How long does it take to receive your settlement check?

Depending on the details of your case or your settlement agreement, the actual time it takes for your check to be delivered varies. While many settlements finalize within six weeks, some settlements may take several months to resolve. Here are some of the reasons why your settlement check may arrive later than expected.

How does it take to receive a settlement check?

The Personal Injury Claim Process in Texas

- Beginning Your Case With a Personal Injury Attorney. After a car accident, the first thing you should do is receive medical attention. ...

- Demand and Negotiations. ...

- Filing a Personal Injury Lawsuit. ...

- Discovery Process. ...

- Negotiations and Mediation. ...

- Trial. ...

How long can my attorney Hold my settlement check?

When the defendant or the insurance company sends the check to your attorney, your attorney will hold it until the check clears. This can take between five and seven days for larger settlement checks. Paying liens and bills is the third factor affecting the timeline.

How long does it take to payout on a settlement?

whether it has driven down the amount of time firms take to pay suppliers. In March 2019, when CN first analysed the payment times of the UK’s 100 biggest contractors, the median average time it was taking to settle an invoice was 43 days. The percentage ...

How long does it take to get a check after you settle?

about six weeksHow long does it take to get a settlement check? The answer depends on the various processing steps and payments required before you get the check, but in most cases, you can expect to receive your funds in about six weeks.

How long does it take for a settlement check to clear in the bank?

You can deposit the settlement check into your bank account and use it any way you wish. It can take about six weeks for you to have the money in your hands. Most law firms issue paper checks to their clients.

What happens when you deposit a check over $10000?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How long does it take for a $15000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

How long does it take for a large deposit to clear?

Large deposits (those greater than $5,000) can be held for a “reasonable period of time,” between two and seven business days, depending on the type of check.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

Do banks report check deposits over $10000?

If you deposit more than $10,000 cash in your bank account, your bank has to report the deposit to the government. The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act, also known as the Currency and Foreign Transactions Reporting Act.

How are settlements paid out?

A structured settlement can be paid out as a single lump sum or through a series of payments. Structured settlement contracts specify start and end dates, payment frequency, distribution amounts and death benefits.

What Factors Delay My Settlement Check?

Depending on the details of your case or your settlement agreement, the actual time it takes for your check to be delivered varies. While many sett...

How Can I Speed Up the Delivery of My Settlement Check?

If you need your settlement check as soon as possible, there are a few ways to speed up the process. Once you get close to a settlement, start draf...

Should I Get a Settlement Advance?

A lawsuit loan, also known as pre-settlement funding, is a cash advance given to a plaintiff in exchange for a portion of their settlement. Unlike...

How long does it take for a settlement check to be delivered?

While many settlements finalize within six weeks, some settlements may take several months to resolve.

What happens when you get a settlement check?

When you finally reach a settlement, there are a few more things you and your lawyer need to do before the defendant gives your lawyer the check. Even so, once the check reaches your lawyer, there are a few obligations they must attend to before they give you the final balance.

How long does it take to settle a liens claim?

It’s usually easy to settle liens, unless the government has a lien against your settlement. If you have any liens from a government-funded program like Medicare or Medicaid, it takes months to resolve them. Your lawyer also uses your settlement check to resolve any bills related to your lawsuit.

How long does it take for a check to clear?

Once your lawyer receives the check, they usually hold it in a trust or escrow account until it clears. This process takes around 5-7 days for larger settlement checks. Once the check clears, your lawyer deducts their share to cover the cost of their legal services.

What is structured settlement?

Unlike a regular settlement that pays the settlement amount in full, a structured settlement is when a defendant pays the settlement amount over time. These types of settlements usually occur when the case involves a minor or if there was a catastrophic injury that requires extensive ongoing medical care.

What form do you sign to get a settlement?

The first form you have to sign to get your settlement is a release form. This form is a legally binding agreement stating that you will not pursue further legal action against the defendant for your specific case. Most defendants or insurance companies won’t give you a settlement check unless you sign the release form. However, if you have concurrent lawsuits against the same defendant for a different matter, you don’t have to stop pursuing those claims.

How to speed up the delivery of a settlement check?

Once you get close to a settlement, start drafting a release form ahead of time so it’s ready once you reach an agreement.

How long does it take for a settlement check to arrive?

Usually, a settlement check could take from 4 to 6 weeks to arrive. The more complex the case, the longer the settlement check me take to arrive.

How long does it take to get a check from a lawyer?

The average time for this entire process will take about six weeks.

What is a settlement release?

Once a settlement is agreed upon, the settlement release is signed. The settlement release is drafted by both attorneys from both sides and contain detailed terms and conditions. However, the most important factor to take from a release is that a settlement release gives up both parties rights to go to trial on the same exact issue. A settlement release must be signed in order for a settlement check to be written out. The check will usually be written out to the client and the client’s attorney.

What are the costs of a settlement?

Once the settlement amount is placed in the bank account, different costs will have to be paid before the client receives their compensation. One of the most common costs include medical liens placed while the plaintiff was getting medical treatment.

Why is it important to hire a personal injury attorney before settling a case?

It is important to hire a personal injury attorney prior to settling because insurance companies may take advantage of unrepresented plaintiffs. For example, they may offer lower than expected just because they know that the person is not well versed in the legal world.

What happens during a settlement?

During settlement negotiations, both sides determine a specific monetary amount they could possibly agree on. This is done after both sides see the evidence and determine if there is a possibility that they should go to trial. Each type of case differs and each circumstance may warrant a different outcome. For example, a case that may not have high medical costs could end up in a settlement rather than go to trial. If you or a loved one have retained counsel and have gone through the settlement negotiations, the next steps would have you wondering when the settlement check would be coming in. This is one of the most common questions after settlement has been reached between both parties. It is definitely understandable that many clients are waiting on settlement checks to come in so they could pay off their medical bills that they have paid for originally out-of-pocket.

Do personal injury cases go to trial?

Personal injury cases either end up in a settlement or go to trial in court. This depends on a case-by-case basis. The settlement occurs when the plaintiff receives monetary compensation from the defendant. When this occurs, both sides agree they will not go to trial. Settlements usually occur because both parties do not want to spend multiple thousands of dollars going to trial. Trials are oftentimes very costly and there’s a probability that plaintiff could incur high costs that would essentially not result in high compensation.

How long does it take for a settlement check to clear?

The attorney may hold the check in a trust or escrow account until it clears. This may take several days, especially if it is a large check.

What is the first step in receiving a settlement check?

Release Form. The first step in receiving your settlement check is to sign a release form that states that you will not pursue any further monies from the defendant for the specific incident in question. The defendant or the defendant’s insurance company will not send a check for your damages without such a form.

What happens if you owe child support?

If you owe child support, a lien may be issued against your settlement. Liens must be paid off before you receive your remaining portion of the settlement. In some instances, your attorney may try to negotiate to have the value of these liens reduced so that you will wind up with more money in your own pocket. However, this negotiation can take up additional time and slow down the receipt of your settlement funds. The internal process of the defendant’s insurance company may also cause a delay, such as if the claim is processed in one state office and the check comes out of another state’s office.

How to speed up a settlement?

The release may indicate the amount of time that actual payment is expected. You can ensure that you submit all documents to your attorney that the defendant requires before cutting a check. Your attorney can also use expedited shipping and return receipt request mailings to avoid excuses that documents were not received by the defendant. If you anticipate that you will owe medical providers or other creditors' funds, you may ask your attorney if you can receive a partial distribution while your attorney holds the rest and settles your outstanding claims.

What are some examples of delay in a settlement?

There are several instances when a delay may occur. For example, the defendant may have its own release form. Your attorney and the defendant’s attorney may have to revise this form until it is acceptable to both parties. Certain cases may require more preparation, such as cases involving estates or minors. You may have a medical lien or other lien against the proceeds of your settlement. For example, a medical provider may have a lien against you if it has not received payment for the services you incurred during an accident.

Can an attorney give you an estimate of when you can expect your check?

While you can ask your attorney to give you an estimate of when you can expect your check, the answer to this question depends on a number of factors, such as the defendant’s policy, the type of case that it is and whether there are any extraneous circumstances affecting payout.

Can you have a lien against a settlement?

You may have a medical lien or other lien against the proceeds of your settlement. For example, a medical provider may have a lien against you if it has not received payment for the services you incurred during an accident. If you owe child support, a lien may be issued against your settlement.

3 attorney answers

GEICO Is notorious for making very small offers, less than medical bills. In my experience, lawsuits have to be filed, discovery commenced, and the case getting close to trial before GEICO makes reasonable offers. More

Lisa Morgan Edwards

Unfortunately, trying to settle a claim with GEICO for a "reasonable amount" is nearly impossible as they routinely make low-ball offers. If you do settle, then on average it can take 7-10 days for the insurance company to send the settlement check to your lawyer and another day or two for the check to clear.

James Andrew Robson

You hied a lawyer to help you. They know the facts better than we do. I suggest you ask them this question.

What Causes Delays with Settlement Checks?

The specifics of your case and settlement agreement mean there is no fixed timeline for the delivery of your settlement check. Some settlements finalize in as little as six weeks, while others drag on for several months before being resolved.

How About a Structured Settlement Payment?

Occasionally, a defendant might pay via a structured settlement. Where a regular payment sees you paid in full, a structured settlement results in compensation paid over time.

Is It Possible to Hasten Delivery of a Settlement Check?

What can you do if you need your settlement check as quickly as possible?

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

How long does it take to get a settlement agreement signed?

Next, the court issues an Order of Settlement. This order generally requires that both parties complete all necessary paperwork within either 30 or 60 days.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

How many personal injury cases go to trial?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

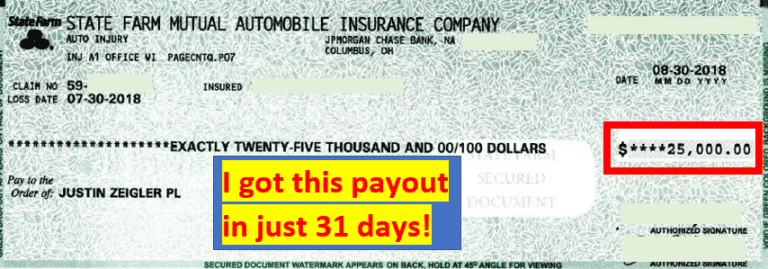

The Settlement Check

After settling a case, you can expect to receive compensation from the opposing party, or their insurer, in the form of a settlement check. The amount of settlement check is however much you and your attorney were able to negotiate for, ideally enough to cover all your damages, including past and future medical expenses and other costs.

How Long Does it Take to Get Paid After a Settlement?

Getting to a settlement is itself a long and often arduous process. It is natural that once you’ve finally agreed to a settlement, you want to know how quickly you will get your check. Usually, the insurance company forwards the settlement check to your attorney.

Steps Toward Getting Your Settlement Check

Once you reach an agreement to settle with another party, one of the attorneys must draft the settlement agreement with the terms you agreed on. The drafting attorney then forwards the draft agreement to the other party’s attorney. If the other attorney has changes, they discuss the changes with the drafting attorney.

After You Receive Your Settlement Check

Once you receive your settlement check, it is yours to spend to cover your expenses.

Injuries that Could Become Permanent Disabilities

Car accidents, slip and fall incidents, dog bites, and several other accidents could cause catastrophic injuries. These injuries are those that often lead to permanent disabilities, leading to life-long expenses your settlement should take into account.

Recovering Damages After an Accident

Your settlement check should cover all of your expenses and impacts, beyond mere medical expenses. You can collect two types of compensatory damages after an accident, including economic damages and non-economic damages.

Popular Posts:

- 1. how to become a lawyer with no degree

- 2. the lawyer how stay office

- 3. how to figure out what kind of lawyer i need

- 4. what do when lawyer receives settlement check

- 5. which ammendment gives you a lawyer if uou cant afford one

- 6. who pays for the proofreader, lawyer or client?

- 7. in luke 10, how did jesus respond to the lawyer who asked him, “and who is my neighbor?

- 8. what do you call a lawyer in car accident

- 9. what to do when your lawyer won't contact you back

- 10. how much do i have to pay a lawyer for probate in california