A good lottery lawyer can help winners protect their anonymity. Another option is to set up a trust to claim the prize. Setting up a trust not only helps protect the winner's identity but also prevents the winner from spending too much too quickly.

Full Answer

Do lottery winners have to pay a lawyer?

However, the winner will have to pay the lottery lawyer fee for such a service. A person who wins a huge amount from a jackpot but doesn’t know how to proceed may commit certain expensive mistakes. These mistakes may be in the form of claiming issues or tax payment issues.

What to look for when hiring a lottery lawyer?

Take the time and do some research on a potential lottery lawyer. Reach out to their past clients and find out how their experience was. You can also look into their records to see if any disciplinary actions were taken against them in the past.

Can a lottery ticket be claimed as possession?

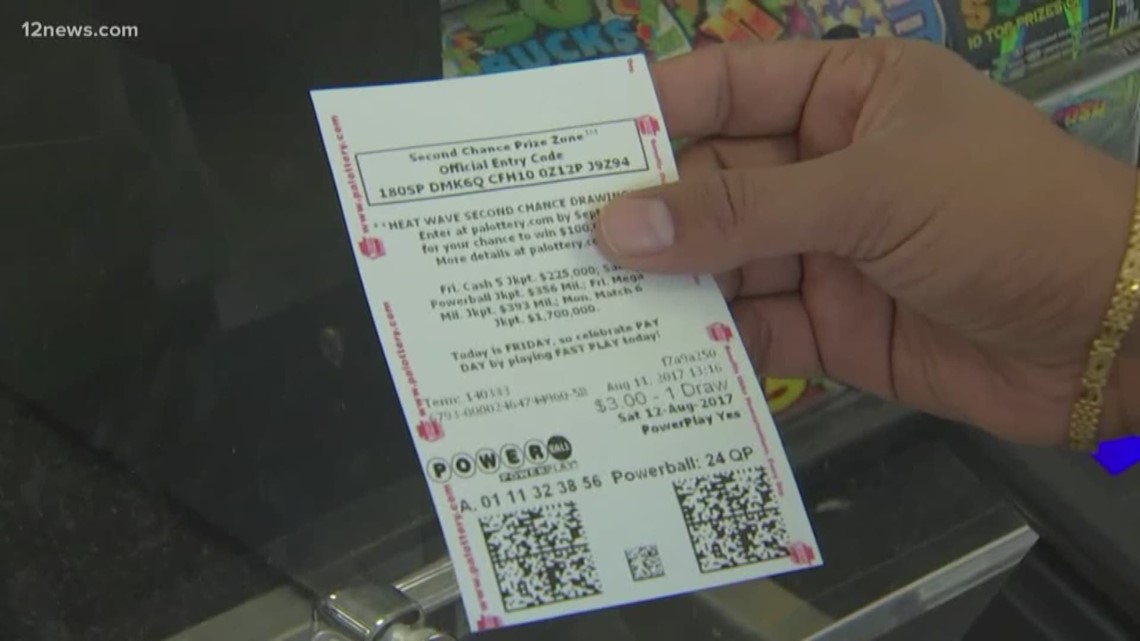

A lottery ticket is a bearer instrument. The person who holds it holds its title. That means possession is often the primary consideration. Although disputes can happen and custody can be disputed, whoever signs the ticket and presents a photo ID can claim the prize.

How long do I have to claim my lottery winnings?

Most international lotteries give winners at least six months to claim their prizes, which is plenty of time to make arrangements, consult professionals, and set up a trust to guard your money and your identity. Here’s how to create a trust: First, sign the back of the winning ticket, leaving some space above your signature.

What kind of trust is best for lottery winnings?

Irrevocable trusts protect lottery winnings because the assets legally do not belong to you. They also benefit your survivors as they are not subject to estate taxes. Blind trusts are also suitable as they protect your winnings from unscrupulous relatives and friends who want your property.

Should I hire a financial advisor if I win the lottery?

The Lotto legal department recommends that lottery winners seek out one or more of the following: a tax planner, a financial adviser, a certified public accountant and an attorney.

How do I keep my lottery winnings secret?

If you win the lottery and really want to stay anonymous, research the rules for your state. You might be able to claim the money in the name of a trust. Then find trusted advisors like tax attorneys, trust and estate attorneys, and accountants.

What steps to take after winning the lottery?

9 Smart Ways To Spend Your Lottery WinningsWait to Share the Good News. ... Take Time to Reflect. ... Hire Legal & Financial Consultants. ... Pay off your Debt. ... Start an Emergency Fund. ... Set Aside Money for Retirement. ... Choose Low-risk Investments. ... Make a Social Impact.More items...

Do lottery winners get financial advice?

We have an aftercare programme in place to ensure that all winners have access to legal and financial advice. It's often the case that when a winner decides to remain anonymous, we are the only people that know about their win so we keep in touch with them for as long as they want to.

How do I give my family money to the lottery?

Currently, that amount is about $5 million a person. Any property given away over that is taxed at the rate of 35%. So by claiming the lottery winnings as a family partnership, a winner can claim that they are not making a taxable gift, because it was a family investment. This could save millions in gift taxes.

How long does it take to receive lottery winnings?

When you win a Powerball or Mega Millions jackpot, there is a 15-day waiting period between the draw date and when the jackpot will be paid out, as money from ticket sales needs to be collected in order to pay out the jackpot.

Should you move after winning the lottery?

If someone were to ask you what you would do once you become a Powerball winner, you might say, "quit my job" or "buy a mansion." However, experts suggest that you don't make any big moves immediately.

What are the luckiest numbers for lottery?

The winning numbers were 6, 14, 25, 33, 46 and the Powerball was 17....Most common red ball numbers21: Drawn 33 times.4: Drawn 30 times.19: Drawn 29 times.3: Drawn 29 times.8: Drawn 28 times.10: Drawn 27 times.6: Drawn 27 times.13: Drawn 27 times.More items...•

What is the first thing a lottery winner should Do?

Take a deep breath and take your time. You have a set amount of time to turn in your ticket, so don't run off to the lottery office first thing the next morning. Let yourself calm down, and then set to work carefully forming your team and plans before you contact the lottery officials.

Is it better to take lump sum or annuity lottery?

While an annuity may offer more financial security over a longer period of time, you can invest a lump sum, which could offer you more money down the road. Take the time to weigh your options, and choose the one that's best for your financial situation.

How Much Does a Lottery Lawyer Cost?

The fee of the lottery attorney doesn’t need to be the same in all the regions or states. It may vary from region to region or state to state. Also, different states may have set different terms and conditions for hiring such a lawyer. So, the fee may also be different. However, such lawyers may charge $60 to $300 per hour from their clients.

Why Should I Hire an Attorney After Winning the Lottery?

After winning a huge amount from a jackpot, you may get confused about the further proceedings. So, you can’t decide what to do next. In such a situation, you’ll need a person who knows well how to claim and manage the lottery amount.

Frequently Asked Questions

You can hire any of the following experts to get the guidelines for receiving your lottery amount.

Conclusion

Being lucky, one may win the jackpot. This winning jackpot will bring a lot of money for the winner. However, new lottery winners may get confused about claiming their amount. This may put them in any complicated situation. To avoid such pitfalls, one must hire a lottery attorney after winning a jackpot.

How to protect lottery winnings?

How Can You Protect Your Lottery Winnings? 1 Consider hiring a lottery lawyer and tax professional as soon as you win the lottery 2 Sign the back of your lottery ticket 3 Place your lottery ticket in a secure place 4 Protect your identity 5 Avoid hasty decisions, think twice before making any move or purchase 6 Never post or declare your lottery win on any social media platform

What to do when you win a jackpot?

When you win a major jackpot, you have to decide whether to your prize as a lump sum or an annuity. Since every person’s financial situation and goals are different, it can be hard to decipher the advice you can find on the internet. Instead, your financial and legal advisors can easily inform you about your choices and the relative benefits of each. Since they know your financial status and risk tolerance, they can help you put together a set of decisions that work together to give you ideal results.

What is a good lottery advisor?

A good lottery advisor knows the ins and outs of lottery laws and has represented winners and others who have received unexpected financial windfalls. They should be able to provide these past clients as references. Ask the references about the lawyer’s experience with tax laws, trust planning, asset protection, and other financial considerations.

What to do after winning the lottery?

Immediately after you win are the most crucial times in your life. You have to curb your excitement and proceed with more caution and attention than in ordinary situations. Irrespective of what lottery you have won, you will need good legal advice to keep yourself and the winnings secure. You have to take into account taxes, estate planning, ...

Why is it important to keep your personal information private when you win the lottery?

When you win the lottery, you want to keep the news of your good luck and your personal details as private as possible. Protecting your privacy helps avoid becoming the target of scams, lawsuits, and straight-outs begging for cash. However, keeping your personal details private isn't as simple as wanting to keep a low profile.

Do legal advisors charge a lot of money?

Everybody demands a price for the professional services they offer. In many cases, legal advisors charge hefty fees. But you should be wary that you are not paying unreasonably high prices. Remember, just because a lawyer is expensive doesn't necessarily mean that he is a good lawyer. You should never pay a percentage of your prize to a lawyer.

Can you own the lottery without taking any help?

If you feel that you can manage your lottery winnings properly and can keep control over taxes, laws and secure your newfound wealth from potential risks, then you can probably own the moment and walk in without taking any help.

How many states allow anonymous lottery winners?

Powerball tickets are sold in 44 states, as well as in Washington, D.C., the U.S. Virgin Islands and Puerto Rico. As of last time we looked, all but six states require lottery winners to come forward publicly. Delaware, Kansas, Maryland, North Dakota, Ohio and South Carolina allow winners to remain anonymous. Many other states are in the process of enacting such laws- some may even require you to donate some money to charity if you want to remain anonymous. Other states permit winners to create limited liability companies, so that when their names have to be announced, it’s the companies and not individuals that are identified. Think seriously about that.

Does Monopoly have a fiduciary duty?

You won’t believe the tax issues which could come up- state taxes, federal taxes, gift taxes, corporate taxes and other taxes even the game Monopoly didn’t try to make up. The lawyer can help with this, as they have a fiduciary (financial) duty to you.

Can you dispute custody of a ticket?

Although disputes can happen and custody can be disputed, whoever signs the ticket and presents a photo ID can claim the prize. You may be requested to verify where you bought it and/or how you obtained custody.

How long do you have to claim a lottery prize?

Most international lotteries give winners at least six months to claim their prizes, which is plenty of time to make arrangements, consult professionals, and set up a trust to guard your money and your identity. Here’s how to create a trust:

Why is it important to stay anonymous in lottery?

Since lottery scams using winners’ names are very common, staying anonymous will help protect not only you but also the general public. Asset control. A trust sets out rules for distributing the prize money, which can help avoid disagreements among multiple winners. Professional management.

How to split money between multiple winners?

An irrevocable trust is a good way to split funds among multiple winners. When this trust is created, ownership of the prize money is transferred to the trustee. Irrevocable trusts remove the funds from your taxable estate, so you won’t have to pay taxes on any income the funds generate if they’re invested. The trust also can’t be cancelled or altered without agreement from all beneficiaries, so it protects the money from creditors and any lawsuits or disagreements among the winners.

What is lottery trust?

A lottery trust acts on the winner’s behalf to collect and distribute the prize money as he or she wishes. Since many state lotteries mandate that there should only be one payee per ticket, a trust can also act as the payee in a situation with multiple winners.

Can you stay anonymous on Lotto?

Although some winners, such as Bill Lawrence, manage to stay anonymous even though their names are published, lotto winners who want to stay completely anonymous must take action before claiming their winnings to protect themselves from media attention.

Can you be anonymous in the lottery?

While lottery winners can easily remain anonymous in many European countries, the UK, Australia, and China, only nine American states (Georgia, Maryland, Texas, Ohio, Delaware, Kansas, South Carolina, North Dakota, and New Jersey) allow winners to conceal their names from the public eye. All other state lotteries default to revealing winners’ ...

Can a lottery trust be cancelled?

LOTTERY TRUST CONS. Some trusts can’t be cancelled or changed, except in a narrow set of circumstances. Irrevocable trusts fall into this category. However, some states allow irrevocable trusts to be altered if all beneficiaries agree. Choosing the wrong trust manager can have serious consequences for your winnings.

1. HIRING A TAX ATTORNEY

If you win the lottery in the US, the very first decision you’ll need to make is how to collect your winnings. Will you take a lump sum or yearly instalments spread out over several decades? Both options come with different tax implications that affect the amount of money you will receive in the end.

2. CREATING A LOTTERY TRUST

Most financial experts recommend setting up a lottery trust with a lawyer before you even think about collecting your winnings. Maintaining anonymity after winning the lottery is a major concern and is the primary way to protect yourself and your money.

3. PLANNING YOUR ESTATE

Wealthy people have complex assets that need serious planning for the future. An estate planning lawyer can ensure a smooth transition of wealth and minimize legal and tax costs for your heirs.

4. FIGHTING LAWSUITS

Despite their best efforts, lottery winners are frequently targeted by scammers who are after their money. Hopefully, you’ve followed lottery experts’ advice to remain anonymous, which should reduce the target on your back.

Why do you need a lawyer for lottery winnings?

Some of the benefits of hiring a lottery lawyer are: They can help you keep as much of your winnings as you legally can. They can help protect your identity. They can introduce you to the right people. They can set up your estate for your family's future.

What is a good lottery lawyer?

They can protect you from potential lawsuits and counsel you in such events. A good lottery lawyer will help you find legal ways of minimizing your tax liability. They'll also be able to assist you in setting up a trust or other legal entity to claim your winnings, if you need to.

What to look for when choosing a lottery lawyer?

What to Look For When Choosing a Lottery Attorney. You should take your time when looking for a lottery lawyer. The difference between a good lawyer and a bad one can easily cost you your money, time, and worse. Choose from different candidates, so you can find the best one.

What to do if you win the lottery?

If you won the lottery, the first person you want to hire: an attorney. That’s right, just one. It’s true that you’re going to need all sorts of lawyers who specialize in taxes, trusts, estates, and the like. But, you don’t really need to hire an entire cavalcade immediately.

Who won the 2011 Powerball?

Kurland has also represented some of the biggest winners in recent lottery history, including: Putnam Avenue Family Trust: Also known as the winner of the $254 million Powerball jackpot of November 2011. Rainbow Sherbert Trust: Also known as the winner of the $336 million Powerball jackpot of March 2012.

Who is the 1/3 of the Powerball winners?

Among his most notable clients include Maureen Smith and David Kaltschmidt. The married couple is better known as 1/3 of the winners of the $1.58 billion Powerball jackpot back in January 2016. On top of providing legal counsel, Panouses also acts as the defacto PR person for the couple.

Do lottery lawyers have to be good?

Well, yes. They're not absolutely necessary, but a good lottery lawyer can keep you from making bad decisions that could jeopardize you or your wealth. They'll be there to stop you from making common mistakes that cause lottery winners to go broke.

Who is John from Lotto?

John is the main author and editor of lottolibrary.com since 2019. He's a long time lottery player who has a specific interest in coming up with and testing various lottery strategies as he's always been obsessed with math, statistics, and probability theory.

Can you claim a lottery prize anonymously?

While there are states that will let lottery winners claim their prize anonymously, or in the name of a business, there are states that will not. A good lottery lawyer can help protect a winner’s identity and personal information as much as possible.

Do you have to partner up with a lawyer before or after winning the lottery?

As mentioned above, you will be spending a considerable amount of time with your lawyer before, during, and after you claim your lottery winnings. Therefore, it is vital that you partner up with someone who you jive with and who jives with you.

What can an attorney do to help with a shared agreement?

The attorney also can help create a sharing agreement or contribution agreement outlining everyone’s rights, powers and responsibilities, as well as the appropriate trust or LLC documentation, on a timely basis.

Can you hide the powerball winner?

While it may not be possible to completely hide the identity of the PowerBall winner in all states, it may be possible to create a legitimate smokescreen for multiple winners using an LLC or trust. If you are using either type of entity, you will want to be careful to select the right jurisdiction where the LLC or trust will be subject to ...

Popular Posts:

- 1. how much does a lawyer get out of wrongful termination

- 2. what majors should i have to be a lawyer

- 3. how much is lawyer fee for du

- 4. law and order episode in which green and fontana deal with a lawyer named fogg

- 5. how much is an immigration lawyer

- 6. lawyer if you don't know who this is

- 7. looking for a lawyer who specialize in fraud

- 8. when did lawyer john cochran die?

- 9. what kind of lawyer can i become with a bs in criminal justice

- 10. when is it time to get work comp lawyer