Under current Social Security Disability regulations, a disability lawyer is generally only allowed to charge 25% of a claimants back pay up to $6,000. In fact, prior to receiving payment, the SSA

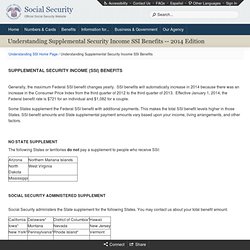

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

How much are social security attorney's fees?

The fee is capped at $6,000 but is often much less, especially if you are approved for benefits without having to wait for a hearing. Under the contingency fee arrangement required by Social Security, your attorney may not charge a fee unless your case is successful.

How much does a Social Security disability lawyer cost?

Social Security disability lawyers are paid a percentage of back-due benefits they win for clients. In our survey, the average amount lawyers received was $3,750. When people got an SSDI or SSI award after a hearing, the average fee was $4,600.

Can my SSI be garnished for court fees?

Your Social Security checks cannot be garnished for private debts, but the government can withhold benefits payments if it finds you have a few different types of debts. First, to put your mind at ease, Supplemental Security Income (SSI) cannot be garnished under any circumstance. That income is totally protected.

How much will I pay in SSDI attorney fees?

You won’t even pay a retainer when you choose an attorney or advocate to represent you throughout your Social Security Disability claim. The laws are rather specific for how Social Security disability lawyers are paid for representing clients. The fee is limited to 25% of the past-due benefits that you are awarded. That payment is capped at $6,000.

How far does SSI back pay go?

Retroactive benefits might go back to the date you first suffered a disability—or up to a year before the day you applied for benefits. For SSI, back pay goes back to the date of your original application for benefits.

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

Will SSI release backpay early?

You can get some of your SSI back pay faster in certain circumstances. If you are approved for SSI or SSI and SSDI both, and you find you need this money sooner than the SSA has scheduled it for release to you, contact the Social Security Administration (SSA) and ask that they release funds to you early.

What is the difference between SSI and SSDI?

The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

What is the hardest state to get disability?

OklahomaOklahoma is the hardest state to get for Social Security disability. This state has an SSDI approval rate of only 33.4% in 2020 and also had the worst approval rate in 2019 with 34.6% of SSDI applications approved. Alaska had the second-worst approval rate, with 35.3% of applications approved in 2020 and 36.2% in 2019.

What are 4 hidden disabilities?

The four most common types of hidden disabilities are:Autoimmune Diseases. In most people, the body's immune system protects them from invaders like bacteria and viruses. ... Mental Health Conditions. ... Neurological Disorders. ... Chronic Pain and Fatigue Disorders.

Does SSI track your spending?

A special note about SSI payments We don't count all resources. However, some items you buy could cause the recipient to lose their SSI payments. Any money you don't spend could also count as a resource.

What happens after you get approved for SSI?

You can usually expect your back pay and first monthly check to start 30-90 days after the award letter. As far as insurance is concerned, if you were approved for SSI, you will receive If approved for SSI, will receive Medicaid benefits automatically depending on the state you live in.

How long does it take for SSI to make a decision?

about 3 to 5 monthsGenerally, it takes about 3 to 5 months to get a decision. However, the exact time depends on how long it takes to get your medical records and any other evidence needed to make a decision. * How does Social Security make the decision? We send your application to a state agency that makes disability decisions.

Is it hard to get SSI?

According to government statistics for applications filed in 2018, many people receive technical denials: 45% for SSDI applicants and 18% for SSI. In that same year, approval rates at the application level based on medical eligibility alone were 41% for SSDI and 37% for SSI.

Is Social Security getting a $200 raise per month?

Bernie Sanders have introduced the Social Security Expansion Act. The plan includes an increased cost-of-living adjustment for seniors, an extension of the program to 2096 and those who qualify to get $200 more per month.

Which pays more SSDI or SSI?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

Contingency Fee Agreement

When you first hire a disability attorney or advocate, whether you are filing for SSDI or SSI, you must sign a fee agreement that allows the SSA to...

How Much Is The Attorney's fee?

For Social Security disability lawyers, the fee is limited to 25% of the past-due benefits you are awarded, up to a maximum of $6,000. Note that th...

How Disability Backpay Is Calculated

Once you are approved for benefits, the SSA will calculate the amount of backpay you are owed. For SSDI, your backpay will include retroactive bene...

Finding A Disability Lawyer

Read our article on how to find a good disability lawyer (and how to screen a lawyer before you hire one), or go straight to our local disability a...

Should You Hire A Social Security Disability Lawyer Or Go It Alone?

Statistically, the vast majority of Social Security Disability (SSDI/SSD) and SSI claims are denied at the initial claim and reconsideration levels...

Developing A Disability Case

The simple fact of the matter is this: the vast majority of SSDI and SSI claimants will have no idea how to properly and thoroughly prepare a disab...

The Chances of Winning Without Legal Help

Can a disability claimant who is not represented by an attorney still win an SSDI or SSI disability claim at an ALJ hearing? Yes, it is possible. H...

Lawyers and Representatives Can Win You More Backpay

The disability claimants who do win their claims without the help of a lawyer may not obtain the most favorable "disability onset date," which affe...

How much can an attorney charge for Social Security?

The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whichever is less. That limit on fees is a part of Social Security law, and in most cases, an attorney can't charge more than that.

What expenses do lawyers pay for Social Security?

In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled.

What does a disability lawyer do?

A disability lawyer generally gets a quarter of your Social Security back payments, if you win. Social Security attorneys work "on contingency," which means that they collect a fee only if they win your disability claim. Whether you are applying for SSDI (Social Security disability) or SSI (Supplemental Security Income), ...

How much can a lawyer collect on Social Security backpay?

For example, if your backpay award is $20,000 , your attorney can collect $5,000 (25% of $20,000). Second, the agreement must be signed by the Social Security claimant and the attorney. If the claimant is a child, a parent should sign for the child. If the claimant is an adult with a guardian, the guardian should sign.

How much does it cost to copy a medical record?

Usually, copying and mailing costs in a case are not more than $100 - $200.

Can a disability lawyer file a fee petition?

If a disability case requires multiple hearings or an appeals to the Appeals Council or federal court, a disability lawyer is permitted to file a fee petition with SSA to request to be paid more than the $ 6,000 limit. Social Security will review the fee petition and will approve it only if it is reasonable. To learn more, read Nolo's article on ...

Do you get paid for SSDI if you have an attorney?

Even if your case goes on for years, an attorney will not get paid until it is over (and won).

Is SSDRC a SSA website?

For the sake of clarity, SSDRC.com is not the Social Security Administration, nor is it associated or affiliated with SSA. This site is a personal, private website that is published, edited, and maintained by former caseworker and former disability claims examiner, Tim Moore, who was interviewed by the New York Times on the topic ...

Can you be charged for representation if you win a case?

And it is only paid in the event that a case is won. In other words, if you have representation and your case is not won, you cannot be charged a fee for representation. However, win or lose, you can be charged for other expenses that are not related to the fee for representation, such as reimbursing your representative for the cost ...

Do you have to take your SSA claim to the Federal Court?

Answer: In reading the SSA regulations, it appears that this may very well be normal. You do not have to take your claim to Federal Court, you could file a new disability claim and go through the process again. The protected maximum on a fee agreement appears to end at the Appeal Council.

Is Social Security law a law?

However, Social security law is not law per se. At the early levels, it is administrative regulation and procedure. In fact, this is why disability applications and reconsideration appeals ( the request for reconsideration is the very first appeal you can file) are actually processed by disability examiners, individuals who have been trained ...

Do legal professionals get paid?

Legal professionals get paid only if you win, so they do what they can to give you the best chance of winning. Updated By Bethany K. Laurence, Attorney. If you're considering filing a Social Security disability claim because you find it hard or impossible to work, or you've already filed a claim and been denied, ...

Do I need an attorney for disability?

Though you aren't required to have an attorney in a disability claim (with an appeal to federal court being the exception), attending a hearing before a judge without the assistance of a legal professional can result in a lost opportunity to win disability benefits. ( Here's why .)

Do you have to go to an ALJ hearing for SSDI?

For this reason, most SSDI and SSI claims will need to go to a hearing in front of an administrative law judge (ALJ) before a claimant can hope to receive disability benefits. It is at the level of an ALJ hearing that having a disability attorney can really help win a claim.

Is a disability claim denied at the initial claim level?

Statistically, the vast majority of Social Security Disability (SSDI/SSD) and SSI claims are denied at the initial claim and reconsideration levels, whether or not a disability claimant ( applicant) is represented by an attorney (or nonattorney representative).

Can I afford a disability lawyer?

Most disability claimants think they can't afford a disability lawyer or law firm, but a lawyer can charge you only if Social Security approves you for benefits, at which point the lawyer's fee is taken out of the back payments that Social Security will owe you.

Can I win an ALJ hearing?

Can a disability claimant who is not represented by a legal professional still win an SSDI or SSI disability claim at an ALJ hearing ? Yes, it is possible. However, the odds of winning a disability claim before an ALJ are markedly decreased when a claimant does not bring an attorney or representative to the hearing.

What happens if you claim Social Security?

If your claim is successful, Social Security pays your representative directly out of your “back pay” — past-due benefits the SSA can award if it determines after the fact that you were medically qualified to receive benefits while still awaiting a ruling on your case.

Who can fill out the SSDI application?

A lawyer or advocate can fill out the SSDI or SSI application on your behalf and help gather medical records and other evidence for your claim. They can review your application for mistakes or omissions that could hurt your chances of success and can join you for meetings or conferences with Social Security officials.

How does the SSA work?

The SSA will work directly with your representative and provide access to information from your Social Security file. Having an attorney or advocate can be especially important if you disagree with Social Security's initial decision on your claim and file an appeal.

Where can I get SSA-1696 form?

Download an SSA-1696 form from the Social Security website and send the completed version to your local Social Security office. Alternatively, your representative can file it for you electronically. Both you and your representative will need to provide an electronic signature for verification.

Can you verbally appoint a representative for Social Security?

During the COVID-19 pandemic, Social Security is also permitting claimants to verbally appoint a representative during a telephone hearing with an administrative law judge. You must still submit the written notice afterward.

Does having a representative help with disability?

But research has shown that having a professional representative can boost your chances of getting Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), the two SSA-run programs that pay benefits to people with disabilities.

Why do people not consult with an attorney?

Often, people fail to consult with an attorney because they are under the misconception that an attorney’s fees must be paid upfront before he or she is willing to take their case and represent them throughout their disability claims process. However, that is not accurate.

What to do if there is no back pay?

If there is no back pay, or if there are other extenuating circumstances, your lawyer or advocate can submit a fee petition to Social Security to request a higher fee to ensure he or she is paid for their work.

Do I have to pay a retainer for a disability attorney?

When you schedule a consultation with a disability attorney or a disability advocate, you won’t have to pay any money up front. You won’t even pay a retainer when you choose an attorney or advocate to represent you throughout your Social Security Disability claim.

Is there a fee to hire a disability attorney?

Getting Started with an Advocate or an Attorney. There usually is no fee to hire a disability attorney upfront because the fee will be paid out of the disability award that you eventually receive.

Who is the disability representative?

Usually, though, disability representatives are either attorneys, or non-attorney representatives who are often former employees of the social security administration. Attorneys and non-attorney representatives charge ...

Is SSDRC a SSA website?

For the sake of clarity, SSDRC.com is not the Social Security Administration, nor is it associated or affiliated with SSA. This site is a personal, private website that is published, edited, and maintained by former caseworker and former disability claims examiner, Tim Moore, who was interviewed by the New York Times on the topic ...

Do Social Security representatives charge fees?

Luckily, Social Security representatives do not charge their fees up front; instead there is a binding agreement between the representative and their client that stipulates what the representative can charge as a fee in the event that a disability case has been won (in other words, if the case is not won, there is no fee).

Does Social Security deduct disability fees?

First, a direct answer to the question: if you are represented and your case is won, in all likelihood, Social Security will deduct whatever fee is owed to your disability attorney or disability representative out of the back pay amount that you are owed. Now, a bit of discussion regarding fees themselves.

What does it mean when a VA charge a percentage of benefits?

If a person is charging a percentage of benefits the claimant is going to receive over a certain period of time, they are charging fees unethically and illegally. They have minimal professional experience in VA disability law – Veterans disability law is complex.

What does VA look for when assessing a reasonable fee?

When assessing if a fee is reasonable, VA will look at some of the following: Extent and type of service. Complexity of the case.

Why do lawyers have to be accredited?

Lawyers or Agents must be accredited in order to represent claimants before the Department of Veterans Affairs. The accreditation process exists to ensure that veterans and their family members receive skilled and informed representation throughout the VA claims and appeals process.

What does it mean to be an accredited lawyer?

When a representative such as a lawyer is accredited, it means they are legally qualified to represent veterans, service members, dependents, and survivors before VA for a number of VA benefits, which can include disability compensation benefits or dependency and indemnity compensation . 23:59.

What percentage of VA benefits are considered reasonable?

Fees that exceed 33.3 percent are presumed to be unreasonable.

What is an initial claim?

An initial claim is the first claim filed for a specific condition. An example of this would be if a veteran files a claim for benefits for a back condition they incurred during service, they will receive a rating decision that may grant or deny the claim.

Is VA disability fee reasonable?

There are ethical rules of reasonableness to which VA disability lawyers are held by VA. VA will look at many different factors to determine if a fee is “ reasonable” or “unreasonable.”. Accredited agents and lawyers typically work on contingency agreements .

When must a claimant file a fee agreement with the SSA?

For SSA to approve a fee agreement in a claim (s) resulting in more than one favorable decision, the claimant or representative must file the agreement with SSA before the date of the first favorable decision SSA made after the representative entered the case.

What happens if SSA makes a favorable decision?

If SSA makes a favorable decision on the claim, SSA will either approve or disapprove the fee agreement when it issues the favorable decision. If SSA's decision on the claim is unfavorable, SSA does not make a determination on the fee agreement and will not provide notice about the fee agreement.

What happens if a claimant appoints a representative after submitting a fee agreement?

Therefore, if the claimant appoints a representative after submitting a fee agreement, the representative must sign onto the first agreement or the claimant and representative must submit an amended agreement signed by all.

Did the former representative waive charging and collecting a fee?

The claimant discharged a representative, or a representative withdrew from the case, before SSA favorably decided the claim and the former representative did not waive charging and collecting a fee. The representative died before SSA issued the favorable decision.

Does the authorized fee include out-of-pocket expenses?

The authorized fee does not include any out-of-pocket expenses (e.g., costs involved in obtaining copies of medical reports or state sales tax, etc.).

Can the SSA approve a fee agreement?

Therefore, SSA will not approve a fee agreement for purposes of authorizing a representative's fee in the following situations: The claimant appointed more than one representative associated in a firm, partnership, or legal corporation, and all did not sign a single fee agreement.

Fee Agreements and Fee Petitions

- To get their fees paid, Social Security lawyers enter into written fee agreements with their clients and submit those fee agreements to Social Security for approval. If Social Security approves the fee agreement, it will pay your attorney for you directly out of your backpay. The attorney and the client can agree on any fee, as long as it does not ...

What Should Be in A Fee Agreement?

- An attorney must submit a written fee agreement to Social Security before Social Security issues a favorable decision on the claim. Most lawyers will submit the fee agreement when they take your case. Social Security has suggestions for the language in the fee agreements, but there are really only two main requirements. First, the amount of the fee cannot be more than the maximu…

Who Pays For Legal Costs?

- There are two kinds of expenses in a case: the amount the lawyer charges for her time and the expenses she pays for while working on your case. In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled. Those records might be located at hospitals, doctors' offices, schools, or mental health facilities, amon…

Popular Posts:

- 1. who was gregorio cortez lawyer

- 2. financial aid how does it work to get a lawyer

- 3. how to address an attorney in the uk esquire? lawyer?

- 4. how will being a lawyer change in the future

- 5. what values does a lawyer support

- 6. how to immigration to australia without lawyer

- 7. where is lawyer richard alderman

- 8. how to find a good cheap lawyer

- 9. what do yoy have to takr to be a lawyer

- 10. how many years of college needed to be a lawyer