Mortgage fees you might have to pay Application fee ($100): Some lenders charge a small fee when you submit your application. This is also sometimes bundled with the origination costs. Attorney fee ($150 to $500): In some states, you bring your own attorney to the closing table; in other states, you don’t.

Full Answer

How much will a foreclosure lawyer cost?

Sep 11, 2018 · How much are legal fees for a mortgage? September 11, 2018. Mortgages must be registered with the province. For this, a lawyer is involved in most provinces. Lawyers (or legal agents) generally charge the following for this service: For purchases: $1,200 to $1,500; For refinances: $1,200 to $1,500

How much does a real estate attorney cost?

Jun 20, 2017 · Origination or processing fee ($300 to $1,500): This fee covers the cost to prepare your mortgage. Sometimes you won’t be charged this fee at all.

How much are real estate attorney fees for closing?

May 18, 2013 · Mortgage Attorney Fees. Debt Real estate Mortgage debt Working with a lawyer Fees General Practice. Show 3 more Show 3 less . Low housing prices and low mortgage rates are encouraging many people to refinance their homes or get a mortgage to purchase a home. These mortgages are the biggest transactions in which most people will ever participate.

How much does a lawyer charge for a closing?

A lawyer prices this fee in such a way that you should be covering his or her estimated hourly rate. Since it is a simple matter, the lawyer already has a good idea exactly how much time is involved. Flat attorney fees are more common under these proceedings: Wills: For wills, the average lawyer fees for a flat rate will be around $1,000

How much are lawyer fees when buying a house Canada?

Based on the price lists of existing Alberta real estate law firms, the average one can expect to pay for real estate lawyer's fees is between roughly $650 – $2000 CAD or more, depending on the value and complexity of the transaction.Jan 29, 2021

How much are lawyer fees for buying a house NB?

Your lawyer should quote a block fee for professional services for all aspects of the transaction. At Meredith Bateman Law Office, our usual legal fee for a general purchase is $730.00, plus HST and disbursements, if on the Land Titles system, or $850.00, plus HST and disbursements, if not on the Land Titles system.

How much are average lawyer fees for a house purchase for Ontario?

between $450 to $1,500Average Real Estate Lawyer Fees in Ontario for house closing are between $450 to $1,500, depending on the transactions' complexity. In addition, some real estate lawyers charge an hourly rate between $270 to $450 + HST per hour plus Law Office disbursements.

What to buy before buying a house?

What to do before buying a houseDetermine if this is the right time to buy. ... Create a list of what you want in a house. ... Research the market. ... Spend some time in your desired neighborhoods. ... Check your credit score. ... Consider seeking help to repair credit, if necessary. ... Estimate how much money you need for closing costs.More items...•Jan 29, 2021

Who pays the land transfer tax in NB?

The purchaser of theWho Pays Land Transfer Tax in New Brunswick? The purchaser of the property pays the Land Transfer Tax. If more than one person is purchasing the property, they will need to agree on who will pay the tax.

Do you need a lawyer to refinance your mortgage in Canada?

While you do not have to hire a lawyer to complete the refinance of your home, it is always a good idea. There are many benefits to doing so. Using the lender's legal services might be tempting as it can sometimes be cheaper, but doing so can cause the refinancing process to take longer than it needs to.Jul 23, 2020

Can legal fees be included in mortgage?

Closing costs, such as legal fees, and other one-time expenses associated with the purchase of a home can really add up, and you'll need to factor these costs into your cash-on-hand budget. Many first time buyers underestimate the amount they will need.Apr 16, 2020

How much does an estate lawyer cost in Ontario?

The average lawyer fees for probate in Ontario is $2880+ according to Canadian Lawyer Magazine. Some probate lawyers even charge a percentage of the estate for probate which can add up to tens of thousands of dollars.

Why Do Homeowners Refinance?

There are four major reasons why you might want to refinance your home loan. You may want to lower your interest rate, change your loan’s term, con...

How Does Refinancing Work?

The first step is to see if you qualify for a refinance. You must already have a significant amount of equity in your home if you want to take a ca...

How Much Does It Cost To Refinance Your Mortgage?

Your Closing Disclosure tells you exactly what you need to pay at closing. Here are a few of the closing costs you might see when you refinance: ap...

How much does it cost to have an attorney at closing?

Attorney fee ($150 to $500): In some states, you bring your own attorney to the closing table; in other states, you don’t. If not, the lender might need to consult an attorney to look at closing documents or contracts. Flood certification ($5 to $10): This tells the lender if the home is in a flood zone.

How much does an appraisal cost for a mortgage?

Mortgage fees you’re likely to pay. Appraisal ($450 to $650): An appraisal by a licensed appraiser will almost always be required by the lender. The price varies depending on the size of the property and the type of loan you’re getting. “A lot of lenders will require payment for the appraisal upfront,” says Oehler.

What are points on a mortgage?

Points (1% of your total mortgage): Points are lender fees paid to reduce your interest rate. These are different from “origination points,” which are just another way of presenting mortgage origination fees. Underwriting fee ($400 to $600): This fee is paid to your lender to cover the cost of researching whether or not to approve you for the loan.

How much does flood certification cost?

Flood certification ($5 to $10): This tells the lender if the home is in a flood zone. Homeowner’s title insurance ($1,000 on average): You aren’t required to take out a title insurance policy for yourself, but it’s highly recommended.

How much does a survey cost?

The cost depends on the size of the policy and is set by the state. Survey ($350 to $500): Most states require a survey of your property before you can get a loan. If a survey doesn’t already exist that can be used, you’ll have to pay someone to do it.

How much does it cost to pull a credit report?

Credit report fee ($25 to $50): This is the fee to pull your credit report. Inspection ($450 to $500): The inspection isn’t a requirement for the loan, but it is highly, highly recommended. This is another cost that is paid before you reach the closing table. Generally, you can negotiate either fixes, concessions, ...

Where does Audrey Ference live?

Audrey Ference has written for The Billfold, The Hairpin, The Toast, Slate, Salon, and others. She lives in Austin, TX.

How much does an attorney charge per hour?

How much money is at stake. The most expensive lawyers are now charging upwards of $1,500 per hour for the elite, but the average attorney hourly rate is nowhere near that high. The typical person can expect to pay between $200 and $520.

What is the fourth type of lawyer fees?

The fourth type of lawyer fees you will commonly see is the contingency fee. Instead of paying your lawyer a certain amount whether you win or lose, contingency fees are a percentage you agree to give your lawyer from your settlement, only if you win your case. Contingency legal fees are common for: Car accidents.

Why do people resist paying their lawyer's fees?

Many people want to resist paying their legal fees because they feel they are just lining their lawyer’s pocket. While many attorneys do make a good living at approximately $114,970 a year, your lawyer fees go toward paying much more than the lawyer’s paycheck. Attorney fees also go toward any of these legal fees.

How much does an uncontested divorce cost?

Uncontested Divorces: The average cost of a lawyer charging a flat fee for an uncontested divorce is between $200 and $1,500. Bankruptcy: With a bankruptcy case, the average flat fee is often between $500 and $6,000. Some Criminal: Greatly varies.

Is the Laffey matrix used to determine lawyer fees?

There are many other areas that use this matrix to determine lawyer fees as well. But even if your area is not using the Laffey Matrix officially, it can be a useful guide to show you a starting place. Of course, if you are in a much smaller town with a simple case, you should expect lower legal fees.

Is flat fee as common as hourly?

Some Criminal: Greatly varies. While flat fees may not be as common as hourly lawyer fees, they do help the client know the lawyer will be working efficiently and quickly. The downside to a flat attorney fees is that your representative may not do as much as an hourly-rate attorney, due to payment constraints.

Is a lawyer's fee flat or hourly?

A lawyer prices this fee in such a way that you should be covering his or her estimated hourly rate. Since it is a simple matter, the lawyer already has a good idea exactly how much time is involved.

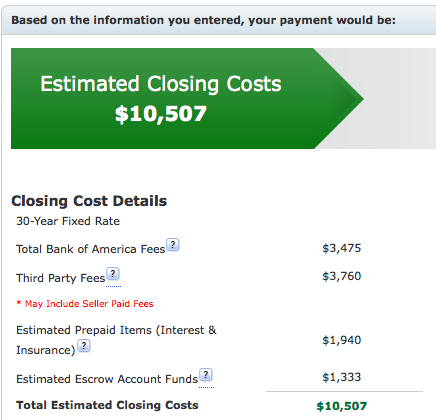

How much closing costs do you pay on a refinance?

You might see appraisal fees, attorney fees and title insurance fees all rolled up into closing costs. Generally, you’ll pay 2% – 3% of your refinance’s value in closing costs.

What happens when you pay off a mortgage?

Equity is the percentage of your home that you own. When you pay off your loan, you have 100% equity in your property. You take on a loan that’s worth more than what you currently owe with a cash-out refinance.

What is PMI in mortgage?

Private mortgage insurance (PMI) protects your lender in the event that you default on your loan. Most lenders require PMI if you have less than 20% down on your loan at closing. You may refinance and cancel your PMI if you now own more than 20% equity in your home.

How much down do you need to get rid of PMI?

Private mortgage insurance (PMI) protects your lender in the event that you default on your loan. Most lenders require PMI if you have less than 20% down on your loan at closing. You may refinance and cancel your PMI if you now own more than 20% equity in your home.

Why refinance to a longer term?

Refinance to a longer term: You might want to refinance to a longer term if you’re having trouble keeping up with your payments. Going from a shorter term to a longer term gives you more time to pay back your loan and also lowers your monthly payment.

Why refinance a home loan?

You may want to lower your interest rate, change your loan’s term, consolidate debt or take cash out of your equity. Let’s take a look at each of these motives in more detail.

How long do you have to live in your home to refinance?

As a general rule, you need to live in your home for at least a year to gain a financial advantage through a refinance. Next, find a lender to service your loan. You don’t need to refinance with the same company that services your current loan.

What is the big fee for a mortgage?

The big fee lenders charge is the arrangement fee. In the past, this covered a lender's administration costs. Now it's a key part of the true cost of a mortgage, along with the interest rate. It can also be called a product fee, or a booking fee or application fee. In fact, your lender can conjure up any name for it.

What are the disadvantages of adding a mortgage fee?

The disadvantage of adding the fee to the mortgage is you'll pay interest on it, as well as the mortgage, for the life of the loan. But if you pay the fee upfront, there's a chance you could lose it if anything went wrong with the purchase.

Why do lenders charge a valuation fee?

Valuation fee. Lenders charge this to check how much the property you're buying's worth – which can be different to what you've offered for it. They do this for their security, so they can be sure that if things go wrong and you fail to repay, they can repossess the property and get a decent amount for it when sold.

What do you pay for when you buy a leasehold property?

If you buy a leasehold property (where you don't own the land – you effectively pay the property price to rent it from the freeholder for many decades), you'll almost certainly pay a service charge for the upkeep of the property and shared areas, plus ground rent to the freeholder. Even if you own the freehold or are a joint freeholder with other neighbours, factor in maintenance costs as you will need to clean communal areas or fix the roof etc.

What does it mean when a link has a * by it?

If a link has an * by it, that means it is an affiliated link and therefore it helps MoneySavingExpert stay free to use, as it is tracked to us. If you go through it, it can sometimes result in a payment or benefit to the site. It's worth noting this means the third party used may be named on any credit agreements.

What happens if you don't get a survey?

If you don't get a survey and something turns out to be wrong with the property at a later stage, you'll have very limited options. The lender's valuation will offer you no protection, in fact the valuer might not even enter the property – they might just drive past to make sure the property exists.

What is the land registry fee?

Compared to the other fees in this guide, the Land Registry fee is a drop in the ocean, as it's 'only' a few hundred pounds. The Land Registry's job is to register properties under their owners' name. When you buy a property from someone else, the Land Registry charges a fee to transfer their register entry into your name.

Why do you need a lawyer when buying a house?

But hiring a lawyer early on in the process makes the whole thing easier and prepares you for any unforeseen circumstances. A lawyer will ensure that you have completed all the required paperwork, made all the required payments, and that everything is in order for your new purchase. That being said, because buying a home is one ...

What is the importance of a lawyer in closing a real estate transaction?

There are many important parts to closing a real estate transaction, and a lawyer will help you navigate the process, keep everything in order, protect you in case of misdealing, and ensure that the whole thing runs as smoothly and easily as possible for you.

What documents do you need to prepare for closing?

Closing Documents: Your lawyer will prepare closing documents, including the transfer of land, mortgage documents, tax forms, and a statement of adjustment using the information you have provided them. A few days before closing you will meet with your lawyer to sign the documents and make any outstanding payments.

What to do before signing an offer to purchase?

Before signing an Offer to Purchase, you will want your lawyer to review it to make sure that everything is in order. Your lawyer will hold onto this and any other documents and money needed for the transaction until the process is complete. This is to protect you from misdealing or dishonesty throughout the process.

What is an unpaid professional disbursement?

But what does that mean? A disbursement is money paid by the lawyer to a third-party on your behalfDisbursements are necessary out of pocket expenses that are paid out to complete your file by your lawyer on your behalf and these costs have to be paid back to your lawyer on the completion of your file.

What is a title search?

Title Search: Your lawyer will conduct a title search – a search for all records and documents that apply to the property, including the ownership. A title search will reveal if there are any legal issues with the property or ownership, and if there are none then you are able to proceed.

Is it necessary to hire a lawyer to buy a house?

Buying a house or condo is an exciting, but complicated, process that requires the help of an experienced lawyer. Hiring a lawyer is a requirement in the final stages of home buying, after a deal has been made. But hiring a lawyer early on in the process makes the whole thing easier and prepares you for any unforeseen circumstances.

What is the average mortgage origination fee?

The average loan origination fee is 1% of the total loan amount . For example, on a loan of $300,000, the loan origination fee would be $3,000.

How much does a notary charge for closing?

A notary makes your signature official. Notaries charge by the signature, about $100 for closing paperwork but they can add fees for their travel.

How to lower closing costs?

How to reduce closing costs 1 Shop various lenders for the lowest origination fees. 2 Utilize military benefits for VA financing, if eligible. 3 Ask the seller to pay your closing costs as part of the negotiations.

What happens to escrow funds during a purchase and sale?

During the purchase and sale transaction, your funds will enter into a holding account managed by a third party — an escrow company. When the transaction is complete, the escrow representative will disperse your down payment, fees and loan to the appropriate individuals.

How much does a HOA transfer cost?

During the negotiation, you can detail which party will pay the transfer fee. HOA transfer fees generally cost about $200. In addition to the transfer fee, your monthly HOA fee will likely be mortgaged. The first payment is often prorated, depending on your closing date.

What percentage of sellers make trade offs with buyers?

According to the Zillow Group Consumer Housing Trends Report 2019, 81% of sellers make some kind of trade-off with the buyer to facilitate the sale of a home. This can be a beneficial strategy if you don’t have enough cash available after paying your down payment to pay for your closing costs, too.

How much does a credit report fee cost?

Lenders charge a credit report fee of approximately $30. This covers collecting your credit report from all three credit bureaus. During underwriting, lenders may also charge a credit supplement fee to pay for a third party company to verify that the information on your loan application is up to date.

What is underwriting fee?

Underwriting fees typically cover a range of other costs, including commitment, flood certification, wire transfer, and tax service fees. Some loans, such as FHA mortgages, do not charge underwriting fees.

What is title fee?

In mortgage speak, the word “title” refers to your legal right to a property, and “ title fees ” refer to the costs of issuing title insurance policies for you, the seller, and your lender. Title insurance is a requirement in any real estate transaction—including a mortgage refinance—to protect you from title claims against ...

What is loan officer commission?

Loans officers play an important role in the mortgage process, and many lenders compensate them with 1% of your total loan amount in commission. (You may see where this is going.) Loan officers are, therefore, incentivized to make more money by selling you a higher loan—which isn’t in your best interest.

What is loan origination fee?

Loan origination fee. Loan origination fees are similar to application fees in that they are an upfront charge for doing business with the lender. These fees are supposed to cover the preparation of documents, attorney fees, notary fees, and more.

How much does an appraisal cost?

The appraisal is an important step in the mortgage process, and the fee associated with it is required. Appraisals typically cost around $300–$550 for a single-family home.

What is title insurance?

Title insurance is a requirement in any real estate transaction—including a mortgage refinance—to protect you from title claims against the property— e.g. if someone else claims that they should be the rightful owner instead of you. You can expect this fee to be part of your closing fees.

What do you need to appraise a home before you can buy a mortgage?

Before you can acquire a mortgage, a third-party appraiser will need to appraise the home you’re looking to purchase or refinance to assure the lender that you’re not borrowing more than its fair market value. The home inspector will base their appraisal on the home’s structural integrity and living conditions, as well as the price of comparable homes in the area. Your lender then uses this figure to calculate your loan-to-value ratio and decide how much money to lend you.

Popular Posts:

- 1. people who say they don't need a lawyer

- 2. how to find lawyer that represent you

- 3. if someone dies does the state notify the lawyer who you wrote a will with

- 4. how many years of training for a master decorate for a lawyer

- 5. finding a lawyer in pa. who has taken many dental malpractice cases

- 6. what is the average salary of a troutman sanders lawyer

- 7. how long does my lawyer have to file a complaint on a pedestrian accident in oregon

- 8. what is a silver sun lawyer

- 9. what its like to be a lawyer

- 10. how long do you have to get a lawyer if you dont want to talk