To form an LLC in NC, you'll need to file the Articles of Organization The articles of organization are a document similar to the articles of incorporation, outlining the initial statements required to form a limited liability company in many U.S. states. Some states refer to articles of organization as a certificate of organization or a certificate of formation. Once filed and approved by the Secretary of State, or other company registrar, the articles of organization legally create th… The North Carolina Secretary of State is an elected official in the U.S. state of North Carolina, heading the Department of the Secretary of State, which oversees many of the economic and business-related operations of the state government. Unlike in many states, the Secretary of State does not oversee state elections.Articles of organization

North Carolina Secretary of State

- Choose a name for your North Carolina LLC.

- Appoint a registered agent for your LLC.

- File Articles of Organization.

- Prepare an operating agreement for your North Carolina LLC.

- Get an EIN & comply with tax & other regulatory requirements.

- File annual reports with the North Carolina Secretary of State.

How do you start a LLC in NC?

Starting an LLC in North Carolina is Easy. To form a North Carolina LLC, you'll need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125.You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.

How to start my LLC in NC?

Starting an LLC in North Carolina

- Complete a Name Reservation Application. ...

- If your LLC has more than one member, it is highly recommended that you have a Limited Liability Company Operating Agreement. ...

- Become familiar with all legal obligations, in particular, annual reports.

How to form a professional LLC in North Carolina?

Steps to Found a North Carolina PLLC

- Deciding on a Name. Finding an appropriate name for a new company is always a good place to start. ...

- Finding a Registered Agent. Every North Carolina limited liability entity, professional types included, is obligated to hire the services of a registered agent to facilitate the legal ...

- Drafting the Articles of Organization. ...

How do you apply for LLC in NC?

Submitting Documents

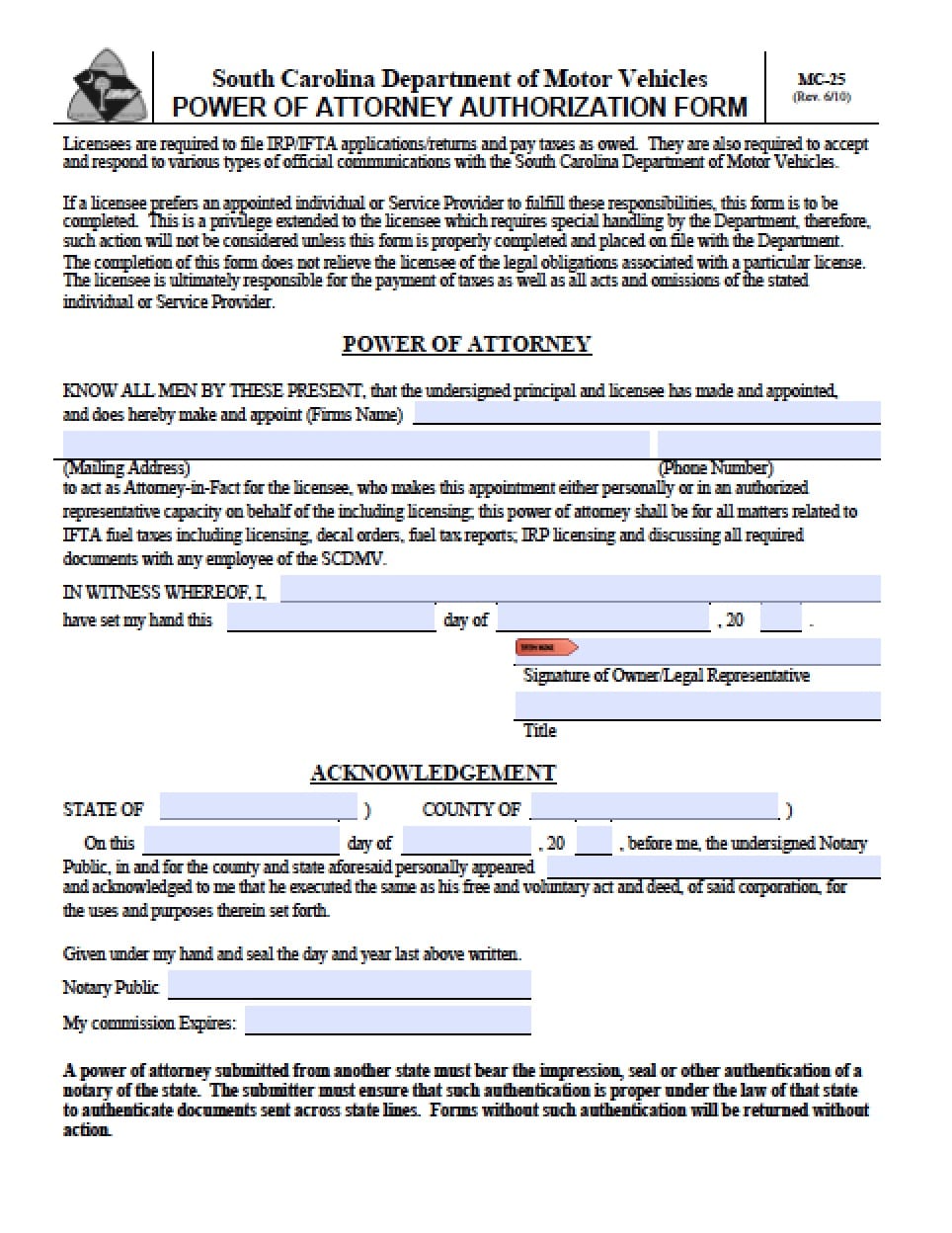

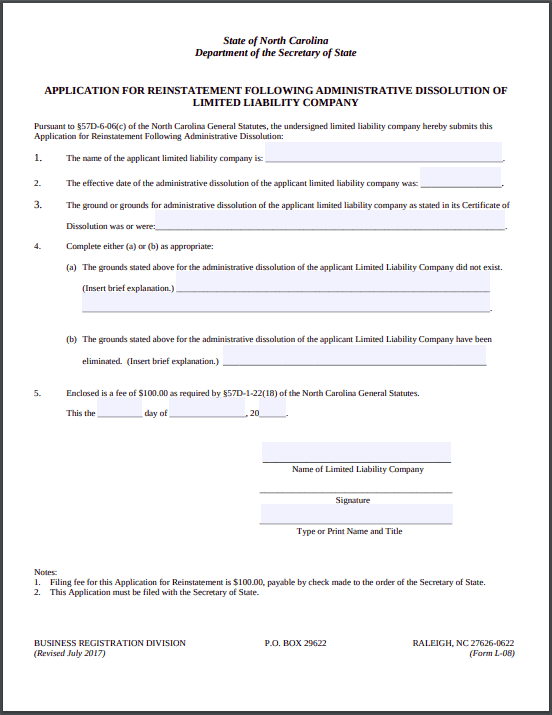

- Online through our PDF Upload Portal .

- Mail Type of Document Mailing Address Annual Report Business Registration Division PO Box 29525, Raleigh, NC 27626-0525 Any other type of document Business Registration Division PO Box 29622, Raleigh, NC ...

- You may deliver your documents directly to us in person between 8:00 a.m. ...

What forms do I need to start an LLC in NC?

To form an LLC in NC, you'll need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.

Can I be my own registered agent in North Carolina?

Can I Be My Own Registered Agent In North Carolina? Yes, any owner or employee of a business can be its registered agent in North Carolina as long as they are over the age of 18, and have a street address in North Carolina.

How long does it take for an LLC to be approved in NC?

7-10 business daysYour North Carolina LLC will be approved in 7-10 business days (regular filing) or 2-3 business days (expedited filing). After your LLC is approved, you will receive an email with your stamped and approved Articles of Organization.

Do you have to pay for an LLC Every year in NC?

The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

How much does LLC cost in NC?

a $125How much does it cost to form an LLC in North Carolina? The North Carolina Secretary of State charges a $125 filing fee for the Articles of Organization. It will cost $30 to file a name reservation application if you wish to reserve your LLC name prior to filing the Articles of Organization.

Can I use a PO Box for my LLC in NC?

North Carolina Registered Agent Requirements Every LLC, both foreign and domestic, must have a Registered Agent with a registered office within the State of North Carolina at all times. The Registered Office must be in the State of North Carolina and located at a street address (a P.O. Box only is not acceptable).

How do I get an EIN number in NC?

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

How do I register my LLC?

How to Set Up an LLCDecide on a Business Name. ... Designate a Registered Agent. ... Get a Copy of Your State's LLC Article of Organization Form. ... Prepare the LLC Article of Organization Form. ... File the Articles of Organization. ... Create an Operating Agreement. ... Keep Your LLC Active.

How much does it cost to register a business in NC?

FeesDomestic & Foreign Business Corporations*FeeArticles of Incorporation$125Application to Reserve a Corporate Name$30Notice of Transfer of Reserved Corporate Name$10Application to Register a Corporate Name by a Foreign Corporation$1028 more rows

How much does an annual report cost in NC?

Annual Report Due DatesType of entityFeeBusiness Corporations and BanksOnline $23.00* Paper $25.00Limited Liability Company (LLC or L3C )Online $203.00* Paper $200.00Partnerships (LLP and LLLP)Online $203.00* Paper $200.001 more row

Do you need a business license in NC?

Licensing. Your business may need a North Carolina business license, an occupational license, and/or environmental permits to meet zoning requirements for your specific type of business and location.

How often do I file taxes for my LLC?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

What is an LLC?

LLC is short for Limited Liability Company. It is a simple business structure that offers more flexibility than a traditional corporation while pro...

How do I name my North Carolina LLC?

You must follow the North Carolina LLC naming guidelines when choosing a name for your LLC: Include the phrase "limited liability company" or one o...

Do I need to get a DBA or Trade Name for my business?

Most LLCs do not need a DBA. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that nam...

Can I be my own registered agent in North Carolina?

Yes. You or anyone else in your company can serve as the registered agent for your LLC. Read more about being your own registered agent.

Is a registered agent service worth it?

Using a professional registered agent service is an affordable way to manage government filings for your North Carolina LLC. For most businesses, t...

How long does it take to form an LLC in North Carolina?

Filing the Articles of Organization can take up to two weeks, but can be expedited for an additional fee.

What is the difference between a domestic LLC and foreign LLC?

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. Normally when we refer to an LLC we are actua...

How much does it cost to start a North Carolina LLC?

The cost to start a North Carolina LLC is $125. To learn more, read our guide on the cost to form a North Carolina LLC.

Do I need to file my operating agreement with the state?

No. The operating agreement is an internal document that you should keep on file for future reference. However, many states do legally require LLCs...

How do I get an EIN if I don’t have a social security number?

An SSN is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to comp...

How to start an LLC in North Carolina?

Choosing a company name is the first and most important step to starting an LLC in North Carolina. Be sure to choose a name that complies with North Carolina naming requirements and is easily searchable by potential clients.

What happens when you mix your personal and business accounts in North Carolina?

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your North Carolina LLC is sued. In business law, this is referred to as piercing the corporate veil.

What is LLC in business?

LLC is short for Limited Liability Company. It is a simple business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. An LLC is one of several business structures, such as a sole proprietorship, partnership, and corporation (C corp and S corp).

What does "LLC" mean in a name?

Your name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.).

What is a domestic LLC?

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. Normally when we refer to an LLC we are actually referring to a domestic LLC. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state.

What are restricted words in LLC?

Restricted words (e.g. Bank, Attorney, University ) may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your LLC.

Do LLCs have to report income to the IRS?

Most LLCs will need to report their income to the IRS each year using:

Requirements for Forming a North Carolina LLC

You form an LLC in North Carolina by filing the Articles of Organization with the North Carolina Secretary of State. The Articles of Organization must be submitted by all LLC's organizers and include the following information:

Forming an LLC in North Carolina: The Basics

Although most states have similar procedures for forming LLCs, it's important to look up the exact procedure in your state. The following table provides an overview of the required steps for forming an LLC in North Carolina and links to relevant statutes and government agencies.

Forming an LLC in North Carolina: Related Resources

For additional information and resources related to this topic, please click on the links listed below.

Get Professional Legal Help to Start Your North Carolina LLC

Even though the information and links above provide a clear to guide to starting an LLC, nothing beats the peace of mind you'll get by having an experienced professional review your paperwork.

How much does it cost to form an LLC in North Carolina?

To form a Limited Liability Company in North Carolina, file the Articles of Organization with the North Carolina Secretary of State. The LLC filing fee is $125, and approval is typically around one week. For an additional $100, you can opt for a filing in under 24 hours.

What is the A section of an LLC?

Section “A” is used if the LLC has a principal office, and Section “B” is used if the LLC does not have a principal office. Section A – In this section, enter the street address, city, state, and zip code of the LLC’s initial principal office.

Why is it important to delay LLC filing?

The main reason for delaying the LLC start date is when the filing is being done close to the end of a calendar year, and the business will not have any activity until the start of the year. By delaying until the following year, they will reduce the number of end-of-year filings.

What are the benefits of LLC?

One of the significant benefits of the Limited Liability Company is the tax flexibility it provides . When applying for the Employer Identification Number, you will choose how the entity will be taxed for federal income tax purposes. While there are some limitations, an LLC may be classified for federal income tax purposes as a:

What is an LLC organizer?

An LLC Organizer is involved with the formation of the Articles of Organization. The Organizer may or may not become a member, such as a mentor, attorney, or accountant, but the initial members will all be listed as organizers.

What are the benefits of a limited liability company?

Besides the liability protection, the Limited Liability Company provides several other benefits over the sole proprietorship, partnership, and corporation because of the multiple tax options, ease of administration, and management flexibility .

Is it hard to form an LLC?

Forming an LLC is a little intimidating, especially when it’s your first time. Professional entity formation services help guide you to make sure it’s done right. Check out our reviews of popular LLC formation services to learn more.

What Benefits Does North Carolina Give to an LLC?

Unlike other states that require an operating agreement to be either written or oral, North Carolina allows for an LLC’s operating agreement to be implied, either in its entirety or in combination with written and/or oral portions.

Where Can I Find the Right Lawyer?

The process of forming a company in North Carolina can be complicated, and the decision of which business structure is right for you is an important one. Speaking with a North Carolina business lawyer will help you determine the risks, benefits, and process associated with forming an LLC in North Carolina.

What can an LLC do in North Carolina?

As a separate legal entity, your North Carolina LLC can be used to run a business or it can be used to hold assets, like real estate, boats, vehicles, and aircraft.

Can operating agreements be limited?

Note: Operating Agreements are not limited in nature. If necessary, you can add any additional provisions or sections.

Is it a good idea to have a separate phone number for a North Carolina LLC?

Getting a separate business phone number for your North Carolina LLC is also a good idea in order to keep your actual number private from those pesky “public record” websites.

How much does it cost to file an LLC in North Carolina?

The North Carolina Secretary of State charges a $125 filing fee for the Articles of Organization. It will cost $30 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

What is LLC in North Carolina?

Under North Carolina law, an LLC's name must contain the words: "Limited Liability Company, " or the abbreviations "L.L.C.," or "LLC," or the combination " ltd. liability co.," "limited liability co.," or "ltd. liability company."

How to file an annual report for an LLC in North Carolina?

In other words, any LLC in existence on or before April 15th of any given year owes an annual report for that year. LLCs that form after April 15th will not owe an annual report until April 15 of the next calendar year. The annual report may be filed online at the Secretary of State Online Annual Report Editor or by postal mail. The filing fee is $202, $200 for postal mail filings.

What happens if an LLC does not adopt an operating agreement?

If an existing or newly created LLC does not adopt an operating agreement, its existing articles of organization, bylaws or operating agreement , and/or its member control or limited liability company agreement will collectively become its operating agreement. 5.

How much does it cost to start an LLC?

Nolo's Online LLC formation service can complete all of the paperwork and filings for you, with packages starting at just $79.00.

What is LLC in business?

A limited liability company (LLC for short) is a way to legally structure a business. It combines the limited liability of a corporation with the flexibility and lack of formalities provided by a partnership or sole proprietorship.

Can a foreign LLC be a fictitious name?

If the name is not available, the foreign LLC must adopt a fictitious name for use in North Carolina. A copy of the resolution of the LLC's managers adopting the fictitious name must be attached to the application.

How much is the annual report for an LLC in North Carolina?

LLCs in North Carolina are required to file annual reports with the Secretary of State. This is done every year and is due on or before April 15 following the year of organization. This process may be done online or by mail. There is a $200 filing fee, which must be paid upon submission of documents. If you opt to submit your report online, there is an additional $18 electronic filing fee.

How to ensure your LLC name is approved?

However, the easiest way to ensure that your LLC name will be approved is to make it distinguishable from other LLCs and include specific words required of LLCs. You may opt to have a preferred name checked for availability before filing your LLC formation documents.

How much does it cost to file an LLC?

Forms and fees. LLC registrants are required to complete and submit Articles of Organization with the Secretary of State. The $125 filing fee must be paid upon submission of the documents. A registrant may opt to have expedited services. The expedited service fee for same-day processing is $200 and $100 for 24-hour processing. Fees can change, check with the Secretary of State for the most recent requirements.

Is an LLC operating agreement filed with the Secretary of State?

Limited liability company operating agreement. Although the LLC operating agreement is not filed with the Secretary of State, it is a good idea to have one in place for LLCs with more than one member. This document should be kept on file by the registered agent. 4.

Do LLCs need an operating agreement in North Carolina?

Create an operating agreement. Although LLCs in North Carolina are not required to have a limited liability company operating agreement, it is wise to have one in place with other members should your LLC have more than one member.

Can an LLC have more than one member?

An LLC with more than one member is also strongly advised to have a limited liability operating agreement among its members. Please take note that LLCs offering a specific professional service are obligated to contact the necessary North Carolina licensing boards as mandated by state law.

What is a North Carolina Professional LLC?

The professional limited liability company (PLLC) is a specialized type of LLC that is intended for licensed professionals to offer their unique services.

Forming a PLLC in North Carolina (in 6 Steps)

Your PLLC’s name is often the first impression you get to make on potential customers, and therefore it goes without saying that this is an important step. There are a few different aspects to take into consideration when selecting a name for your business:

Would You Prefer a Professional Form Your PLLC?

If you would prefer to have a professional handle the paperwork for you, consider hiring an online business formation service.

Next Steps: What to Do After Creating a PLLC in North Carolina

We highly recommend that you establish a separate business banking account so that your business and personal finances are maintained completely separate. This is important because it helps protect your personal assets and also makes filing taxes much easier.

Popular Posts:

- 1. lawyer who was murdered in the brindisi law offices in utica, ny

- 2. show when model comes back as lawyer

- 3. how to recover lawyer fees in a criminal case ga

- 4. who pays lawyer in injury settlement case

- 5. how much is a lawyer for child custody issues

- 6. why type of lawyer makes a will

- 7. what agencies might be helpful to be a lawyer

- 8. what to say to a disability lawyer online

- 9. how much is a lawyer for wrongful termination

- 10. how do i make a small change to my will without a lawyer