How much should a lawyer charge for a probate case?

Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case. Hourly Billing. Many probate lawyers bill clients by the hour.

How much money do Probate lawyers make?

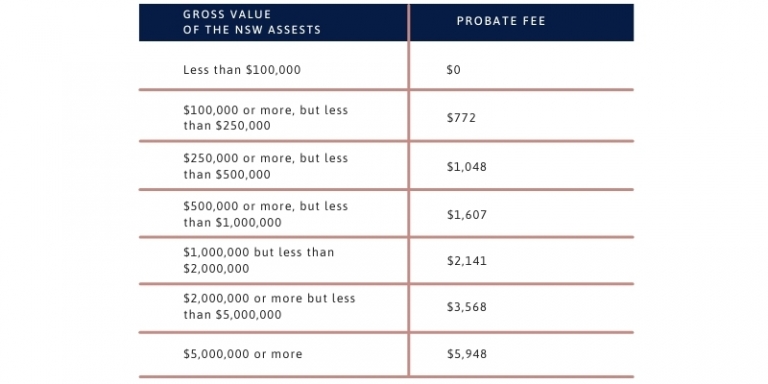

Probate costs vary greatly from one location to another, but they commonly tally up to be somewhere in the range of 3% to 7% of the estate’s value. They can go much higher, though, and tend to do so as the value of an estate rises. Indeed, the higher the value of the estate, the higher the probate costs are likely to be.

What are some basic costs related to probate?

Third-party costs are often called disbursements, and can include:

- The probate court fee of £155 to apply for a grant of probate

- The cost of copies of the original grant of probate, at £1.50 a copy.

- The official entry of a house or property into the Land Registry of £3 plus VAT

- A bankruptcy search of approximately £2

- Around £5 plus VAT to have an electronic ID search done

What is the typical cost of probate?

Probate cost varies from estate to estate. An often-quoted average is between 3% to 7% of the total estate. Most people think of estate taxes when they think of the cost of probate. While the estate tax does apply to qualifying estates (estates of over $1 million for the MN estate tax, as of the date of this post), this particular post focuses ...

How much does an estate have to be worth to go to probate in Texas?

$75,000Probate is needed in Texas when someone dies with assets in their single name, whether they have a will or not. Full court probate (court supervised) is required in Texas when the total assets of the estate are greater than $75,000 and or if there is a will.

How much is probate in California?

Statutory probate fees are; 4% of the first $100,000 of the estate, 3% of the next $100,000, 2% of the next $800,000, 1% of the next $9,000,000, and one-half % of the next $15,000,000. For an estate larger than $25,000,000, the court will determine the fee for the amount that is greater than $25,000,000.

How do I probate a will without a lawyer in Texas?

How to probate a will without a lawyer1) Petition the court to be the estate representative. ... 2) Notify heirs and creditors. ... 3) Change legal ownership of assets. ... 4) Pay funeral expenses, taxes, debts and transfer assets to heirs. ... 5) Tell the court what you have done and close the estate.

How much does it cost to hire probate lawyer in California?

Just for an example, take a look at California's statutory fee schedule: 4% of the first 100,000 of the gross value of the probate estate. 3% of the next $100,000. 2% of the next $800,000.

How much do probate lawyers charge in California?

Percentage of the estate's value According to California probate statutory fees, an attorney in the state of California may collect 4% of the first $100,000 of the gross value of the probate estate as attorney fees. Percentage values are based on the total value of the estate.

What is the average cost to probate a will in Texas?

The Cost Of Probate With A Will In Texas, if the deceased had a Will providing for an independent administration, which is standard for lawyers to include in a Will, the cost of probate probably would range from $750 to $1,500 in attorneys' fees. Court costs are about $380 in Texas.

Can I file probate myself in Texas?

In Texas, probating a will yourself is an independent administration. Independent administration is only possible if the person who died stated in her will that her executor, the person she named to oversee probate, does not need court supervision.

Is probate necessary if there is a will?

A probate is nothing but the verification form genuineness of the will. It is not always necessary to get a probate order for a will. If there is no dispute between the legal heirs as to the contents of a will they may choose to forgo a probate.

How much money triggers probate in California?

California law provides that a probate is not necessary if the total value at the time of death of the assets, which are subject to probate, does not exceed the sum of $100,000. There is a simplified procedure for the transfer of these assets. The $100,000 figure does not include vehicles and certain other assets.

What is the threshold for probate in California 2021?

California allows for a simplified probate in cases where an estate has probate assets valued less than $166,250.

Is probate mandatory in California?

Probate is generally required in California. However, there are two different types of probate for estates. Simplified procedures may be used if the value of the estate is less than $166,250. Probate may not be necessary if assets are attached to a beneficiary or surviving owner.

How do I avoid probate in California?

In California, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How probate attorneys charge for their services

Probate attorneys charge for their services in many ways. In some states, probate fees are set by statute—often as a percentage of the value of the estate.

How much should simple probate cost?

Probate is a complicated process that can take years to complete. The cost of probate will depend on the total value and complexity of your estate, but you should plan for it is at least 3% – 7%. In some cases, this fee may be waived if there are no assets or heirs requiring distribution from the deceased’s estate.

What increases the cost of a probate attorney?

Regardless of the method, an attorney uses to charge clients, their fees will increase if there are complications with probate. Some examples of issues that may result in increased costs include:

How long does probate take?

Probate can take anywhere from a few months to several years to fully complete. For most estates of average size, the process will range from six months to two years. If an estate is especially large, if any heirs contest anything, or if beneficiaries cannot be found, things will take longer.

What are the drawbacks of probate?

Perhaps one of the biggest drawbacks to probate is the cost . And the more it costs, the less inheritance your beneficiaries will receive. Total cost can widely vary, depending on a number of factors including: But there are some things you can count on being fairly consistent in the probate process.

What does an executor charge for?

Executors can charge a fee to be reimbursed for most expenses they incur. This can include the cost for any travel needed, to pay for tax prep, to buy any supplies, or for anything else required to settle an estate. Executors can also be reimbursed a fair fee for the job they do as a representative of an estate.

Do you have to pay probate fees out of your estate?

And in some states, you’re actually required to do so by law (although most states do not mandate this). A probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket.

Do all estates need to go through probate?

Depending on how you set it up, your estate may need to go through probate so the courts can begin the process. It’s important to understand that not all estates need to go through probate. And, there are smart, strategic ways you can make probate easier or even eliminate it all together.

Do probate attorneys charge hourly?

At the end of the day, that’s money that could be going to your beneficiaries. Probate lawyer fees can vary - lawyers can charge hourly or a flat rate.

How to avoid probate?

Some people want to avoid probate, and that’s understandable. Probate can be stressful and taxing. If you’re looking for ways to not have to go through probate, these strategies may help: 1 Establish a Revocable Living Trust 2 Title property/assets as Joint Tenancy 3 Create assets/accounts/policies that will TOD or POD (Transfer on Death; Payable on Death)

What happens to an estate after someone passes away?

After someone passes away, their estate needs to be settled. Debts and taxes need to be paid and distributions to heirs need to be made. Often, this happens by way of a court-supervised process known as probate. Despite probate being fairly common in the state of Texas, there are often a lot of questions about it.

Is probate common in Texas?

Despite probate being fairly common in the state of Texas, there are often a lot of questions about it. And the majority of these questions stem from wondering what the average cost of probate in Texas actually is. The cost of probate can depend on a number of things, including: Size and complexity of the estate.

How much a probate lawyer costs and how they charge for their services

The death of a loved one seems to bring with it a plethora of tasks that have nothing to do with grieving—managing bills, planning a funeral, and going through the probate process. The expenses can quickly become overwhelming.

How probate attorneys charge for their services

In many states, probate fees are set by statute—often as a percentage of the value of the estate.

What increases the cost of a probate attorney?

Regardless of the method an attorney uses to charge clients, their fees will increase if there are complications with probate.

How to save money on a probate attorney

Saving money on a probate attorney is mostly about saving time. The less time an attorney has to spend on your probate matter, the less they’ll charge you.

Do I need a probate attorney?

The truth is, the majority of probate cases proceed without issue. And executors and administrators throughout the United States regularly complete the probate process without an attorney. (In fact, that’s what inspired our founder to start EZ-Probate.)

How much does it cost to publish a probate notice in California?

Probate Notice Publication Fee: $200. In California and most states, the executor of the will must publish the estate’s probate notice in a public newspaper or publication. Typically, the executor will publish the probate notice in a local community newspaper or magazine for about $200.

What is ordinary compensation for executor of will?

In addition to the statutory ordinary compensation to which an executor of the will and his/her attorney may be entitled, the executor and/or attorney may also receive “extraordinary” compensation for such things as property sales and transactions, carrying on a business, tax returns, handling audits or litigation (including will contests and contested accountings), and coordinating ancillary probate administrations. These fees are not set by statute but must be reasonable as determined and approved by the court. They can often exceed the statutory ordinary compensation discussed above.

What is the ordinary executor of a will entitled to?

Ordinary Executor Compensation. As it turns out, the Executor of the Will also is entitled to statutory compensation for ordinary time and effort associated with administering the probate process. It’s actually the exact same cost paid to the probate attorney, see the chart below.

Do sole beneficiaries get tax free?

And in many cases, they will receive those distributions tax-free. If that’s the case, then the sole beneficiary would receive more by declining the probate compensation and avoiding having to pay any income tax. Then in effect, receiving that same compensation as part of the estate distribution, tax-free.

Is probate attorney standardized in California?

Probate lawyer and attorney costs are standardized in California and most other states. Plus, other fees and compensation also are predetermined. To help clarify, let’s discuss the four basic groups of probate lawyer costs and other fees:

What a probate lawyer charges and what they charge for their services

There are many tasks associated with the death of a loved one. These include managing bills, planning a funeral, and going through Probate. It is easy to become overwhelmed by the cost of living.

What do probate attorneys charge for their services – Probate attorney fees

Probate fees in many states are set by statute, often as a percentage of the estate’s value.

What causes a higher cost for a probate lawyer?

No matter how an attorney charges clients, the fees they charge will go up if there is a probate problem.

How to Save Money on a Probate Attorney

It’s not about saving money, but time. A probate attorney will charge less if they spend less time on your case.

Do you need a probate lawyer?

Most probate cases are resolved without any problems. Executors and administrators in the United States can complete probate cases without the assistance of an attorney.

How much does a probate lawyer charge?

A probate lawyer’s fee has to do with where the case gets filed. Attorneys can charge a $250/hour fee in smaller towns or a $5,000 flat fee in a city. In certain states, attorneys can charge a percentage of the estate’s value.

What does a probate lawyer do?

Probate lawyers work to untangle the hard-to-decipher portions of a deceased individual’s will. They usually handle the legalities of changing possession of assets and settling outstanding debts.

What is a flat fee in probate?

Flat Fee. Flat fees are another common way probate lawyers opt to receive their payments. Sometimes, lawyers will give you the option between paying them a flat fee or an hourly wage. Flat fees remove the headache of keeping up with billable hours.

What is a large estate?

A large estate is one that has a gross value of over $1,000,000. Most large estates are complicated to probate and can become confusing during the asset redistribution part of the process.

What states pay percentage of estate value?

This payment option is only available in seven states: Arkansas, Florida, Iowa, California, Missouri, Wyoming, and Montana. Paying a percentage of the estate’s value is often extremely costly. The percentage comes from the gross amount of the estate, so even a small percentage can easily be thousands of dollars.

Do probate lawyers get paid?

Many probate lawyers can be paid by the hour to handle aspects of a case without taking on its entirety. It is also important to note that the fees incurred for legal counsel can be settled with the estate’s assets. The lawyer fees should get paid off before assets are distributed to the heirs listed in the will.

Does flat fee include court filing costs?

Paying a flat fee may be expensive on the surface, but you can ask more questions without running up the costs. Flat fees may not include court filing costs or appraiser’s fees, so it is essential to understand what the flat fee does and does not cover.

Popular Posts:

- 1. my lawyer keeps postponing my trail what can i do

- 2. what kind of lawyer do i need

- 3. what are my chances of being a lawyer

- 4. who was fred korematsu lawyer

- 5. how to fight custody battle without lawyer

- 6. how to become a business lawyer in uk

- 7. are there divorce lawyer who work for veteran in california with free advice

- 8. what lawyer handles first offender act

- 9. what does an ssi lawyer do

- 10. what degree is lawyer