How much does it cost to hire a chapter 13 lawyer?

Most Chapter 13 filers (63%) paid $3,000 or less, but a significant number (30%) paid between $3,000 and $5,000. Cost to Hire a Chapter 13 Bankruptcy Attorney Nearly two-thirds of readers (63%) paid their lawyers $3,000 or less for Chapter 13 bankruptcy.

How much does a lawyer charge?

A one-third fee is common. Some lawyers offer a sliding scale based on how far along the case has progressed before it is settled. Courts may set a limit on the amount of a contingency fee a lawyer can receive.

How much does a Chapter 7 bankruptcy lawyer cost?

In general, attorney fees for a Chapter 7 bankruptcy range from $1,000 to $3,500 depending on the complexity of the case. Larger firms with more advertising and overhead costs sometimes charge more than a solo practitioner, but not always. Some larger operations offer low fees and count on a higher volume of cases.

How much does it cost to file Chapter 13 in 2020?

Other Fees and Costs in Chapter 13 Bankruptcy Filing Fee The national filing fee for Chapter 13 bankruptcy is $313 in 2020. Here are a few other expenses you’ll have to pay in your Chapter 13 bankruptcy: Filing fees. In addition to the fees you pay your attorney, you’ll have to pay the bankruptcy court’s filing fee of $313(as of December 2020).

How much is the average Chapter 13 payment?

about $500 to $600 per monthThe average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation. It takes into account a large number of low payment amounts where low income debtors are paying very little back.

What percentage do most attorneys charge?

33 to 40 percentSo, What percentage of a settlement does a lawyer get? Your attorney will take around 33 to 40 percent of your financial award, plus court costs.

What percent do you pay back for Chapter 13?

If your request to pay off Chapter 13 early is approved by a court, you'll be required to pay 100 percent of the debt claims on your bankruptcy case. This includes unsecured debt, such as credit cards, which would've been discharged if you'd kept making Chapter 13 plan payments on the original schedule.

How are Chapter 13 plans calculated?

Chapter 13 Payment Calculation ShortcutAdd together debts you must pay in full, then divide the total by 60 (we're getting a monthly payment amount that we'll build on): ... Add required monthly payments for: ... Add monthly living expenses (use the US Trustee expense multipliers for more accuracy):More items...

How do you know if your lawyer is selling you out?

Unprofessional or unethical behavior can include:Arriving late or failing to show up for important meetings, or missing court dates.Making decisions of importance about your case without discussing it with you first.Missing filing deadlines, filing paperwork incorrectly or filing the wrong paperwork with the court.More items...•

What is a retainer fee for a lawyer?

The fixed retainer fee is a predetermined fee paid on a lump sum, in advance of any legal work to be performed. In corporations, for example, a general corporate retainer would include general corporate services such as drafting minutes and board resolutions, secretary's certifications, ant the like.

What is the minimum payment in Chapter 13?

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

Can you claim Chapter 13 on your taxes?

Everyone loves saving money on their taxes, and Chapter 13 debtors are fully eligible to take certain tax deductions if their plan payments are comprised of deductible items.

What does 100% means in a Chapter 13?

What is a Chapter 13 100 Percent Bankruptcy Plan? A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

What if my Chapter 13 payment is too high?

Every case has different requirements on repayment to creditors. If your income is too high, you may not realize a significant reduction in your plan payment by “changing your plans.” You may be required to pay back up to 100% of your debt in your Chapter 13 case depending on your debt and income levels.

What is the downside to filing Chapter 13?

Although a Chapter 13 bankruptcy stays on your record for years, missed debt payments, defaults, repossessions, and lawsuits will also hurt your credit and may be more complicated to explain to a future lender than bankruptcy.

Can you pay off a Chapter 13 early?

In most Chapter 13 bankruptcy cases, you cannot finish your Chapter 13 plan early unless you pay creditors in full.

How Much Do Attorneys Charge For Chapter 13 Bankruptcy?

Our survey results tell us that readers paid their attorneys an average of $3,000 to handle their Chapter 13 bankruptcy cases. Most Chapter 13 file...

When You Might Pay More For Chapter 13 Attorney's Fees

You will probably pay more than the average if your attorney has to spend extra time strategizing on your behalf. That can happen for different rea...

When You Might Pay Less For Chapter 13 Attorneys’ Fees

When attorneys use a local court’s presumptive fee to set the amount they charge, it’s unlikely that they’ll be willing to give you a discount (alt...

Chapter 13 Attorneys’ Fees Need Not Be Paid All at Once

The most common way of paying a lawyer’s flat fee in Chapter 13 bankruptcy is to make an initial down payment before the bankruptcy petition is fil...

What Services Are Included in Your Chapter 13 Flat fee?

Before you agree to a flat fee, make sure you know what will (and won’t) be included. In addition to filing your bankruptcy petition and representi...

Other Fees and Costs in Chapter 13 Bankruptcy

Here are a few other expenses you’ll have to pay in your Chapter 13 bankruptcy:Filing fees. In addition to the fees you pay your attorney, you’ll h...

Attorney's Fee Must Be Reasonable

Under the bankruptcy law, attorneys who file Chapter 13 bankruptcies must disclose their fees for the court’s review and approval. No matter what y...

Presumptively Reasonable Or "no-look" Fees

To avoid having to review fees in every case, most courts have local rules or fee guidelines which set a "presumptively reasonable" or "no-look" fe...

What Services Are Included in The Attorney's Fee

The services that are included in the flat fee for Chapter 13 bankruptcies also vary by district. In some districts, the attorney is expected to ha...

Paying The Attorney Fee Through The Plan

Unlike Chapter 7 cases, where the fees are generally paid before the case is filed, the Chapter 13 fee is often paid, at least in part, through the...

How to Find The Fee Guidelines For Your District

Virtually all of the bankruptcy courts have websites which have links to the court’s local rules and fee guidelines. Many Chapter 13 trustees also...

Statistics on Average Chapter 13 Attorney Fees

According to a recent study using data from 2005 to 2009, the average fee for a Chapter 13 bankruptcy was $2,564 nationwide. But when broken down b...

How much does a Chapter 13 bankruptcy cost in Florida?

The fees our readers told us they paid—typically from $2,500 to $3,500 —fall in line with the maximum amounts recommended by the courts in Florida.

What is a no look fee?

If your lawyer agrees to represent you for the presumptive amount or less, the court will automatically approve the fee without looking at the specific circumstances of the case —which is why it’s sometimes called a “no look” fee.

What can an attorney ask the court to approve?

Also, if a case becomes more complicated than originally expected, the attorney can ask the court to approve additional fees for further services that are required. Some of the court’s guidelines include presumptive amounts for some of these services (such as filing plan modifications or motions).

How to pay a lawyer's fee in bankruptcy?

The most common way of paying a lawyer’s flat fee in Chapter 13 bankruptcy is to make an initial down payment (or “retainer”) before the bankruptcy petition is filed, with the remainder of the fee included in your monthly payments under the repayment plan.

How much does a lawyer charge for bankruptcy in Florida?

The presumptive lawyers’ fees in Florida for Chapter 13 bankruptcy cases that don’t involve a business range from $3,500 to $4,500, with add-on charges for services beyond the basics.

What is the court's decision on a Chapter 13 bankruptcy?

The bankruptcy court has to approve all of your financial expenditures in a Chapter 13 case—including what you pay your lawyer—so the judge will decide whether your attorney’s fee is reasonable. The general rule under federal bankruptcy law is that the court will hold a hearing to review a lawyer’s fee application, ...

How to find bankruptcy court in your area?

Courts may change their guidelines at any time, so it’s a good idea to check with your local court to get the latest information. Use the government’s court locator tool to find the website and phone number for the bankruptcy court in your area. (Because the guidelines can be difficult to find, your best bet may be to call the court and ask.)

3 attorney answers

That is a lot to unpack, but I will try to clarify one issue. 1. The attorney fees charged for legal services, any legal services, are dictated by the attorney-client fee agreement. That is true even in chapter 13. You agreed to pay $X amount as a retainer and be charged hourly for services rendered...

Matthew Scott Berkus

This legal fee is unwarranted and should be challenged. Do not pay it!

What is a simplified application?

The Simplified Application process described in subsections (A) and (B) above does not limit the trustee, United States Trustee, creditors or any interested party from questioning the reasonableness of an attorney's fees requested on a Simplified Application. This rule also does not limit the court's discretion to review the amount of fees paid to or agreed to be paid to a debtor's attorney or to enter appropriate orders allowing, disallowing or reducing attorney's fees or expenses. If an objection is raised, the attorney may be required to submit an application for compensation and an itemization of fees and costs that satisfy the requirements of § 330 and Fed. R. Bankr. P. 2016.

What is the purpose of consulting and communicating with the debtor?

5. Consulting and communicating with the debtor to gather information and to inform the debtor of his/her responsibilities.

How much compensation can a Chapter 13 case require?

In a Chapter 13 case, an attorney who represents a debtor after confirmation in the following matters may request an order awarding compensation by simplified application, and the court may issue the requested order without a hearing, if the sum of the requested compensation does not exceed $750 per application.

What is the purpose of a joint filing?

In the case of a joint filing, notifying both spouses that they must appear at the meeting.

What is the purpose of meeting with a debtor?

1. Meeting with the debtor to discuss and analyze the debtor's situation, goals and objectives and to recommend a solution.

What does "resolve motion" mean?

1. resolving motion (s) for relief from stay;

Can an attorney accept a presumptively reasonable fee?

An attorney who elects to accept the presumptively reasonable fee for the tasks listed in subsections (A) or (B) may apply for additional compensation for tasks which exceed the scope of those subsections. This application must conform to the requirements in section 330 and Fed. R. Bankr. P. 2016 (a) and 2002 (a) (6). The application for additional compensation for tasks or expenses exceeding the scope need not include an itemization of tasks or fees that fall within the presumptively reasonable fee under subsections (A) or (B), unless specifically requested by the court.

What is Martindale Nolo?

Nolo is a part of the Martindale Nolo network, which has been matching clients with attorneys for 100+ years.

What is the no look fee for Chapter 13?

Courts don't want to review fees in every case, so most courts have local rules or fee guidelines which set a "presumptively reasonable" or "no-look" fee amount for a Chapter 13 case. Different courts use different terms, but the meaning is the same. If the amount charged by the attorney is equal to or less than the presumptively reasonable ...

What is the law for filing bankruptcy?

Bankruptcy law requires an attorney who files a Chapter 13 bankruptcy to disclose the fees for the court's review and approval. The judge determines whether the amount is reasonable. If the court finds the fee excessive, it can order the attorney to refund all or a portion of it.

How to find bankruptcy court?

Check the website of the bankruptcy court. You can use the Court Locator tool to find bankruptcy court websites.

Why do you need to do a court review?

Doing so helps avoid the time and expense associated with a court review. Court review is required for higher fees. Some cases require more work than others and an attorney can charge a higher fee. But the attorney would need to follow the fee review procedure in their court, and justify the higher fee.

Do attorneys charge fee guidelines?

Most attorneys charge guideline fees. While the presumptively reasonable fee isn't intended as a fee limit , an attorney will likely set the fee based upon the court's guidelines as long as it's a straightforward case . Doing so helps avoid the time and expense associated with a court review.

Can a bankruptcy attorney review a no look fee?

If the amount charged by the attorney is equal to or less than the presumptively reasonable or no-look fee, the court will let it stand. Here are a few other things to know. Court review is still permitted. The guideline or local rule, however, does not change the bankruptcy law.

What is Martindale Nolo?

Nolo is a part of the Martindale Nolo network, which has been matching clients with attorneys for 100+ years.

How to shop around for bankruptcy lawyers?

When shopping around for a bankruptcy lawyer, call at least a few attorneys in your area. Compare their fees and ask if bankruptcy is an area they specialize in , as well as the number of cases they file each month .

What happens if you file Chapter 7?

Chapter 7 wipes out most unsecured debt in a Chapter 7 case, including attorneys' fees. So if you had a balance due when filing the matter, it would get discharged. Chapter 7 attorneys know this, of course, and require full payment. Learn how to find a bankruptcy attorney.

How much does a lawyer charge for a chapter 13 case?

Chapter 13 guideline fees are different for each judicial district. However, they are typically between $2,500 and $6,000 depending on the complexity of the case.

How much does a lawyer charge for bankruptcy?

In general, attorney fees for a Chapter 7 bankruptcy range from $1,000 to $3,500 depending on the complexity of the case. Larger firms with more advertising and overhead costs sometimes charge more than a solo practitioner, but not always. Some larger operations offer low fees and count on a higher volume of cases.

Can an attorney charge a fee for bankruptcy?

Attorneys are free to charge what is reasonable given their experience and the complexity of your case subject to review by the court. Some courts have a "presumptive" maximum fee for certain types of bankruptcy cases, but the attorney can overcome the ceiling by demonstrating a good reason for charging more.

Do you have to pay a bankruptcy attorney upfront?

Fortunately, most attorneys don't require you to pay the entire Chapter 13 bankruptcy fee upfront. In most cases, attorneys will ask for a portion of their fees before filing your matter, and the remainder will get paid through your Chapter 13 repayment plan. How much a bankruptcy lawyer will require before filing will depend on each attorney ...

What is a flat fee for a lawyer?

Flat or fixed fee. Lawyers may charge a flat fee for services like: a will, power of attorney, personal directive. an uncontested divorce. incorporation of a company. real estate purchase and sale. a first consultation. The lawyer’s out-of-pocket expenses (disbursements), if any, will generally be extra though.

What is interest charged if you do not pay your bill on time?

interest charged if you do not pay your bill on time. out-of-pocket expenses (disbursements). A lawyer must not charge or accept a fee or disbursement, including interest, unless it is fair and reasonable and has been disclosed in a timely fashion. ( Rule 3.6-1 Code of Professional Conduct for NS Lawyers)

What is contingency fee agreement?

A contingency fee agreement is a contract with your lawyer. Read it carefully and be sure you understand its terms before you sign it.

What is contingency fee?

A contingency fee is a percentage of the money the lawyer gets for you if successful. If you win, the lawyer gets the percentage agreed on as the lawyer's fee.

Do you have to pay a lawyer if you lose a case?

Lawyers often use a contingency fee agreement in lawsuits where the client cannot pay up front, such as for a personal injury claim. If you lose the case, you do not pay the lawyer any fee. However, you may still have to pay the disbursements.

Do lawyers pay retainers?

Most lawyers will ask you to pay a retainer fee up front when you hire them, unless you have agreed on a flat fee, contingency fee, or other fee arrangement. A retainer is a lump sum of money provided to a lawyer when you hire them. The retainer is kept in the lawyer’s trust account, and covers legal fees and other expenses for the legal work.

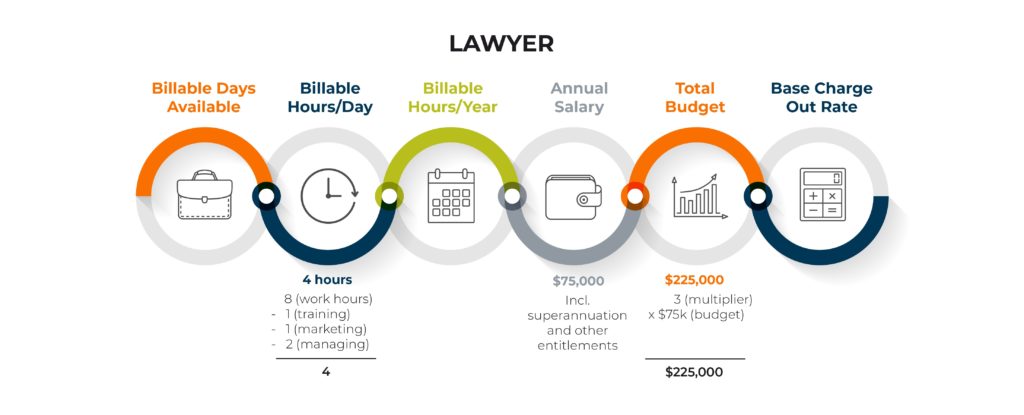

How much does a lawyer charge per hour?

Hourly Rate: The lawyer will charge you for each hour (or portion of an hour) that the lawyer works on your case. Thus, for example, if the lawyer's fee is $100 per hour and the lawyer works 5 hours, the fee will be $500. This is the most typical fee arrangement. Some lawyers charge different fees for different types of work ...

What are the factors that affect the fees charged by a lawyer?

The type of fee arrangement that you make with your lawyer will have a significant impact on how much you will pay for the services.Legal fees depend on several factors, including the amount of time spent on your problem; the lawyer's ability, experience, and reputation; the novelty and difficulty of the case; the results obtained; and costs involved. There will be other factors such as the lawyer's overhead expenses (rent, utilities, office equipment, computers, etc.) that may effect the fee charged.

What is referral fee?

Referral Fee: A lawyer who refers you to another lawyer may ask for a portion of the total fee you pay for the case. Referral fees may be prohibited under applicable state codes of professional responsibility unless certain criteria are met. Just like other fees, the total fee must be reasonable and you must agree to the arrangement. Your state or local bar association may have additional information about the appropriateness of a referral fee.

What is a statute fee?

Statutory Fee: The fees in some cases may be set by statute or a court may set and approve a fee that you pay. These types of fees may appear in probate, bankruptcy, or other proceedings. With all types of fee arrangements you should ask what costs and other expenses are covered in the fee.

What is contingency fee?

Contingency Fees: The lawyer's fee is based on a percentage of the amount awarded in the case. If you lose the case, the lawyer does not get a fee, but you will still have to pay expenses. Contingency fee percentages vary . A one-third fee is common.

Can a lawyer make contingency arrangements?

Lawyers may also be prohibited from making contingency fee arrangements in certain kinds of cases such as criminal and child custody matters. Contingency fee arrangements are typically not available for divorce matters, if you are being sued, or if you are seeking general legal advice such as the purchase or sale of a business.

Do lawyers charge different fees?

Some lawyers charge different fees for different types of work (legal research versus a court appearance). In addition, lawyers working in large firms typically have different fee scales with more senior members charging higher fees than young associates or paralegals.

Legal Fees - Simplified Application

- An attorney who represents a debtor, whether joint or individual, in a Chapter 13 case is excused from the compensation application requirements of Fed. R. Bankr. P. 2016(a) and the notice requirement of Fed. R. Bankr. P. 2002(a)(6) if the attorney's claim for compensationdoes not exceed a presumptively reasonable fee of $3,500. This fee shall be p...

Objection to Fees

- The Simplified Applicationprocess described in subsections (A) and (B) above does not limit the trustee, United States Trustee, creditors or any interested party from questioning the reasonableness of an attorney's fees requested on a Simplified Application. This rule also does not limit the court's discretion to review the amount of fees paid to or agreed to be paid to a debt…

Legal Fees - Standard Application Required

- Employing the simplified fee application process described in subsections (A) and (B) is optional. An attorney who declines to accept the presumptively reasonable fee for the minimum services listed may submit an application that conforms to the requirements in section 330 and Fed. R. Bankr. P. 2016(a) and 2002(a)(6). An attorney who elects to accept the presumptively reasonabl…

Legal Costs and Expenses

- An attorney who represents a debtor in a Chapter 13 case may apply for actual costs and expenses incurred, including photocopies, PACER fees, postage, long distance telephone charges, due diligence fees, credit counseling costs and mileage on the simplified application form or the standard application form.

Popular Posts:

- 1. how to be a lawyer in germany

- 2. how to prepare for a court case without a lawyer in tn

- 3. what to wear as an environmental lawyer

- 4. questioning a witness by the lawyer who called him

- 5. lawyer who defended 9/11 terrorists

- 6. when can a lawyer breach client confidentiality

- 7. what questions to ask an elder lawyer

- 8. what is the typical work schedule for a lawyer

- 9. how to become a crisis management lawyer

- 10. which gulfport ms workers comp lawyer wins the most cases