- Determine Whether Your Income Meets the Means Test. When considering whether to file bankruptcy without a lawyer, the first step is to conduct a “ Means Test " to ...

- Obtain Your Credit Reports and Complete Credit Counseling. The next step is to obtain credit reports from all three credit bureaus. ...

- Fill Out the Paperwork. Filling out the official bankruptcy forms is generally the most complicated and time-consuming task if you choose to file bankruptcy without a lawyer.

- Attend the Meeting of Creditors. You'll have to attend your “ Meeting of Creditors " on the scheduled date. ...

- Take a Personal Financial Management Instruction Course. Finally, you must complete a post-filing Personal Financial Management Instruction Course within 45 days of your meeting of creditors.

Full Answer

How to file "Chapter 7" bankruptcy yourself?

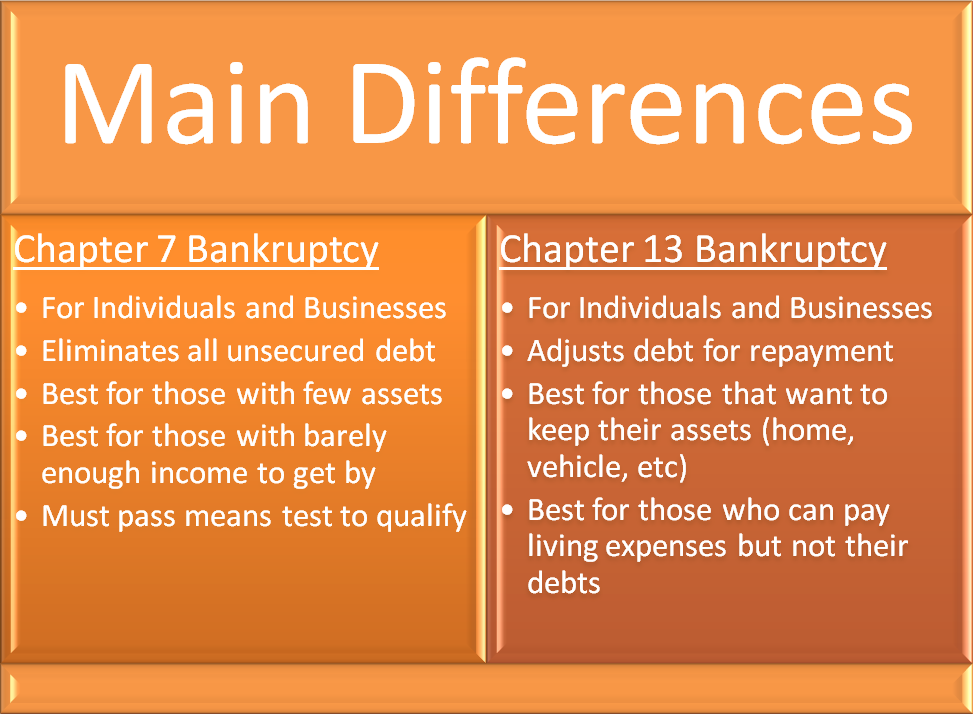

Filing Without an Attorney. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended because bankruptcy has long-term financial and legal outcomes. Filing personal bankruptcy under Chapter 7 or Chapter 13 takes careful preparation and understanding of legal issues.

Where can I find free bankruptcy Chapter 7 forms?

Nov 15, 2012 · For the most part, the people who are filing for bankruptcy without a lawyer are using some sort of paralegal or typing service but we all know they’re not allowed to give legal advice. In fact, all those folks can do is type up the forms and charge a maximum of $200 for the service. What that means is that, aside from typing, your need to know a few things in order to …

What is the cheapest way to file bankruptcy?

Mar 27, 2019 · You Qualify for Chapter 7 Bankruptcy Under the Means Test. First you will need to determine if you are eligible to file a Chapter 7 by passing the means test. If you are below a certain threshold for your state you will qualify, otherwise, you need to complete both parts of the means test calculation to determine your disposable income.

Where is the cheapest bankruptcy lawyer?

Jun 30, 2021 · You should follow these steps when you file your bankruptcy case: 1. Determine Whether Your Income Meets the Means Test. When considering whether to file bankruptcy without a lawyer, the first step is to conduct a “Means Test" to determine whether you qualify for Chapter 7 bankruptcy. The federal government provides a test form. You can also find …

What Cannot be discharged in Chapter 7 bankruptcy?

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

Do you lose all assets when you file bankruptcy Chapter 7?

In most situations, Chapter 7 bankruptcy cases are no-asset cases, meaning the courts do not require the debtor to give any specific property to the trustee.Jan 27, 2022

What Bankruptcy clears all debt?

Chapter 13 bankruptcy eliminates qualified debt through a repayment plan over a three- or five-year period. Chapter 7, Chapter 11 and Chapter 13 bankruptcies all impact your credit, and not all your debts may be wiped out.Jun 2, 2021

Do they freeze your bank account when you file Chapter 7?

Do they freeze your bank account when you file Chapter 7? Generally, no. Especially if the full amount in the account is protected by an exemption. Some banks (most notably, Wells Fargo) have an internal policy of freezing bank accounts with a balance over a certain amount once they learn about a bankruptcy filing.Mar 21, 2022

What happens to your bank account when you file Chapter 7?

If you are filing for bankruptcy under Chapter 7, you probably can expect to keep your checking account with a bank. If you owe a debt to the bank, however, the bank may have the right to take some of the funds from your account as a set off for the debt. This might arise if you hold a credit card through the bank.Oct 18, 2021

What debts Cannot be discharged?

Additional Non-Dischargeable Debts Debts from fraud. Certain debts for luxury goods or services bought 90 days before filing. Certain cash advances taken within 70 days after filing. Debts from willful and malicious acts.Apr 7, 2021

Can creditors collect after Chapter 7 is filed?

Once you file for bankruptcy, an automatic stay goes into effect. An automatic stay specifically states that creditors cannot contact you to collect debts after you've filed for bankruptcy. It protects you from harassing phone calls, emails, and letters.Feb 20, 2020

What can be discharged in Chapter 7?

A Chapter 7 bankruptcy will generally discharge your unsecured debts, such as credit card debt, medical bills and unsecured personal loans. The court will discharge these debts at the end of the process, generally about four to six months after you start.Dec 2, 2019

What is the bankruptcy code?

The U.S. Bankruptcy Code governs every bankruptcy case filed in the United States, so you want to be intimately familiar with it – especially Sections 1, 3, 5 and 7. Also hit the local court website and read all the local rules and court orders to ensure that you’re in compliance with forms and procedural requirements. Things like past bankruptcy filings, domestic support ordered and credit counseling requirements are important – ignore them at your own risk.

What happens to your leases in Chapter 7?

In a Chapter 7 bankruptcy, your leases become the property of the trustee. If you rent an apartment or house at below-market value (New York City residents, think about that rent-stabilized lease) you need to determine the chances of the trustee taking it over and forcing you out of your apartment.

Do you have to disclose assets in Chapter 7?

You already know that you need to disclose all of you assets, even the ones that are in your name but being used by other people. Though it’s true that you can keep many types of personal property when you file for Chapter 7 bankruptcy, you’ve got to be sure to exempt those assets properly. California’s difficult for some people because there are two types of exemptions to choose; in New York you can choose either the federal exemptions or the state scheme. If you pick the wrong exemption scheme, you’re going to end up losing something you might have otherwise been able to keep.

How long does a Chapter 7 bankruptcy last?

A Chapter 7 is what you think of as a traditional bankruptcy, where you walk away from your debt and get a fresh start. A Chapter 7 case lasts for a significantly shorter amount of time than a Chapter 13 case. A Chapter 13 can be much more complicated. A Chapter 13 involves a repayment plan that will run for three to five years.

How to determine if you qualify for Chapter 7?

First you will need to determine if you are eligible to file a Chapter 7 by passing the means test. If you are below a certain threshold for your state you will qualify, otherwise you need to complete both parts of the means test calculation to determine your disposable income.

What are non-dischargeable debts?

There are also debts which are non-dischargeable in a bankruptcy case. Non-dischargeable debts include things like child support, alimony, most tax debt, etc. If the bulk of your debts are non-dischargeable a Chapter 7 bankruptcy may not offer the relief you are seeking.

Is bankruptcy good for unsecured debt?

Bankruptcy is most helpful to people with unsecured debt, like credit cards and medical bills, because these kind of debts are dischargeable. You can potentially walk away from them completely. Secured debts are those which are tied to a specific item as collateral.

How long does it take to get a trustee's meeting?

This is generally a short proceeding, maybe 15-20 minutes, and Trustees are accustomed to working with pro se debtors.

Do I need an attorney to file for bankruptcy?

You are not required to hire an attorney to file bankruptcy. You can do so for free, or with a legal aid organization. Written by Attorney Eva Bacevice. Updated October 7, 2020.

How do I file for bankruptcy?

The bankruptcy process may be simple enough to handle on your own if the following are met: 1 You own few assets 2 Your household income is below your state's median 3 You haven't been accused of fraud

How long do you have to take a post filing course?

Finally, you must complete a post-filing Personal Financial Management Instruction Course within 45 days of your meeting of creditors. Take a look at the U.S. Trustee Program's site to find an approved course near you. After you've completed the course, the last step is to wait to hear from the bankruptcy court whether your debts have been discharged.

Can I file for bankruptcy without a lawyer?

Yes, you can legally file for bankruptcy without a lawyer. But should you? Every year, thousands of Americans find themselves too broke to pay off their debts, yet unable to afford bankruptcy. It probably comes as no surprise that attorneys' fees make up the lion's share of bankruptcy expenses.

What do you need to do before filing for bankruptcy?

In Chapter 7 and Chapter 13 bankruptcy filers must receive credit counseling from an approved provider before filing for bankruptcy, and complete a financial management course before getting a discharge.

What happens in Chapter 7?

Motions or Adversary Actions. Most Chapter 7 cases move along predictably: you file for bankruptcy, attend the 341 meeting of creditors, and then get your discharge. But, that's not always the case. Other, more complicated issues can arise that most pro se filers aren't prepared to handle.

Can bankruptcy attorneys meet with you?

And most bankruptcy attorneys will meet with you for free for an initial consultation. That might be enough for you to learn that bankruptcy is not for you, to determine which chapter is best for you, or to discover that you have some issues that might mean going it alone is a bad idea.

Can you lose everything in bankruptcy?

You don't lose everything in bankruptcy. Property exemptions play a vital role in protecting property in both Chapter 7 and Chapter 13 bankruptcy. But, many pro se filers don't list the proper exemption to keep an item of property, and, as a result, risk losing it. If you stand to lose valuable property (like your home or car) ...

Purchasing

You have to go to the nearby office supply shop to buy Official Form 1 or the Voluntary Petition; Notice to Debtor by Bankruptcy Petition Preparer; Notice to Individual Debtor With Primarily Consumers Debts Under 11 U.S.C and 342 B; and other essential forms that needs to be bought for the filing of the chapter 7 bankruptcy.

Credit Counseling

It is also important that you’d be attending some credit counseling courses before you even try to file for the chapter 7. To do this, you may contact the credit counseling department or email them for you to be able to know the nearest recognized credit counselor in your locale.

Forms to be completed

You have to complete the form like the Individual Debtor’s Statement of Compliance with Credit Counseling Requirement once you have received the certificate of completion. Now you have to complete the form on the Statement of Current Monthly Income.

Submission and Personal Financial Management Course

If you have already filled out the forms, submit it to the office of Federal Bankruptcy Court in your area. Those mentioned forms in the previous step should be submitted. The next thing you should do is to wait for your Chapter 7 bankruptcy case notification that the court will send to you.

What to do if you are not comfortable with bankruptcy?

If you are not comfortable with any aspect of the bankruptcy process, you should consider hiring an attorney who will prepare the forms, attend the hearings with you, and guide you through the process. Talk to a Bankruptcy Lawyer.

Does bankruptcy go away?

Priority debts get paid first if money is available to pay creditors. More importantly, they're nondischargeable—they don't go away in bankruptcy.

Can you file bankruptcy without an attorney?

Your case is likely simple enough to handle without an attorney if: creditors aren't alleging fraud against you.

Can you dismiss a Chapter 7 bankruptcy?

If You Have a Complicated Chapter 7 Bankruptcy. Filers don't have an automatic right to dismiss a Chapter 7 case. If you make a mistake, you risk having your case thrown out, your assets being taken and sold, or facing a lawsuit in your bankruptcy case to determine that certain debts shouldn't be discharged.

Is the internet secure?

The Internet is not necessarily secure and emails sent through this site could be intercepted or read by third parties. You don't need an attorney when filing individual bankruptcy, and filing on your own or "pro se" (the term for representing yourself) is feasible if the case is simple enough.

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy is a very effective tool for erasing credit card debt, medical debts, and most other unsecured debt. Although Chapter 7 is a liquidation bankruptcy, filers are able to keep all their property in more than 90% of all consumer bankruptcy cases in the United States.

How often can you file for bankruptcy?

You can file bankruptcy under Chapter 7 once every 8 years . Chapter 13 bankruptcy is another type of bankruptcy available to consumers. The main difference to Chapter 7 is that you pay back some of your debts through the Chapter 13 trustee. Your monthly payment is based on how much you’re able to pay.

When is a 341 meeting?

Your 341 meeting, or meeting of creditors, will take place about a month after your bankruptcy case is filed. You’ll find the date, time, and location of your 341 meeting on the notice you’ll get from the court a few days after filing bankruptcy. Due to the COVID-19 pandemic, all 341 meetings are held either by video conference or via telephone until at least October.

What happens if you own a car that you still owe?

If you own a car that you still owe on, you’ll have to let the bank and the court know what you want to do with it one one of your bankruptcy forms.

How long does it take to rebuild credit after bankruptcy?

Either way, once granted permanent debt relief in the form of the bankruptcy discharge, most people are able to rebuild their credit score in less than one year. Collect Your Documents.

Can you file for bankruptcy if you have cosigners?

If you have any cosigners, they will not be protected by your personal bankruptcy. If you have great credit when your Chapter 7 bankruptcy is first filed, your credit score will likely drop a bit once the bankruptcy filing is reported to the credit bureaus.

How long do you have to take credit counseling before filing for bankruptcy?

Take Credit Counseling. Every person who files for bankruptcy has to take a credit counseling course in the 6 months before their bankruptcy petition is filed with the court. This is a requirement in both Chapter 7 and Chapter 13 cases.

What is the first step in Chapter 7 bankruptcy?

The first step in every Chapter 7 online bankruptcy means test is a review of your income. If your gross household income is less than the median household income for a household of your size, you can file Chapter 7 bankruptcy in Virginia.

What is Chapter 7 bankruptcy in Virginia?

The Virginia Chapter 7 bankruptcy forms are a combination of national bankruptcy forms and certain local forms that are specific to the state. The Eastern District requires that all debtors filing without an attorney ("pro se") file a specific certification about whether anyone helped them prepare the documents filed in their Virginia bankruptcy. While in a slightly different format, the Western District also has a specific statement pro se debtors have to file to disclose this type of information to the court.

What is the 341 meeting in bankruptcy?

The 341 meeting tends to be the most stressful part of filing for bankruptcy in Virginia; after all you have to go to court to answer questions under oath. What most people don't realize is that as long as you are prepared and have everything you need (a picture ID and acceptable proof of your social security number) you will probably spend more time waiting for your case to be called than you will answering questions. The meetings are semi-public and usually several folks who have filed Chapter 7 bankruptcy in Virginia will have the same hearing time as you. Your creditors may appear to ask you some questions as well. This does not happen often, but if it does, just remember to take a deep breath and tell the truth. It's the easiest thing to remember anyway.

How long is a certificate of completion valid for?

The certificate of completion is only valid for 180 days, so make sure to keep that in mind if you are not filing for Chapter 7 in Virginia for a few months. There is nothing wrong with taking the course only a few days before filing bankruptcy, as long as it gets done.

Who is the trustee in bankruptcy?

The trustee is the official assigned by the court to handle your Virginia bankruptcy. Part of the trustee's job is to make sure that the information you put in your paperwork before filing Chapter 7 in bankruptcy in Virginia is accurate.

How to file bankruptcy in Virginia?

The final - official - step on how to file bankruptcy in Virginia is to bring the forms, your filing fee (or application for a waiver) and your credit counseling certificate to the bankruptcy court. The office that will handle this process is called the clerk's office. The clerk's office handles the administrative back end while at the same time functioning as the main point of contact for debtors filing bankruptcy in Virginia without an attorney (“pro se”). Make sure you bring both copies of your bankruptcy forms with you when you go. The clerk will put a stamp on your copy confirming that your Virginia bankruptcy has officially been filed. Since filing Chapter 7 in Virginia is stressful enough, make sure you give yourself enough time to find parking, find the courthouse, and go through security when you head to the courthouse.

Can you use your homestead exemption in Virginia?

If you do not have a home, or your home is upside down, you can use the remaining amount of your Virginia homestead exemption as a "wildcard" exemption to protect personal property.

Popular Posts:

- 1. in new york how long can a collection agency or lawyer attempt to collect on a debt?

- 2. what is a symbol for a lawyer

- 3. what epuside kf the office is jan and mkcjeal in the lawyer room suing dunder miflon

- 4. what does lawyer do after injury case

- 5. what is a good gift to thank a lawyer who handled our estate

- 6. how to pay off a lawyer when you don't have any money

- 7. why would a lawyer become a teacher

- 8. harrison arkansas how many years to be come a lawyer attorney

- 9. according to bar assisotion what is a lawyer suppose to do once retained

- 10. how to get money for a lawyer