How much does a lawyer cost?

What are Standard Lawyer Fees? “There are no ‘standard’ attorney’s fees, but the hourly charge typically ranges from $250 to $600/hour depending on where you live and the size of the law firm. Some lawyers do state work for $50/hour, and law firms in New York City that far exceed the $600/hour mark,” says Costantini.

Why do real estate lawyer fees vary so much?

David Reischer, a real estate attorney based in New York City and CEO of LegalAdvice.com, said real estate lawyer fees also vary depending on the market the home is in. “Geographic location plays a big part in the cost for a home closing,” he said. “Rural areas will typically charge much less than an urban major metropolis.”

Can I pay my lawyer with financing?

Once you sort your financing, you can pay your lawyer, get on with the case, and get back to normal life as soon as possible. How Much Should You Pay for a Lawyer?

Do you have to pay fees when buying a house?

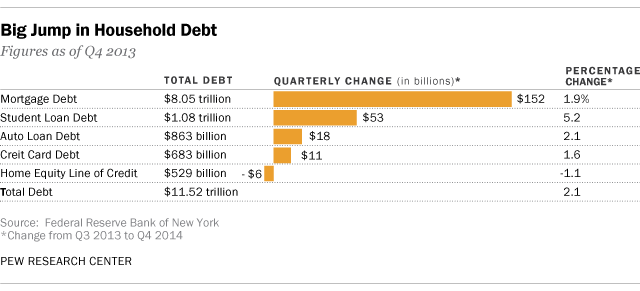

Some fees must be paid up front and require careful planning and budgeting before your home purchase. Other fees can be rolled into your home loan and paid as part of your mortgage payment. Understanding both sets of fees is critical to ensuring a successful, affordable home purchase.

How Much Does A Lawyer Cost?

When clients ask, "how much does a lawyer cost," the answer can vary from $50 to $1000 or more per hour. But if you're facing a legal issue, workin...

Why Is The Cost of A Lawyer Important?

Understanding the cost of a lawyer before you enter into an agreement can help prevent unpleasant surprises or costs that you cannot afford. Some p...

Reasons to Consider Not Using A Lawyer Based on Cost

Many people don't have enough money to hire a lawyer for legal help. The United States of America offers rights to its citizens, called Miranda Rig...

Reasons to Consider Using A Lawyer Based on Cost

The cost of the lawyer will certainly factor into your decision, but remember that cheaper does not equal better. A lawyer who charges more per hou...

What Could Happen When You Use A Lawyer?

When you use a lawyer in any type of legal proceeding, you now have someone on your side who understands the complex legal system. Even something t...

What Could Happen When You Don't Use A Lawyer?

Without legal representation, you could miss a due date for forms or documents, causing delays in your case or even a ruling that is not in your fa...

Frequently Asked Questions

1. How much will a lawyer cost for a divorce?Some lawyers offer flat-rate pricing for simple, uncontested divorce proceedings. But when a divorce i...

How do standard lawyer fees vary?

Klein says, “Standard lawyer fees vary from market to market. It’s not so much that the price depends on the type of lawyer, but on the experience, education, knowledge, and training of a particular lawyer working on the matter.

What factors affect the price of a lawyer?

In summary, the key factors that impact the price are location, case type, case complexity, law office type, and the lawyer’s experience, education, and expertise . Further, you’ll have to contact lawyers to find out what they charge.

How much is a retainer for divorce?

“The upfront retainer can be $1,500 for a very simple divorce with no issues, to a $15,000 + retainer when the issues and the monetary value of the assets involved are sizeable. You can count on a minimum retainer of $5,000 for divorces with a hint of custody issues,” says Constantini.

How much does a misdemeanor defense cost?

A simple misdemeanor defense may cost no more than $1,000, while a major felony charge could cost tens of thousands,” says Earley. Constantini answers along the same lines saying, “A misdemeanor charge has degrees of seriousness and is charged accordingly; the retainer can range from $1,500 to $5,000.

How to pay off a credit card?

Credit cards are an option as you can charge the costs upfront and then slowly pay off your balance over time. Whether this will work for you depends on a couple of factors, including: 1 If you can get approved for a credit card 2 The credit line you can get 3 Interest costs 4 Benefits of the card 5 Promotional offers 6 How long it will take you to pay it off

What is a personal loan?

Personal Loans. Another option is a personal loan. This is a lump sum that a lender extends to you based on your credit and financial profile. The loan amount, interest rate, fees, and repayment term will depend on the lender’s evaluation of you as well as your credit score and creditworthiness.

What is a flat fee?

Flat Fees are Common for Certain Cases. Klein adds, “A flat fee is common in the area of criminal law and bankruptcy law. For example, a client comes in to retain us for a chapter seven bankruptcy; we will charge a flat fee of $3,500 to accomplish the requested service.”. “The old billable hour is going away.

How much does a real estate attorney charge per hour?

The hourly rate of a real estate lawyer may be $150 to $300, but it is rare to find. Most of the real estate attorney’s fees are typically structured on the basis of a flat fee, and this fee is paid after the completed transaction.

How much does a sponsor's attorney cost?

The rate of the sponsor’s attorney is much higher, which may range from $3000 to $5000, which is really expensive to bear by the new buyer. However, the sponsors’ closing costs may be manageable and negotiable with the help of the experienced buyer’s agent.

Why is it important to have a real estate attorney?

The role of a real estate attorney is very crucial because it is totally about huge money.

What do you need to do before closing?

These tasks include title search, preparation of the deeds, contracts and transfer papers. The attorney may be agreed to perform the specific tasks either an hourly basis or flat rates.

Do lawyers get paid at the closing table?

The real fact is the good and renowned lawyer don’t go for an engagement letter and they don’t want their clients to go after getting service for the first time. So the standard system to pay the attorney is when the transaction is completed, the lawyer will be paid at the closing table.

Do real estate lawyers get paid after closing?

It is common to see that the real estate lawyers are paid their fees after the closing and cost is also determined according to closing. However, any extra charge after closing cannot be accepted. A written agreement may cease the lawyer to pursue more dollars from your pocket in the name of additional charge.

Is it normal to charge higher fees for a complex transaction?

It is normal to believe that fees for the complex transaction can be higher. There is complexity with the heir of the property, which is really difficult to handle this issue. A real estate lawyer has to work much more with their law and future complexity of the property issue. More importantly, if there is any foreign buyer, ...

Why is it important to understand the cost of a lawyer?

Understanding the cost of a lawyer before you enter into an agreement can help prevent unpleasant surprises or costs that you cannot afford. Some people might start working with an attorney, only to find that the fees are mounting dramatically.

How often do you have to pay a lawyer?

Before you sign an agreement with a lawyer, find out how often he or she requires payment. Some require it monthly, while others require weekly payments toward a bill. If payment to your attorney includes part of a settlement, make sure you understand how that will be paid after the case is closed.

What percentage of contingency fees are negotiable?

Courts may limit contingency fee percentages. The average ranges from 25 to 40 percent . Contingency fees may be negotiable. Referral fees: if a lawyer doesn't have a lot of experience with cases like yours, he or she may refer to you another lawyer who does.

What is flat fee lawyer?

Flat fee: a lawyer may offer a flat fee for a specific, simple, and well-defined legal case. Examples of cases eligible for flat fee billing include uncontested divorces, bankruptcy filings, immigration, trademarks , patents, and wills. Before agreeing to a flat fee, make sure you understand what is covered in the agreement.

Why do criminal cases require contingency fees?

Because a criminal case is often more intricate, pricing with contingency fees doesn't really make sense. Serious criminal cases often require multiple legal proceedings, such as the preliminary hearing, jury selection, trial, writs and appeals, and sentencing, so the process can take months.

What factors affect the hourly rate of a criminal lawyer?

A criminal lawyer's hourly rate will depend on multiple factors, which may include: The reputation of the lawyer and/or firm. The complexity of your criminal charges. The lawyer's level of experience. The location (hourly rates are typically higher in large cities)

What does it mean when a lawyer is not willing to discuss the costs with you?

If the lawyer is not willing to discuss the costs with you, it's a sign of poor client service.

How much does a closing attorney charge?

These fees can be in the form of a dollar amount or a percentage. For example, a closing attorney may charge $1,000 or one percent of closing costs as their standard fee.

Why are attornies so expensive?

Attornies, like everything else, cost more in states with higher costs of living. They are also generally more expensive in states with heavier bureaucratic and legal burdens built into the home sale process.

Why do lawyers use add ons?

More upstanding attorneys will use add-ons to cover the cost of one-off services not included in the package or flat service you contracted for.

Do you need a lawyer for a home sale?

Some states require that every home sale involve an attorney. Others require lawyers only in certain circumstances , such as when there are legal disputes over the ownership of the home in question. In most cases, these laws call for “closing attorneys” specifically.

What can a real estate attorney do?

A real estate attorney can help you through all of the paperwork required to make the sale. He or she usually comes in after you have determined the selling price and terms of the sale. Even in states where you are not required to hire a lawyer, you may want an attorney to look over the contract.

Why do you need an attorney for a trust?

You will also want to use an attorney to make sure that you are complying with the terms of any trust that may have been established. There may be fiduciary responsibilities for the property that you may not be aware of. An attorney will help you determine what your obligations are for the trust.

What to do if you get a foreclosure notice?

It's always best to contact a real estate attorney if you get a foreclosure notice. They may be able to find a way to stop foreclosure through an injunction. You may also want to hire an attorney if you are going through a divorce or separation. The attorney can help you negotiate the sale with an uncooperative partner.

What to do if you sell a rental unit on behalf of a deceased owner?

The last thing that you want is a legal entanglement due to your rental unit. You may also want to hire an attorney if you are selling on behalf of a deceased owner. It's best to talk to a lawyer to ensure that, if the property is inherited, the rightful heir is legally determined.

What to do when selling a house with an uncooperative partner?

The attorney can help you negotiate the sale with an uncooperative partner. An attorney will also be able to you determine what your legal rights are (and those of your spouse) during the selling process. You will also want to contact an attorney if you are selling a property that has tenants.

Do you have to contact an attorney if you are selling a property?

You will also want to contact an attorney if you are selling a property that has tenants. There are a myriad of local and state laws when it comes to tenants rights. Most have legal requirements that you must meet (and notices that you must provide to tenants) before tenants have to vacate.

What expenses do clients have to pay for a lawyer?

Clients may also be responsible for paying some of the attorney or law firm’s expenses including: Travel expenses like transportation, food, and lodging; Mail costs, particularly for packages sent return receipt requested, certified, etc; Administrative costs like the paralegal or secretary work.

Why do attorneys charge different fees?

Some attorneys charge different amounts for different types of work, billing higher rates for more complex work and lower rates for easier tasks .

Why do lawyers need to put contracts in writing?

A written contract prevents misunderstandings because the client has a chance to review what the attorney believes to be their agreement.

What are the biggest concerns when hiring a lawyer?

Attorney fees and costs are one of the biggest concerns when hiring legal representation. Understanding how attorneys charge and determining what a good rate is can be confusing.

What is flat rate legal fees?

Flat rate legal fees are when an attorney charges a flat rate for a set legal task. The fee is the same regardless of the number of hours spent or the outcome of the case. Flat rates are increasingly popular and more and more attorneys are willing to offer them to clients.

What are the costs of a lawsuit?

Some common legal fees and costs that are virtually inescapable include: 1 Cost of serving a lawsuit on an opposing party; 2 Cost of filing lawsuit with court; 3 Cost of filing required paperwork, like articles forming a business, with the state; 4 State or local licensing fees; 5 Trademark or copyright filing fees; and 6 Court report and space rental costs for depositions.

What factors determine if a lawyer's fees are reasonable?

Factors considered in determining whether the fees are reasonable include: The attorney’s experience and education; The typical attorney fee in the area for the same services; The complexity of the case; The attorney’s reputation; The type of fee arrangement – whether it is fixed or contingent;

What is escrow fee?

Escrow Fees. During the closing process, an escrow account will usually hold the money while the buyer and seller finalize the agreement. In addition, you’ll probably have a portion of your monthly mortgage payment go into escrow to pay for property taxes and insurance. Essentially, you prepay some of the homeowner's insurance ...

How much down payment do I need for a $300000 home?

Though some loans (like USDA and VA loans, for example), require no money down, the majority of homebuyers will need a down payment of at least 3% (on conventional loans) or 3.5% (on FHA loans). 2 On a $300,000 home purchase, this would equate to a down payment of $9,000 to $10,500.

What is origination fee?

An origination fee is paid to the bank or lender for their services in creating the loan. You also may owe an underwriting fee, an application fee, and a fee for your credit report. 3

What do you focus on when buying a house?

When buying a home, most people focus on the price of the house and what interest rate they can get on their mortgage loan. While knowing these costs is very important, they aren’t the only expenses you’ll encounter on your journey toward homeownership.

How many days before closing do you have to pay closing costs?

These will all be outlined in your closing disclosure, which you should receive at least three days before your closing date. For an idea of these costs earlier in the process, ...

How much does a home warranty cost at closing?

These cost anywhere from $278 to $391.

How much does it cost to inspect a house for mold?

This requirement can vary by location, and the cost usually runs between $50 and $280. 15 .

What are closing costs on a mortgage?

These range typically from 2 percent to 5 percent of the loan principal, and can include: Application fee. Appraisal fee. Credit check fee.

How much should I budget for home maintenance?

Many experts recommend budgeting 1 percent of your home’s value for home maintenance each year, as well as maintaining an emergency fund to address urgent, non-budgeted concerns as they crop up. You’ll also need to pay for utilities, likely including water, sewer, gas and electricity.

Why is it important to prepare for buying a home?

You’ll want to save money, improve or maintain your credit and compare lenders to get the best mortgage rates possible.

What kind of insurance should I buy when buying a house?

When buying a home, there are two kinds of insurance to consider: homeowners insurance and private mortgage insurance, or PMI. Homeowners insurance protects you financially from unexpected events that damage your home, such as natural disaster, theft or vandalism.

How much is PMI on a mortgage?

According to the Urban Institute, annual PMI premiums range from 0.58 percent to 1.86 percent of the loan amount. PMI isn’t permanent, however. As you pay down your mortgage and build equity in your home, you can get rid of PMI.

What is down payment on a mortgage?

Down payment. The down payment is the part of the home’s purchase price you pay upfront, rather than financing it through a mortgage. If you’re buying a $200,000 home, for example, and put 10 percent down, or $20,000, you’d be getting a mortgage for $180,000.

How much down payment do you need for FHA?

With an FHA loan, you could be able to put down as little as 3.5 percent. It’s important to note that there are loans without a down payment requirement: USDA loans, for borrowers buying in designated markets (generally rural), and VA loans, for eligible service members and veterans.

Popular Posts:

- 1. how to become a lawyer for the un

- 2. a lawyer who

- 3. where do i find a white collar crime lawyer

- 4. what kind of lawyer does disability

- 5. what degree does a lawyer get

- 6. how to offer immigration services not lawyer

- 7. what is the limit a lawyer can get paid on a disibility case

- 8. who is steve harmons lawyer in monster

- 9. how much school to be lawyer

- 10. how to enforce child visitation in nc without a lawyer