How do you prepare a lien?

- The lien waiver and the lien release are NOT the same. ...

- The lien waiver is submitted BEFORE a mechanics lien is filed. ...

- The lien release is submitted AFTER a mechanics lien has been filed. ...

- Some states require a lien release to be submitted while others have no specific requirement. ...

Is it bad to have a lien on Your House?

It’s generally considered to be a bad thing if you have a lien on your property. However, I’m going to let you in on a little secret: Lots of people have one on their home. Although liens generally get a bad rap, the reality is a little more nuanced than traditional thought.

How to put a lien on someone?

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

How to sell a home with a lien?

Common types of liens:

- Mortgage Lien

- Judgment Lien

- Mechanic’s Lien

- HOA Lien

- Property Tax Lien

- Child Support Lien

How is lien made?

A lien is often granted when an individual takes out a loan from a bank to purchase an asset. For example, if an individual purchases a vehicle, the seller would be paid using the borrowed funds from the bank. In turn, the bank would be granted a lien on the vehicle.

How do you get around a lien?

How to remove a property lienMake sure the debt the lien represents is valid. ... Pay off the debt. ... Fill out a release-of-lien form. ... Have the lien holder sign the release-of-lien form in front of a notary. ... File the lien release form. ... Ask for a lien waiver, if appropriate. ... Keep a copy.

How do you file a lien in California?

Preparing the California Lien Form. Download a free Claim of Lien form. Video: Preparing the lien form. Information to include on a California Mechanics Lien Form. The lien claim amount. ... Serve your lien on the property owner. Prepare a Proof of Service Affidavit.File the lien with the county recorder's office.

How do I file a lien in Florida?

A Florida mechanics lien must be in the proper format and filed in the county recorder's office in the county where the property is located within the required timeframe. To record a lien in Florida, you will need to bring your completed Claim of Lien form to the recorder's office and pay the filing fee.

What is a lien on property?

A lien is the right of a person who has lawfully received property belonging to another to retain that property for so long as a debt owed by the owner of the property remains unpaid. Liens may be recognised by common law or may be created by contractual agreement.

What does a lien on a house mean?

A lien refers to a legal claim against property that can be used as collateral to repay a debt. Depending on the type of debt owed, liens can be attached to real property, such as a home, or personal property, such as a car or furniture.

How much does it cost to file a lien in California?

The fee for filing an initial lien is $150.00.

How do I put a lien on a property in California?

You can place a lien on the debtor's recovery in a pending lawsuit by:Having the court issue an Abstract of Judgment – Civil and Small Claims (Form EJ-001 ). ... Prepare a Notice of Lien (Form EJ-185 ).File the 2 forms with the court where the debtor's lawsuit is pending.More items...

Can a contractor file a lien without a contract in California?

If the contractor isn't paid, he can sue on the contract and record a mechanic's lien. But subcontractors, workers and suppliers don't have a contract with the property owner.

Can you file a lien without a notice to owner in Florida?

Prior to filing a lien, a lienor who does not have a direct contract with the owner, must serve the owner with a Notice to Owner.

Who can lien a property in Florida?

WHO CAN FILE A CLAIM OF LIEN? There are two categories of individuals that can file a Claim of Lien: persons in privity of contract with the property owner and persons not in privity of contract with the property owner.

Can a handyman file a lien in Florida?

It is not uncommon for property owners to refuse to pay contractors, subcontractors, laborers, or suppliers after they have already performed work improving the owner's property. Luckily, those individuals can turn to Florida's Construction Lien Law, found in Fla. Stat.

What Is A Lien?

A lien refers to a legal claim against property that can be used as collateral to repay a debt. Depending on the type of debt owed, liens can be at...

How Do I Remove A Lien?

To have a lien removed from your property, you’ll typically have to convince the lien holder to remove it – most often, by paying them or by negoti...

How Do Liens Work?

There are a few different types of liens, each with their own nuances, but in general, a lien means that the lien holder has a right to the propert...

What Types Of Liens Are Available?

A mortgage is a type of lien called a voluntary lien. When you get a mortgage, you agree that the home you’re purchasing will act as collateral in...

What Is Tax Lien Investing

Tax lien investing is the act of buying the delinquent tax lien on a property which is in the first lien position, or has first priority from any l...

Tax Lien Investing Risks and Benefits

There’s no question investing in tax lien properties does contain it within some amount of risk. But when compared to other forms of investing it c...

How Do I Buy Tax Lien properites?

To Buy tax lien properties, you must follow a specific blueprint. The bidding process for purchasing tax liens is typically preformed as an auction...

Types of Liens

Consensual liens are created by contractual obligations between the concerned parties. The most common examples are loans obtained to purchase real estate Real Estate Real estate is real property that consists of land and improvements, which include buildings, fixtures, roads, structures, and utility systems.

Example of Lien

John wants to purchase a new house. In order to afford the purchase, he borrows $300,000 from ABC Bank. The bank wants to guarantee the repayment of the loan, and it requires John to provide the house as the collateral for the loan.

Additional Resources

CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career.

What Is a Perfected Lien?

A perfected lien is a lien that has been filed with the appropriate filing agent in order to make the securing interest in an asset binding. A lien is used in secured loans and integrated into the lending contract. Liens can also be involved in other special situations.

How Perfected Liens Work

There can be several types of liens and perfected liens. A perfected lien is a binding document that has been filed with the appropriate agency allowing for a legal claim to seize assets if a payor defaults. Commonly, a perfected lien is enacted for the purpose of legally securing collateral for a creditor in a secured loan.

Secured Loans

Secured loans require a lien since the loan is backed by a specified collateral asset. Secured loans can be offered against a range of collateral types, the most common being real estate used in mortgage loans. Other types of collateral loans include secured loans for commercial equipment, automobiles, art, or jewelry.

Lien Types and Other Special Considerations

In most cases, a lender will perfect a lien at the time of purchase and closing. In some situations, a lender may not take steps to perfect a lien until they feel they are at risk of not receiving their full payments. Different states and scenarios can have their own rules about liens and perfected lien filings.

Perfected Lien Filing

In the legal industry, perfected is a term that refers to the process of officially filing a claim in order to make it legally binding. Perfected liens have various filing requirements based on the situation, type of collateral, and state or federal rules.

Lien vs. Levy

It can be important to understand the distinction between a lien vs. a levy when a lien has been documented and a perfected lien has been filed. A lien provides documentation that an associated party, usually a lender, has secured collateral repossession rights if a default occurs.

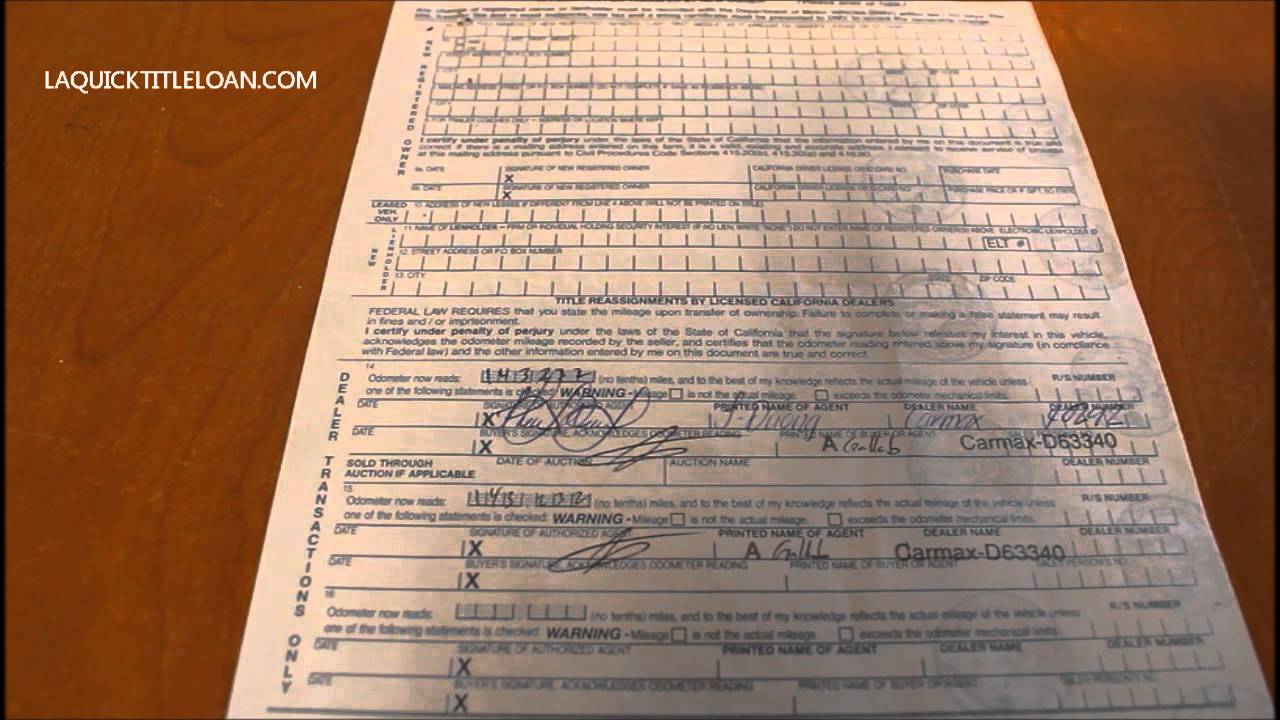

What is a Lien Title?

First, what is a lien title? A lien title refers to the fact that another entity (not necessarily the “owner”) has rights to a piece of property. In this case, the property is a vehicle, and the lien title likely means the registered owner still owes money on a loan.

Is a Lien Title Bad?

On its own, a lien title isn’t necessarily a bad thing. If you have a vehicle you bought with financing, or you’re leasing a vehicle, then there is a lien on the title. The title itself will show the lienholder, whether a bank, vehicle manufacturer, or a related body, as well as the registered owner.

How Does a Lien Work?

While a lien isn’t always a negative thing, it’s important to understand how the lien process works.

Can You Sell a Car with a Lien?

The short answer is yes, you can sell a car with a lien on it. However, it can be more complicated than selling a car you own outright.

Should You Buy a Car with a Lien?

Buying a car with a lien is one way to purchase the vehicle you want at a reasonable price. However, you should do thorough research and make sure your assets have proper protection (via an escrow service or other option) throughout the transaction.

What Is A Tax Lien?

A tax lien is a legal claim applied to a property when the owner fails to pay required taxes to the government. Tax liens total the amount of outstanding taxes, plus interest or additional fees accumulated by the property owner.

What Is Tax Lien Investing?

Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral securing the loan.

Are Tax Liens A Good Investment?

Tax lien certificates can certainly be an excellent investment to add to your portfolio, as long as you know how to find tax-delinquent properties. Like any other investment, the key is to know as much as you can about the property, the neighborhood, and the town in general.

How Do Tax Liens Affect Mortgages?

Tax liens do not necessarily affect mortgages, but they do impact homeowners (and their credit). Property tax liens are treated as a separate debt alongside a homeowner’s mortgage. When a property with a lien is sold, the lien remains associated with the property while the buyer applies for a unique mortgage loan.

Tax Lien Investing Pros And Cons

There’s no question investing in tax lien properties does contain some amount of uncertainty. But when compared to other forms of investing, it can actually have a much lower risk profile. (Though this can depend widely on certain factors.)

Buying Tax Liens in 6 Steps

Investors interested in buying tax liens will need to learn how real estate auctions work. While these processes are not complicated, they can be surprising to new investors. If you are interested in getting started, review the following steps to buying tax liens:

Pro Tips For Buying Tax Liens

Now that you understand the benefits of tax lien investing and how to purchase tax liens, here is more information that you should know before getting started. Read through the following tips before trying your hand at tax lien investments:

Selling Options for Vehicles with Liens

Once you've decided to sell your vehicle, you'll need to determine the pay-off amount.

Selling to a Dealer

The easier option of the two is selling your vehicle with a lien to the dealership where you intend to purchase your new car. Once you give the dealer a power of attorney, the dealer will contact the lender directly and handle all financial arrangements.

Selling to a Private Party

Though more effort will be required on your part, selling a car with a lien privately could net you a higher profit.

How to Buy a Tax Lien Certificate

County governments don’t like to wait for outstanding tax bills so they auction the liens off to local investors to generate quick cash. The auctions are often held at the county courthouse, but some counties even have online auctions.

Collecting Interest

As long as you hold a lien against your neighbors’ house, you will continue to accrue interest on your investment.

Compare Rates and Save on Your Auto Loan

One of the best ways to save money on a car is to buy a used vehicle. It’s possible to save even more money by buying a used car directly from its prior owner, rather than going to a dealership. But this also poses a chance that the seller is still paying off the car, which means there’s a lien on the vehicle.

What Is a Lien?

A lien is a claim that another person called the lienholder (who’s usually a lender) has on a car. If the person you’re buying a car from still has an auto loan, that car will have a lien on it. In that case, the lender will hold the title for the vehicle and will release it once the loan is paid off.

How to Check if the Car Has a Lien

You can ask the person who’s selling the car whether they’re still paying off the loan or whether it has a lien on it. But it’s a good idea to verify it with another method, too. Luckily, it’s relatively easy to find this out.

How to Buy a Car With a Lien

It can be a little scary at first to learn that the car you want to buy has a lien. But it’s actually pretty common to find a lien attached to a vehicle if you’re buying it from a private seller. After all, car loans are getting longer and longer, and that increases the odds that someone will still be paying it off when they want to sell it.

Popular Posts:

- 1. how old is lawyer/judge kenneth futch pierce cpounty ga

- 2. search lyrics for everybody's telling me what i oughta be a doctor or a lawyer but i need a degree

- 3. does california require a lawyer when buying a house

- 4. what the most can a va lawyer charge

- 5. how a lawyer can organize their day

- 6. who is the lawyer in heineken commercial

- 7. fact check who is paying stormy daniels lawyer

- 8. when a lawyer works for a percentage

- 9. who retired because they didnt a right to lawyer or remain silent

- 10. how to be patent lawyer