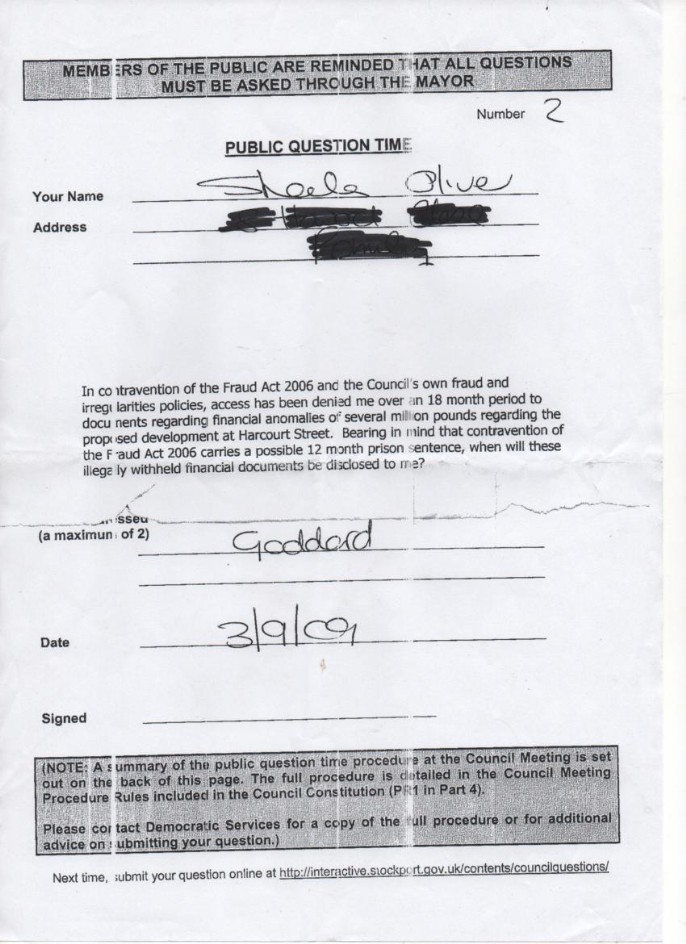

FIRST, THE LAWYER Once a company has asked a CPA to look into a business fraud, the first step he or she needs to take is to advise the client to hire an attorney, specifically to establish privilege of information. (Of course, CPAs who suspect fraud while performing an audit are bound by additional rules and regulations.

Full Answer

Do I need a CPA or a lawyer for my business?

However, if your situation isn’t overly complicated, a CPA will cost you less than a lawyer. If your business faces legal tax issues, you need to hire a tax attorney because they have a deeper understanding of the legalities in the U.S. tax system.

What is the difference between a CPA and a tax attorney?

Furthermore, a tax attorney provides the advantage of attorney-client privilege while a CPA only offers attorney-client privilege if acting at the direction of a lawyer to give the client information relevant to the case. Finally, both CPAs and tax attorneys must have had extensive education to practice in their fields.

What type of tax attorney should I hire?

However, two of the most reliable and well-known professionals that can aid you with various tax problems are the tax attorney and the CPA, both of which offer different — though often overlapping — services.

What do accountants need to know about fraud in accounting?

The accountant will need to document any responses to inquiries of management as well as all analytical procedures performed including, in this case, those that are related to fraud. During an engagement in which the CPA is compiling financial statements of a privately held business there is almost no concern of fraud.

Can CPA report fraud?

Accountants can receive an award as a whistleblower under the IRS program. They do not have any special internal reporting requirements. However, there are two restrictions on their ability to submit information and earn a reward.

Is accountant liable for tax fraud?

Is my tax advisor liable for helping me commit tax evasion? Yes. A tax practitioner (attorney, CPA, enrolled agent, accountant, bookkeeper, etc.) can be found guilty to the same extent as the taxpayer who actually owes the taxes.

Should a CPA represent a client in tax court?

Be aware that CPAs do not represent the taxpayer before U.S. Tax Court and do not usually take on clients without an attorney present for representation if the clients have indulged in criminal actions.

Can a CPA go to tax court?

CPAs or Enrolled Agents who are seeking to have greater interaction with the Internal Revenue Service (IRS) or the right to practice in U.S. Tax Court can pursue a tax specialty designation referred to as "Admitted to Practice, U.S. Tax Court" by successfully passing the Tax Court Exam.

How do I get rid of tax fraud?

How To Get Away With Tax FraudBe consistent. Audits and examinations aren't random. ... Be good at math. ... Keep good records. ... Know your credits. ... Be realistic about your dependents. ... Don't tell anyone. ... Don't call the tax authorities. ... Check your bank or the mail for your refund.

Can you go to jail for tax evasion?

If you are found guilty, the penalties can include substantial fines and a prison sentence. If however, you are charged with tax evasion, for example, because you misrepresented or misled CRA, you could face a fine of up-to 200% of the total amount of taxes evaded, and up-to two years in jail.

Can a CPA represent you before the IRS?

Unlimited Representation Rights: Enrolled agents, certified public accountants, and attorneys have unlimited representation rights before the IRS. Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals.

What can a CPA do that an EA can t?

While EAs can't provide compiled, reviewed, or audited financial statements like most CPA's can, they can generally perform bookkeeping work to put the business's records into tax-basis statements that they then use to prepare a tax return.

Can an accountant represent you in court?

We are often asked by accountants whether they can represent a client at court, for example at a company restoration hearing or a hearing for the winding up of a company. Accountants do have the right to represent a client at court, but only in limited circumstances.

Is it worth going to Tax Court?

More than 50% of all petitions filed in tax court bring some tax reduction. In cases under $50,000 (called small cases), 47% of all taxpayers win at least partial victories. In cases involving $50,000 or more (called regular cases), 60% come out ahead.

Can you fight the IRS and win?

You won't be able to go to Tax Court, but you can contest the taxes in federal district court or the U.S. Claims Court. Usually you must pay the taxes first and file a claim for refund. If the refund request is not granted, then you can sue for a refund.

How do I sue the IRS and win?

Generally, to sue the IRS in Tax Court, the petitioner (you) must simply meet the timelines for filing. Conversely, to sue the IRS in Federal Court, the complainant (you) will typically have to pay the amount outstanding and sue for refund, and/or wait to be sued by the IRS — and filed a counter lawsuit.

What is a Tax Lawyer?

A tax lawyer is a legal professional who graduated with a law degree and specialized in the very complicated world of tax law. A tax attorney must...

What is a CPA?

A CPA, or certified public accountant, does not have a law degree, but a five-year business degree. CPA programs require at least 150 hours of lear...

Tax Attorney vs CPA: When is a Tax Lawyer the Better Choice?

Trying to decide between hiring a tax attorney or a CPA? It depends on your business’s tax situation. Keep in mind that a tax attorney can do basic...

What is the difference between a tax attorney and a CPA?

While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes , the advantages of having a two-in-one professional are hard to overstate.

What can a CPA do?

However, one of the most beneficial services a CPA can offer is the ability to review or audit a business’ financial records to identify problem areas that need improvement, as well as where you are in good standing.

What is the role of a tax attorney?

The role of a tax attorney. Tax attorneys are lawyers who have gone through law school, passed their state’s bar exam and emphasize tax issues in their practice.

What is the role of a CPA?

The role of a CPA. CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available.

Who can help with tax issues?

However, two of the most reliable and well-known professionals that can aid you with various tax problems are the tax attorney and the CPA, both of which offer different — though often overlapping — services.

Do CPAs have to be dually licensed?

Not only do dually-licensed Attorney-CPAs have the financial background to understand the intricate details of your company’s balance sheets, but they are also able to advise on business structure to reduce tax liabilities and hopefully help you avoid any trouble with the IRS.

How Can Accountants Get Entangled into a Federal Conspiracy?

Accountants must realize the dangers of becoming entangled into a federal tax fraud conspiracy. Federal prosecutors like to charge federal cases by way of a conspiracy because it allows them to glue various defendants together into one case by simply arguing that each of those defendants contributed something to the overall success of the tax fraud scheme. Importantly, the law does not require that all defendants explicitly agreed to defraud the IRS. Similarly, defendants do not need to know all aspects of the fraud. Decisive is that they worked in concert and everyone added an overt act.

What Are the Steps of a Tax Fraud Investigation?

Like all federal cases, tax fraud investigations occur in several stages. Starting with a complaint or a lead, IRS agents begin to investigate a case by interviewing potential witnesses, requesting documents to be produced, or sometimes also by way of surveillance. Once the agents believe to have sufficient information to confirm the validity of a lead, they will approach an Assistant United States Attorney (AUSA) to formalize the investigation by either issuing subpoenas to witnesses or targets or to request the testimony before a grand jury. In a process that can easily take months, sometimes years, the job of the grand jurors then is to assess the gathered written and testimonial information to ultimately decide whether or not to indict the targeted individual.

What Should You Do When You Receive a Grand Jury Subpoena?

So much more can be done to help clients at the beginning of an audit or investigation while, at later stages of an investigation, the means to undo mistakes or to regain missed opportunities are significantly slimmer.

What Is Tax Fraud?

Tax fraud, in simple language, refers to intentional misrepresentations (lying) on your tax return and falsifying tax documents. Tax evasion, by contrast, stands for the use of illegal means to avoid paying your taxes. Tax fraud, in its most common application, is a federal felony offense that is governed by 26 U.S.C. 7206 (1). Pursuant to this statute, a person is guilty of tax fraud if the following conditions are met:

What Are the Penalties for Tax Fraud?

Pursuant to Title 26 of the United States Code, a defendant guilty of tax fraud will be ordered to not more than 3 years imprisonment, a term of supervised release of not longer than 3 years, a fine not to exceed $ 250,000; asset forfeiture, and a mandatory special assessment. The exact exposure depends on the amount that was owed to the IRS. The more money was non-reported, the higher the sentence expectation. All sentencing calculations are subject to complex mathematical analysis under the Federal Sentencing Guidelines and consider, besides the damage amount, the defendant’s prior criminal history, the motivation for the offense, the restitution already paid, and a variety of other factors tailored to the circumstances of the offender.

What Is the Statute of Limitations for Tax Fraud?

In criminal tax evasion investigations, the Statute of Limitations is typically three years. However, if the IRS audit reveals that more of 25% of your income had been concealed, the SOL extends to six years.

Did Michael Cohen pled guilty to tax fraud?

Not just since the case against the former personal attorney to the President, Michael Cohen, who famously pled guilty to tax fraud in 2018, have tax fraud charges become more of a national phenomenon in federal criminal cases. Unlike in the past, when the government focused its investigations against those tax payors that simply did not provide truthful information about their income, a plethora of current prosecutions suggest that tax preparers and CPAs themselves are increasingly targets of grand jury proceedings and federal criminal prosecutions.

What is the difference between a tax attorney and a CPA?

Now you should better understand the key differences between a tax attorney vs CPA. They both offer helpful tax services for your business , but a tax attorney wields greater power when dealing with serious tax issues.

What does a tax attorney do?

All tax attorneys help clients with dispute resolutions. They understand the intricate details of negotiating with the IRS and other financial institutions. They also can assist businesses with the legal aspects of tax preparation.

What is a Tax Lawyer?

A tax lawyer is a legal professional who graduated with a law degree and specialized in the very complicated world of tax law. A tax attorney must pass the bar in the state they wish to work just like any other lawyer. But what does a tax attorney do?

What is a CPA?

A CPA, or certified public accountant , does not have a law degree, but a five-year business degree. CPA programs require at least 150 hours of learning during those 5 years. They must also pass an extensive exam before graduating.

What can a tax lawyer do for a business?

A tax lawyer can advise your business on major decisions like whether to switch to an S-Corp from an LLC. They can also point out the potential liabilities and any overall structure protections. Their law license then allows them to complete the legal documents needed to make things happen.

How many small businesses get audited every year?

The most common fear is an audit, but that does not happen as often as you would think. Only about 2.5% of small businesses in the United States get audited every year.

When is the best time to hire a CPA?

The best time to hire a CPA is when you’re not dealing with any formal legal issues or extra-complicated tax matters. Choose a CPA when creating a basic financial plan for your business, or for your personal finances.

What is the difference between a CPA and an accountant?

Accountants generally cover financial planning, general bookkeeping, preparing and filing tax returns, tax planning, assisting with audits, budgeting, cost and asset management, estate planning, and can help in making in depth business growth decisions. CPAs (Certified Public Accountants) have more specialized training and credentials. For basic tax filing and business advice, an accountant may suit your needs. For various out-of-state tax returns, financial and estate planning, asset management, or audits, a CPA is well worth the additional expense.

Who said "Nothing is certain except death and taxes"?

Just as Benjamin Franklin said, “Nothing is certain except death and taxes,” you’ll probably need to call a CPA or tax lawyer at one time or another (and according to that statement a mortician too, but that is a different topic for another time).

Is a CPA worth it?

For various out-of-state tax returns, financial and estate planning, asset management, or audits, a CPA is well worth the additional expense.

Do CPAs and tax attorneys have the same expertise?

For these situations, tax attorneys offer more specialization in the legal questions of tax planning whereas CPAs have more expertise on the financial implications.

How is Accounting Fraud Committed?

Accounting fraud can be committed in a variety of ways. These include:

What are the Penalties for Accounting Fraud?

Accountants must follow what are known as Generally Accepted Accounting Principles (GAAP) when preparing financial statements. GAAP consists of a set of accounting principles that the law considers the authoritative, or proper, way to conduct accounting.

What is accounting fraud?

Accounting fraud is a white-collar (business) crime. This type of fraud occurs when a company falsifies or manipulates the information in its accounting books or financial statements. The goal of the falsifications is to commit some kind of fraud against an unwitting person. For example, an accountant within a company may make false entries in ...

What is the SEC complaint?

Investors who suffer financial losses due to accounting fraud may file a complaint with the federal Securities and Exchange Commission (SEC). The SEC will investigate the complaint and, if the complaint is valid, the SEC may file a civil or administrative proceeding against the company.

What is whistleblower law?

A whistleblower is an individual who informs on a company engaged in fraudulent activity. In 2002, a federal law known as the Sarbanes-Oxley Act was passed. This law prevents whistleblowers from being retaliated against for reporting accounting fraud.

Why do companies falsify their financial records?

They falsified their financial records to show that they are making a profit and have no outstanding debts. The victim believed that the company was a wise investment, but after investing they discovered that the company is going under and used their investment as a way to avoid creditors. Now the victim has lost all of their investment.

Why do accountants make false statements?

For example, an accountant within a company may make false entries in the company’s financial statements to give the appearance the company is worth more than it is. An investor, relying on the false information, might then purchase the company’s stock.

Why do I need an attorney for my taxes?

In many instances, an attorney is needed to resolve a case that has dragged on for too long. In addition, there are many instances in which the attorney-client privilege of confidentiality comes into play with the IRS. There may be many different scenarios in which you wish any information you share with your tax professional remains confidential (i.e. cannot be shared with the IRS or anyone else). But only an attorney can provide this type of confidentiality in all tax matters. You may also wish to avoid any further communications directly with the IRS and hiring an attorney will require the IRS agent to deal with your attorney and not you, sparing yourself any additional telephone calls, in-person meetings or other stressful communications with the government.

Who can handle IRS audits?

While many of these audits are “routine,” and can be handled by any qualified tax professionals—including an attorney, CPA, accountant, or enrolled agent —there are some instances where only a tax attorney will suffice.#N#The purpose of this article is to assist you in determining if/when hiring tax professionals (such as a tax attorney in this instance), and offer some specific advice on how best to seek the services of an experienced tax attorney who can protect your rights and keep your hard-earned money away from the IRS.

Do tax attorneys have to be seasoned?

While the attorney assigned to handle your case may not be fully seasoned, it is imperative that the partners or other attorneys at the firm have such experience. It is important to ask questions concerning his/her IRS or Tax Court experience before hiring any tax attorney.

Is the IRS the correct position?

In many tax cases, the IRS position is often the “correct” position —at least as far as the law is concerned. As such, there are some cases in which the IRS cannot be beat. It is important to work with an experienced tax counsel so that you can be prepared for all phases of the case: good, bad and indifferent. With the right counsel, hard work, and a bit of luck, the cases sometimes come out better than they perhaps should. But keep all expectations realistic, as the IRS is nearly always a very tough adversary and miracles are few and far between.

Can you guarantee a tax outcome?

Quite simply, it is impossible to guarantee any results when dealing with the IRS. A prediction as to the likelihood of an outcome with a tax case is acceptable, but not a guarantee as to the outcome. If a tax attorney makes any promises or assurances about a specific outcome, you need to seek counsel elsewhere.

Do you need an attorney for a criminal case?

While prior experience is always preferred, with a criminal tax matter—it is essential. You do not want an attorney handling your criminal case (tax fraud, tax evasion, criminal failure to file tax returns, etc.) as his/her first criminal tax case. The stakes are too high with your freedom to take this risk. While it is fine if an inexperienced attorney assists with your case, it is imperative that an attorney experienced in criminal tax cases (either from representing the IRS/US Government and/or Individuals) handles your case and is the primary/lead attorney.

Do attorneys need a retainer agreement?

All attorneys use some form of written retainer agreement prior to engaging in any legal work for their clients. This retainer agreement should set out the entire fee structure for anyone working on your case (senior attorney, attorney, paralegal, etc.), along with any fees expected (research, experts, travel, etc.). You should have a basic idea as to your overall legal costs, depending upon how far the case must go before it gets resolved (i.e litigating a case in US Tax Court would certainly cost much more money than settling a case in the IRS Appeals Division).

Where to send CPA reports?

Send CPA reports to the attorney. Any litigation support or special project report you prepare should state at the outset that it has been generated for potential litigation purposes. You should send commissioned reports directly to the law firm, not to the client. If possible, discuss the content of reports only with counsel present and collect all copies at the conclusion of each meeting; document such actions.

How should CPAs mitigate the risk of inadvertent disclosure and eavesdropping from the use?

CPAs should mitigate the risk of inadvertent disclosure and eavesdropping from the use of electronic communications by minimizing use of cordless or cell phones to discuss privileged information.

What is the attorney-client privilege?

ATTORNEY-CLIENT PRIVILEGE EXTENDS to accountants under the Kovel rule when a CPA acts at the direction of the lawyer to provide information for the client. Inadvertent disclosure of confidential information may lead to loss of the privilege.

Why is the Ninth Circuit refusing to extend privilege to the accountant?

On appeal the Ninth Circuit refused to extend privilege to the accountant because there was insufficient evidence to show the lawyer had commissioned CPA services to support the rendering of legal advice ( United States v. Gurtner ). Thus, if a practitioner provides business advice rather than litigation-related information for the attorney, no privilege attaches. Even litigation-specific information is unprivileged if it is incidental to business advice.

What can reduce the likelihood of waiver of privilege due to inadvertent disclosure?

SCRAMBLERS AND ENCRYPTION TOOLS can substantially reduce the likelihood of waiver of privilege due to inadvertent disclosure but can be expensive ways to foil interception.

Which court ruled that in applying Kovel it is inappropriate to distinguish between those on the client’s payroll and independent?

The Eighth Circuit Court of Appeals ruled that in applying Kovel it is inappropriate to distinguish between those on the client’s payroll and independent contractors such as CPAs. In the example of In re Bieter Co. the court set out principles applicable to determining whether privilege protected third-party communications. It said

How to conduct a meeting with a client?

For meetings involving you, client representatives and/or the attorney, take minutes noting the date, who is present, the subject and legal reason for the meeting and the confidentiality of the proceedings. It’s important to state the legal purpose; a court may ask whether the meeting would have been held if litigation had never been a prospect. If the answer is “yes,” the meeting likely will be viewed as having a business purpose. Be aware that in a corporation, only employees with essential information should be in attendance.

When was attorney-client privilege added to the tax code?

It was added in to the tax code (IRC Section 7525 (a) (1)) in 1998. But it is quite narrow, and is completely inapplicable to criminal tax cases. That makes it of little value. In contrast, attorney-client privilege is worth a great deal and provides enormous protections under the law.

Who should address all correspondence to the lawyer?

The attorney is the client in a Kovel engagement so the accountant should address all correspondence to the lawyer. That means information acquired by an accountant under a Kovel agreement should be distinguished from information collected by the accountant as an auditor or in some other capacity.

Why is the attorney-client privilege important?

The attorney-client privilege is strong precisely so that clients (in both civil and criminal cases) will be forthcoming with their lawyers. Accountants, however, don’t have this privilege. If you make statements or provide documents to your accountant, he can be compelled to divulge them no matter how incriminating.

When will the IRS remind you to fly right?

In the run-up to April 15th, the government wants to remind you to fly right. But even flying right may be somewhat nuanced.

Can an accountant make a statement to the IRS?

The IRS generally can’t even make your lawyer produce documents. The attorney-client privilege is strong precisely so that clients (in both civil and criminal cases) will be forthcoming with their lawyers. Accountants, however, don’t have this privilege. If you make statements or provide documents to your accountant, he can be compelled to divulge them no matter how incriminating.

Can the IRS make a lawyer talk?

Thanks to attorney-client privilege, if you tell a lawyer secrets (say you are hiding money offshore), the IRS cannot make your lawyer talk. The IRS generally can’t even make your lawyer produce documents.

Does a Kovel agreement make accountants more comfortable?

And having a Kovel agreement can make accountants more comfortable and more responsive as well. Pre-existing relationships between the accountant and the ultimate client can be prickly.

The Role of A Tax Attorney

The Role of A CPA

- CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available. Considered the most trusted advisor in their industry, CPAs are a great choice for year-round financial recordkeeping and tax preparation; however, their diverse s…

The Benefits of A Dually-Certified Professional

- While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes, the advantages of having a two-in-one professional are hard to overstate. Not only do dually-licensed Attorney-CPAs have the financial background to understand the intricate details …

Popular Posts:

- 1. how to choose the best divorce lawyer

- 2. fiction story lawyer who defends brothers arrested for murder

- 3. how long do u have to go to college to be a lawyer

- 4. which lawyer has tv ads

- 5. why get a lawyer

- 6. disability lawyer who files appeal

- 7. what are the benefits of having a dui lawyer in colorado springs

- 8. who is the lawyer on hanny's show other then guliani and jarrett

- 9. how to become a lawyer l;ecture

- 10. what is the work environment for a corporate lawyer