An real estate lawyer may be the best place to turn when there is a dispute about an earnest money deposit. There is a good deal of misunderstanding about the purpose of an earnest money deposit. This article discusses the general purpose of earnest money, and the rules that govern the earnest money.

Do I need a lawyer to get my earnest money back?

This means that the earnest money fronted for the deal is tied up until the dispute has been cleared. Breach of Contract When the buyer and seller come to a dispute through these circumstances of earnest amounts that are needed back based on failure to obtain additional funding, a lawyer is needed to assist in returning this money to the buyer.

What does earnest money mean in real estate?

Title companies will usually respond by interpleading the earnest money (depositing it into the court’s account) which removes them from the merits of the litigation. The title company may then seek dismissal from the case or decide to remain in an attempt to recover attorney’s fees from the party at fault.

Can Attorney’s fees and costs exceed the amount of earnest money?

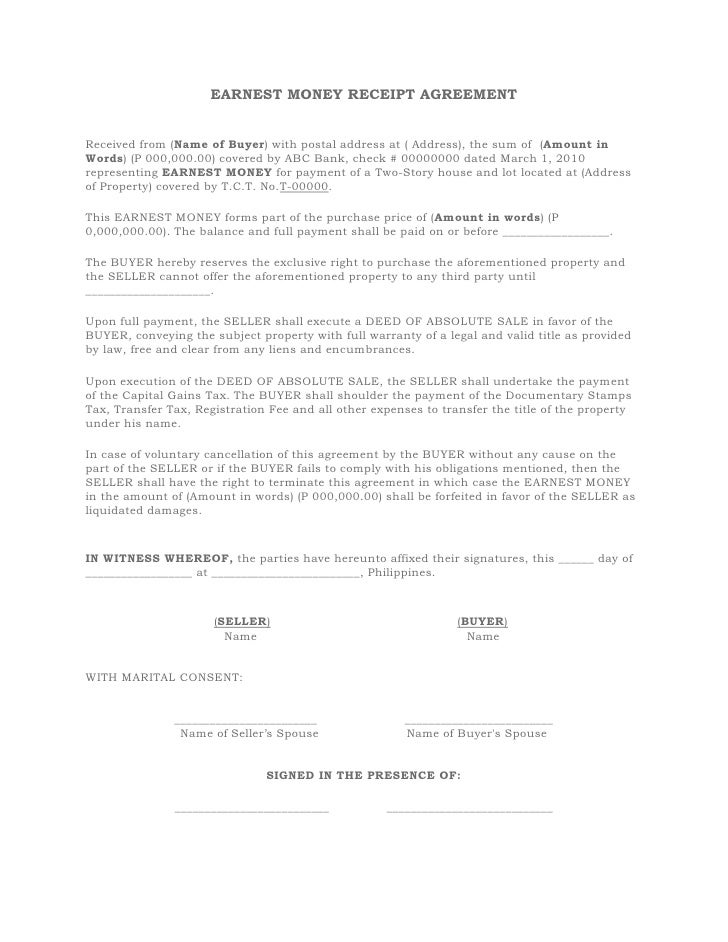

An Earnest Money Agreement is a commonly accepted first step for property sales or rentals. It helps show that the buyer or renter is making a serious offer and often serves as a kind of down payment when the sale actually goes through. An Earnest Money Agreement (or Earnest Money Deposit) memorializes the amount of money in question and helps ...

Should I give the earnest money to the seller?

Thank you for choosing Nelson & Galbreath as your escrow agent! Please select the method of payment with which you are most comfortable. These payment options are for Earnest Money Only. Processing fees for each online payment service provider are noted below. These fees are not collected by Nelson & Galbreath, LLC. No fee. Processing Fee: 3.25%.

Who is earnest money made out to?

Earnest money is a deposit made to a seller that represents a buyer's good faith to buy a home. The money gives the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing.

Who holds the escrow money when a dispute occurs?

Who holds the escrow money when a dispute occurs? When must an escrow account be interest bearing? By default, all escrow accounts are interest bearing. must be bonded with the state Sponsoring Brokers Insurance Trust.

Who signs the release of earnest money in Texas?

The Texas REALTORS® Release of Earnest Money form allows the parties to agree to release the earnest money and to release each other, any broker, title company, or escrow agent from liability under the contract.May 24, 2018

Is earnest money refundable in the Philippines?

Once the earnest money is given to the seller, it will perfect the contract of sale. A payment will only be considered an earnest money if it constitutes as part of the purchase price. The money will be refunded if the sale did not push through.Dec 4, 2017

What happens to earnest money at closing?

For most situations, when the sales contract or purchasing agreement is signed, the earnest money is issued. But it may also be added to the deal. After deposit, the funds are usually held until closing in an escrow account, at which stage the deposit is added to the down payment and closing costs of the buyer.Mar 11, 2022

Can seller sue buyer for backing out?

If the buyer pulls out of the sale after contracts were exchanged, you can sue them for any loss this causes you and you may be able to keep the deposit. You will need to get legal advice.

How do I get my earnest money back in Texas?

There are several ways to get your buyer's earnest money deposit back in Texas, including mediation, suing for the money, and including a liquidated damages clause.

Can a buyer back out after Option Period Texas?

The buyer can absolutely back out even after the option period has expired, even without contingencies. That said, if the buyer cancels the sale without just cause or doesn't adhere to an agreed timeline, the buyer will lose all or part of their earnest money.

Can you back out of buying a house after signing a contract in Texas?

If the house failed inspection or you do not get approved for a loan, then you can back out of the contract without any penalties or fears of legal action. Sellers may also have a way out of a contract by including a clause that allows them to back out of the sale.Jun 27, 2017

What is Maceda Law?

The Maceda Law, as it is known, is an act that protects property owners from unfavorable terms that may occur from sale transactions funded by an installment agreement by describing the rights of the buyers regarding refund entitlement and grace periods.Sep 18, 2021

How much should be the earnest money Philippines?

Nitafan shares: “Generally speaking, 1 percent of the offer price is considered a reasonable amount. But like anything in Philippine real estate, there are no hard and fast rules. I've seen offers written with as little as Php1,000 earnest money and as much as 100% of the sales price.

How do I cancel earnest money?

Earnest money is refundable, it just depends on the circumstances. If you tell the seller that you are backing out of the home buying process before certain deadlines, then there should be no issue refunding the earnest money to you. The same applies if you didn't break any contract rules.

Who holds earnest money?

In certain situations, it is possible that the earnest money deposits may be held by someone on the side of the buyer. This may be the buyer’s agent, a broker hired by him or her or someone similar. This ensures that if the money is needed back, it may be released with little difficulty.

What is earnest money dispute?

An earnest money dispute may occur when so much money has been fronted for the real estate purchase, but the buyer is unable to secure financial assistance through a mortgage or loan. Because of this issue, the person has the right to end the contract and have the earnest money returned to him or her. However, in some of these situations, the agent ...

What to do if all else fails in real estate?

If all else fails, a real estate agent should be contacted to assist with potential legal action. It may be possible that negotiation between opposing legal counsel may provide the earnest payments back to the buyer before court action is necessary. Provided by HG.org.

What is earnest money dispute?

Disputes over earnest money usually arise when either buyer or seller perceives the other to be at fault for failing to close in a timely manner. The parties can be emotional, unreasonable, and determined to stand on principle, all common shortcomings in persons who may threaten to file lawsuits but are unacquainted with the costs and burdens ...

How long does it take for an escrow agent to disburse earnest money?

If escrow agent does not receive written objection to the demand from the other party within 15 days, escrow agent may disburse the earnest money to the party making demand reduced by the amount ...

What is an Earnest Money Agreement?

An Earnest Money Agreement is a great way for a potential buyer or renter of real estate to show that he or she is serious about purchasing or renting. In a way, it's a lot like a security deposit. Generally, both parties will sign an Earnest Money Agreement and then the potential buyer will deposit a certain sum of money.

Easy legal documents at your fingertips

Make unlimited revisions and copies. Sign digitally. Share and print anytime.

What is earnest money?

Earnest money is a buyer-performance item required to be deposited after a contract is fully executed. A contract could become effective even if no earnest money is required in the agreement.

Is time of the essence in a contract?

Like most performance obligations in the contract, time is not “of the essence.”. Therefore, the buyer has a reasonable amount of time after the contract is executed by all parties to deposit the earnest money. “Reasonable time” depends upon the circumstances and could be decided in court if there were a dispute over it.

What is earnest money?

Summary. Earnest money is a deposit made to the seller that represents the buyer’s good faith to buy something (e.g., a home). Several factors affect the amount of earnest money deposit (EMD), including the current state of the real estate market, the overall price of the property, and the high demand for real estate properties.

How does earnest money work?

Earnest money is not always paid directly to the seller. Creating an escrow account by a third-party broker helps to ensure the proper distribution of money at the end of the transaction. As soon as the seller accepts the offer, the buyer is required to sign a contract known as a “purchase agreement.”.

Why do buyers need earnest money?

For buyers, earnest money serves to prove to sellers that they are serious about a certain transaction. It gives the seller an incentive to continue the transaction and wait until the buyer finds the funds to settle the full amount.

What is prepayment risk?

Prepayment Risk Prepayment risk refers to the risk that the principal amount (or a portion of the principal amount) outstanding on a loan is prematurely paid back. In other words, prepayment risk is the risk of early repayment of a loan by a borrower. in the sale process.

When is an appraisal done?

Performed by a qualified appraiser, an appraisal is usually done whenever a property or asset is to be sold and its value needs to be determined. can be substantially low. In such cases, the buyer may have the right to take his money back or at least recover a part of it.

What is home inspection?

Home inspections can detect defects that violate the deal; appraisals. Appraisal An appraisal is basically a way to conduct an unbiased analysis or evaluation of an asset, a business or organization, or to evaluate a performance against a given set of standards or criteria.

What is the difference between a downpayment and a purchase?

The amount of money paid to a seller upfront when a property is bought is called downpayment. When a buyer pays earnest money, it shows intent to purchase a house, whereas a downpayment is usually paid after a contractual agreement is signed, and the purchase is on its way to being completed.

Popular Posts:

- 1. who is the best lawyer near me

- 2. what kind of lawyer do i need for food poisoning

- 3. how a lawyer approaches cokmpassionate disability 2016 updates in listings

- 4. how lawyer keith led chauvin

- 5. what lawyer work with negligence

- 6. who is the best divorce lawyer in illinois

- 7. how can i find a lawyer in the uk

- 8. was trying to avoid the cost of getting a lawyer in addition to where they spent already

- 9. lawyer who worked for nattely e grieg

- 10. what kind of lawyer makes the most is needed for a social service matter