What is an extended reporting period (ERP) for claims-made liability insurance?

Apr 18, 2013 · Most professional liability policies for law firms of size only provide coverage for claims arising from work done on behalf or in the name of the insured law firm, but career coverage covers claims arising from work done at any prior point in a lawyer's career, irrespective of where the lawyer worked.

How much does it cost to hire an expert lawyer?

Sep 23, 2013 · An extended reporting period (ERP) is a set amount of time to report claims after an insurance policy has expired. This period is designed for professionals that need coverage for their business if they switch providers or stop offering their services. Learn more about extended reporting periods and why your small business might need one.

What are the different types of ERP policies?

For most lawyers, malpractice insurance coverage is something they need but hope to never use. But JoAnn L. Hathaway, author of "Legal Malpractice Insurance in One Hour for Lawyers," thinks lawyers should be well-informed about their coverage needs and protection.In her book, Hathaway, Michigan State Bar practice management advisor, licensed insurance agent and …

What is an ERP and how does it work?

If a claim does arise, malpractice insurance can serve as an important financial buffer for the lawyer and law firm and can provide for legal defense fees, meaning an attorney with more experience in malpractice cases can handle your case for you. Insurance policies vary, but many will provide additional or sub-limited coverage for pre- and ...

What is ERP coverage?

The ERP, also known as “tail coverage,” provides for an additional period of time during which the insured can report a claim after its claims-made policy has expired.Oct 5, 2021

How is extended reporting period premium calculated?

The cost to purchase an ERP is commonly calculated as a multiple of the last annual policy premium, for instance, 150% of last year's annual policy cost. The cost is often specified within the general terms and conditions of the policy with an option for multiple years.

What is extended reporting coverage?

An extended reporting period ( ERP ) is a feature you can add to your claims-made professional liability insurance policy. It allows you to report claims even after your policy expires. This policy endorsement is also known as tail coverage.

What is E&O tail coverage?

What is tail coverage? And should I get it? From VanEd: Good question! This is simply a type of Errors & Ommissions (E&O) coverage that will bridge the gap between activities that occur when you are licensed and a period of time after your license expires, is placed inactive, or you retire.Sep 19, 2012

Is Tail coverage the same as run off?

Tail coverage, can be considered synonymous with run-off insurance and or used interchangeably with extended reporting period provisions. It includes several important features: The tail coverage applies only if the wrongful act giving rise to the reported claim took place during the expired/canceled policy period.

What is coverage trigger?

A coverage trigger is an event that must occur in order for a liability policy to apply to a loss. Coverage triggers are outlined in the policy language, and courts will use different legal theories pertaining to triggers to determine whether policy coverage applies.

What is run off period in insurance?

Runoff Provision — a provision in a claims-made policy stating that the insurer remains liable for claims caused by wrongful acts that took place under an expired or canceled policy, for a certain time period.

What is a CGL policy?

A Commercial General Liability (CGL) policy protects your business from financial loss should you be liable for property damage or personal and advertising injury caused by your services, business operations or your employees.

What is an excess policy?

Excess policies, also called secondary policies, extend the limit of insurance coverage of the primary policy or the underlying liability policy. In other words, the underlying policy is responsible for paying any portion of a claim first before the excess policy is used.

Why is tail coverage needed?

Why Do I Need Tail Coverage for Insurance? Tail coverage can give you extra protection and help cover claims filed after your policy ends. If a claim gets brought against you after your policy ends, your insurer normally wouldn't cover it.

Who needs tail coverage?

Physicians who are permanently leaving the practice of medicine for a reason other than retirement, such as disability or a career change, will need to make sure they have tail coverage.May 10, 2016

How does a tail coverage work?

Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. It applies to claims-made insurance policies and typically involves paying your insurer an additional fee.

What is ERP insurance?

Key Takeaways. ERPs give you professional insurance after you've switched policies or stopped offering your services. Extended reporting provisions vary widely, so it is important to understand the coverage time frames. There are two types of ERPs you can purchase, basic and supplemental.

When does supplemental ERP take effect?

Supplemental ERP. ERPs might also include an option for a supplemental ERP. The supplemental tail takes effect when your basic ERP ends and has an unlimited duration. If you wish to purchase the supplemental ERP, you must notify your insurer in writing within 60 days after your policy expires. Many policies include the option to purchase ...

What is an occurrence policy?

Under an occurrence policy, the insurance company covers a claim if it happened during the period the insurer covered your business, even if the claim is made years later. Claims-made policies cover any claims made when you're covered, but only during the period the policy is in force.

How long does a claims made policy last?

A short-term tail is often provided automatically if the insurer cancels or non-renews your policy. It typically lasts for 30 or 60 days after your policy expires. A short-term tail may be called a basic ERP or an automatic ERP.

Why do I need an extended reporting period?

An extended reporting period is an extra coverage period you purchase so that you're covered in case you don't renew your professional insurance policy. The main reason for this type of coverage is to ensure that you can afford the costs associated with a claim against your business if you don't renew your professional insurance.

What is professional liability insurance?

Professional and business insurance policies cover you if a client files a claim for a mistake they believe you have made. There are two types of professional liability policies: occurrence and claims-made. Under an occurrence policy, the insurance company covers a claim if it happened during the period the insurer covered your business, ...

Does a claims made policy cover a claim filed against a company?

Claims-made policies don't cover claims filed against your company after your coverage has ended. For example, suppose you're insured under a one-year claims-made general liability policy that covers you annually from January 1 to December 31. When your policy expires, you replace it with a one-year occurrence policy.

How much of a predecessor firm's assets are included in a new insurance policy?

Often, a predecessor firm can be included in the new firm’s insurance policy if the new firm has assumed at least 50 percent of the predecessor firm’s assets and liabilities and if at least 50 percent of the attorneys from the predecessor firm become members of the new, successor firm.

What are the top three risk areas of practice?

The publication contains a wealth of valuable information, including that the top three highest risk areas of practice are: personal injury – plaintiff, real estate and family law. Underwriters not only review an applicant’s practice area concentration for risk, but also for type of risk.

What happens when an attorney leaves a firm?

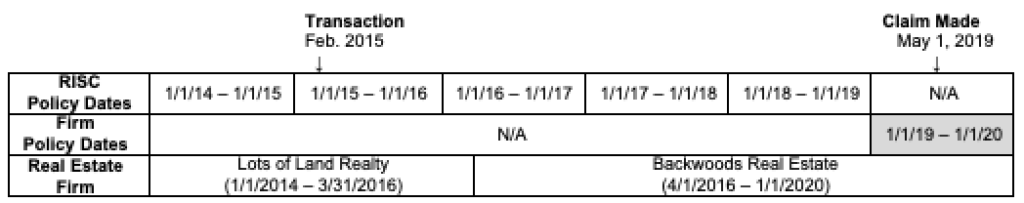

When attorneys leave firms, coverage usually remains in force for their client representation during the time they were employed by their now-predecessor firm , providing the predecessor firm continues to maintain an insurance policy or purchases an extended report period (ERP) in the event the firm discontinues coverage.

Should lawyers expect excellent customer service?

Lawyers can and should expect excellent customer service when shopping for a policy and when dealing with their carrier thereafter. It pays to do some research on a carrier’s reputation before signing on the dotted line.

Does cyber insurance cover cyber risks?

Many believe they have adequate coverage for cyber risks under their firm’s current insurance policies . However, other policy types with add-on endorsements often offer only a minimal amount of cyber coverage compared to a dedicated cyber-liability insurance policy.

1. Functional fit

ERP systems aren't a one-size-fits-all proposition, so consider required business functions. For example, a global organization that requires multiple currencies and languages will need different features than a smaller, single-location company.

2. Systems integration

ERP software will inevitably need to connect with third-party systems, so IT should make sure they're considering those systems in their discussions.

4. Vendor technology

The ERP buying team should evaluate whether the vendor's technology is the right fit for them.

5. Customization options

Another criterion for consideration is the ERP software's customizability and how much customization a business might need.

6. Vendor roadmaps

A vendor's software plans are another important aspect of the ERP selection list.

7. Implementation and maintenance costs

Keeping ERP costs in mind is crucial, and the buying team can easily overlook some figures.

8. Vendor support

The amount of support a vendor will provide is extremely important to consider.

What are the advantages of law firm management software?

2. Enhances Coordination. Another significant advantage of law firm management software is that it promotes collaboration between attorneys and their support staff.

What is lean law?

LeanLaw is a timekeeping and management software which takes your law practice to a different dimension making it paperless. It helps you become efficient, powerful and proactive. This legal software helps you manage your schedules to help you be on time thus having a good reputation among your clients. Once you have entered timekeeping data you can utilize this data to generate accurate bills on time with just a few clicks. View Profile

What is mycase law firm?

MyCase Law Firm is a fully featured cloud based legal software programs suit catering to all the needs of a modern law firm. It is highly customizable and adapts itself to suit your specific needs. This lawyer software can record all the legal documents needed by you without any storage limitation and can keep them securely for further use. View Profile

What is casepeer software?

CASEpeer is a legal case management software catering to all the needs of people involved in the legal profession. It specializes in dealing with personal injury attorneys. It is the best law firm software that will serve you perform your business undertaking better whether you are a sole lawyer or a law firm.

What is a leap?

LEAP is a true cloud practice management software for law firms. LEAP includes matter management, automated legal forms, email management, automatic time recording, trust accounting, billing, office reporting, and a client service portal in one system for one price. View Profile

Do law firms use software?

For decades, law firms have relied on conventional methods to do business. But now, as technology paves the way into the legal industry, law firms have started using legal software solutions. However, new technology adoption can seem daunting, especially for new firms never used digital solutions before.

Should law firms invest in on-premise software?

Large law firms should amp up their legal tech spending and invest in on-premise law practice management software. On-premise solutions are more secure as you'll be in charge of the servers, upgrades, and maintenance. Large law firm owners also need to manage other business aspects, apart from the regular legal tasks.

How long is an ERP policy?

ERP options are expressed in years and those options may include up to five years, or an unlimited period to choose from. 4.

What is the limit of liability?

Limit of Liability – The maximum amount the insurance company will pay for the coverage. Typically, limits are expressed as “per claim” and “aggregate” (the most the insurance carrier will pay for all claims during the policy period).

What is an extended reporting period?

Extended Reporting Period (ERP) also known as “tail” coverage covers claims resulting from errors which occur on or after the insured’s retroactive date and before the policy termination date, and are reported to the carrier during the ERP coverage period. ERP options vary by insurance carrier, therefore it is important to review the options available when deciding which insurance policy to purchase. ERP options are expressed in years and those options may include up to five years, or an unlimited period to choose from.

What is worldwide coverage?

Worldwide coverage – coverage applies wherever the lawsuit is filed. Disciplinary coverage – coverage for bar matters. Subpoena coverage – coverage for expenses associated with a subpoena. Reimbursement for lost earnings – lost wage coverage for attending hearings/trial associated with the lawsuit.

Can a lawyer be sued for malpractice?

Any attorney in the private practice of law is at risk of being sued for malpractice (our current economic condition only increases this likelihood). An allegation of malpractice can cost thousands of dollars in defense costs that could put significant financial strain on a lawyer or law firm.

Why is errors and omissions insurance important?

This coverage, also called errors and omissions insurance, may be necessary, in addition to any general liability policy you may have, to protect you in the event that clients sue, claiming that you caused them financial loss or interruption of services. It’s important to assess your risk and consider coverage, because as an independent, ...

Do independent contractors need insurance?

As an independent contractor, you’ve probably had to set up your own insurance coverage, including health insurance and possibly other policies. Along with these, you must evaluate your need for professional liability insurance, which will protect you if a client files a suit regarding how you did or didn’t fulfill your professional obligations.

Do 1099 workers need liability insurance?

Also, more companies have recently begun requiring independent contractors to carry liability insurance when working on a project for them. If you subcontract, you may find that many computer-consulting companies are requiring their 1099 workers to carry professional liability insurance coverage in an amount equal to their own.

How often do you have to pay a lawyer?

Before you sign an agreement with a lawyer, find out how often he or she requires payment. Some require it monthly, while others require weekly payments toward a bill. If payment to your attorney includes part of a settlement, make sure you understand how that will be paid after the case is closed.

What to do if you don't include attorney fees in estimate?

If these aren't included on the written estimate, make sure to ask. You might end up with a separate bill, unless your attorney absorbs the extra fees into the total bill. It's also important to make sure that the cost of the lawyer is worth the overall cost of the case and what you could recoup.

What percentage of contingency fees are negotiable?

Courts may limit contingency fee percentages. The average ranges from 25 to 40 percent . Contingency fees may be negotiable. Referral fees: if a lawyer doesn't have a lot of experience with cases like yours, he or she may refer to you another lawyer who does.

What is flat fee lawyer?

Flat fee: a lawyer may offer a flat fee for a specific, simple, and well-defined legal case. Examples of cases eligible for flat fee billing include uncontested divorces, bankruptcy filings, immigration, trademarks , patents, and wills. Before agreeing to a flat fee, make sure you understand what is covered in the agreement.

Why do criminal cases require contingency fees?

Because a criminal case is often more intricate, pricing with contingency fees doesn't really make sense. Serious criminal cases often require multiple legal proceedings, such as the preliminary hearing, jury selection, trial, writs and appeals, and sentencing, so the process can take months.

What factors affect the hourly rate of a criminal lawyer?

A criminal lawyer's hourly rate will depend on multiple factors, which may include: The reputation of the lawyer and/or firm. The complexity of your criminal charges. The lawyer's level of experience. The location (hourly rates are typically higher in large cities)

What does it mean when a lawyer is not willing to discuss the costs with you?

If the lawyer is not willing to discuss the costs with you, it's a sign of poor client service.

How much does an attorney charge per hour?

Attorney fees typically range from $100 to $300 per hour based on experience and specialization. Costs start at $100 per hour for new attorneys, but standard attorney fees for an expert lawyer to handle a complex case can average $225 an hour or more.

What to ask when hiring an attorney?

When hiring your attorney, ask for a detailed written estimate of any expenses or additional costs. They may itemize each expense out for you or lump their fees all together under different categories of work. Lawyers may bill you for: Advice. Research.

What is retainer fee?

An attorney retainer fee can be the initial down payment toward your total bill, or it can also be a type of reservation fee to reserve an attorney exclusively for your services within a certain period of time. A retainer fee is supposed to provide a guarantee of service from the lawyer you've hired.

How to avoid disagreements with your attorney?

Avoid disagreements with your attorney about how much you owe by taking the time to review your attorney fee agreement carefully. You may also hear this document called a retainer agreement, lawyer fee agreement or representation agreement. Either way, most states require evidence of a written fee agreement when handling any disputes between clients and lawyers. You must have written evidence of what you agreed to pay for anyone to hold you accountable for what you have or have not spent.

Why is legal aid more affordable?

Legal aid billing rates are more affordable if the law firm has a sliding-scale payment system so that people only pay for what they can reasonably afford. Seeking out fixed fees in legal aid agencies is the best option for those in desperate need who cannot otherwise pay for a lawyer.

Can you get a credit for a retainer?

Since most retainer fees are nonrefundable, you probably won't get any credit next month if you don't use the full amount of your retainer for the current month. You'll almost always have to pay additional fees if your case takes up more time than you paid for with the retainer fee.

Do paralegals pay more than legal research?

For example, a court appearance often costs more than legal research time. Besides that, the same younger paralegals who may do the majority of research receive lower wages than senior associates who conduct interviews and present the case before a judge.

Popular Posts:

- 1. what amendment guarantees the right to a lawyer even if a person cant afford one

- 2. why i became a lawyer meme

- 3. what is the name of the lawyer in erin brockovich

- 4. . what type of relationship do a lawyer and a client have

- 5. how do i find a dissibilty lawyer

- 6. "how to find a personal injury lawyer" "what is a personal injury lawyer"

- 7. christian discrimination lawyer they get paid when you do

- 8. why is being a lawyer so stressful

- 9. how does lawyer know execute will

- 10. how to become a record industry lawyer