Kinds of Fee Arrangements

- Hourly Billing. Many probate lawyers bill clients by the hour. ...

- Flat Fees. It's also common for lawyers to charge their probate clients a flat fee. ...

- Percentage of the Estate's Value. The worst way to pay a probate lawyer—from the estate's point of view—is to pay a percentage of the value of the estate as the ...

Full Answer

How much do lawyers charge for probate?

Dec 28, 2020 · How does a probate attorney get paid? · Court filing fee. · Publication fee of legal notices. · Property appraisals. · Postage fee. · Real estate deeds recording fee. But, who pays?

How much is a probate attorney in California?

Apr 25, 2021 · How Do Probate Attorneys Get Paid? • 4% of the first 100,000 of the gross value of the probate estate. • 3% of the next $100,000. • 2% of the next $800,000. • 1% of the next $9 million • ½% of the next 15 million • “a reasonable amount” of anything over $25 million Get Your Fee Agreement in ...

What are some basic costs related to probate?

Probate lawyers get paid by executors of the estate. The executor is the person that administers the estate of the deceased. At the outset of the probate process, executors are expected to deposit with a bank an amount that is sufficient to cover …

How much does it cost to probate a will?

Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case. Hourly Billing. Many probate lawyers bill clients by the hour.

Do you have to pay probate fees up front?

The probate application fee must be paid up-front. As a result solicitors are being bombarded by applicants trying to submit forms before the new fees come in.Mar 23, 2019

How much does it cost to hire a probate lawyer?

Probably the most common way for probate lawyers to charge clients is to bill by the hour. Hourly rates vary depending on where you live and how experienced (and busy) the lawyer is. In a rural area, you might be billed $150/hour; in urban areas, you're more likely to see rates of $200/hour and up.

What is the cost of probate?

How much does professional help with the probate process cost? The fees for probate and estate administration can vary widely depending on who does it, whether that be a solicitor, probate specialists or a bank. The cost for these range between 2.5 to 5% of the value of the estate.

How much does a solicitor charge to be an executor?

Some probate specialists and solicitors charge an hourly rate, while others charge a fee that's a percentage of the value of the estate. This fee is usually calculated as between 1% to 5% of the value of the estate, plus VAT.

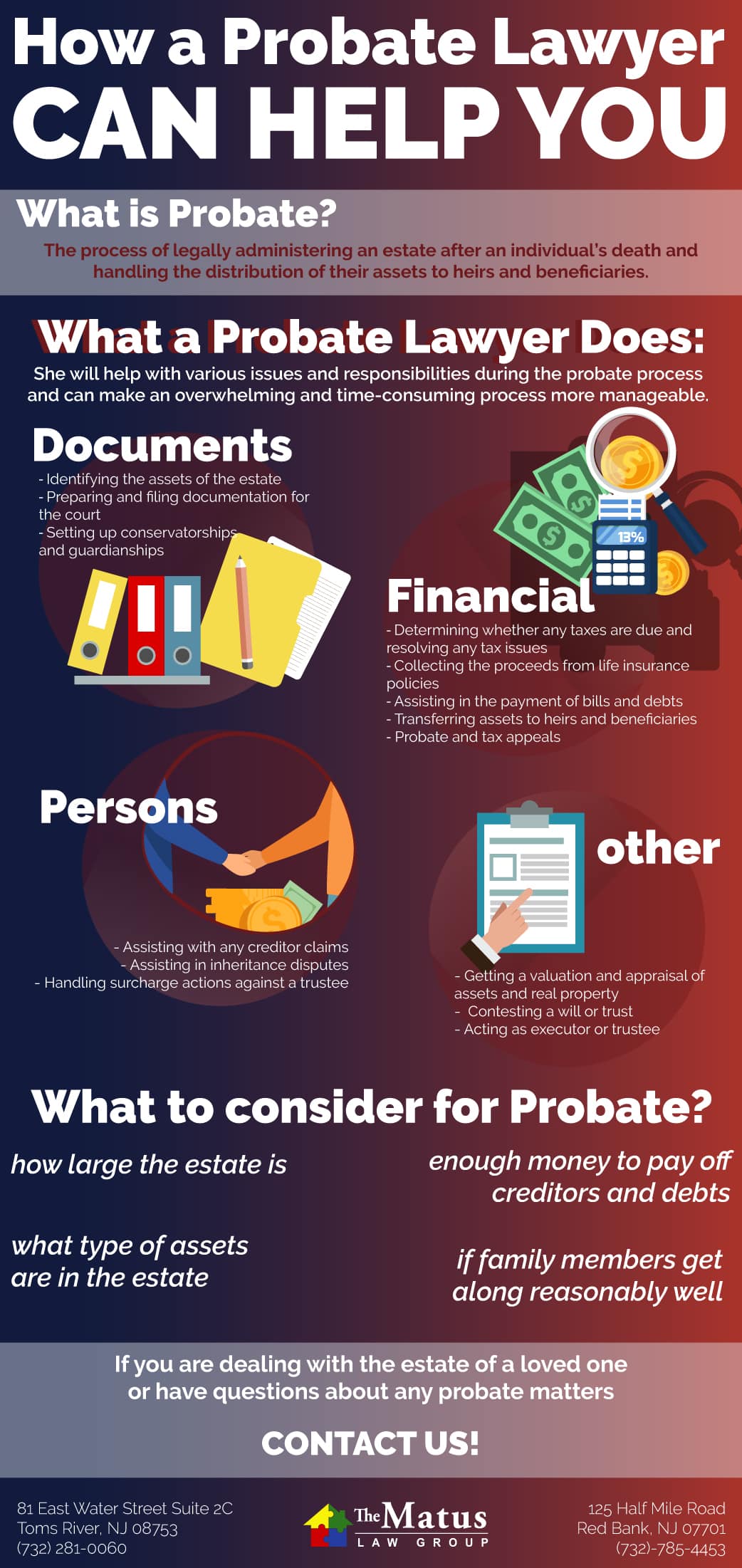

What does a probate attorney do?

A probate attorney usually handles the process of estate administration after a person dies. An estate planning attorney, on the other hand, works with living clients on how their client's estates should be administered. The attorney could do that by helping clients prepare trusts, wills, and other relevant documents.May 8, 2020

How long does it take for probate to be granted?

Typically, after death, the process will take between 6 months to a year, with 9 months being the average time for probate to complete. Probate timescales will depend on the complexity and size of the estate.Mar 1, 2022

Do I need to send death certificate for probate?

You'll need a copy of the death certificate for each of the deceased's assets (eg, each bank account, credit card, mortgage etc), so before you can start probate, you'll need to register the death.Feb 23, 2022

What happens to direct debits when someone dies?

When someone dies, their bank will need to be notified of the death and their account(s) will be frozen. This means that direct debits and standing orders for paying household bills and other expenses will be cancelled.Mar 4, 2019

Do all executors have to apply for probate?

Do all executors of a will have to apply for probate? Often more than one executor is named in a will, but not all of the executors have to apply for probate. A maximum of four people can apply to the Probate Registry to prove a will and be named on the grant of probate.

What rate is inheritance tax paid at?

The tax is set at 40% of any value over that threshold, reduced to 36% if more than 10% of the estate is given to charity. To work out how much IHT, if any, needs to be paid, the executors of the estate need to add up the value of all of the assets, then subtract any debts, bills and funeral expenses.Feb 4, 2013

What is the average cost of probate in the UK?

Generally, probate fees, if we deal with all of the administration of an estate, are approx. 2.5/3% of the gross value of the estate for estates up to £500,000 and 1.5/2% for estates with a gross value of over £500,000.

What happens when a solicitor is executor of a Will?

notifying third parties of your death; investigating the assets and debts in your estate; applying for a grant of probate, submitting an inheritance tax return and paying any tax due; collecting in your assets or their sale value.Aug 7, 2020

How much does a probate lawyer charge?

Small town rates may be as low as $150/hour; in a city, a rate of less than $200/hour would be unusual. Big firms generally charge higher rates than sole practitioners or small firms, unless a small firm is made up solely of hot-shot specialists.

How long does a lawyer bill?

Many lawyers bill in minimum increments of six minutes (one-tenth of an hour). So, if your lawyer (or a legal assistant) spends two minutes on a phone call on behalf of the estate, you'll be billed for six minutes.

What is the billing method for probate?

Another popular billing method is the flat fee. An attorney who's done a lot of probates knows about how long the work takes, and charging a lump sum means the attorney doesn't have to keep careful records of how the lawyers and paralegals spend their time. Some attorneys also find that clients are more relaxed and comfortable dealing with the attorney when they know the meter isn't always running.

What are some examples of real estate fees?

Some examples include court filing fee, postage, publication of legal notices in the newspaper, property appraisals, and recording fee for real estate deeds.

Do you have to get a fee agreement for an estate attorney?

When you hire an attorney on behalf of the estate, get a fee agreement in writing. It's required by law in some states, and it's a good idea no matter where you are.

Do lawyers collect percentage of estate value?

In a few states, lawyers are authorized by law to collect a percentage of the value of the estate as their fee. They're not required to do so—you are free to negotiate an hourly rate or flat fee with them. But many prefer it because it usually pays so well in relation to the amount of work actually required.

Total Fees Charged by Estate Administration Lawyers

In our survey, more than a third of readers (34%) said that their lawyers received less than $2,500 in total for helping with estate administration. Total fees were between $2,500 and $5,000 for 20% of readers, while slightly more (23%) reported fees between $5,000 and $10,000.

How Lawyers Charge for Probate and Other Estate Administration Work

The total fees that estates paid for legal services were based on one of three types of fee arrangements charged by attorneys for probate and other estate administration work: hourly fees, flat fees, and fees based on a percentage of the estate’s value.

Free Consultation With Probate Lawyers

More than half (58%) of the probate attorneys in our national study reported that they offered free consultations. The typical time for these initial meetings was 30 minutes, though the overall average was higher (38 minutes).

Patricia Ann Simmons

Extraordinary fees are based upon the attorney's regular hourly rate. Any extraordinary fees requested by the attorney must be specified in a a separate fee declaration which includes, the number of hours expended in any extraordinary service and what extraordinary service was performed.

Gregory Paul Benton

There are pros and cons as to going either Iimited authority vs full authority. Each has an advantage and when it come to the sale of real property, this could be very important. Asking for funds to be paid prior to a final court order for payment of attorney fees is "sketchy" in my opinion and my practice is different.

Christine James

Wow! Neither are correct. Probate is very regulated. Probate attorney fees are set by statute and are 4% of the first $100,000, 3% of the next $100,000 and 2% of the next $800,000. If the value exceeds $1,000,000 an additional 1% over that amount will be due. You, as administrator earn the same fee as the attorney, period.

Christine James

Probate attorneys are priority creditors. The probate attorney will likely get paid and other creditor's may have to take less than their claim. With regard to property gifted to you, it is unlikely they can ask for that back unless it is substantial and will be sold to satisfy creditors. Any gifts given to you before death are not touchable.

Gregory Paul Benton

If there are no assets, then the attorney will probably seek a lien or judgment for his/her fees against the estate. But, you are not responsible for this debt. As to personal property, who is asking for these? What would be their actual dollar value?

Popular Posts:

- 1. what type of lawyer is needed for failure to appear

- 2. how to be a lawyer i

- 3. what being a marine lawyer entails

- 4. what dose it take to be a good lawyer

- 5. how to become a lawyer after degree

- 6. how to be a lawyer in va

- 7. who was the lawyer for timothy leary case defence lawyer

- 8. what type of lawyer handles workplace harassment

- 9. romance novel where hero breaks heroines heart debate lawyer

- 10. what to bring to lawyer for disability appointment