Some attorneys, for example, may draft a Lady Bird deed for a flat fee, whereas another attorney may charge based on your circumstances. From what we researched, however, the costs could greatly vary as with any attorney-related fees, but for the most part, be prepared to spend anywhere from $150 to $350 plus the recording fees, which, depending on the state you live in, can be an additional $xx.

How much does a Lady Bird deed cost?

Aug 15, 2018 · Some attorneys, for example, may draft a Lady Bird deed for a flat fee, whereas another attorney may charge based on your circumstances. From what we researched, however, the costs could greatly vary as with any attorney-related fees, but for the most part, be prepared to spend anywhere from $150 to $350 plus the recording fees, which, depending on the state you …

What is the difference between a life estate and Lady Bird?

Mar 10, 2018 · Estates Lady bird deeds and estate planning Ask a lawyer - it's free! Browse related questions 3 attorney answers Posted on Mar 10, 2018 probably $100 to $150 depending on the legal description and other issues plus recording fee in the county where the property is located. 0 found this answer helpful | 0 lawyers agree Helpful Unhelpful 0 comments

Does a Lady Bird deed avoid probate in Florida?

Oct 28, 2014 · It tends to vary but generally deeds are prepared at a flat rate. It is not uncommon for the cost to range between $100 and $200 plus recording fee and other miscellaneous costs. This communication is for informational purposes only and does not constitute legal advice and does not establish an attorney-client relationship. Helpful Unhelpful

What is an enhanced life estate deed (Lady Bird deed)?

Mar 18, 2022 · Creating a lady bird deed is very inexpensive. In fact, the approximate “do it yourself” cost is only $30. Professional assistance is also very affordable, and on average, costs between $200 and $400. This includes drafting the deed …

How much does a ladybird deed cost in Florida?

The cost to create a Lady Bird Deed is $195 plus recording fees; the cost for other deeds is $150 plus recording fees.

How much does a ladybird deed cost in Michigan?

$30.00Cost of a Lady Bird Deed This price typically includes the time spent researching your deed, preparing the Lady Bird Deed, and the time spent to sign and record the deed. Your county will charge a recording fee to record the deed. The fee in Michigan is typically $30.00.

What are the drawbacks of a ladybird deed?

Disadvantages.Confusion – Banks and title companies may not understand the non-vested nature of the remainder interest and require that the remaindermen join in a conveyance or a mortgage.Creditors. ... Homestead Devise Restrictions – This type of deed should not be used by an owner with a spouse or minor child.More items...

Is a Lady Bird deed better than a trust?

If your primary home constitutes most of your net worth, the Lady Bird deed cost will be much less than the cost of having a revocable trust created. If you have a significant amount of property of any type in addition to your primary home, a revocable trust may be a better way to go. Lady Bird deed vs. will.

What do you do with a ladybird deed after death in Michigan?

As long as the owner is alive and has the capacity to revise legal documents, provisions of the lady bird deed can be changed or the deed can be revoked and terminated. However, if the deed is still in place on the owner's death, ownership of the property transfers to the designated beneficiaries automatically.Feb 2, 2021

Can I do a Lady Bird deed myself in Michigan?

The property transfer occurs automatically at the prior owner's death, avoiding probate. Michigan lady bird deeds work by dividing ownership into lifetime and future interests. When a person creates a lady bird deed, she transfers property to herself for the rest of her life.

What are the advantages of a Lady Bird deed?

Medicaid Asset Protection A Lady Bird deed can also help you when you apply for Medicaid, as it allows you to transfer property rights and maintain control of the property. The deed can keep assets in the family that would, under other conditions, be taken by the state.

Do you pay taxes on a Lady Bird deed in Florida?

With a Florida Lady Bird Deed, there is no need to pay the taxes immediately. The reason for this is that there is no immediate transfer of ownership. The taxes will be due, however, when the person holding the estate passes. Capital Gains Taxes.Dec 21, 2021

Does Michigan have transfer on death deeds?

Michigan does not allow real estate to be transferred with transfer-on-death deeds. There is a type of deed available in Michigan known as an enhanced life estate deed, or "Lady Bird" deed, that functions like a transfer-on-death deed.

Can you sell a house with a deed of trust?

Can You Sell a House with a Deed of Trust? Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

Can a house with a mortgage be put in a trust?

A mortgage in trust may be something that you have never previously considered, but it may be appropriate. Anyone who owns property can put their mortgage in a revocable living trust so as to not deal with the probate process after death and utilize other estate planning benefits.Nov 21, 2018

How do I transfer a deceased property?

To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.May 1, 2021

Howard Marshall Rosenblatt

probably $100 to $150 depending on the legal description and other issues plus recording fee in the county where the property is located.

Melanie A. Essary

Cost is dependent on the attorney you choose. You should contact a couple of attorneys in the area of the property you own and ask what they charge for preparing a simple lady bird deed.

Chad Edward Brocato Sr

The drafting of a Lady Bird (enhanced life estate) varies from attorney to attorney. In addition to the fees charged for preparing the deed, there will be a cost associated with filing it in the public record.

What is a lady bird deed?

A lady bird (ladybird) deed (also called an enhanced life estate deed, lady bird trust or a transfer on death deed) is a type of life estate deed. In simple terms, a life estate is a form of co-ownership in a piece of property, and a deed is a document that legally transfers the property from one owner to another.

Why do people use lady bird deeds?

However, lady bird deeds protect one’s home from estate recovery. This is because they allow persons to automatically transfer property (in the case of a Medicaid recipient, their home) upon their death without it going through probate. (Probate is a court process in which the property of a deceased person is transferred to his or her ...

What happens to a life estate after death?

Upon the death of the homeowner, the life estate ends, and the home is automatically transferred to the beneficiary, also called the grantee, remainderman, or the remainder beneficiary. With a standard life estate deed, the life tenant (the homeowner) no longer has full control over his or her home. For example, the life tenant cannot sell ...

Does Medicaid have an asset limit?

This rule is in place because, as mentioned above, Medicaid has an asset limit, and states do not want applicants to give away assets or sell them for less than they are worth in order to meet the asset limit.

What is the maximum amount of home equity for Medicaid?

In most cases, in 2020, the limit is either $595,000 or $893,000.

Can you use a lady bird deed for Medicaid?

While professional assistance is not required to create a lady bird deed, it is highly recommended that one seeks counsel from a Medicaid planner when using this type of deed as an estate planning tool for Medicaid.

What is a Medicaid asset protection trust?

This option is a Medicaid asset protection trust (MAPT), a type of irrevocable (cannot be altered or cancelled) trust that protects one’s assets from Medicaid. If planning to utilize any of these options, it is highly recommended that one consult with a Medicaid planning professional.

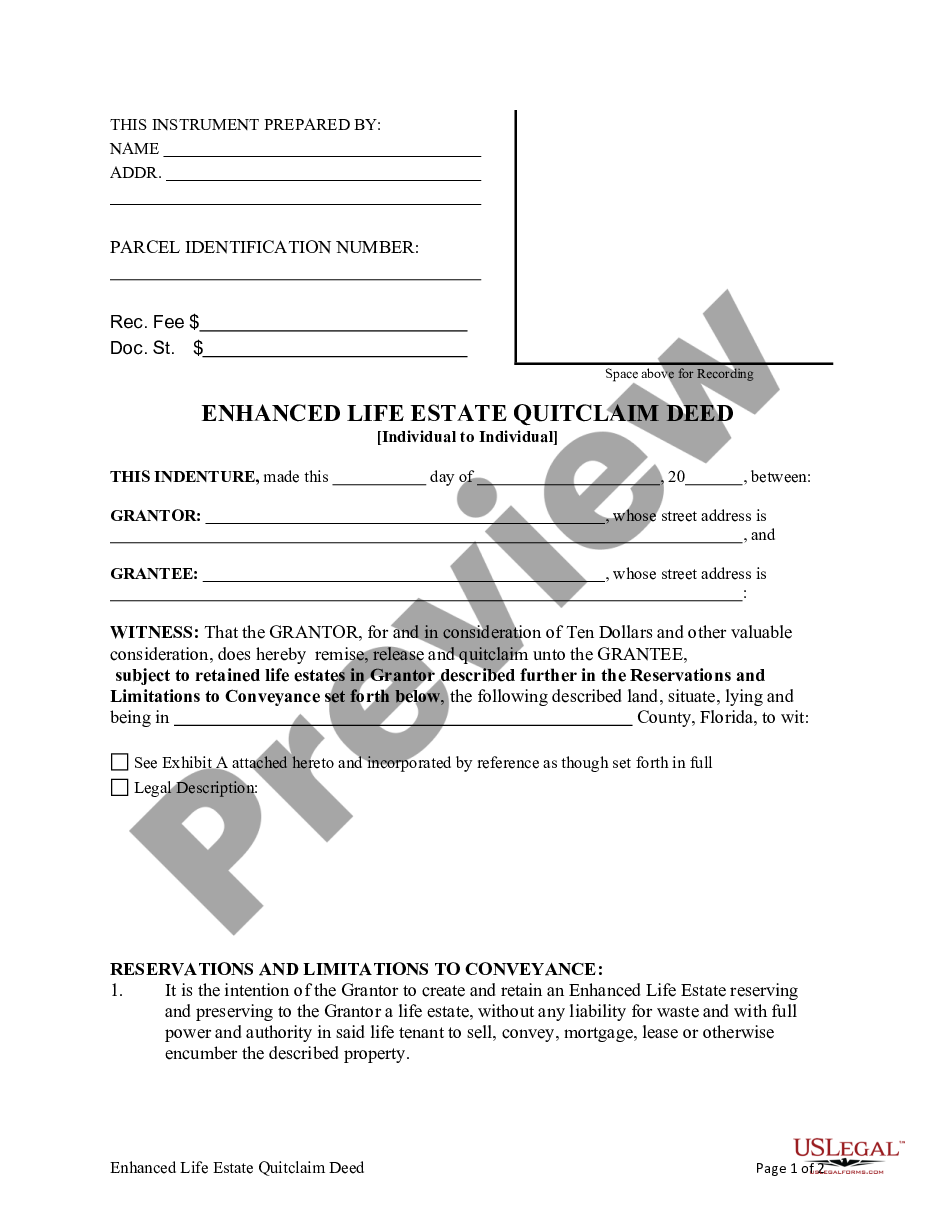

What is a Lady Bird Deed?

A Florida Enhanced Life Estate Deed, more commonly referred to as a Lady Bird Deed or Ladybird Deed, is a special type of life estate deed that is used to automatically transfer ownership of a home or real-property to others upon the death of the owner (s).

Can anyone record a Lady Bird Deed?

Lady Bird deeds are only authorized in Florida, Texas, West Virginia, Vermont, and Michigan, at this time. You may find more helpful information on this popular website . We are not affiliated with this company, but their website may give you additional information and a better understanding of the value that we offer.

How much do you charge to prepare a Lady Bird Deed?

We charge a flat fee of $125. This includes email delivery and US mail delivery. (See below for value-added services)

Is there a way to notarize and execute my Florida Lady Bird Deed without leaving home?

Yes. Remote Online Notarization, or “RON” as it’s commonly called, is a 100% online video notary system where documents are signed and notarized over the Internet using a webcam and microphone. Florida Document Specialists is a certified remote notary provider for the State of Florida.

How will I know that my lady bird deed has actually been recorded?

That’s a common question. Our e-recording system will automatically send you a copy of the recorded deed with the recording information stamped at the top of the deed. Also, you can visit your county clerk of court website and look up your deed in the official records. All deeds are a matter of public record.

Can I change my mind after I record a Lady Bird deed?

Yes. Because the life estate retained by the owner (s) is “enhanced”, you can record a new deed without the consent or involvement of the remainder beneficiaries.

How does the title to my property pass to the remainder beneficiaries when the owners pass away?

The property passes automatically, outside of probate, to your remainder beneficiaries by operation of law. In other words, “it just happens.” A lady bird deed eliminates the need to probate the property described in the deed. This benefit alone is probably why a Florida enhanced life estate (lady bird) deed is so popular.

Why do you need a lady bird deed?

This is because the beneficiaries of the deed receive a step up in tax basis on the value of the real property when you pass.

Is a lady bird deed good for estate planning?

A Lady Bird Deed is an incredibly effective tool for estate planning. This is particularly true given their relative ease and low cost.They do, however, have drawbacks. They are not a one size fits all solution to everyone’s estate planning needs.

Can you use a lady bird deed for Medicaid?

A Lady Bird Deed can be an extremely effective way to pass real property to the heirs of a Medicaid recipient. Using a Lady Bird Deed is not considered a Medicaid di vestment. Further, you will not lose your home exemption for using a Lady Bird Deed.

Can you collect Medicaid from a probate estate in Michigan?

Michigan’s Medicaid Recovery or Estate Recovery Laws allow the State of Michigan to collect against the probate estate of a Medicaid recipient for money paid on his or her behalf. You can take steps to prevent estate recovery by preventing your property from going through probate. This includes using a Lady Bird Deed.

Does a lady bird deed increase property taxes?

A Lady Bird Deed will not increase your property taxes because it does not uncap your property tax. This is because you still own the property until your death. Since there is no transfer until your death, your property tax is not uncapped. Similarly, you will not lose your homestead exemption from using a Lady Bird Deed.

What is a lady bird deed?

A lady bird deed includes features of a deed with a retained life estate and of a deed with transfer on death provisions. A lady bird deed therefore has two roles: A grantor—the current owner of the property and the person who will live in and control the property during their lifetime. A grantee—the person who will inherit the property upon ...

What are the disadvantages of a lady bird deed in Florida?

Disadvantages of a Lady Bird Deed in Florida. The several disadvantages to lady bird deeds in Florida include: Lack of Asset Protection. A creditor may be able to place a lien or levy on the remainder interest in the lady bird deed. Ineffectiveness Against Florida Constitutional Restrictions.

What is the difference between a lady bird deed and a quit claim deed in Florida?

The difference between a lady bird deed and a quitclaim deed in Florida is that a lady bird deed allows the current property owner to retain an enhanced life estate in the property during his life, while a quit claim deed typically transfers all title and rights to the property to the grantee, or the person receiving the property.

What is probate in Florida?

Probate is a legal process by which a court brings together all of a deceased person’s assets, determines if any creditors have claims against the deceased person or their assets, and then distributes whatever is left according to the person’s will. Florida law requires that an attorney be involved in formal probate.

Can a lady bird deed be transferred?

In other words, the grantor of the deed retains the right to live in the property during their lifetime, but he cannot not sell or transfer the real estate during his life without the remainderman’s consent. All lady bird deeds create a life estate, but not all life estate deeds are also lady bird deeds.

What is fee simple interest?

Normally, property is owned as fee simple, which means the entire ownership and control of the property is in the name of the current property owner. When someone transfers ownership by a typical deed with a retained life estate, the fee simple interest splits into two: (1) the life estate and (2) the remainder.

What is enhanced life estate?

The enhanced life estate is the key and distinguishing feature of lady bird deed. Only states that allow an enhanced life estate, therefore, can have a lady bird deed. For that reason, a lady bird deed is often called an enhanced life estate deed.

Why do you need a lady bird deed?

There's another Medicare-related reason to use a Lady Bird deed, which helps your family members after your death. If you receive Medicaid benefits during your life, then after your death, the state will make a claim for repayment from the assets you leave behind. Federal law requires every state to have such a Medicaid "estate recovery" program.

What is an enhanced life estate deed?

By contrast, an enhanced life estate deed (the Lady Bird deed ), lets you: avoid probate of the property. keep the right to use and profit from the property for your lifetime. keep the right to sell the property at any time. avoid making a gift that might be subject to federal gift tax. avoid jeopardizing your eligibility for Medicaid.

What is the look back period for Medicaid?

When you apply for benefits, you must also disclose any assets you've given away in the previous few years, called the "look-back" period. Otherwise, people could simply give away their valuable assets to family members, claim poverty, and receive Medicaid benefits.

Does Medicaid count as primary residence?

Some assets, however, aren't counted for purposes of Medicaid eligibility. Typically, your primary residence isn't counted when Medicaid adds up the value of your resources. It may be completely exempt, or exempt up to a certain value. For example, if your state exempts residences up to $750,000, then any value above that amount will be counted as a resource belonging to you.

Popular Posts:

- 1. what can a lawyer put lein on if you have no property

- 2. how hard is it to get certified as a lawyer in a different state

- 3. how to sunea a trust fund for court hearing with out lawyer

- 4. how to pay for divorce lawyer adultery

- 5. when did the lawyer that played in aron brosivich movie die?

- 6. how much apprenticeship do i need to be a lawyer

- 7. what type of lawyer deals with medicarefraud

- 8. who is the most corrupt lawyer ever

- 9. how long to go to school to be a lawyer

- 10. how to pick a good criminal lawyer