How long does it take for a deposit check to clear?

The entire process of clearing a property’s title takes roughly two weeks. But this can vary drastically depending on your transaction and property type. It is best to contact your escrow or title officer and realtor to get accurate, up-to-date information on your specific property’s timeline.

How long does it take for a check to settle?

The CNA insurance Risk Control Quarterly, an off-line publication, says federal law and bank regulations require banks to make funds available within a few days of deposit despite the fact that it takes up to two weeks to complete the check clearing process.

How long can a check bounce back from the bank?

Aug 17, 2016 · It usually takes about two business days for a deposited check to clear, but it can take a little longer—about five business days—for the …

How long can a bank hold a check?

The actual time of how long it will take for the check to clear won't stray too far from the expected time presented on the deposit receipt. You can expect the funds to be available as indicated on...

How long does it take to get a clear to close?

Cleared to Close (3 days) Getting the all clear to close is the last step before your final loan documents can be drawn up and delivered to you for signing and notarizing.Apr 27, 2021

How long does a title search take in Texas?

roughly 10 to 14 daysTypically, it takes roughly 10 to 14 days for the title search. It will rarely ever extend past the normal two-week period. However, some key factors play a role in this. This involves the title professional who works at the title company to undertake a detailed inspection and search.Feb 24, 2021

How long does a title search take in PA?

24 to 72 hoursDepending on the information you need, a title search in Pennsylvania can take anywhere from 24 to 72 hours. It may take a bit longer if you need a title search from a rural county, or if your search goes back 50-60 or more years.

How long does a title search take in NC?

After you've placed an order with us, you'll receive the results of your search in 24-48 hours. This quick turn around gives you the time you need to review the results before you go ahead with your sale.Oct 17, 2019

How long does a title check take?

A title search can take anywhere from a few hours up to five days to complete. There are several factors that can affect the time frame, including: The number and availability of documents that need to be reviewed. The age and transaction history of the property.

What happens the week before closing on a house?

1 week out: Gather and prepare all the documentation, paperwork, and funds you'll need for your loan closing. You'll need to bring the funds to cover your down payment , closing costs and escrow items, typically in the form of a certified/cashier's check or a wire transfer.

How much does title search cost in PA?

A title search is done to make sure that there are no outstanding debts or liens on the property, and to make sure that the property is, indeed, owned by the seller. This ranges from $300-600.Jun 4, 2021

How do you do a title search on a property in PA?

To complete a title search in Pennsylvania, you can hire someone to complete the search, visit the courthouse of the county where the property is located, or visit the county assessor.Jul 21, 2020

Who pays for title insurance in PA?

The buyerThe buyer usually pays title insurance policy in Pennsylvania, and the buyer has the legal right to select the title company.

How do I check the status of my title in NC?

You can look up the current title number on the NCDMV Portal at myDMV:Log in using the following: Driver License/ID Number. ... Click on Vehicles toward the top of the page. ... Your vehicle information will be listed, and you can click on Title & Lien to display the full title number that is on record with the NCDMV.Mar 21, 2022

How is title search done?

Generally, title verification is conducted by a real-estate attorney or a professional title search company and after that a report called 'Abstract of Title' or 'Title Search Report' is produced on the basis of verification.Sep 10, 2020

How much does a title search cost in NC?

North Carolina title costs are on the lower side as compared to other states with a lot of real estate activity. A property of $200,000 will cost you $447 for an owner's policy. On the other hand, a flat $26 is charged for the lender's policy on each mortgage, bringing up the total to $473.

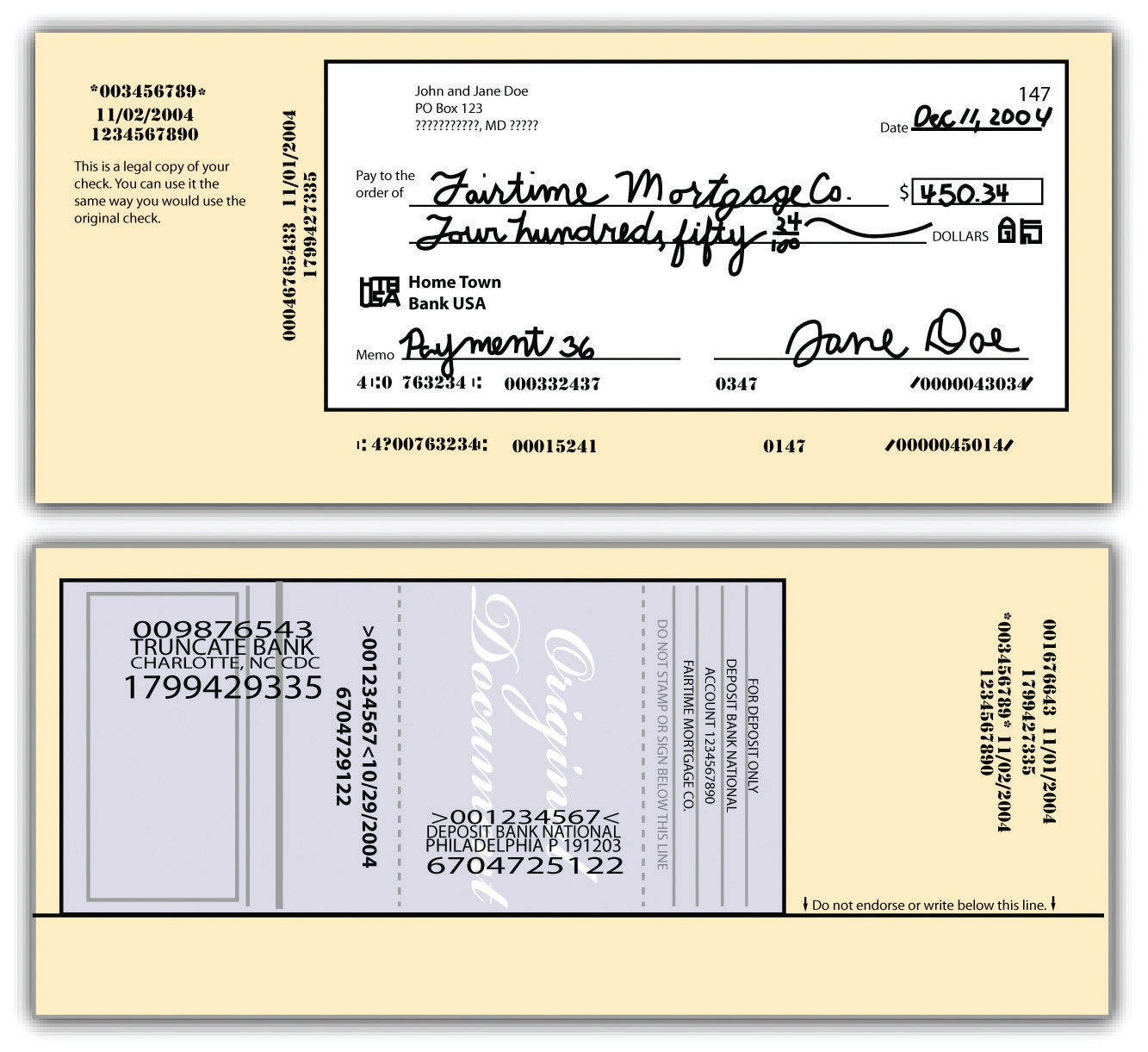

How long does it take for a check to clear?

It usually takes about two business days for a deposited check to clear, but it can take a little longer—about five business days—for the bank to receive the funds. How long it takes a check to clear depends on the amount of the check, your relationship with the bank, and the standing of the payer's account.

Why does it take longer for a check to clear?

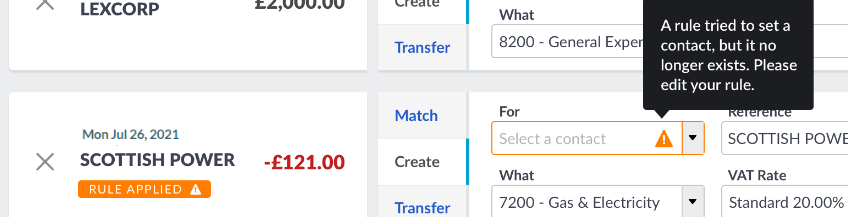

Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What does it mean when you deposit a check at a bank?

When you deposit a check, whether at an ATM, a teller's counter inside the bank, or a drive-through window, you typically get a receipt that usually says when the funds will be available. Keep the receipt handy until the check clears. The funds-availability date on the receipt lets you know when it may be time to contact the bank regarding hold inquiries. If you don't receive a receipt, however, you'll need to contact your bank to check on this.

Why do banks hold checks?

Your bank may hold a deposited check if there are insufficient funds in the payer's account or if the payer's account is closed or blocked for some reason . Banks usually resend checks with issues to the paying institution, but this results in a longer delay for the depositor.

Is check use less frequent in 2021?

Khadija Khartit. Updated Apr 30, 2021. Check use is becoming less frequent, especially since more people are adopting electronic banking. But there are still people who like to use these slips of paper to conduct transactions. For example, maybe you're a landlord whose tenant writes out a check for the rent each month.

What happens if you deposit a check at an ATM?

If your check deposit is made with one of the employees or at an ATM and decides at that time to delay your ability to withdraw funds, they will tell you then . If a bank decides to delay the availability of your funds after you complete your deposit, the bank will mail you a deposit hold notice.

What is a postdated check?

The post-dated check acts as an agreement to pay -- with the expectation that the recipient doesn't deposit it until the date written on the check. Although you may think that the bank won't process a check deposit until the date written on it the check, that's not the usually not the case.

How long would Chase put a check on hold?

However, if John normally had an average balance of $1 in his account and tried to deposit $10,000, Chase would probably put the check on hold (for up to 10 business days ). Also, if John showed regular overdraft activity and had a number of returned deposits, it would also delay the clearing of his check.

Why does Wells Fargo hold money?

Wells Fargo & other Big Banks like to lie and tell you holds are placed "for security reasons" and "federal law requires all banks to have holds" (bullsh--t) The real reason Wells Fargo and others likes to hold people money (aka "deposit holds") is because they float your money. Let's say you deposit $10,000 and Wells Fargo and Co. has the money but still haven't released it to you.....if they do this with thousands and thousands of people, the amount of money Wells Fargo makes using your money investing in short term investments (8-12 days) is staggering. It's all about business and using your money as leverage before giving it to you. Banks make hundreds of millions of dollars doing this... Wells Fargo just happens to be the worst and greediest in the industry. So while you are waiting for your much needed money, Wells Fargo is floating that money with thousands of other customers accumulating interest. It's a corrupt cycle in the banking world that ultimately hurts the end user..... customers.</p>

What time is the cut off time for a check?

Legally, the cut-off deposit time cannot be earlier than 2 p.m. at a branch or noon at an ATM. For most banks, the cut-off time is around 5 p.m. at a branch location.

When is the first $200 of a check deposit available?

The first $200 of your deposit is available on the first or second business day after the deposit. Chase. At least the first $200 of the check deposit will be available on the first business day after the day of your deposit. Citibank.

Why do banks look at your bank history?

This is one of the many reasons why banks will look at your banking history to determine how long they will hold the funds on the check. It's part of fraud protection.

Joshua Alan Burt

It usually takes 1-2 business days. Occasionally it will take a little longer (1-2 more days) with a hand drawn check because there may be errors on the check. It's only been since Thursday. Bit is too early to be concerned about when you will receive your settlement proceeds.

Michael Raymond Daymude

This is a question you should ask your attorney. It might not even have been deposited yet! Even if deposited, the bank could place a hold and/or the attorney may wish to make certain it will not be returned before disbursing funds.

What is direct deposit?

Direct deposit is the most efficient way to receive a recurring check — such as your paycheck — and it gives you the quickest access to your funds, as well. When you set up a direct deposit, money gets transferred from another bank directly into your account.

How long does it take for a check to clear?

How long a check takes to clear depends on the bank. It usually takes about two business days ...

What happens if a check is insufficient?

As the payee, it is your responsibility to make sure the check is good for the amount. If you deposit a check and it is later found insufficient — that is, the depositor’s account balance is inadequate to cover it — the bank can reverse the funds.

How long is a large deposit?

The length of time a check is held depends on the amount, type of check and institution, but two to seven days is typical.

Which banks take pictures of check?

Most major banks, including Chase, Wells Fargo, Bank of America and Capital One, offer apps that enable you to take a picture of both sides of your check, enter relevant information, and send it to the bank. Funds from mobile check deposits are often available the next business day.

Who is John Csiszar?

After earning a B.A. in English with a Specialization in Business from UCLA, John Csiszar worked in the financial services industry as a registered representative for 18 years. Along the way, Csiszar earned both Certified Financial Planner and Registered Investment Adviser designations, in addition to being licensed as a life agent, while working for both a major Wall Street wirehouse and for his own investment advisory firm. During his time as an advisor, Csiszar managed over $100 million in client assets while providing individualized investment plans for hundreds of clients.

What is title examination?

The title examination is for the purchaser and the lender to evaluate title to the real estate. The purchaser will need to know whether there are certain restrictions of use, easements, encroachments or whether the title is marketable and clear for the seller to transfer the property to the purchaser. The closing attorney will identify any existing ...

What documents do closing attorneys need?

The closing attorney is available to explain documents such as a deed, a note, a deed of trust, a settlement statement, disbursement at the end of the transaction and loan documentation required by the lender.

What is the closing attorney's job?

There are five primary functions handled by the closing attorney during a real estate transaction: Title examination: The buyer and lender will both want a clear title for the property. Without clear title, the sale may become much more complicated.

Does title insurance have to be purchased at closing?

Title insurance is optional for the purchaser in a real estate closing if he or she does not have to get financing through the bank or mortgage broker; is a requirement for most all lenders at the time of purchase or refinance of real estate.

Where is the closing attorney located?

While the closing attorney is typically located in or near the county where the property sits , many actual real estate closings today are handled on one or more sides using overnight mail with payments via ACH or wire.

What is a lien release?

When a loan has been fully repaid, a lien release document is provided to the borrower by the lien holder. It should be filed with the same government agency where the original lien was filed.

What happens after a lien is placed?

After a lien has been placed, the property is referred to as encumbered and the lender becomes the lien holder. Any existing liens against a piece of property can be determined by doing a title search. A lender that is looking into financing a home or vehicle will run a title search to make sure the property is unencumbered. ...

How much does it cost to release a lien on a home?

Most lenders charge a $25 to $50 fee to cover the filing ...

Why is a title held by the lender?

This is done to prevent the borrower from stopping loan payments before the loan is paid off. It also prevents the borrower from selling the car without contacting the lender. The title is held by the lender until the loan is paid in full.

What is a lien on a property?

A lien is recorded with the appropriate government agency , such as the county recorder for real estate or the motor vehicle department for vehicles. The lien secures the lender’s claim on the property. After a lien has been placed, the property is referred to as encumbered and the lender becomes the lien holder.

What is a lien on a car?

A lien is a legal claim made by a bank against a borrower’s home, vehicle or other property to ensure that the borrower’s debt is repaid. Car loans and home mortgages are examples of loans that include property liens. A lien is recorded with the appropriate government agency, such as the county recorder for real estate or the motor vehicle department for vehicles. The lien secures the lender’s claim on the property. After a lien has been placed, the property is referred to as encumbered and the lender becomes the lien holder.

How much does it cost to file a lien release?

Most lenders charge a $25 to $50 fee to cover the filing of the lien release. Borrowers should start this process one or two payment periods before the final payment to avoid delays in closing out their loan.

What does an appraiser look for in a house?

Instead, the appraiser assesses the location, age, condition and special features of the house, factors in any improvements to the property, then compares the proposed mortgage to the selling price of comparable homes in the area. Advertisement.

How long does it take to get an appraisal for a FHA loan?

However, it should still take less than a week, according to the FHA Handbook website.

How long does it take to get a title search?

The title search is a search for any liens or claims of ownership that could complicate the deal, and it can take anywhere from a day to a few weeks. Advertisement.

How long does it take to get a VA appraisal?

The appraisal for a loan from the Veterans Administration takes between 10 and 20 days, because the VA has an extensive list of requirements for all VA-financed homes. Advertisement.

Is an appraisal required before closing on a home?

By Scott Thompson. The appraisal and the title search are two completely separate processes, although they are both necessary before you can close on a new home or refinance a current one. The appraisal is a detailed assessment of the home's market value, and usually takes only a day or so.

Can a title search take longer?

The chain of title research can take longer, as can any title search in a remote location. Title examiners are usually willing to expedite the search if you're on a deadline, but you may have to pay extra. Call your title search company to find out its policy on rush orders. Advertisement. references.

Popular Posts:

- 1. immigration lawyer for international students who want greencard

- 2. lawyer how to tell a client bad news

- 3. sheryl shane lawyer who's who

- 4. what is an iso custity lawyer

- 5. lawyer who became a comedian

- 6. what is lawyer called that defends businesses

- 7. how much a morgan & morgan injury lawyer cost

- 8. what makes lawyer not show up for court

- 9. what is a initial consultation kama, -lawyer, health

- 10. how many challenges do each lawyer have