- Petitions to the court. A probate petition is a set of specific probate forms that the court needs to open an estate . ...

- Notifying creditors, heirs, and other interested parties. Notifying all parties of the proceeding is the next step in probating a Will with or without an attorney .

- Changing the legal name of assets. Once the notices and appointment are completed, you will need to change the name of assets from the deceased’s to “The Estate Of ...

- Paying creditors and taxes, paying expenses, and leaving heirs. You should not pay any money to your heirs until all estate expenses have been paid or you are sure ...

- Reporting to court and closing the estate. The last step in probating an estate is to notify the court about your actions and ask the court to close it.

Full Answer

Can a missing will go through probate in Florida?

A missing will can go through probate in Florida with testimony of 1 (if there is a copy of the will) or 2 (no copy) disinterested witnesses.

Can you sell a house without probate in FL?

Without probate, the heirs cannot sell/convey/transfer the real estate. This process of an attorney opening a court file, procedurally moving what the deceased had to the rightful heirs, formally transferring title, is probate. Once title is transferred, the heirs have authority to sell/convey/transfer the real estate.

Does a last will and testament avoid probate in Florida?

No. Unfortunately, your beneficiaries will still be required to go through probate even if you have a will. Valid wills must be “proved” in a court of law and accepted as a valid public document as the true last testament of the deceased.

What happens if someone dies without a will in Florida?

- life insurance proceeds

- real estate, bank accounts, and other assets held in joint tenancy, tenancy by the entirety, or community property with right of survivorship

- property held in a living trust

- funds in an IRA, 401 (k), or retirement plan for which a beneficiary was named

- funds in a payable-on-death (POD) bank account

Can I file probate myself in Florida?

Yes, in almost all cases you will need a Florida Probate Lawyer. Except for “disposition without administration” (very small estates) and those estates in which the executor (personal representative) is the sole beneficiary, Florida law requires the assistance of an attorney.

Can you go through probate without a lawyer in Florida?

For all but the simplest estates, Florida law requires that the personal representative of an estate hire a probate attorney to guide him or her through the process. While hiring an attorney might seem like an unnecessary burden, an attorney should help make the probate process as efficient as possible.

How much does an estate have to be worth to go to probate in Florida?

$75,000Formal administration is the more involved variety of Florida probate. Formal administration is required for any estate with non-exempt assets valued at over $75,000 when a decedent died less than two years ago.

How long do you have to file probate after death in Florida with no will?

How Long do You Have to File Probate After Death in Florida? You must file the will with the court within 10 days after death. Once the will is filed, you can file a petition to start the probate process. If the person died without a will, then you can file the probate directly after the person's death.

What is the average cost of probate in Florida?

For estates of $40,000 or less: $1,500. For estates between $40,000 and $70,000: $2,250. For estates between $70,000 and $100,000: $3,000. For estates between $100,000 and $900,000: 3% of the estate's value.

Who decides if probate is needed?

Whose responsibility is it to get probate? If the person who died left a valid will, this will name one or more executors, and it is their responsibility to apply for probate. If there isn't a will, then inheritance rules called the rules of intestacy will determine whose responsibility it is to get probate.

Do bank accounts go through probate in Florida?

Examples of assets that must go through probate in Florida are bank or investment accounts owned solely in the name of the decedent (although these accounts can be made payable on death to avoid probate – but you have to specifically ask the bank to make the account “P.O.D.”); and, life insurance, annuity contracts or ...

Does probate look at bank accounts?

Many banks and other financial institutions will not require sight of the grant of probate or letters of administration if the account value is below a certain amount. This threshold is determined by the bank, and as such this varies for each bank and financial institution.

What triggers probate in Florida?

If a person passes away without a will or trust and has assets in their name ONLY, then probate is required to distribute property and monies. If property, bank accounts, insurance policies, annuities, 401K plans, and all assets have beneficiaries or joint owners, probate is unnecessary.

What happens if you don't probate a will in Florida?

Without going through the probate process, no one will know which assets they are entitled to receive from their loved one's estate, assets may unnecessarily be lost to creditor claims, and heirs and beneficiaries will lack the certainty they need to move on.

Can you go through probate without a lawyer?

The simple answer is... yes! For the vast majority of probate cases, a lawyer is not required to probate a will. In fact, anyone can interact with the court system and you can do probate without a lawyer.

Does a car have to go through probate in Florida?

Florida Statute 319.28 says that if the owner of the car died without a Will, there is no need to have an Order from the probate court authorizing the transfer of the car.

Can I open an estate by myself?

Unfortunately you cannot open an estate by yourself. You will need to hire an attorney to file for probate in Miami.#N#If you need to take the estate through probate it must be because there are assets in the name of your wife alone.

Does Florida require an attorney for probate?

The Florida Probate Rules require the use of an attorney in most actions in the probate court. If you are unable to afford an attorney, you may wish to contact the Miami-Dade County Bar Association Referral Service. There may be attorneys in that county who may be able to assist you on a reduced fee or pro bono basis.#N#More

What happens if a will is not found in Florida?

If the original cannot be located, it is presumed destroyed with the intent to revoke the will. Under Florida statute 732.901, the original will is supposed to be deposited with the clerk of court where the deceased resided within 10 days of receiving information that the testator is dead. If the original will cannot be located, but ...

What is required to admit a will to probate in Florida?

If the original will cannot be located, but the presumption of revocation is overcome, testimony of at least one disinterested witness will be required to admit the will to probate if a copy can be located, under Florida statute 733.207. If a copy cannot be located, the testimony of two disinterested witnesses is required.

How long does a creditor have to file a claim in an estate?

Known creditors must be given a Notice to Creditors, stating that the creditor has 90 days within which to file a creditor claim in the estate. Notice to Creditors must also be published in the local newspaper, alerting such creditors of the deadline for filing creditor claims. Marshall Assets, Preserve and Protect.

Who needs a notice of administration in Florida?

Florida law requires that a Notice of Administration be provided to beneficiaries named in the will, as well as surviving spouses.

Who should take custody of the assets of the deceased?

Once the estate has been opened and letters of administration issued to the personal representative, the personal representative should take custody of the assets of the deceased that are properly part of the probate estate.

How long does it take to close an estate?

Creditor lawsuits can go on for years. If the estate is subject to the estate tax, it will require a minimum of two years to close the estate, usually longer.

What happens if you die without a will?

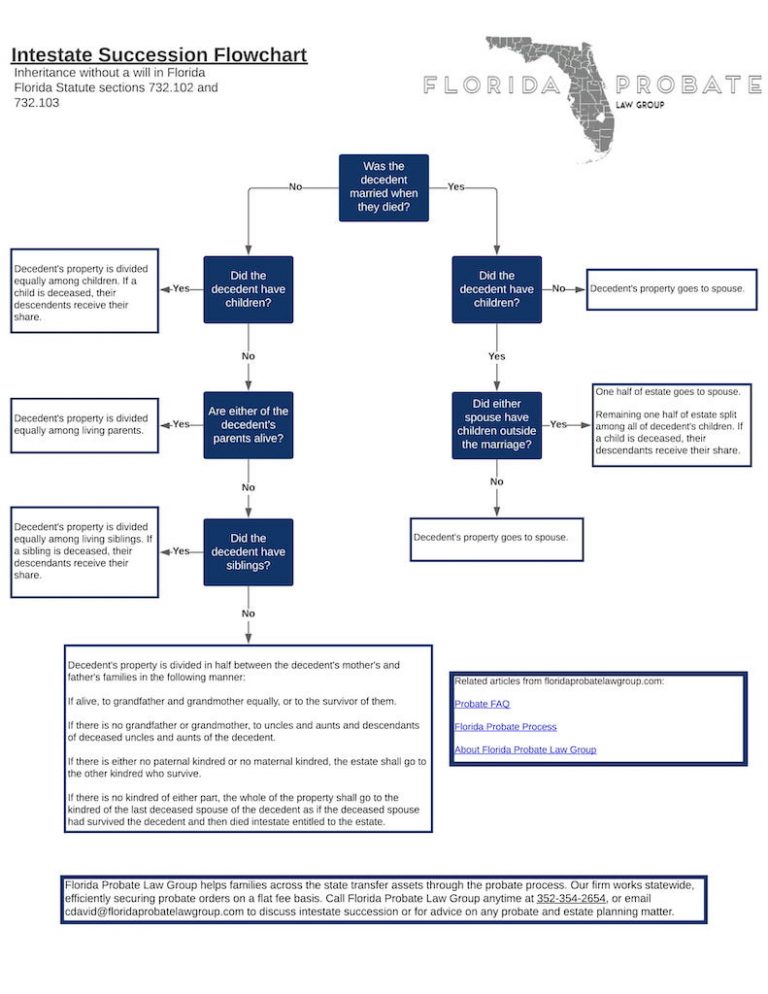

When a person dies without a Last Will and Testament, they are deemed to have died "intestate". In many respects, the probate process is similar with or without a Will. However, one must make a critical analysis of who the rightful heirs will be pursuant to state law regarding intestate succession. When there is no Will, you must consider ALL heirs ...

What happens when there is no will?

When there is no Will, you must consider ALL heirs of the decedent, including those who died before the decedent. This can get complicated in large families. Even small families may face problems if the decedent was survived by multiple generations of heirs.

What is the intestate estate?

—The part of the intestate estate not passing to the surviving spouse under s. 732.102, or the entire intestate estate if there is no surviving spouse, descends as follows:#N#(1) To the descendants of the decedent.#N#(2) If there is no descendant, to the decedent’s father and mother equally , or to the survivor of them.#N#(3) If there is none of the foregoing, to the decedent’s brothers and sisters and the descendants of deceased brothers and sisters.#N#(4) If there is none of the foregoing, the estate shall be divided, one-half of which shall go to the decedent’s paternal, and the other half to the decedent’s maternal, kindred in the following order:#N#(a) To the grandfather and grandmother equally, or to the survivor of them.#N#(b) If there is no grandfather or grandmother, to uncles and aunts and descendants of deceased uncles and aunts of the decedent.#N#(c) If there is either no paternal kindred or no maternal kindred, the estate shall go to the other kindred who survive, in the order stated above.#N#(5) If there is no kindred of either part, the whole of the property shall go to the kindred of the last deceased spouse of the decedent as if the deceased spouse had survived the decedent and then died intestate entitled to the estate.#N#(6) If none of the foregoing, and if any of the descendants of the decedent’s great-grandparents were Holocaust victims as defined in s. 626.9543 (3) (a), including such victims in countries cooperating with the discriminatory policies of Nazi Germany, then to the descendants of the great-grandparents. The court shall allow any such descendant to meet a reasonable, not unduly restrictive, standard of proof to substantiate his or her lineage. This subsection only applies to escheated property and shall cease to be effective for proceedings filed after December 31, 2004.

Do you have to go through probate if you have a last will and testament?

There is a common misconception that if you have a Last Will and Testament, then you don't have to go through probate for the estate. There is also a misconception that if there is no Will, then you cannot probate an estate. Both of these misconceptions are false . Probate is NOT determined by whether or not a Last Will and Testament exists.

Avoiding Probate in Florida

To avoid probate in Florida, a person must use legal tools to ensure their property is owned in some way other than solely in their individual name. The overriding goal of probate is to convey the decedent’s assets to whom they wanted, how they wanted, and free and clear of creditor claims.

Understanding How to Avoid Probate

The primary purpose of probate is to transfer a decedent’s assets to their intended heirs free of debts. Probate is a legal procedure to transfer legal title of the decedent’s property to the heirs listed in the decedent’s will and to pay any creditors to whom the decedent owed money at the time of their death.

Why Do People Want to Avoid Probate?

Because probate entails filing legal documents, court hearings, and attorney representation, probate in Florida is lengthy and expensive. Families typically have to wait six months or more to complete the probate legal process and receive their inheritance.

Ways to Avoid Probate in Florida

Some of the most common legal tools to avoid probate in Florida involve joint ownership with rights of survivorship, beneficiary accounts, lady bird deeds, and living trusts.

Popular Posts:

- 1. what is difference in attorney and lawyer

- 2. how many years to become a lawyer in mexico

- 3. where in the bible say if we need a lawyer we have a lawyer in jesus christ

- 4. how much schooling to become a real estate lawyer

- 5. a non-lawyer who is unlawfully practicing law can be sued for malpractice

- 6. what are the requirments to become a lawyer in maryland

- 7. what are the bachelors.degree prereqyisite for.a lawyer

- 8. how to apply to an email from a partner as an associate lawyer

- 9. “rectal rehydration,” which his lawyer calls sodomy, while at a black site.

- 10. what are lawyer fees for house closing