Where can I file Chapter 7 bankruptcy in Georgia?

Filing Without an Attorney. Corporations and partnerships must have an attorney to file a bankruptcy case. Individuals, however, may represent themselves in bankruptcy court. While individuals can file a bankruptcy case without an attorney or "pro se," it can be difficult. Hiring a competent attorney is highly recommended because many bankruptcy issues can be very …

Can I file Chapter 7 bankruptcy without an attorney?

Filing personal bankruptcy under Chapter 7 or Chapter 13 takes careful preparation and understanding of legal issues. Misunderstandings of the law or making mistakes in the process can affect your rights. Court employees and bankruptcy judges are prohibited by law from offering legal advice. The following is a list of ways your lawyer can help you with your case.

What is the Georgia means test for Chapter 7 bankruptcy?

Nov 18, 2014 · The entire process can last for approximately four to six months. The standard filing fee associated with filing for Chapter 7 bankruptcy is $385 ($335 court costs and $50 credit counseling). When handled properly with the assistance of a bankruptcy lawyer, the filing process can be handled in one trip to the courthouse.

Is Georgia a good state to file bankruptcy?

How do I file Chapter 7 bankruptcy in Georgia?

How to File Bankruptcy in Georgia for FreeCollect Your Georgia Bankruptcy Documents. ... Take Credit Counseling. ... Complete the Bankruptcy Forms. ... Get Your Filing Fee. ... Print Your Bankruptcy Forms. ... Go to Court to File Your Forms. ... Mail Documents to Your Trustee. ... Take Bankruptcy Course 2.More items...•Oct 9, 2021

How much does it cost to file Chapter 7 in Georgia?

$ 338.00FEE TABLE (Effective December 1, 2020)Filing FeesChapter 7$ 338.00Chapter 9$ 1,738.00Chapter 11$ 1,738.00Chapter 11 Railroad$ 1,571.0061 more rows

How much cash can you keep when filing Chapter 7 in Georgia?

Especially during tax refund season, I often have clients who will ask, “How much of the cash in my bank account can I keep if I file bankruptcy?” In Georgia bankruptcy cases, the answer to this question is a maximum of $5,600 for individuals and $11,200 for married couples (see GA Code 44-13-100).

How do I qualify for Chapter 7 in Georgia?

To qualify to file a Chapter 7 bankruptcy case in Georgia, you must have not filed a Chapter 7 bankruptcy less than eight years ago and must also meet an income test that is referred to as the “means test.” The means test uses the median income for your household size as a threshold for qualifying to file Chapter 7.

What is the means test for Chapter 7?

The bankruptcy means test determines who can file for debt erasure through Chapter 7 bankruptcy. It takes into account your income, expenses and family size to determine whether you have enough disposable income to repay your debts.

How long does it take to rebuild credit after Chapter 7?

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can't remove bankruptcy from your credit report unless it is there in error.Jun 30, 2021

What assets are exempt from creditors in Georgia?

Personal Property ExemptionsJewelry:Animals, Crops, Clothing, Appliances, Books, Furnishings, Household goods, and Musical Instruments, Health Aids, Burial Plot:Motor Vehicle Exemption:Tools of Trade: 44-13-100.Wages- § 18-4-20.Retirement Accounts - 11 U.S.C § 522.Public Assistance:Life Insurance Proceeds:More items...•Jan 5, 2022

Will I lose my car in Chapter 7?

If you file for Chapter 7 bankruptcy and local bankruptcy laws allow you to exempt all of the equity you have in your car, you can keep the vehicle—as long as you're current on your loan payments. And if the market value of a vehicle you own outright is less than the exemption amount, you're in the clear.Aug 27, 2020

Will I lose my house if I file Chapter 7 in Georgia?

Answer: Yes, you can keep your house if you file bankruptcy! Without a large amount of equity in the home, many homeowners file a chapter 7.Jun 6, 2018

How long does Chapter 7 Stay on credit?

10 yearsA Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date. After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.May 18, 2021

Can I keep my cell phone in Chapter 7?

The long and short of it is that, no, you probably won't lose your cell phone or your contract if you file for bankruptcy. This means you should never leave any asset off your bankruptcy petition.

Can you keep your house with Chapter 7?

Most Chapter 7 bankruptcy filers can keep a home if they're current on their mortgage payments and they don't have much equity. However, it's likely that a debtor will lose the home in a Chapter 7 bankruptcy if there's significant equity that the trustee can use to pay creditors.

What happens when you file Chapter 7?

Once you file chapter 7 bankruptcy all garnishment actions have to stop. Collection lawsuits must stop as soon as you file for Chapter 7 bankruptcy protection. The automatic stay of bankruptcy prevents creditors from calling you or contating you. Chapter 7 allows you clear your debt and start a new financial life.

How long does it take to file for bankruptcy?

This course can be done online or by phone and usually only takes about 30 minutes to complete. You cannot file your case without it. Review and Sign Off On Your Paperwork.

What is Chapter 7 trustee?

A Georgia Chapter 7 trustee analyzes the debtor’s property to determine if the Chapter 7 trustee can sell the property at a bankruptcy auction. The proceeds from the sale are used to pay the debtor’s unsecured creditors.

What happens after a case is reviewed?

After your attorney has reviewed your case they will provide you a petition to review and sign. This is the legal document that lists all your debts, assets, monthly budget, and household size. Attend Your Court Hearing. Once your case has been filed you will be assigned a trustee, court date, and time.

Can you keep your home if you file Chapter 13?

A Chapter 13 bankruptcy case allows you to keep your home and your vehicle by giving you more time to catch up the payments.

What is a trustee in bankruptcy?

A trustee is an independent contractor (not an employee of the bankruptcy court), who is appointed to in effect oversee your bankruptcy case. They are essential to the operation of the bankruptcy system. A trustee will be appointed in almost every bankruptcy case except for Chapter 11 reorganizations and Chapter 9 municipality cases.

Can you get rid of debt in bankruptcy?

You are not able to get rid of some debts in bankruptcy. However, through a Chapter 13 plan, you can repay many of these debts in full over three to five years. Priority unsecured debts that must be paid in full in a Chapter 13 or Chapter 7 case include alimony, child support, and most taxes.

Why is bankruptcy important?

It is very important that a bankruptcy case be filed and handled correctly because a misstep may affect a debtor's rights. More information from uscourts.gov website. Credit Counseling. Individual debtors are generally required to obtain credit counseling from an approved provider within 180 days before filing a case, ...

Do corporations have to file for bankruptcy?

Corporations and partnerships must have an attorney to file a bankruptcy case. Individuals, however, may represent themselves in bankruptcy court. While individuals can file a bankruptcy case without an attorney or "pro se," it can be difficult.

What is a non-attorney petition preparer?

Non-attorney Petition Preparers. If you file bankruptcy pro se, you may be offered services by non-attorney petition preparers. By law, preparers can only enter information into forms. They are prohibited from providing legal advice, explaining answers to legal questions, or assisting you in bankruptcy court.

Can you file bankruptcy under Chapter 7?

Filing personal bankruptcy under Chapter 7 or Chapter 13 takes careful preparation and understanding of legal issues. Misunderstandings of the law or making mistakes in the process can affect your rights. Court employees and bankruptcy judges are prohibited by law from offering legal advice.

Can I file for bankruptcy without an attorney?

Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended because bankruptcy has long-term financial and legal outcomes. Filing personal bankruptcy under Chapter 7 or Chapter 13 takes careful preparation and understanding of legal issues.

Get Debt Free, Fast!

Chapter 7 bankruptcy laws are here to give individuals who are in financial trouble a fresh start from burdensome debts.

What is Chapter 7 Bankruptcy?

Chapter 7 Bankruptcy is a process used by individuals who are unable to pay their debt obligations. In order to pay them off, a bankruptcy trustee is appointed to arrange the liquidation of a debtors assets. This is typically referred to as “straight bankruptcy.

How Do I File for Chapter 7 Bankruptcy?

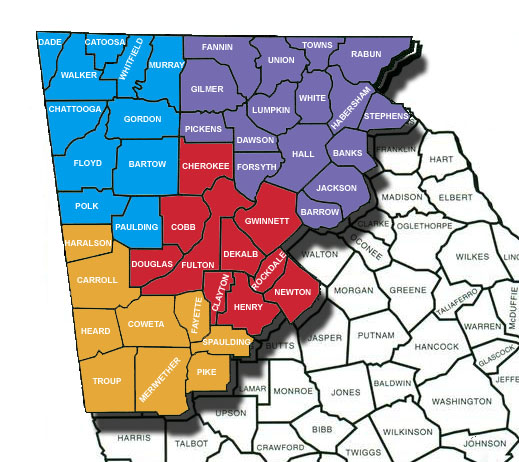

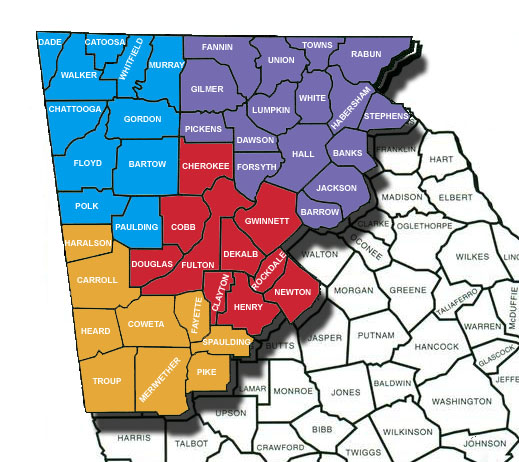

To file for Chapter 7 Bankruptcy, you generally file your case in the District where you reside or have resided for the last 180 days.

Popular Posts:

- 1. how to become a bankruptcy lawyer

- 2. ex-civil rights lawyer who represented terrorists dies

- 3. where did lawyer michael rips go to law school?

- 4. what other causes of action can be filed against a lawyer by a client?

- 5. what lawyer specializes in theft and burglary

- 6. what can you do if you lawyer is dragging out a case?

- 7. what does a criminal lawyer do on a daily basis

- 8. i'm a new lawyer. how do i sign my name at the end of a leter

- 9. how much does a lottery lawyer cost

- 10. how can a lawyer call the pdf in duval county