRS provides tips on avoiding unscrupulous tax preparers and is committed to investigating paid tax return preparers who act improperly. Make a complaint if you have been financially impacted by a tax return preparer's misconduct or improper tax preparation practices.

Can a case be litigated by the IRS?

Cases are very rarely litigated and are usually settled in IRS Appeals ; however, the IRS knows that if you’re represented by an attorney that the case has the potential to go to litigation. The IRS is required to consider the hazards of litigation in determining an appropriate settlement.

Can an attorney have attorney-client privilege?

Attorneys can maintain attorney-client privilege and cannot be forced by a third-party, including government entities, to provide confidential information. Under federal law, CPA/accountant-client privilege is not recognized.

Can a tax attorney help with bankruptcy?

However, for larger balances, it helps to have a licensed tax attorney representing you, as they can also consider other options including Chapter 7 bankruptcy.

Can an attorney be a tax attorney?

Some may decide to practice in two or three areas. There is no formal requirement for an attorney to call themselves a “tax attorney”. As with CPAs, you want to ensure that the attorney has experience in the specific area ...

Can an EA represent you in an audit?

Audit representation and tax litigation – An EA, CPA, or tax attorney can represent you in an audit, but only an attorney can litigate your case in tax court if needed. There are some exceptions whereby an EA or CPA can take an exam administrated by the US tax court, but only a 100 have passed in the past 16 years.

What does a tax attorney do?

They may negotiate your tax debt or other issues with a government agency, find ways of settling your tax debt, advise you about how best to respond to an investigation, defend you in court, and more. They also handle communications with the government for you.

What can a tax lawyer do?

Tax lawyers can help you through a tax controversy, or help you avoid one. To get the right lawyer for your needs, you need to know what to look for. To reduce the high anxiety associated with hiring a lawyer and to help you avoid making snap decisions, we've put together a list of seven tips on what to ask a tax lawyer to ensure ...

What are the two types of tax law?

As the personal finance website The Balance explains, there are roughly two types of tax law: tax planning and tax controversies. Tax planning lawyers help businesses and people with high net worths arrange their financial affairs in a way that minimizes their tax burdens and helps them avoid a tax audit. You might want to talk to this kind of tax ...

What do tax lawyers do?

Of course, they specialize in helping people file tax returns and responding to IRS audits, but take a look at all of the ways in which a tax lawyer could assist you! 1. When You Owe Back Taxes.

How long does it take to become a tax lawyer?

The certification process to become a tax lawyer in incredibly stringent and includes hundreds of hours of practice and continuing education before one can even get certified. Take a look at some of the things they learn that you should also be aware of. 1. Not All Tax Changes Are Permanent.

What is the penalty for not filing taxes?

The penalty for failing to file is 5% of what you owe for up to five months. After that, the IRS can choose to come after you with criminal or legal charges.

What is IRS field audit?

It is a thorough investigation of your tax records. There are three types of audits: Field audits are the most invasive and occur when the IRS sends an actual IRS agent to your home or business to perform the audit.

Why don't people file taxes?

Most people who don’t file their taxes fail to do so because they know or suspect they’re going to owe money to the IRS and don’t want to pay it.

How long is a tax refund valid?

However, that refund has an expiration date and will only be valid for three years.

What happens if you don't pay taxes?

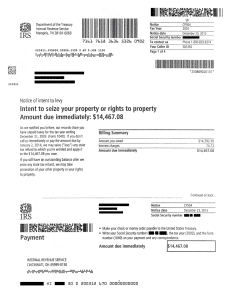

At this point, if you don’t pay, the IRS will send you a final notice, giving you 30 days to request a hearing with a settlement officer.

What to do if a tax preparer doesn't have a PTIN?

If the tax preparer does not have a PTIN, walk away. CTEC is a nonprofit organization that was established in 1997 by the California State Legislature to protect taxpayers against fraud and incompetent tax preparers. To report unregistered tax preparers, visit www.ctec.org or call (877) 850-CTEC.

Who is required to prepare California taxes?

California law requires anyone who prepares tax returns for a fee to be either an attorney, certified public accountant (CPA), IRS enrolled agent (EA), or registered tax preparer with the California Tax Education Council (CTEC) .

Is a tax preparer legal?

A degree in accounting, for example, does not automatically mean the tax preparer is legal. California law is very strict about who can prepare tax returns professionally.

Popular Posts:

- 1. what kind of lawyer do i need as a performer

- 2. how to speak to a lawyer for free

- 3. where is the lawyer shelley brandt working now

- 4. how to find an e commerce lawyer

- 5. can a lawyer be present when a child is question by dcf

- 6. how much a lawyer earns in uk

- 7. how much are divorce lawyer fees in thailand

- 8. when must a lawyer withdraw

- 9. what is the lowest job as a lawyer

- 10. how to get authorization letter from lawyer