The calculator estimates lawyer fees to be around $750. Some of the services that your lawyer provide for you include: Title Search: The seller lawyer must ensure that the seller closes any outstanding permits and agrees to pay any outstanding items from the proceeds of the sale of the house.

How much are real estate lawyer fees?

Feb 16, 2022 · House buyers should be able to find some firms offering fixed-rate conveyancing fees from around €950 plus VAT. but solicitors legal fees can range from €1200 plus VAT to €2000 plus VAT Some solicitors might try and charge a percentage fee – but the legal work they have to do is exactly the same for a cheap house as it is for an expensive house.

How much does a real estate closing attorney cost?

In total, you can expect to pay something between £1,000 and £5,000+ plus VAT to your solicitor (excluding stamp duty, which we’ll look at in a minute). It depends on the value of the property. Some of these costs might need to be paid along the …

How much for attorney real estate?

Which states require attorneys for real estate closings?

How much do you have to pay to close on a home loan?

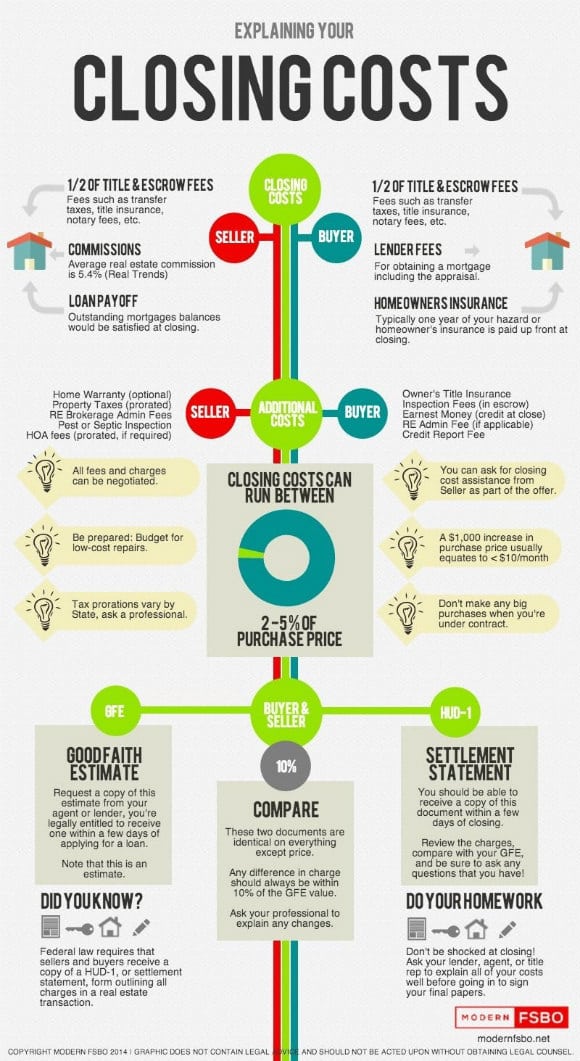

These range typically from 2 percent to 5 percent of the loan principal, and can include:

What are the closing costs for a home loan?

To close on your home loan and get the keys to the property, you’ll need to pay closing costs, which are all of the fees associated with the mortgage. These range typically from 2 percent to 5 percent of the loan principal, and can include: 1 Application fee 2 Appraisal fee 3 Credit check fee 4 Origination and/or underwriting fees 5 Title insurance 6 Title search fee 7 Transfer tax (if applicable)

Why is it important to prepare for buying a home?

You’ll want to save money, improve or maintain your credit and compare lenders to get the best mortgage rates possible.

What is down payment on a mortgage?

Down payment. The down payment is the part of the home’s purchase price you pay upfront, rather than financing it through a mortgage. If you’re buying a $200,000 home, for example, and put 10 percent down, or $20,000, you’d be getting a mortgage for $180,000.

How much down payment do you need for FHA?

With an FHA loan, you could be able to put down as little as 3.5 percent. It’s important to note that there are loans without a down payment requirement: USDA loans, for borrowers buying in designated markets (generally rural), and VA loans, for eligible service members and veterans.

Who are Matt Hester and Ross Hester?

Matt Hester and Ross Hester, father and son co-founders of The Hester Group, Harry Norman Realtors in Atlanta, Georgia, encourage all of their clients to prepare for the funds needed to purchase.

Can I afford my dream home?

I can afford my dream home.”. You may be able to, but the costs associated with buying a home go beyond the mortgage payment. To determine how much house you can afford, it’s important to factor in additional expenses, such as closing costs, insurance and taxes, before committing to a mortgage.

What is bank charge?

A bank charge to cover the cost of them transferring money that is being used to buy the property to the seller’s own solicitor. The fee depends on the property’s value and will be included in the solicitor’s quote. This will transfer the ownership of the property into your name.

What are the responsibilities of a conveyancing solicitor?

A conveyancing solicitor’s responsibilities will include: 1 The drawing up of contracts for you to buy a house in a legal and professional way 2 They will deal with the Land Registry 3 The solicitor will arrange the paying of Stamp Duty

What is conveyancing disbursement?

These are known as conveyancing disbursements which are legal fees that will be charged to help cover the costs undertaken by the conveyancer in connection with your property purchase. These disbursement fees are charged by third parties which the conveyancer will collect from you, so they can pay them.

How long can you live in a leasehold property?

Essentially, when you are buying a leasehold property you are agreeing to lease the property from the freeholder – the lease will allow you to live in the property for a specified number of years.

What is Stamp Duty?

The drawing up of contracts for you to buy a house in a legal and professional way . They will deal with the Land Registry. The solicitor will arrange the paying of Stamp Duty. The Stamp Duty must be paid from your own funds, that is to say you cannot use your mortgage agreement for this purpose.

What is forward contract?

Specialist money transfer companies can give you the option of locking in an exchange rate for a future transfer – this is known as a “forward contract”.

Where is Garton Global Payments based?

Garton Global Payments is based in London and was set up by Irish native Niall Walsh. They have plenty of experience in dealing with large money transfers between Ireland and other countries.

Popular Posts:

- 1. how can a lawyer loose their liscence

- 2. in michigan how much can a lawyer charge on a s.s.i or s.d.i

- 3. how the state department caved to hillary's lawyer

- 4. what if the lawyer knows his client is guilty

- 5. rose palermo, a lawyer who handles divorce cases

- 6. lawyer who made swartz commit suicide

- 7. what happens once a lawyer doesn'tpay his bar fee

- 8. movie where a band has lawyer pay to record

- 9. what to do when lawyer will not return call months?

- 10. what jobs would be good in dallas area for a foreign lawyer not u.s certified