What is a CPA lawyer and what do they do?

- Prepare financial statements.

- Review financial statements for accuracy, as well as systems and procedures for efficiency.

- Organize and keep current all financial records.

- Prepare tax returns, schedules, and forms, ensuring that they're filed in a timely manner and that all taxes due are paid on time.

What is the highest paying lawyer?

Types Of Lawyers That Make The Most Money

- Medical Lawyers. Medical lawyers make one of the highest median wages in the legal field. ...

- Intellectual Property Attorneys. IP attorneys specialize in patents, trademarks, and copyrights. ...

- Trial Attorneys. ...

- Tax Attorneys. ...

- Corporate Lawyers. ...

What is the highest paying attorney job?

- Patent attorney: $180,000

- Intellectual property (IP) attorney: $162,000

- Trial lawyer: $134,000 (remember, this is average; trial lawyers especially can be sink-or-swim)

- Tax attorney: $122,000

- Corporate lawyer: $115,000

- Employment lawyer: $87,000

- Real Estate attorney: $86,000

- Divorce attorney: $84,000

- Immigration attorney: $84,000

- Estate attorney: $83,000

How much does a lawyer make in the United States?

How much does a Attorney make? The national average salary for a Attorney is $112,602 in United States. Filter by location to see Attorney salaries in your area. Salary estimates are based on 9,835 salaries submitted anonymously to Glassdoor by Attorney employees.

What type of lawyers make the most money?

Types of Lawyers That Make the Most MoneyTax attorney (tax law): $122,000;Corporate lawyer: $118,000;Employment lawyer: $88,000;Real estate attorney: $87,000;Divorce attorney: $86,000;Immigration attorney: $85,000;Estate attorney: $84,000;Public defender: $66,000.More items...

Does cpa make good money?

The average salary for a certified public accountant is $85,995 per year in California. 443 salaries reported, updated at June 3, 2022.

What is the highest salary for a cpa?

The starting salary for Certified Public Accountants ranges from $44,750 and $104,500, depending on their industry and the type of accounting they perform....Average Annual Salary for Highest-Earning Accounting Jobs.Job TitleAverage Annual SalaryChief Risk Officer$183,000Director of Finance$152,2505 more rows

Who makes more money lawyer or accountant?

Overall, lawyers can expect to earn a median salary of about $126,930, according to 2020 U.S. Bureau of Labor Statistics (BLS) data. 4 Half earn more than that, and half earn less. Comparatively, accountants earn a median salary of just $73,560.

Can a CPA make millions?

Few individual accountants have built practices that generate at least $5 million annually. While there are various ways to reach this lofty achievement, there are a number of common best practices among those that have.

Can accountants make 200K?

You can make 200K if you enter Big 4 and stay ~10 years until you become a very experienced Sr. Manager. To make 400K you'd need to spend 15 to 20 years in Big 4 and become a partner, which is hard to do.

Can accountants make 6 figures?

A CPA salary usually reaches the high five figures, and senior CPAs in management can earn a six-figure salary.

Is CPA a good career?

The CPA is one of the most secure professions, because it is highly in demand and gives you an advantage over non-CPAs. CPAs are expected to see higher than average job growth in the coming years, meaning there will be plenty of openings and companies will want to retain talented CPAs.

Is CPA exam hard?

It is considered one of the most challenging exams for obtaining standardized professional credentials. When the national pass rate is approximately 1 in 2, those who will eventually need to take the CPA exam should use every resource possible to give them an edge against a nearly 50% fail rate.

Does having a CPA help get into law school?

And being a CPA could possibly put you at an advantage when applying to law schools, “The interesting thing is that because you have experience and have a CPA, it can help you get into some of the better law schools,” Tim Gagnon said.

Can I be an accountant with a law degree?

Students from degree disciplines such as engineering, philosophy, law, history and modern languages can all qualify as an ICAEW Chartered Accountant in three years. Graduates do not require a finance-related degree or even maths at A-level to start their rewarding career as an ICAEW Chartered Accountant.

Can you be a lawyer and accountant at the same time?

Medium and large enterprises often need both accounting and legal services to function optimally. Pursuing a CPA after law school would allow you to reach more clients and expand your services. Law and accounting complement one another, and many of the challenges faced by businesses pertain to both of these fields.

What is a CPA starting salary?

According to data from PayScale, CPAs in their first year of working in the field earn an average salary of $54,000 as of October 2021. This averag...

What are the highest-paying public accounting jobs?

According to BLS data, industries offering the highest-paying jobs for CPAs include computer and peripheral equipment manufacturing, the federal ex...

Where is the best state to work as a public accountant?

According to BLS data, Texas offers some of the highest employment rates and one of the highest average salaries for accounting professionals. Howe...

What is the best industry to work in as a public accountant?

Accounting, tax preparation, bookkeeping and payroll services employ the largest number of accounting professionals, offering an average salary of...

Does having a CPA guarantee a job?

No credential guarantees a job in any industry. However, earning a CPA license can help prospective accountants pursue CPA positions, boost competi...

How much do CPAs make?

The national average salary for CPAs is $81,004 per year but varies according to experience, geographical location, company and industry. For the most up-to-date information from Indeed, please click on the salary link above.

What is the job of a CPA?

Common duties of a CPA include managing investments and expenses, performing audits and assisting clients in reaching their personal and professional financial goals.

What is a CPA?

A certified public accountant, or CPA, is a financial professional who works with individuals and organizations to interpret and record their financial data for various reasons, such as tax and financial planning purposes. CPAs must take and pass the CPA exam and are held to the highest standards when working in financial positions. There are several financial positions a CPA can hold, including:

How to leverage when negotiating salary?

If you want leverage when negotiating your salary, emphasize your previous work experience and any transferrable skills you have that make you unique. This might include advanced skills that aren’t listed in the job description but which make you an even more attractive fit for the job.

Can a CPA negotiate a salary?

While much of a CPA's salary is based on location, experience and various other factors, you can still negotiate your salary. Use these tips to successfully negotiate a better salary:

Can you limit your research to accounting?

Don 't limit your research to accounting, as you might also realize you have skills that could support another area of the company and boost your chances of landing a higher salary.

Does a CPA make more money in California?

For example, a CPA in California will likely make more money than a CPA in Florida, largely due to the higher cost of living in California vs. Florida.

How much does a senior CPA make?

As a Senior-Level CPA salary, you can expect to $66,000 to $110,000 depending on your job description and firm size.

How much does an accountant make?

Entry-level accountants typically have a starting salary of $44,000 and can earn as much as $60,000 depending on the size of the company they work for and the industry they work in.

How many years of experience do CPAs have?

Senior CPAs typically have 4-6 years of work experience and have a good amount of experience in their area of expertise. Most accountants have already chosen a specific career path by this point. For example, most accountants have already chosen whether they want to go into tax or audit by this point in their careers.

Why do larger companies pay better than smaller companies?

Typically, larger companies pay better than smaller companies because they have more resources and more opportunities for employees. Thus, you can assume that the larger the CPA firm or company, the more the accountants and CPAs working there are getting paid.

How do I become a CPA?

The first step to becoming a CPA is to get a proper CPA review course and start studying for the exam. I reviewed all the top courses that are out there right now, so you can easily find one that matches your learning style and works for your study process and budget.

How many years of work experience do accountants need?

Normally, these accountants have less than two years of work experience and no specialization. Basically, they are right out of college.

How long does it take to become a senior accountant?

Senior accountants in corporate accounting typically have at least 4-6 years of work experience and earn a little less than their counterparts in public accounting. This obviously depends on the industry as well. The faster growing and more profitable industry will always pay their senior level accountants more.

How Much Does a CPA Make?

According to data from the Bureau of Labor Statistics (BLS), accountants and auditors earn a median salary of $73,560. Education, experience, and location can all impact earning potential for CPAs.

What is the average salary of an accountant?

offers the highest average salary for accounting professionals at $110,140. California rounds out the top five with an average accountant salary of $88,130.

What is a CPA license?

CPA licensure affords professionals the credentials they need to provide accounting services in a wide variety of industries. Nearly every type of business needs the guidance of a professional accountant to balance books, ensure financial laws and policies are followed, set up and distribute payroll, and file and pay taxes.

What is the career of a certified public accountant?

A career as a certified public accountant is ideal for individuals interested in the fiscal and legal fields. The Bureau of Labor Statistics (BLS) projects employment for accountants and auditors to increase 6% from 2018-28. CPAs can pursue opportunities in a variety of industries.

Why do CPAs get paid higher?

Some states may offer higher average salaries due to factors like increased demand, larger population, and higher costs of living.

How much does an accounting professional make in 2020?

Accounting, tax preparation, bookkeeping and payroll services employ the largest number of accounting professionals, offering an average salary of $85,050 in 2020.

Where are accountants most likely to work?

However some of the nonmetropolitan areas with the highest employment rates for accountants include Kansas, northeastern and northwestern Ohio, and northern Texas.

How much does it cost to get a CPA?

Overall, expect to pay around $3,000 to obtain the CPA!

How will Certified Public Accountant (CPA) impact your salary in the United States?

The average salary for someone with a Certified Public Accountant (CPA) in the United States is between $70,235 and $461,014 as of January 27, 2022. Salary ranges can vary widely depending on the actual position requiring a Certified Public Accountant (CPA) that you are looking for. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target. View the Cost of Living in Major Cities

What is the job of an accounting professional?

Has overall responsibility for assigned accounting operations and systems as well as associated analysis and report preparation. Leads and directs accounting professional and support staff through subordinate managers. Requires a bachelor's degree. May require CPA certification. Typically reports to the CFO or top management. Manages a department... View job details

What is the CPA exam blueprint?

The CPA Exam Blueprint, provided by AICPA, is a document that details what to expect in the exam and includes an outline of the content, sample questions, and definitions of the skills that will be tested.

What is a CPA?

Certified Public Accountant (CPA) is a statutory title of a qualified accountant and functions as a license that allow the holder to provide accounting services to the public. All CPA's are accountants, but not all accountants are CPA's. The CPA designation distinguishes a professional with extensive education, experience, and high standards.

How long does it take to get a CPA?

Candidates for the CPA are allowed 18 months to complete all four exams. It is generally recommended to sit for the exam as soon as the requirements are fulfilled and to complete the testing within 12 months. There are many CPA review courses available and employers often will pay for these courses.

How many CPA licenses are there?

There is only one CPA license. However, many CPA holders obtain additional credentials that indicate expertise in certain specialized areas of Accounting. For example, a Forensic CPA may hold a Certified Fraud Examiner (CFE) certification and concentrate on anti-fraud investigations and auditing activities.

How much do corporate lawyers make?

In most cases, a corporate lawyer’s salary will start somewhere between $30,000 and $100,000 a year, depending on the size, location and financial condition of the employer. The best graduates of top law schools can expect much higher salaries and lucrative careers right after they graduate if they have the right skill set and have performed well during their internships. The Forbes website lists several first rate programs, such as Columbia Law School, whose graduates can expect an average starting salary of $165,000.

How much do tax attorneys make?

As shown below, the median annual salary for tax attorneys in 2014 was $99,690. Starting salaries tend to be somewhere between $55,000 and $83,000; lawyers who remain in the field of tax law can expect a steady increase in their annual earnings as their career progresses.

How much do personal injury lawyers make?

The average annual pay for a personal injury lawyer is approximately $73,000. Many attorneys in this field do not have a set annual income as they work for contingency fees. This means that they earn a percentage of any compensation settlement the plaintiff receives. As in most cases, lawyers working for non-profit organizations or the government tend to earn the least, while their colleagues in big law firms are the top earners.

What is real estate lawyer?

Real estate lawyers assist their clients in a variety of ways regarding commercial and residential real estate. Issues regarding tenants, neighbors, zoning and property development also fall under the umbrella of real estate law.

How much does a family lawyer make?

The median annual salary of a family lawyer, according to PayScale.com, is $70,828. In family law, an attorney’s degree of specialization and experience strongly correlates with compensation. Experienced family lawyers in the private sector are the top earners in this group, and have higher earning potential than their counterparts in the public sector.

What does a personal injury lawyer do?

In case of an accident or injury, personal injury lawyers represent their clients to obtain justice and compensation for any losses or suffering. The vast majority of these cases fall under the area of tort law.

How much does Columbia Law School make?

The Forbes website lists several first rate programs, such as Columbia Law School, whose graduates can expect an average starting salary of $165,000. Other institutions that produce top earners in the field include Stanford University, the University of Chicago, Harvard University, and the University of Virginia.

HOW MUCH DO TAX ATTORNEYS MAKE?

The average salary of a tax attorney is $120,910 per year, according to the BLS. Salaries in the law field range from $58,220 to $208,000. Several factors may impact earning potential, including a candidate's work experience, degree, location, and certification.

How much do accountants make?

The BLS reports that accountants earn an average annual salary of $70,500, with jobs projected to increase by 10%. This rate is faster than average. Tax attorneys may earn $120,910 per year, but job growth is about average at 8%.

HOW DO TAX ATTORNEYS COMPARE TO OTHER ACCOUNTING CAREERS?

For instance, most accounting careers only require a bachelor's degree. Practicing as a tax attorney requires individuals to complete an undergraduate degree, law school, and pass the LSAT.

What industries do tax attorneys work in?

The BLS reports the top industries for tax attorneys as subscription programming, the oil and coal industries, motor vehicle manufacturing, and computer equipment manufacturing. These complex industries must cooperate with government rules, regulations, and tax laws, which require a tax attorney’s expertise.

What is tax attorney?

Tax attorneys specialize in tax policies and tax liability at the federal, state, and municipal levels. They typically work at law firms or on a consultative basis. Their tax law expertise makes them essential to auditing or litigation processes with the IRS. These professionals may also draft documents for estate planning or other legal documents.

How long does it take to become a tax attorney?

Becoming a tax attorney involves earning a bachelor’s degree, completing law school, and passing the bar exam. The process usually takes about seven years.

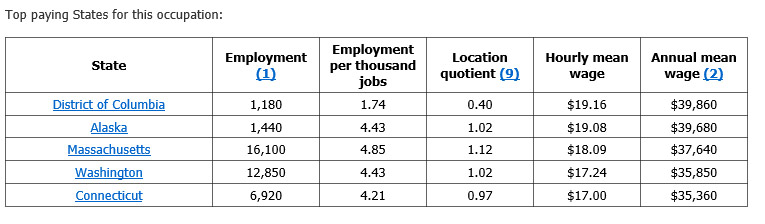

What states have tax attorneys?

When it comes to salary, some of the top states for tax attorneys include the District of Columbia, California, New York, Massachusetts, and Connecticut, according to the BLS. These states offer higher than average salaries, making them attractive locations for tax attorneys.

How much does a corporate lawyer make in 2021?

The average Corporate Lawyer salary in the United States is $115,303 as of June 28, 2021, but the salary range typically falls between $100,083 and $130,750. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

How much should you be paid?

For a real-time salary target, tell us more about your role in the four categories below.

What is corporate lawyer?

A corporate lawyer is a lawyer who specializes in corporate law.... Source: Wikipedia (as of 04/25/2019). Read more from Wikipedia. See user submitted job responsibilities for Corporate Lawyer.

Popular Posts:

- 1. how to pick anentrainment lawyer

- 2. how to pursue legal action against a lawyer

- 3. what kind of lawyer do directors use

- 4. when will lawyer mail my inheritance check in ga

- 5. why keeps changing lawyer

- 6. who is weinstein's lawyer

- 7. what tpye of lawyer is she-hulk

- 8. how much does an immigration lawyer cost for removal of green card conditional status

- 9. why does king’s lawyer want to make sure the jury connects him to steve?

- 10. a lawyer asked me for money up front and daid he will give back what is not use