Ways to Get Your Repossessed Vehicle Back

- Pay your back payments plus fees (varies by state and contract)

- Redeem your vehicle by paying it off in full

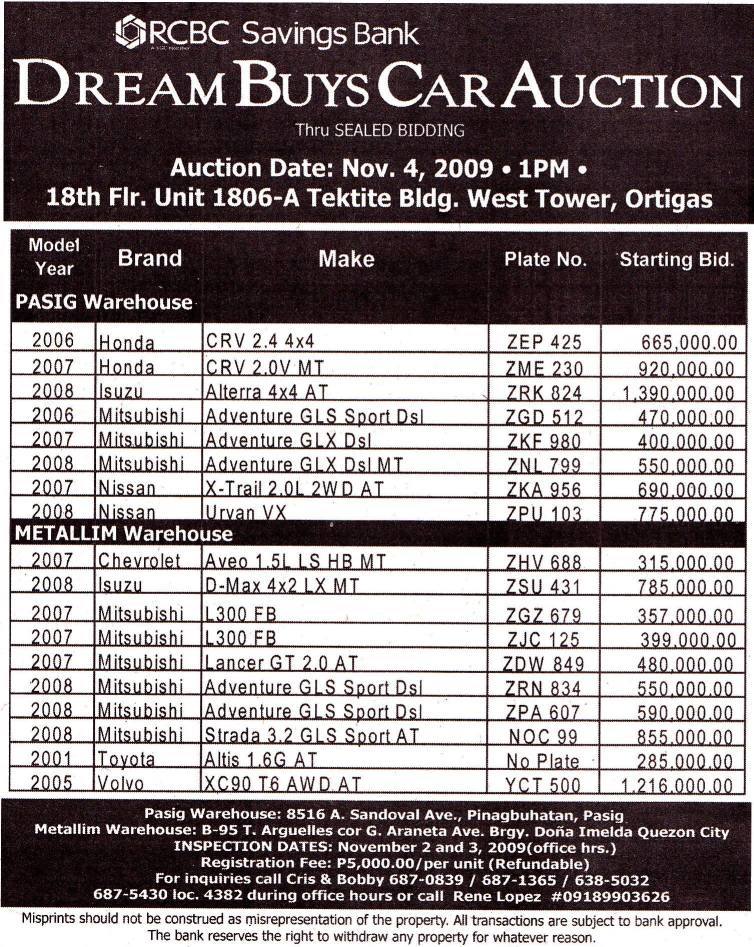

- Buyback your vehicle at auction 1

- Agree to an electronic disabling device 2

- File for bankruptcy 3

Full Answer

How can I Save my Car from being repossessed?

Dec 09, 2021 · If your car is repossessed, to redeem it (take ownership back), you have to pay off the balance that you owe. Keep in mind, this balance will include any repossession fees and charges, including storage, towing, and attorneys’ fees. The lender will notify you to give you the option to redeem the car.

How do you stop your car from getting repossessed?

Mar 25, 2022 · If your car has been repossessed, then you may need to scrape together some money and call the lender to see how you can get the car back. According to Credit Karma, the laws for getting your car back can vary from state to state, but here are some possible ways to get it back: Reinstate the car loan: Depending on your state, your auto loan ...

How do you get a car back after repossession?

Jan 31, 2020 · How to Get a Repossessed Car Back: File for Bankruptcy If you’re struggling with other debts and plan to file for bankruptcy, doing so can increase your chances of holding onto the car. Filing for bankruptcy involves the courts and makes it a legal requirement for the creditor to ask permission from a judge to repossess the vehicle.

What do you do to get your car back after Repo?

Oct 29, 2021 · The best way to get your car back is to call your bank or lender. Often, they may give you your car back if you agree to pay the loan in full, along with repossession fees. But keep in mind that once a car is repossessed, banks or repossession companies begin the process of selling it at an auction.

Can a car repossession be reversed?

Often, a bank or repossession company will let you get your car back if you pay back the loan in full, along with all the repossession costs, before it's sold at auction. You can sometimes reinstate the loan and work out a new payment plan, too.

How do you recover from a repossession?

How do you recover after a car repossession?Speak to your lender. If your car is repossessed, you should immediately call your lender. ... Determine if you can get your car back. ... Recover your personal property left in the car. ... Pay outstanding debts. ... Make a plan. ... Ask for help.Aug 11, 2020

Should I pay off a repossession?

Paying off a repossession can help your credit score since it reduces debt owed, and you may be able to get the item removed from your credit report. However, the significance of impact on your score depends on your credit history and profile and whether you take a settlement.

How long does it take to recover from a repo?

A repossession takes seven years to come off your credit report. That seven-year countdown starts from the date of the first missed payment that led to the repossession. When you finance a vehicle, the lender owns it until it is completely paid off.Sep 7, 2020

What happens to your personal belongings when your car is repossessed?

Your personal belongings are your personal belongings. If a repo company took your car, you have the right to get these belongings back without having to pay a fee. Even if your car has been repossessed, you have rights including the right to get your personal belongings back.Oct 5, 2021

Do you still owe money after repossession?

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

How many months can you be behind on your car payment?

about 3 monthsTypically, most lenders wait until you are about 3 months behind on car payments. Although you can be considered in default after 30 days, lenders may wait 90-120 days before taking action. In addition to an added sense of uncertainty, repossessions also leave a negative mark on your credit history.

Can you negotiate after repossession?

Ideally, you should start these negotiations before the repossession process. If you negotiate after repossession, however, you may be able to use any questionable actions by the lender during that process to help bolster your bargaining position.Oct 18, 2021

When Can a Car Repossession Happen?

Did you read the fine print when you signed your auto loan? If not, you might want to do so right now. Likely, there’s a clause that says if you miss X number of payments, the lender has the right to seize your vehicle to cover what you owe on the loan. A number of situations can result in your not being able to make your loan payment.

How to Get Your Car Back from a Repossession

Whether you can get your car back after being repossessed depends on several factors. First, how many months you’ve gone without making a payment on your loan. If it’s been a month or two, your lender may work with you to let you catch up on late payments and get your vehicle back.

Can You Refinance a Car Loan After Repossession?

So, can you refinance an auto loan after repossession? Possibly. It might make sense to refinance with the lender you already have a loan with. But realize you’ve got a lot working against you there, since that lender has already seen you miss payments and has had to go to the trouble of repossessing your car.

Sample Refinance Options After Repossession

Here are a few lenders you might consider for refinancing your car loan after repossession, based on results found with the search terms “best repossession refinance loans” on July 5, 2021.

Watch Out for Predatory Lenders

When you start looking for refinancing options after your car is repossessed, you may come across lenders who seem ready to bend over backwards to get you the refinance loan you need. But that comes at a price. These lenders may say that even if you have bad credit, you can qualify for a car loan.

How Long Does a Car Repossession Affect Your Credit?

So does refinancing hurt your credit? No, but a car repossession probably will. It can result in negative marks that can stay on your credit report for seven years from when you stopped paying your auto loan and make it more difficult to get another loan. There are several ways the car repossession can affect your credit.

Repossession?

There is one way you may be able to mitigate a little of the damage that getting your car repossessed can cause (including the embarrassment of having your car towed out of your driveway). It’s called voluntary surrender.

How to get your car back after repossession?

If you still have your vehicle, but a repossession is soon, you may have a few options to explore: 1 Opportunity to cure – Also called reinstating your loan, it means paying back what you owe and resuming your loan. To do this, it usually involves repaying all missed or late payments to catch back up, typically required with one lump sum. Once you’re caught up, you resume paying as normal. Not all auto loan contracts or lenders allow this, so talk to them about your options. 2 Voluntary surrender – If you know that repossession is imminent a voluntary surrender can save you money. If you wait for the repossession company to take your car, you end up paying the costs incurred in the process. Many recovery companies charge hundreds of dollars, but if you give up the vehicle yourself, that fee doesn’t appear. Additionally, you get the chance to drop off the car at your convenience and remove all your personal belongings.

How long do you have to give notice of a car being repossessed?

Your lender is typically required to give you at least a 10-day notice before the sale .

How much down payment do you need for a BHPH?

A BHPH dealer may require a down payment of around 20% of the vehicle’s selling price.

How long does a repossession last?

Repossession is recorded on your credit reports for up to seven years. A recent repo can make getting approved for another auto loan tough. Most lenders don’t approve borrowers with a repossession that’s less than one year old.

Can you resell a car at auction?

In some cases, a dealer may resell the vehicle privately, but the goal is the same. Here’s the kicker: if you do have the funds to your car back at auction, you’re still responsible for the auto loan amount.

How to get your car back after repossession?

Once your car is repossessed, your auto lender may offer two options so you can get your car back, neither of which involve refinancing a loan: 1 Reinstating your vehicle loan if you make all back payments plus all costs of the repossession. 2 Sell you your car if you pay the balance due on the loan plus any repossession costs.

What is voluntary repossession?

A voluntary repossession is where you surrender your car because your lender has asked for it or you’re expecting the lender will ask for the car anyway and want to make the process easier. This can reduce your creditor’s expenses, which you’d be responsible for paying after the repossession.

What happens if you don't pay off your car loan?

If that isn’t enough money to pay off the balance, then you’ll owe a deficiency balance that will be reported to the credit bureau and listed on your credit report and will hurt your credit score. And, don’t forget, you’ll still owe that balance.

How long does it take to get a bad credit car loan?

Most bad credit car loan sites stipulate they can reach a decision within 24 hours. The loan application process takes only a few minutes, so it’s easy to apply to a few of these companies to see if you qualify for a loan and then get to a car dealership to buy a car.

How much down payment do you need for a subprime loan?

A subprime loan after a repossession will likely require a down payment. Even without a repo, subprime lenders typically require at least $1,000 or 10% of the vehicle’s selling price, according to Auto Credit Express. A trade-in with equity can also meet that requirement.

Can a credit union repossess a car?

If you stop paying your credit card bill, the credit union could repossess the car it financed for you — even if your car payments are made on time.

What is repossession on credit report?

A repossession is usually a last-resort option for a lender after a borrower has stopped making payments. It’s considered derogatory on a credit report, meaning it will have a substantial negative impact on credit scores. It can lead to a borrower paying higher rates to make up for the added risk the lender is taking.

What to do after a car is repossessed?

After Repossession. Immediately after your creditor repossesses your car, you can contact it to discuss your options for getting the car back. Generally, this requires either paying off the loan in full or making your past due payments plus repossession fees. If this is not an option, the lender will begin making arrangements to sell ...

What happens when you have a car loan?

When you have a car loan, the lender is listed on your title as a secured lien holder. Once the lender repossesses your car, it must remove your name from the title before it can sell your vehicle at auction.

Can you surrender your license plate?

The plates and tags remain with you. Depending on your state laws, you may surrender your plates to your state's Department of Motor Vehicles (DMV) to cancel your registration.

Can you sell a car at an auction?

If this is not an option, the lender will begin making arrangements to sell the car at a public auction. Once it auctions off the car, it will apply any proceeds from the sale to the outstanding balance on your loan. If there is still a balance on the loan after the lender applies the sale proceeds, you will be responsible for paying ...

Popular Posts:

- 1. what type of lawyer helps subcontractors get payments

- 2. syracuse ss disability lawyer .who only gets paid if you win

- 3. lifetime movie woman who abuses boyfriend he works in construction and she is lawyer

- 4. knowing when to consult a divorce lawyer

- 5. what movie was cher a lawyer in

- 6. how to get a pro bono lawyer for a criminal case

- 7. which of james comey's children is a lawyer

- 8. dc lawyer who handles claims against nursing board

- 9. when you pay for a lawyer up front but stop utilizing their services they owe you?

- 10. how you could be a lawyer