What percentage of income should be paid in alimony?

Lawyer directory. Find a lawyer near you. Avvo has 97% of all lawyers in the US. Find the best ones near you. First, choose your state: Alabama; Alaska; Arizona; Arkansas; California; Colorado; Connecticut; ... Divorce and alimony calculator. Estimate your spousal and child support, and division of assets and debts. ...

What income is used to calculate alimony?

FREE detailed reports on 3397 Alimony Attorneys. Find 28622 reviews, disciplinary sanctions, and peer endorsements. ... Lawyer directory. Find a lawyer near you. Avvo has 97% of all lawyers in the US. Find the best ones near you. First, choose your state: ... A divorce lawyer who specializes in alimony knows what information you need to ...

How much alimony should I ask for?

· Lawyer directory. Find a lawyer near you. Avvo has 97% of all lawyers in the US. Find the best ones near you. First, choose your state: Alabama; Alaska; ... Alimony calculator: …

How much will your loan really cost calculator?

FREE detailed reports on 127 Alimony Attorneys in New York. Find 1166 reviews, disciplinary sanctions, and peer endorsements. ... Lawyer directory. Find a lawyer near you. Avvo has 97% …

What is the biggest factor in calculating alimony?

Aside from the length of the marriage, the biggest factor in calculating alimony is the financial situation of the spouse who will be paying alimony (known as the "payor"), followed by the financial situation of the spouse who will be receiving alimony (the "payee").

How much alimony do you have to pay in New York?

For example, New York courts adhere to a formula in which the higher-earning spouse must pay 30 percent of his or her monthly income, minus 20 percent of the lower-earning spouse’s income. But even with this alimony calculator, courts may still adjust this amount up or down as they decide what is fair, especially if one spouse ends up with more than 40 percent of the combined total income of both parties.

What should be included in a divorce report?

The amount you report should include everything you received in cash payments from your ex, and should match the amount spelled out in your legal separation agreement, divorce agreement or divorce decree.

What are the factors to consider when determining a post divorce income?

They’ll consider each party’s education level and ability to earn a post-divorce income, as well as age and health – especially if the payee is unable to work due to a physical or mental condition.

How long can you expect alimony?

In many states, if you’re married for less than 10 years you can expect alimony for a number of years equal to half the length of the marriage itself. For couples who made it past 10 years, the court will use a different approach to the situation, with an eye toward fair treatment of both spouses.

How long can you get alimony if you are married?

Generally, the shorter the marriage, the lower the alimony payments, or the shorter the length of time you’ll continue to receive payments. In many states, if you’re married for less than 10 years you can expect alimony for a number ...

Who writes alimony?

Written by family law attorney Stephanie Reid. Known in some jurisdictions as spousal support or spousal maintenance, alimony is a major component, and source of contention, in the divorce process.

What an Alimony lawyer can do for you

When an ex-spouse makes payments to a former spouse after the divorce, the payments are called alimony. Alimony payments (also called spousal support) are intended to preserve the lifestyle the former spouse enjoyed before the divorce. Unlike child support, which is a required payment to fund a child's necessities, no one is guaranteed alimony.

Why hire an Alimony attorney

When an ex-spouse makes payments to a former spouse after the divorce, the payments are called alimony. Alimony payments (also called spousal support) are intended to preserve the lifestyle the former spouse enjoyed before the divorce. Unlike child support, which is a required payment to fund a child's necessities, no one is guaranteed alimony.

Did you know?

Only three percent of divorcing men receive alimony. In 2010, there were 12,000 male alimony recipients compared to 380,000 female alimony recipients.

Three Simple Steps

Find out how simple the divorce process can be when you work with a law firm that puts you first. Book your consult today!

Book Your Consultation with Sterling Lawyers, LLC

"I was represented very well, my attorney fought for me, and definitely made sure my interests were well represented. I felt as though Dan, my attorney, would go to war with me, and do everything in his power to make sure I came out on top."

How to calculate alimony?

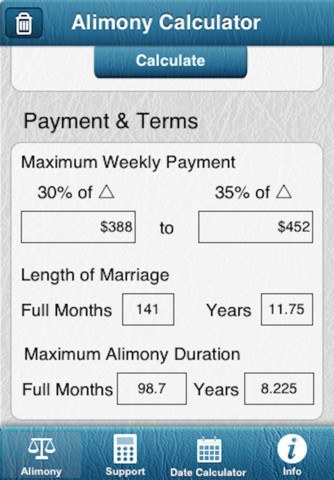

To calculate alimony or spousal support you will need the following information: 1 Your gross yearly income. Gross income is income before taxes. 2 Your net yearly income. Net income is income after taxes. 3 Your spouse’s gross yearly income. 4 Your spouse’s net yearly income. 5 The amount that you or your spouse pays in child support for children that are the result of a prior relationship. 6 The amount of child support you pay or receive for children of your relationship. 7 Length of marriage.

What happens if you don't raise alimony?

If you fail to raise the alimony claim, you may lose your right to do so later. Alimony orders may be enforced through motions for contempt. Alimony in a separation agreement is enforceable through a lawsuit to enforce the contract. These are very different ways of enforcement.

What are the factors that determine the length of a marriage?

Those factors can include the length of the marriage, the age of parties, education of parties, individual contributions to the marriage , whether either spouse had an affair, and the overall estate and income of each of the parties. If you don’t see your state listed, you can use the average calculations.

Can alimony be modified?

Another important decision in determining whether to agree to alimony in an agreement or have it in a court order is the ability to modify alimony in the future. In some states, alimony that is in an agreement cannot be modified by the court.

Can you file alimony in a divorce?

Alimony may be agreed to in a separation agreement or mediated settlement agreement. If alimony is not agreed to you can file a claim for alimony with the court. In some states, you must raise your claim for alimony prior to the divorce decree being issued. If you fail to raise the alimony claim, you may lose your right to do so later. Alimony orders may be enforced through motions for contempt. Alimony in a separation agreement is enforceable through a lawsuit to enforce the contract. These are very different ways of enforcement.

Can alimony be paid in monthly installments?

Alimony awards may be paid as a lump sum or in monthly installments. You should consult with your tax accountant if you plan to make your alimony payment in a lump sum. Prior to 2019, the paying spouse could deduct support payments from their tax return and the spouse receiving support had to pay the taxes. For orders entered after January 1, 2019, the law changed and the payor is no longer allowed to deduct support payments. The receiving spouse no longer has to pay tax payments.

Does North Carolina have a formula for alimony?

Disclaimer: Not all states us a formula to calculate alimony or spousal support as part of a divorce. For example, North Carolina courts do not have a set formula to calculate Alimony. Rather, judges award alimony on a case by case basis. In states that do use a calculator, the law may provide for deviations.

Why do you need to modify your alimony?

In many cases, the court will consider modifying your alimony order because of this “boost” in the recipients income. Keep in mind your ex-spouse’s ability to use your income to boost their social security does not reduce your payments

Is there a formula for alimony in Florida?

Currently there is no set calculation or formula in Florida. That may change soon based on current alimony legislation. Florida alimony is based on the “need” for alimony of one person and the “ability” to pay alimony on the part of the other person.

Can you reduce alimony payments?

If you understand the rules about alimony modification, you may be able to reduce or eliminate your payments completely.

Can alimony be modified if a mortgage is paid off?

Provided the overall change in expenses is in excess of $25 the court may consider reducing support payments. Home is paid off – another possible reason to have request a modification of alimony is when a mortgage is paid off. After all, the spouse receiving alimony payments now has significantly more disposable income.

Can you modify alimony if you are married again?

While most people believe that these modifications can only occur when the receiving partner gets married again, this simply is not in line with the facts. Cohabitation – if you believe your spouse is living with another person and is involved in a relationship, you may apply to have your alimony payments modified.

Is alimony modification necessary?

When a Modification of Alimony is Necessary. Your divorce is final and you think that alimony payments are going to go on forever and a day. Not so: There are many instances that could result in the need to request a modification of alimony.

Does Florida have an alimony calculator?

The calculator is based on a model created by a national organization of attorneys. Florida does not have an official calculation or guide to the exact determination of alimony. This Florida Alimony Calculator will not give you an “official” figure, because Florida alimony law does not gave an official guide to alimony calculation.

Length of Marriage

- One of the first factors a court will consider is the length of your marriage. Generally, the shorter the marriage, the lower the alimony payments, or the shorter the length of time you’ll continue to receive payments. In many states, if you’re married for less than 10 years you can expect alimony for a number of years equal to half the length of the marriage itself. For couples who made it pa…

Payor’S Financial Situation

- Aside from the length of the marriage, the biggest factor in calculating alimony is the financial situation of the spouse who will be paying alimony (known as the "payor"), followed by the financial situation of the spouse who will be receiving alimony (the "payee"). First, the court will determine the payor’s monthly gross income. Then, the court will take into account the payor’s a…

State-Specific Alimony Calculators

- While some jurisdictions focus on fairness alone, other states have adopted a spousal support calculator designed to result in a consistent and predictable amount. For example, New York courts adhere to a formula in which the higher-earning spouse must pay 30 percent of his or her monthly income, minus 20 percent of the lower-earning spouse’s incom...

Personal and Subjective Factors

- States also consider a number of subjective factors, even if they use an alimony formula. Family court judges will consider each party’s contribution during the marriage – both financially and domestically. And there may be negative factors to consider; for example, a payor may be ordered to pay additional alimony if there is evidence of domestic violencein the marriage. They’ll consid…

Taxes

- Remember that the alimony payments you receive are considered taxable income and you must report them as such. The amount you report should include everything you received in cash payments from your ex, and should match the amount spelled out in your legal separation agreement, divorce agreement or divorce decree.

Popular Posts:

- 1. what if a lawyer forged someone signature

- 2. who is the best divorce lawyer in ct

- 3. who was the lawyer that annalise conntacted in how to get away with a murderer season 2

- 4. what is it like being a corporate lawyer

- 5. how do i find a medical malpractice lawyer?

- 6. what can an employment lawyer do if my job is in trouble

- 7. what type of lawyer do you need for living trust in georgia

- 8. mchenry county dui why do i need a lawyer

- 9. what is a cnon lawyer

- 10. what is a lawyer who works for the state