Agree to the terms set in the demand letter and settle the dispute. Reach out to the sender or their attorney to inform them that you refuse to meet their terms and explain your reasons. Reach out to the sender or their attorney, challenge their claim and suggest an alternative dispute resolution channel like mediation.

Full Answer

How to respond to a demand letter from a lawyer?

How to Respond to a Demand Letter. 1 1. Evaluate the letter. The first step after receiving a letter is to carefully read it and evaluate its merits. Did the incident occur as described? 2 2. Determine its intent. 3 3. Calculate the claims. 4 4. Is a lawyer needed? 5 5. Respond within allotted time frame.

What should I do if a demand letter is unclear?

If any aspects of the demand are unclear, you should also seek clarification on those points. You should request copies of documents, such as invoices or contracts, that the letter relies on if you do not have copies.

What is a response to a demand letter for payment?

A Response to Demand Letter is a formal written reply to a demand for payment. Though this response may be enough to repel the quest for payment, it may also enter as evidence in a court case if things aren’t resolved – so the letter should provide a clear and detailed explanation.

How long does an insurance company have to respond to demand letters?

Unfortunately, there is no way to know how long an insurance company will take to respond to a demand letter since there is no deadline by law. The insurer can take as long as they want, and in general, that can be anywhere between a week to eight months.

What to do when receiving a letter of demand?

How to respond to a claim made against you?

Why is it Important to Respond to a Letter of Demand?

What is statutory demand?

What to do after giving letter consideration?

What happens if you fail to pay a statutory demand?

How does court work affect your business?

See more

About this website

How do you respond to an attorney demand letter?

What to IncludeA summary of the original demand letter, with an outline of its assertions (even if these are disputed) and the total payment that was demanded.An alternative account of events, as relevant, with corroborating evidence, if possible.Suggestions for how to remedy the dispute.

How do you respond to a letter threatening legal action?

Stand your ground, but be polite as abrasive language is likely to result in inflaming the recipient and making the situation worse. Explain to the threatening party that you will be adding the sender's letter or email to the CMLP Legal Threats Database--and do so!

How do I respond to a 93A demand letter?

Some helpful tips on how to handle the receipt of a 93A demand letter:Do Not Assume the Claim is Valid. ... Evaluate the Potential Damages. ... The "Reasonable" Settlement Offer. ... Keep All Evidence When You Receive the Letter.

Can a demand letter be ignored?

Ignoring a demand letter — particularly if you don't read it at all — usually gives the obligee no other choice but to initiate a formal legal action against you or your business, perhaps even sooner than they otherwise would have.

How do you respond to demand explanation?

Respond to the Letter If you disagree with the claims made against you, you should respond noting your disagreement and explaining why you disagree. The explanation may be brief or detailed. It should be clear why you believe you are not liable to meet the other side's demands. Your response should be measured.

Should I respond to a lawyer's letter?

It's always best to have an attorney respond, on your behalf, to a “lawyer letter,” or a phone call from a lawyer. If that's not an option for you, though, make sure that you send a typed, written response to the attorney (by e-mail or mail), and keep a copy for yourself.

What is a demand letter in law?

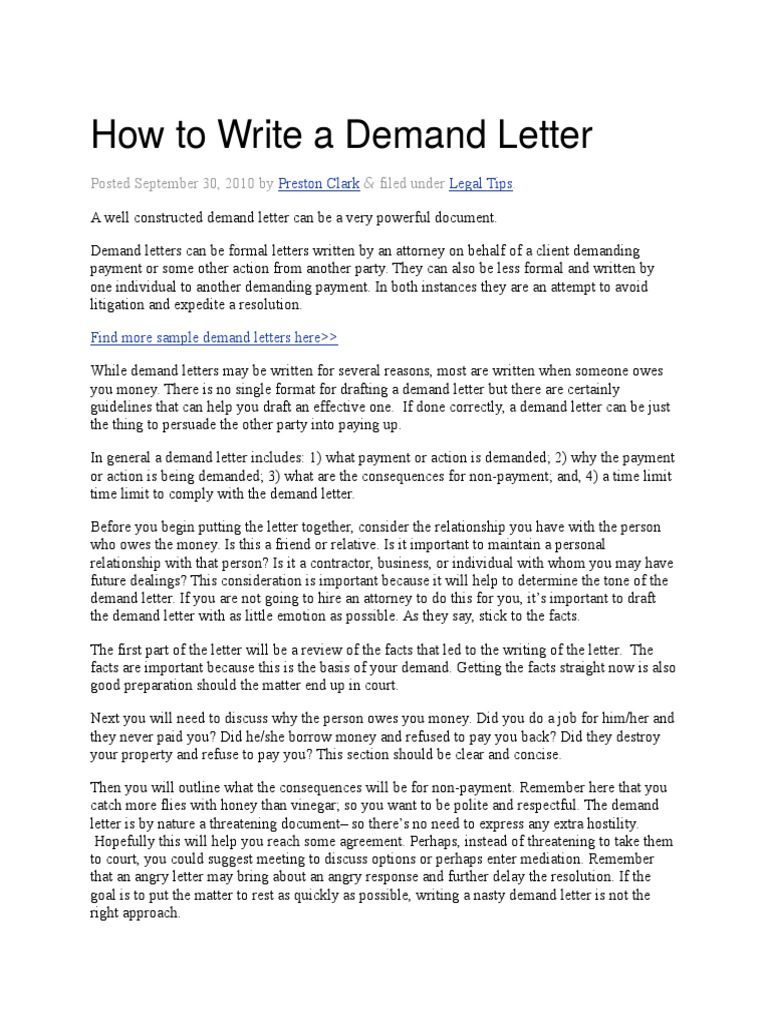

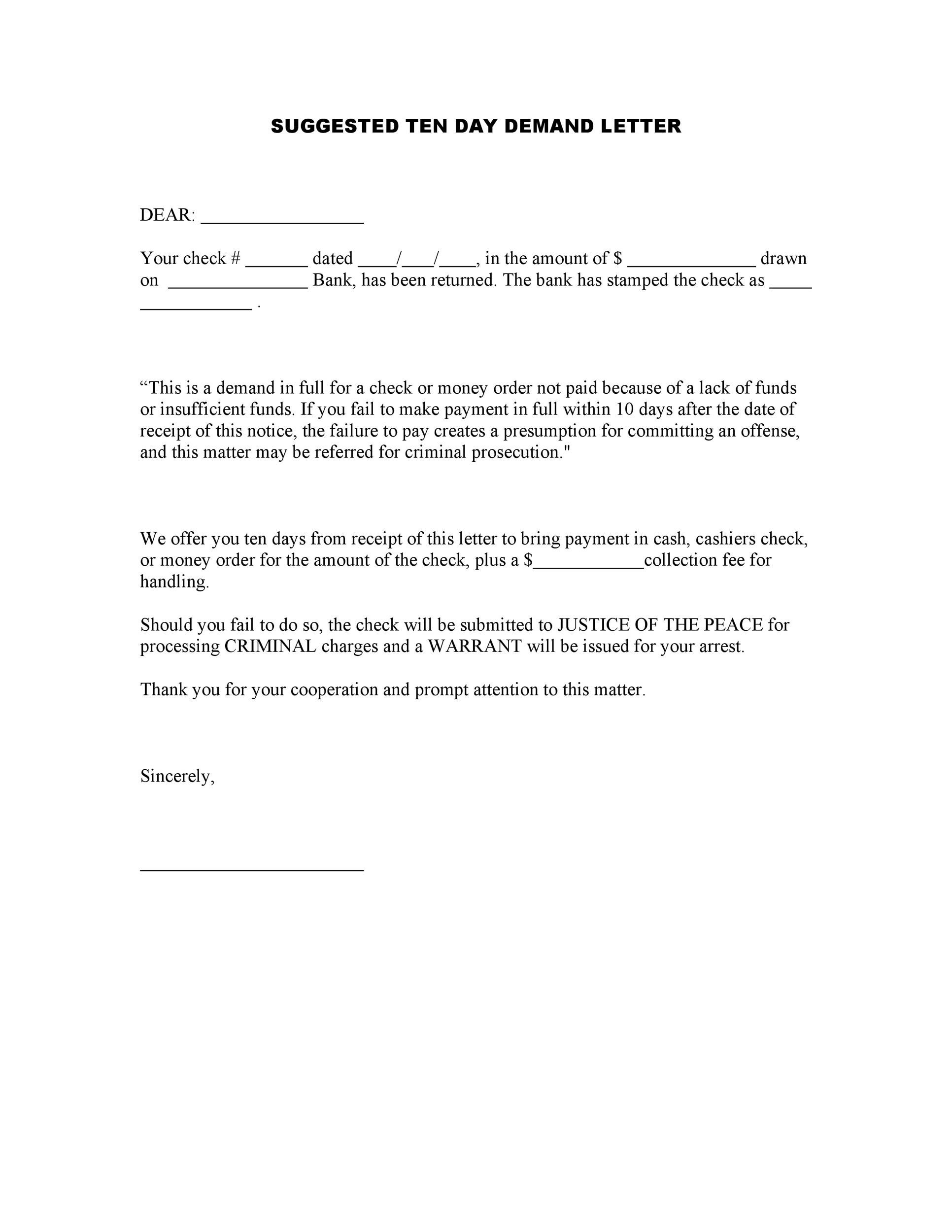

A demand letter is a letter, usually written by an attorney on a client's behalf, demanding that the recipient of the letter take or cease a certain action.

Do companies respond to demand letters?

At some point after you send your demand letter, the employer, through its attorney, will respond.

What is a 93A in Massachusetts?

The Consumer Protection Act (M.G.L. Chapter 93A ) protects people from unfair and misleading business actions. It gives buyers the right to sue in court and get back money they lost. The law also allows businesses to sue other businesses. This only happens when a business was dishonest or unfair to another one.

What happens when someone doesnt respond to a demand letter?

The fact that you ignored the demand letter will be used against you in court. The demand letter will likely end up as an exhibit to the court and jury in any subsequent litigation, and your response to the demand will be judged accordingly.

What comes after a letter of demand?

If the debtor does not comply with the letter of demand, summons will be issued and the debtor must defend the summons or a judgment will be given against them.

How do you handle a demand letter?

What to Do If You Receive a Demand Letteragree to do what the person is asking and put an end to the dispute.contact the person(or her lawyer) to explain why you don't agree with her. ... contact the person (or her lawyer) to let her know that you refuse to do what you're being asked to do and to explain why.More items...

Response to Demand Letter | Sample and Template

Sample Response to Demand Letter. 2 August 2031. Patricia Higgins. 0009 Base Boulevard. New Orleans, LA 12940. Re: Response to Demand Letter 002/D. Dear Patricia Higgins, I am writing in response to your demand letter, dated 29 July 2031.

Sample response to a letter of demand - debt 1

Case study - Meena and Fiona Meena runs a small business from home, doing website design and IT support for other small businesses. One of her clients, Fantastic Florists, has failed to pay her invoice of $4,000 for the website she built.

Response to Demand Letter Sample Clauses: 212 Samples - Law Insider

Related to Response to Demand Letter. Demand Letter Upon a finding that Progenity has failed to comply with any of the obligations described in Section X.A and after determining that Stipulated Penalties are appropriate, OIG shall notify Progenity of: (a) Progenity’s failure to comply; and (b) OIG’s exercise of its contractual right to demand payment of the Stipulated Penalties.

Free Response to Demand Letter - PDF | Word – eForms

Updated May 31, 2022. A response to demand letter is a formal written reply to a demand for payment. Though this response may be enough to repel the quest for payment, it may also enter as evidence in a court case if things aren’t resolved – so the letter should provide a clear and detailed explanation.

One Day to Respond to a Legal Letter? Here's What To Do | LegalVision

About LegalVision: LegalVision is a commercial law firm that provides businesses with affordable and ongoing legal assistance through our industry-first membership. By becoming a member, you'll have an experienced legal team ready to answer your questions, draft and review your contracts, and resolve your disputes.

What to do when receiving a demand letter?

But to make sure the issue is resolved good-naturedly, the first thing you need to do is write a response to the demand letter. If you didn’t know how this needs to be done, highlighted is everything to know about writing the demand letter’s response.

What is demand letter?

The demand letter is a letter sent to you by another party by their lawyer informing you that they’re against an action you’ve committed and the reason why. Usually, the goal of this letter is to ask for some relief in money damages. If not fulfilled, you risk suffering legal consequences for not doing as requested within the stated duration.

Why do you need to understand why precisely the party has decided to send the demand letter?

It’s best to do this as your complainants might see this either as a quick chance to make money or acting in good faith. Knowing your plaintiff’s intent will help you know the best response strategy to use. If dealing with a good-faith accuser, this may help build a conciliatory tone with them but might not be effective at repulsing an embezzler.

Do you have to respond to a demand letter?

You must make sure to always respond to the demand letter within the allocated time frame. Doing this is advised irrespective of the claim’s merits as it looks good to the judge if this matter eventually lands in a civil court.

Is it normal to expect the other party to document their claims?

Expecting the other party to document their claims is normal and rational. This usually happens even when the events happen as exactly stated, thereby anticipating the other party to bring out the evidence to authenticate their claims.

Is Hiring an Attorney Necessary?

It’s no doubt that hiring an attorney is expensive. However, having legal advice is necessary for many complex or high-stakes issues. It’s also beneficial even in simpler cases and ensures you get value for your money.

What is a response to a demand letter?

Response to Demand Letter. A Response to Demand Letter is a formal written reply to a demand for payment. Though this response may be enough to repel the quest for payment, it may also enter as evidence in a court case if things aren’t resolved – so the letter should provide a clear and detailed explanation.

Why do people send demand letters?

People send demand letters for all sorts of reasons. Some plaintiffs act in good faith, while others are just seeking a quick buck. Assessing intent can help in picking a strategy for response. It might work to strike a conciliatory tone with a good-faith adversary, but it probably won’t help fend off a profiteer.

What is the first step after receiving a letter?

The first step after receiving a letter is to carefully read it and evaluate its merits. Did the incident occur as described? Who is responsible? Is the amount demanded justified by the facts?

Is it cheap to hire a lawyer?

Even in simpler cases, it can help to have an “esq.” on the letterhead. It’s never cheap to hire a lawyer, but it might be money well-spent.

What is a demand letter for an attorney?

That’s when you receive a letter. Its from an attorney and law firm you have never heard of. They are demanding the records of a former employee of yours. This is called an attorney demand letter.

What to do if you have broken labor laws?

If you have truly broken labor laws and the opposing counsel is willing to settle for a reasonable number, I think it makes sense to limit your liability. However, if you have not done anything wrong or if a labor violation is relatively small and opposing counsel is not reasonable in his demands, fight and fight hard.

What happens if you are 100% in the right?

Sometimes even if you prove that you are 100% in the right, a jury may award something nominal as a gesture of solidarity.

Who pays attorney fees if plaintiff wins?

If the plaintiff’s attorney wins even on one cause of action, YOU the employer must pay all his attorney’s fees.

Do you get a demand letter from an attorney in California?

If you have a successful business in California with employees, at one time or another it is likely you will receive a demand letter from an attorney.

Is a labor demand letter vague?

Labor demand letters are quite a bit different. In fact, most people that review them with a layman’s eye will find them to be very vague in some cases and in other cases complete exaggerations of facts with huge demands for payments of money related to those exaggerated facts.

Can an attorney claim reasonable fees?

Yes. Again, even if in the end you lose just a nominal amount to the employee you are going to get stuck paying their high legal fees which is the real killer. To add insult to injury, the attorney can claim “reasonable” fees and expenses in any amount.

Can you respond to a demand letter?

Your response to a demand letter doesn't have to be solely reactive. If it fits with your defense strategy, you may consider taking swift, preemptive action. You may be able to file for a declaratory judgment or invoke an arbitration provision.

Can a disclaimer be used in a deposition?

Don't think that your disclaimer will keep your demand response from being used in trial or depositions, though. Several cases have found that response letters may be admissible -- once the settlement boilerplate is stricken. If the letter becomes an exhibit at trial, you will want it to put you and your client in a sympathetic light, so avoid sounding threatening or unreasonably sarcastic. Avoid threatening " legal proctology exams ."

Why do people use demand letters?

Many parties use demand letters as a way to try to resolve a dispute or breach of contract before filing a lawsuit. When a company or individual receives a demand letter, do not ignore it. It’s important to respond to the demand letter and consider the claims.

How to write a letter to a lawyer?

1. Remove any personal emotions from the matter . 2. Consult with an attorney about drafting a formal response if the matter is complex. 3. Write the letter on company letterhead and respond in a professional matter. 4. Lay out all the facts of the claim to argue your case. 5.

Why do you need to respond to a legal demand letter?

You need to respond to the legal demand notice or letter in a reasonable manner in order to avoid any sort of legal action that can cause you greater trouble. If you want to know how to respond to a legal demand letter then take guidance from this article.

What happens if you don't respond to a legal demand notice?

It is very important as if you do not respond to this legal demand notice, then the sender will go to the court and you will be in greater trouble.

How to respond to a letter without delay?

Make sure you respond the letter without making any delay as it will help you to avoid any sort of legal trial which can go against your favour. 3. Carefully read the time limit that the sender has given to you.

What is a demand letter?

Usually a demand letter is an indication that another person or party has some reservation against you in property or other relevant matters.

What to do if you think you cannot deal with the matter effectively?

If you think that you cannot deal with the matter effectively then taking help from the lawyer will save you from complications. The lawyer will also help you in determining the validity or merit of the claim of the sender. He or She will also let you know about the legal provisions that are applicable to the matter.

What is disclosure in law enforcement?

Any court, governmental authority, law enforcement agency or other third party where we believe disclosure is necessary to comp ly with a legal or regulatory obligation, or otherwise to protect our rights, the rights of any third party or individuals' personal safety, or to detect, prevent, or otherwise address fraud, security or safety issues.

Does JD Supra use automatic decision making?

Please note that JD Supra does not use "automatic decision making" or "profiling" as those terms are defined in the GDPR.

Does JD Supra share your information?

Onward Transfer to Third Parties: As noted in the "How We Share Your Data" Section above, JD Supra may share your information with third parties. When JD Supra discloses your personal information to third parties, we have ensured that such third parties have either certified under the EU-U.S. or Swiss Privacy Shield Framework and will process all personal data received from EU member states/Switzerland in reliance on the applicable Privacy Shield Framework or that they have been subjected to strict contractual provisions in their contract with us to guarantee an adequate level of data protection for your data.

How long do you have to respond to a demand letter?

Settlement agreements don’t happen overnight, so you may want to give the insurance company between two weeks to 30 days.

Why are insurance claims rejected?

Rejection: it’s often in the best interests of an insurance company to settle a claim before courts get involved; but, valid claims are routinely rejected in bad faith, to deter individuals from pursuing compensation.

How Long Does it Take for an Insurance Company to Respond?

The insurer can take as long as they want, and in general, that can be anywhere between a week to eight months. However, that doesn’t mean that you must continue waiting if the insurance company is taking an inordinate amount of time to respond, and you or your attorney believes you have a strong case.

What is demand letter 2021?

The demand letter is a document sent to the at-fault party’s insurance company, explaining your side of the story, the losses you have incurred, and the total amount you are requesting as a settlement. ...

What is the internal circumstance of an insurance policy?

Internal circumstances, such as the size of the insurance company, or the adjuster’s caseload. The size of the insurance policy, as the larger the insurance policy, the greater risk of financial liability for the insurer.

Can an insurance company accept an offer?

Acceptance: it is rare, but the insurance company might accept your offer.

Can you counter an insurance settlement offer?

Counter Offer: the insurer may come back to you with a settlement offer of their own, often for a significantly less amount than originally requested. You can either accept it, counter it, or file a lawsuit in response. Acceptance: it is rare, but the insurance company might accept your offer.

What to do when receiving a letter of demand?

In summary, when you receive a letter of demand, you should: consider the accuracy of the claims made against you; get legal advice from a lawyer; request any additional documents or information you need from the other side to assess the accuracy of their claims; and. respond to the letter as appropriate, which may be through a ‘without prejudice’ ...

How to respond to a claim made against you?

If you disagree with the claims made against you, you should respond noting your disagreement and explaining why you disagree. The explanation may be brief or detailed. It should be clear why you believe you are not liable to meet the other side’s demands. Your response should be measured.

Why is it Important to Respond to a Letter of Demand?

If you respond to a letter of demand, you are giving yourself a chance to avoid that process and resolve the matter commercially.

What is statutory demand?

A statutory demand is issued under the Corporations Act 2001 (Cth) and requires payment of the debt within 21 days. If you fail to pay within 21 days or seek a court order to set aside ...

What to do after giving letter consideration?

Once you have given the letter consideration and sought legal advice, you may need to request further information before you can respond. If any aspects of the demand are unclear, you should also seek clarification on those points.

What happens if you fail to pay a statutory demand?

If you fail to pay within 21 days or seek a court order to set aside the statutory demand, your company will be deemed insolvent and can be wound up by a court order. This will be to the detriment of your business.

How does court work affect your business?

Not only will court proceedings be costly and time-consuming, but it can damage your reputation both personally and professionally . Additionally, the time taken away from your business dealing with court processes and lawyers will likely impact on your business’ productivity.

Popular Posts:

- 1. what skills are required to be a criminal lawyer

- 2. when are you not allowed to get a lawyer for an interrogation

- 3. how to get a super lawyer nomination

- 4. do i need a lawyer where the ticket takes place

- 5. how to become lawyer in america

- 6. how much is a retainer for lawyer

- 7. how do the degrees to become a lawyer help you complete your career and goals

- 8. how much can a lawyer reduce your medical bills

- 9. who was the lawyer indcerditables

- 10. how was dr fords lawyer connected to bill clinton