When you respond to a letter of demand, you can: admit you owe some or all of the money deny you owe the money and explain why you don't owe it ask for more information, without admitting or denying you owe the money

- A summary of the original demand letter, with an outline of its assertions (even if these are disputed) and the total payment that was demanded.

- An alternative account of events, as relevant, with corroborating evidence, if possible.

- Suggestions for how to remedy the dispute.

How do you respond to a letter from a lawyer?

Sep 12, 2017 · Crafting Your Response. It’s always best to have an attorney respond, on your behalf, to a “lawyer letter,” or a phone call from a lawyer. If that’s not an option for you, though, make sure that you send a typed, written response to the attorney (by e-mail or mail), and keep a copy for yourself.

Do you get a demand letter from an attorney?

Jan 19, 2022 · If you want to know how to respond to a lawyer’s letter, you must read and address every concern in the letter. If you feel you’ve done no wrong, you’ve likely done nothing. You can write to the lawyer and state that you have done nothing wrong, and you have no idea why they are threatening legal action on a matter that has nothing to do with you. It is a good …

How do you write a legal document for money owed?

Jul 27, 2017 · Begin the letter by typing the date in the top left corner with your address below it. Leave a space, then type the collector's name with his office address under it. Begin the letter by typing the title of the issue to which you are responding.

How do I respond to a letter of demand?

Dec 04, 2021 · It’s never cheap to hire a lawyer, but it might be money well-spent. 5. Respond within allotted time frame. Make sure to follow the timeline laid out in the demand letter. Whatever the merits of the claim, a prompt response will look good to a judge, should things end up in civil court. Sample Response to Demand Letter. Dear Jane Theroux, This letter is in …

How do you respond to an attorney letter?

- Step one: Take your time for a legal letter….. but not too much.

- Step two: Don't' give away too much and respond with questions of your own.

- Step Three: Try to keep emotion out of it.

- Step four: Always have your response tested by someone else first.

How do you write a response letter to a dispute?

What happens if you ignore lawyers letters?

How do you respond to a demand payment letter?

...

Here are 6 things you should do if you receive a demand letter:

- Take It Seriously. ...

- Be Honest With Yourself. ...

- Consider the Evidence. ...

- Consider an Offer. ...

- Speak to a Lawyer. ...

- Verify Receipt.

Do I have to respond to a lawyer letter?

How do you respond to demand explanation?

- Evaluate the letter. The first step after receiving a letter is to carefully read it and evaluate its merits. ...

- Determine its intent. People send demand letters for all sorts of reasons. ...

- Calculate the claims. ...

- Is a lawyer needed? ...

- Respond within allotted time frame.

Can you ignore a lawyer letter?

If you receive one, contact your attorney immediately. Some people think if they don't respond, the sender will go away. This is usually not the case — especially if the other party has retained an attorney.

What is reasonable response time for a lawyer?

How do I write a final notice of payment?

- Mention of previous attempts to collect– including any statements, emails, and letters you have sent. ...

- Invoice number and amount.

- Original invoice due date.

- Current days past due.

- Instructions- what they need to do next.

Can you ignore a letter of demand?

How do you respond to a letter threatening legal action?

What does it mean when a lawyer sends a demand letter?

How to write a demand letter?

The first demand letter presented a claim. The task here is to rebut this claim with a counterargument, generally including: 1 A summary of the original demand letter, with an outline of its assertions (even if these are disputed) and the total payment that was demanded. 2 An alternative account of events, as relevant, with corroborating evidence, if possible. 3 Suggestions for how to remedy the dispute.

Is it cheap to hire a lawyer?

Even in simpler cases, it can help to have an “esq.” on the letterhead. It’s never cheap to hire a lawyer, but it might be money well-spent.

What is the first step after receiving a letter?

The first step after receiving a letter is to carefully read it and evaluate its merits. Did the incident occur as described? Who is responsible? Is the amount demanded justified by the facts?

How to respond to a letter of demand?

When you respond to a letter of demand, you can: 1 admit you owe some or all of the money 2 deny you owe the money and explain why you don't owe it 3 ask for more information, without admitting or denying you owe the money 4 offer to pay a different amount 5 offer to pay some or all of the money in instalments.

What happens if you receive a letter of demand?

When you receive a letter of demand, this might be the first time you find out that someone is chasing you for money. A letter of demand will usually state: how much the other party is claiming. why the other party believes you owe them money.

What is a letter of demand?

Responding to a letter of demand. A letter of demand is a letter from the other party asking for money to be paid. It often warns you that if this is not done they may start a court case to recover the money you owe them. When you receive a letter of demand, this might be the first time you find out that someone is chasing you for money.

What is a demand letter for an attorney?

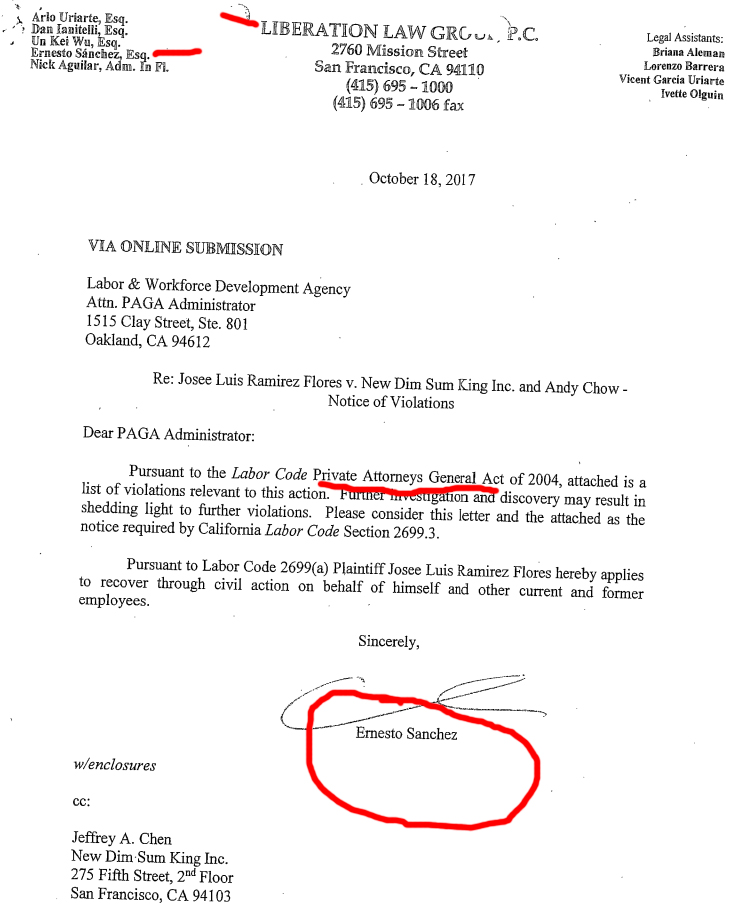

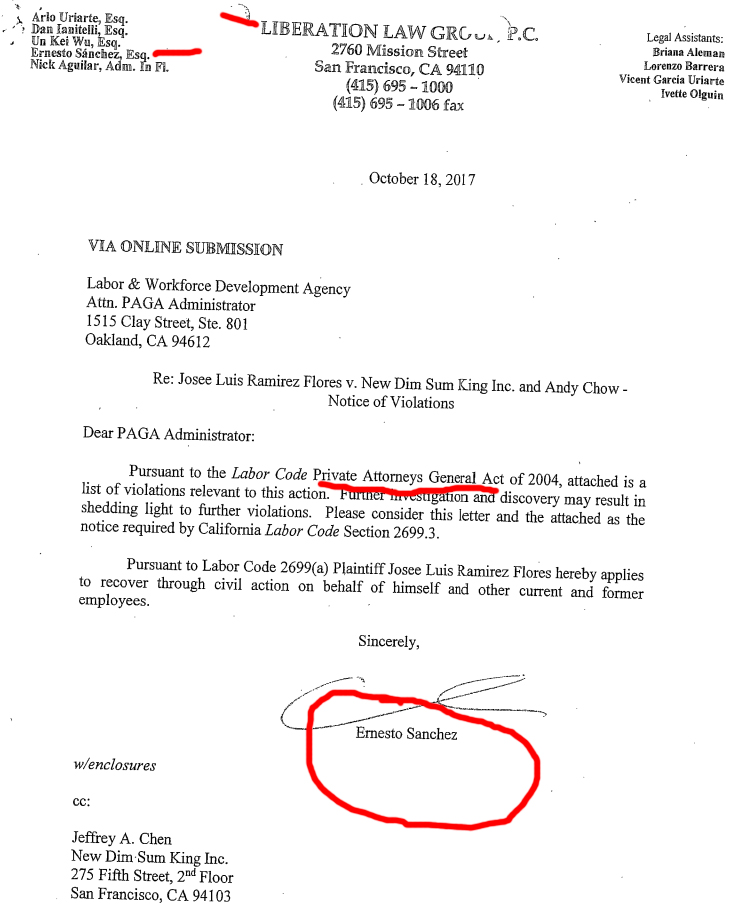

That’s when you receive a letter. Its from an attorney and law firm you have never heard of. They are demanding the records of a former employee of yours. This is called an attorney demand letter.

Is litigation a cost of doing business?

It’s the cost of doing business. Most businesses take the attitude that litigation is a cost of doing business and tend to settle for an amount lower than the potential cost of litigating and the potential cost of losing a case. In some cases, this is a good strategy.

Why are labor laws important?

Labor laws are necessary and valuable when used for the purpose intended; to ensure that employees who may be in a disproportionate level of power are not taken advantaged of and in some cases abused.

How to make a promissory note non-negotiable?

If you want to make a promissory note non-negotiable, meaning the note will not be able to be transferred from one person to another, you must simply write "non-negotiable" somewhere on the promissory note. For example, assume you loan money to a friend and execute a promissory note.

What is a promissory note?

The promissory note requires your friend to repay the amount loaned, plus interest, on a certain date. At this point, you are considered the "holder" of the promissory note, because you have possession of the note and can ask your friend, "the borrower," for the amount of money owed on the date agreed upon.

Why do you need a lump sum payment?

A lump sum payment provision can be used when you want to reduce the potential interest charges incurred by the other party. This is the case because, with a lump sum payment, the party paying back your loan can pay off the loan quicker, therefore avoiding interest payments over an extended period of time. ...

What is a bank check?

A bank check effectively orders a bank to pay the person presenting that check the amount owed. The most common example of a note is a promissory note, which you know is a promise by a borrower to pay a holder an amount owed. ...

What to do if you are owed money and you don't repay it?

If an individual is owed money, and the borrower shows no signs of repaying it, one of the first steps they should take is to send a demand letter. This is a formal letter that clearly states the circumstances for the loan, the required repayment and a suggestion that taking the issue to court may be an option if the debt is not repaid. .

What to do if you are owed money?

If an individual is owed money, and the borrower shows no signs of repaying it, one of the first steps they should take is to send a demand letter. This is a formal letter that clearly states the circumstances for the loan, the required repayment and a suggestion that taking the issue to court may be an option if the debt is not repaid.#N##N#The letter will demonstrate to the borrower that the lender is serious about wanting their money and it will also serve as evidence if the case needs to go to court. This letter could be the first step in the legal process of recovering debt.

Should a demand letter be polite?

Demand letters should be polite and not harass the debtor especially if it is going to a family member or friend of the lender. They will most probably need to maintain a friendly relationship with the borrower. This is why the letter should simply state the facts and not have an emotional tone.

What is a demand letter?

Remind the Borrower. In many cases, especially between individuals, a demand letters are all it takes to remind the borrower that they need to pay their debts. A demand letter may also need to be sent to an employer who has not paid promised wages. . Demand letters can be sent for other purposes than financial debt.

Popular Posts:

- 1. how to get business as a lawyer

- 2. who was the lawyer associated with joseph mccarthy

- 3. how much does the lawyer charge to file for parent

- 4. how much does a criminal lawyer cost per hous

- 5. how to become a bank lawyer

- 6. should i get a lawyer when child protective services

- 7. who is ambassador taylor's lawyer

- 8. how do i get a divorce lawyer if i dont have financial access

- 9. what is an pllc lawyer

- 10. what do you do as a lawyer intern