How much does an estate planning attorney make?

· How Much Lawyers Charge to Prepare Estate Planning Documents by Learn More Updated: May 21st, 2019 TYPICAL PACKAGE FEE $1,000 - $2,000 Readers typically paid their lawyers $1,000 to $2,000 to prepare a bundle of estate planning documents. FLAT FEE 82 %

How much do lawyers charge to settle an estate?

How much does an estate lawyer cost?

How much does an estate plan cost?

How Much Do Estate Planning Attorneys Charge? Attorneys are notorious for not disclosing how much they charge for their services. If you do a search online for “how much does estate planning cost,” you will find that there is either a very wide range of fees, or your $599 do-it …

Are estate planners expensive?

Estate plan costs vary because each estate plan has unique needs. The lower end of the spectrum can include a basic will written for as little as $150 to $200. But a more complex plan may cost you upwards of $300 per hour.

What is the average cost for someone to do the process for estate planning in Texas?

Single PersonMarried CoupleFee for Basic Estate Planning Package:$725.00$1,350.00** Will for Non-Taxable Estate (couple – each has own Will)$350.00$600.00Statutory Durable Power of Attorney75.00150.00Medical Power of Attorney with HIPAA Authorization150.00300.002 more rows

How much does an estate have to be worth to go to probate?

Every state has laws that spell out how much an estate would need to be worth to require the full probate process—anywhere from $10,000 to $275,000.

Who pays to probate a will?

The costs involved in administering the property left in a person's will can be reclaimed from the estate, when it is unlocked. However, the person named as the will's executor is usually responsible for paying the probate fee, first.

What Factors Cause The Costs of An Estate to Vary?

The primary factors that cause the cost of an estate to vary include: 1. Size of the Estate and Types of Assets – When there are more assets or par...

What Goes Into Determining A Lawyer's Fees?

A number of factors affect how much an attorney will charge. The biggest factors tend to be the experience of the attorney, where the attorney is l...

Why Would An Estate Lawyer Charge An Hourly fee?

An estate lawyer will likely charge by the hour if the estate is large and complex, or the client will require several services, such as a trust, h...

Is One Fee Structure Better Than another?

The best billing structure is ultimately the one that works for the client. Wills, trusts, and estates lawyers understand this, and tend to bill ac...

Is division of labor bad for you?

This division of labor isn't necessarily a bad thing for you. Junior attorneys, paralegals, and staff have hourly rates much lower than the experienced senior attorney who conducted your first meeting. Having staff complete tasks under the supervision of that senior attorney saves you money while also allowing you to take advantage of that senior attorney's experience and knowledge.

What is Martindale Nolo?

Nolo is a part of the Martindale Nolo network, which has been matching clients with attorneys for 100+ years.

How much does an estate plan cost?

Some attorneys may prepare a simple will or power of attorney for as little as $150 or $200. On average, experienced attorneys may charge $250 or $350 per hour to prepare more sophisticated estate plans. You could spend several thousand dollars to work with such an attorney.

Can an attorney delegate tasks to a junior attorney?

If you hire an attorney from a larger law firm, your attorney will typically delegate some tasks to junior attorneys, paralegals, or other staff. This is particularly true if common, formulaic documents fit your estate plan's needs. This division of labor isn't necessarily a bad thing for you. Junior attorneys, paralegals, ...

What factors contribute to the cost of an estate plan?

A final factor that contributes to the cost of your estate plan is who actually performs the work. This can vary depending upon the type of lawyer or law firm you hire. If you hire a solo attorney or a small firm, your attorney typically handles much of the work on your case and will charge you their hourly rate for all the work.

What should an attorney offer you?

Your attorney should offer you an engagement letter that details: fees and payment terms. the scope of work your attorney will do (i.e., what estate planning documents are included in your plan) confidentiality requirements, and. any agreements about conflict resolution.

Do estate planning attorneys charge contingency fees?

Estate planning attorneys typically do not use contingency fees. Contingency fee arrangements work best in cases where your attorney is trying to win you money in a lawsuit or settlement. For example, you agree to pay the attorney a portion (typically one-third) of whatever the attorney can get for you.

Is estate planning marketed to the public?

Unfortunately, this is how estate planning is often marketed to the public. An attorney will promote a fixed price, and then you will receive an estate plan that the attorney wants to give you. But shouldn’t something as important and personal as estate planning be the opposite way around? Shouldn’t the attorney guide you through each of your options, explain the pros and cons of each option, how they are important to your situation, and then let you decide if those options are worth the cost?

What is Modern Wealth Law?

At Modern Wealth Law, our goal is help you make a more informed decision about the cost of your estate plan. We follow an easy 3 step method to help you determine the cost of your estate plan:

Who is Jaclyn from LegalMatch?

Prior to joining LegalMatch, Jaclyn was a paralegal and freelance writer. After several years of working for both criminal defense and entertainment law firms, she enrolled in law school. While in law school, her law journal note was selected for first-round publishing, and can be found on various legal research databases. Jaclyn holds a J.D. from Benjamin N. Cardozo School of Law, specializing in both intellectual property law and data law; and a B.A. from Fordham University, majoring in both Journalism and the Classics (Latin). You can learn more about Jaclyn here.

Can you avoid probate if you have a living trust?

In contrast, if a person chooses to create a living trust instead as part of their estate plan, then they can avoid the probate process entirely. Although the cost of setting-up a living trust may be more than a will, it might save time and money in-the long run since it negates the need for the probate process.

What is probate in a will?

On the other hand, probate is the legal process in which a court oversees all things related to a will, such as establishing the will’s validity, administer ing the estate, and appointing or approving guardianships of an estate. Probate deals strictly with wills and will contests.

How to keep estate planning costs low?

The best way for an individual to keep costs low is to determine what they want to accomplish beforehand and come prepared with a list of items they wish to discuss.

How much does an attorney cost?

Thus, an attorney can cost anywhere from $200 to $2,000 dollars , depending on the circumstances. This also may vary depending on whether or not the cost includes the necessary filing fee, which is provided by the local court.

How much does it cost to create a living trust?

The whole process could cost them less than $100.

What are the factors that determine the cost of an attorney?

In general, the two main factors that cost usually depends on include: what type of plan is needed (e.g., what legal documents) and how the attorney bills (e.g., flat fee versus hourly fee). Other factors might include how much experience the attorney has, what state the plan is being formed in, how complicated or in-depth the plan is, ...

What is a durable power of attorney?

A durable power of attorney is similar to a health care power of attorney. A financial power of attorney allows you to appoint someone to make financial decisions on your behalf should you become incapacitated. You can choose when this goes into effect; whether its immediately, at a certain date in the future, or only under specific circumstances. Without a financial power of attorney in place, no one will be able to step in and pay bills for you, make investment decisions, or handle other financial decisions.

Where is Smith Barid located?

At Smith Barid, we are estate planning experts who want to help you with your estate planning needs. Located in Savannah, GA, we are here to help you today. Contact us to set up an appointment.

How much does it cost to complete an estate plan?

Estate planning costs can vary depending on complexity. Completing documents 1-3 listed about should cost you in the $1,500-2,000 range. However, for more extensive estate plans including trusts, you can expect to pay upwards of $4,000 or more.

What is the most common estate planning document?

The most commonly known estate planning document is a will . A will details out how you would like your belongings distributed after you have died.

Is it too early to start planning for an estate?

It is never too early to begin thinking about your legacy and establishing your estate plan. Estate plans can be elaborate but do not have to be. They vary widely and so can the estate planning costs associated. Estate planning costs should include four key documents and may become more involved if trusts need to be drafted. The four key documents include:

How many hours does an estate attorney spend?

If he quotes you a $5,000 flat fee and he bills his time at $200 an hour, he expects that he and his firm will spend about 20 to 25 hours on your case. The general rule is that the higher an attorney's hourly rate, the more experience he has.

What is flat fee attorney?

A flat fee is a composite of the attorney's standard hourly rate and how many hours he thinks he'll have to invest in your case to resolve it. Ask what that hourly rate is, and find out how much you'll be charged for the services of other attorneys and paralegals in the firm.

Can an attorney charge you an hourly fee?

The only reasonable alternative would be for the attorney to charge you on an hourly basis. The downside to this approach is that it leaves a great deal of uncertainty for you as to what the final total cost will be. You can avoid this by asking your attorney to come up with a flat fee to cover all the services that she'll be providing to you. Just be prepared to move on and interview other attorneys if she declines.

Do attorneys charge for first meeting?

Many attorneys recognize the context of a first meeting and don't charge for it.

What is estate planning attorney?

An estate planning attorney is in business to earn a living, and time spent with you takes time away from billable hours that he could be spending on other clients' matters. That said, this is also his opportunity to "sell" you on retaining his services and to get an idea of what your matter involves. This is when he determines how many hours he and his staff will have to invest into resolving your issue...and if he wants to take your case on.

Do estate planning attorneys charge a fee?

Most estate planning attorneys don't charge a fee for the initial meeting, but this is by no means a universal rule. Don't be surprised if the attorney does charge a small fee for sitting down with you for the first time. It can go either way.

Who is Toby Walters?

Toby Walters specializes in accounting, banking, credit cards, investing, and a variety of finance topics. He has more than two decades of experience in finance and is a chartered financial analyst.

What is a married couple's estate tax plan?

This Plan is for married couples with assets over either the state or federal estate tax exemption limits . It avoids probate and allows the minimization of estate taxes due after the death of both spouses, and/or the deferment of state estate taxes. For families with sizeable assets, this plan can save hundreds of thousands of dollars for your heirs.

Do I need a revocable trust plan?

This is a probate avoidance Plan. Most families do NOT need a revocable trust plan, despite the many seminars that promote such plans. For older or disabled individuals, or multi-state property, however, it can be an excellent choice. I will explain the pros and cons.

What is a medical power of attorney?

A Medical Power of Attorney (“Advance Directive”) with living will provisions. This Plan is for married couples with assets over either the state or federal estate tax exemption limits. It allows the minimization of estate taxes due after the death of both spouses, and/or the deferment of state estate taxes (Maryland only).

What is a family will plan?

The Family Will Plan is for families with minor children as well as for parents who wish to leave assets to their adult children in trust until they reach specified ages or other milestones.

What is advance directive?

A Medical Power of Attorney (“Advance Directive”) with living will provisions. Basic Wills leave your entire estate to one or more persons, and do not include specific bequests (except for general bequests of tangible personal property), provisions for minor children, or any trust provisions.

Is estate planning flat fee?

We endeavor to provide estate planning services on a flat fee basis as much as possible. However, clients with multiple beneficiaries and/or complex trust and will provisions may be charged fees additional to those shown below, either as a flat fee or hourly.

Why do estates pay more for legal services?

It shouldn’t be a surprise to learn that large estates tended to pay more for legal services. Big estates are more likely to have complex issues— including taxes and business assets —that require more of an attorney’s time and expertise. Also, some states limit fees according to the size of the estate, allowing attorneys to charge more for larger estates. More than a third (36%) of readers who were settling estates worth $1 million or more said that the estate paid $10,000 or more in legal fees, compared to 18% of those who were handling estates worth less than that.

How long is a probate consultation?

More than half (58%) of the probate attorneys in our national study reported that they offered free consultations. The typical time for these initial meetings was 30 minutes, though the overall average was higher (38 minutes). So when you’re looking to find a good probate lawyer, ask the potential attorneys whether they offer a free initial consultation. Even if they charge for their time , it can be worth your while to meet with more than one lawyer—and to go to the meetings prepared with a list of questions—in order to find the right attorney for your needs.

Is it expensive to pay a probate attorney?

Paying a percentage-based fee to probate lawyer can be very expensive for the estate, because the percentage is based on the gross value of the probate assets (for instance, the total value of a house, rather than the amount of equity that the estate owns in the property). Even in the states that allow percentage fees, the law doesn’t require this type of fee arrangement. So if you want to preserve the estate’s assets, you should try to negotiate for an hourly or flat fee with any attorney you’re considering.

Do attorneys charge a percentage of the estate value?

In a few states (such as California and Florida), attorneys are allowed to charge a percentage of the estate’s value as the fee for handling probate. In our survey, only 8% of readers who paid a lawyer for help said the estate they were handling paid a percentage-based attorney’s fee.

Do probate attorneys charge more per hour?

The attorney’s experience. Not surprisingly, our study showed that hourly rates climbed as probate lawyers had more years in practice. But it’s worth keeping in mind that in this respect, at least, a higher hourly rate doesn’t necessarily translate into a higher total bill. Often, specialists with significant experience in estate administration may be able to answer your questions or handle difficult estate matters more quickly than less-seasoned lawyers.

How much does a probate attorney charge?

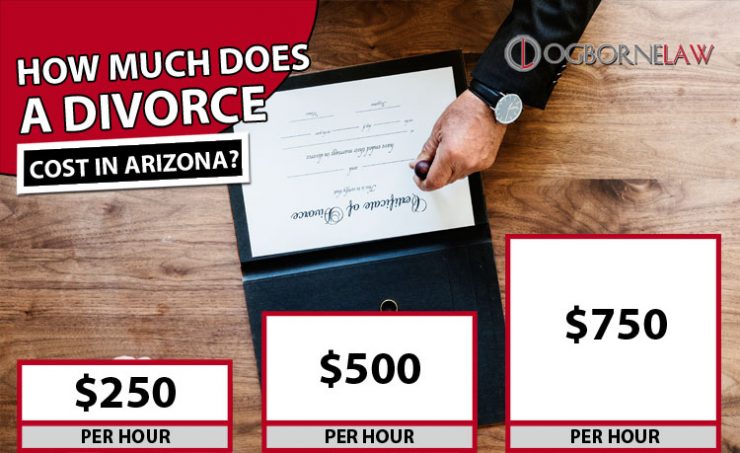

Nationally, the average minimum hourly rate attorneys reported was $250, while the average maximum was $310. Individual lawyers often charge different rates, depending on the client and the type of service they’re providing. Also, rates vary among attorneys depending on several factors, including:

How much do estate attorneys charge per hour?

The most common rate (reported by 35% of readers) was between $300 and $400, although half of readers paid less than that. Only 15% paid $400 or more per hour.

Do executors have to sign a fee agreement?

Whichever option an executor – or their chosen attorney – decides on, they should be sure to get all the details in writing. Reputable lawyers will be glad to sign a fee agreement, and some states even require it. The agreement should not only cite the payment arrangement, but also when the estate will be billed, when payment is due and in the case of hourly fees, how much the estate will pay each individual who performs work on it.

What states allow a 5% bill?

Only a handful of states – Arkansas, California, Florida, Iowa, Missouri, Montana and Wyoming – allow this type of billing, however. And even in these jurisdictions, it’s not required.

Can executors call the attorney?

The good news is that with a flat fee, the executor can call the attorney as often as is necessary without worrying that they're driving the bill sky high in six-minute increments.

Do estates have to pay $300 an hour for paralegal work?

Attorneys often delegate some routine work to paralegals and young associates – under their supervision, of course – and the hourly rates of these individuals are usually less, sometimes significantly. The estate won’t have to pay $300 an hour for correspondence drafted by a paralegal. Even so, the executor won’t know what the total fee will end up costing the estate until the end of the road when all the legal work is complete, every minute is accounted for and the estate closes.

How long does an executor have to call the executor?

The estate will pay for six minutes or one-tenth of their time if they take a phone call on the executor's behalf that lasts just three minutes. It will pay for 18 minutes if the attorney spends 15 minutes drafting a letter – and yes, they keep meticulous records of their time. But there’s a bright side here.

How much do probate lawyers charge?

Some attorneys charge an hourly rate for their services, which can range from $150 to upward of $300. It can depend on several factors, including the lawyer’s experience, whether they’re a general practitioner or a dedicated probate lawyer, whether they’re part of a firm or work on their own, as well as their location. Big city attorneys invariably charge more than their more rural counterparts, and probate lawyers’ fees tend to be steeper than those of general practitioners. After all, they’re experts when it comes to handling probate issues.

Do probate courts approve attorney fees?

Some states require that the probate court approve the amount of compensation an attorney receives unless all beneficiaries consent to the fee or it falls within statutory “reasonable” guidelines. What’s considered reasonable can vary by state.

Popular Posts:

- 1. what to do when your lawyer fails to file an appeal to social security in a timely manner

- 2. what is the highest lawyer

- 3. when a lawyer files a motion for appearance in iowa

- 4. what lawyer paid off its debt

- 5. what do you call a lawyer that works for free

- 6. us divorce lawyer who also understands french divorce laws

- 7. how to get a lawyer for vandalization

- 8. what is a jewish lawyer called

- 9. what happens if you leave preliminary hearing before lawyer tells you to

- 10. how much percentage gets a lawyer for a contract